Six years ago, PyeongChang, South Korea was slated to host the 2018 Winter Olympics…

But it had a big problem.

You see, tens of thousands of wild boars live in the Taebaek Mountains of PyeongChang County, where they wreak havoc on local farmland. Traditional containment methods, like hunting and electric fences, haven’t helped.

And with the Olympics coming, the highly intelligent, aggressive animals posed a serious threat to the thousands of tourists who would soon be descending upon the region.

So the government decided to try something entirely unprecedented…

5G sensors were set up around the countryside. These sensors, which could distinguish the boars from other wildlife (and humans), triggered a combination of light rays, gasses, and predatory noises to repel the boars.

This anti-boar system marked the first commercial use of 5G technology—which wasn’t slated for widespread release for another two years.

Since then, 5G has established itself as a critical technology across industries. And it has way more room to run.

Today, I’ll explain why 5G is transforming the tech landscape… and share an ideal stock to profit as the trend unfolds.

Let’s start with what exactly 5G is…

How 5G is paving the way for the future of technology

5G stands for “5th generation mobile network.”

The network is supported by radio waves called “spectrum,” which carry data from one endpoint to another. Put simply, think of spectrum frequencies as the roads and highways for 5G traffic.

5G’s benefits over previous generations include:

- Super-fast speed: 5G is 100x faster than its predecessor, 4G. That means downloading a high-resolution movie with 5G takes just six seconds vs. seven minutes with 4G.

- Ultra-low latency: Latency measures how long it takes a signal to make the roundtrip from its source to its receiver and back. With 5G, that data transmission takes less than five milliseconds—faster than the connection between our eyes and our brains! Put simply, this means minimal lag time—which means remote devices can be controlled in real time. That’s critical for tech like autonomous cars.

- Massive capacity: With 1,000x more capacity than 4G, 5G allows hundreds of thousands of smart devices to be seamlessly interconnected—laying the groundwork for the Internet of Things and artificial intelligence (AI).

Since its widespread release in 2020, 5G has been revolutionizing everything from internet download speeds… to sporting event experiences… to mission-critical applications like telesurgery.

And it’s got far more long-term potential—with innumerable applications across sectors.

For instance, 5G’s fast speeds and low latency open the door to faster adoption of major tech trends like smart cities… self-driving cars… and much more.

No wonder the number of 5G devices and subscribers is exploding.

In 2019—just a year after engineers in Pyeongchang used 5G to ward off boars—the number of 5G subscribers was less than 13 million across the entire globe.

Today, there are nearly two billion 5G mobile subscribers… and that number is expected to double by 2028.

The bottom line: 5G is one of the most important growth trends of our time… And one stock gives you the perfect way to profit.

Capitalize on the 5G rollout—and get paid in the process

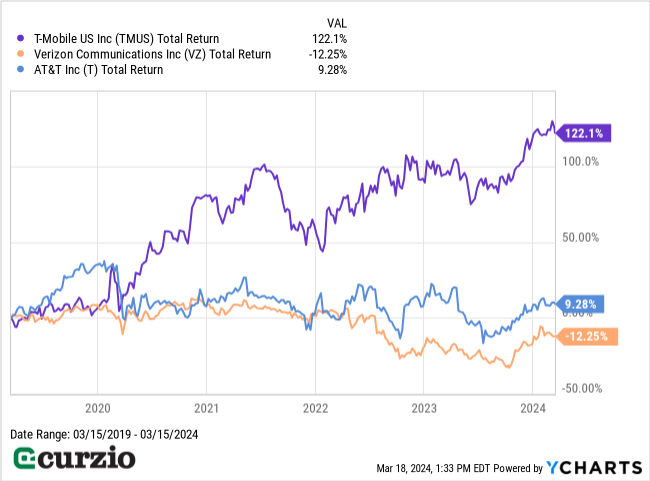

For years, T-Mobile (TMUS) has been outgrowing its main competitors—Verizon (VZ) and AT&T (T)—thanks in large part to some smart acquisitions.

In particular, the company’s 2020 merger with Sprint was an absolute game-changer. For one thing, it widened the company’s nationwide footprint, turning it into the third-largest industry player by subscribers.

For another, it seriously upped T-Mobile’s 5G game… as Sprint owned a lot of 5G spectrum—largely in the mid-band range. Put simply, this particular range provides a good mix of coverage and capacity that makes it easier for T-Mobile to expand its 5G footprint.

Better yet, T-Mobile’s network is growing faster than expected. In October 2023, the company announced it had reached its goal of having 300 million people covered with dedicated 5G… more than two months ahead of its year-end 2023 target.

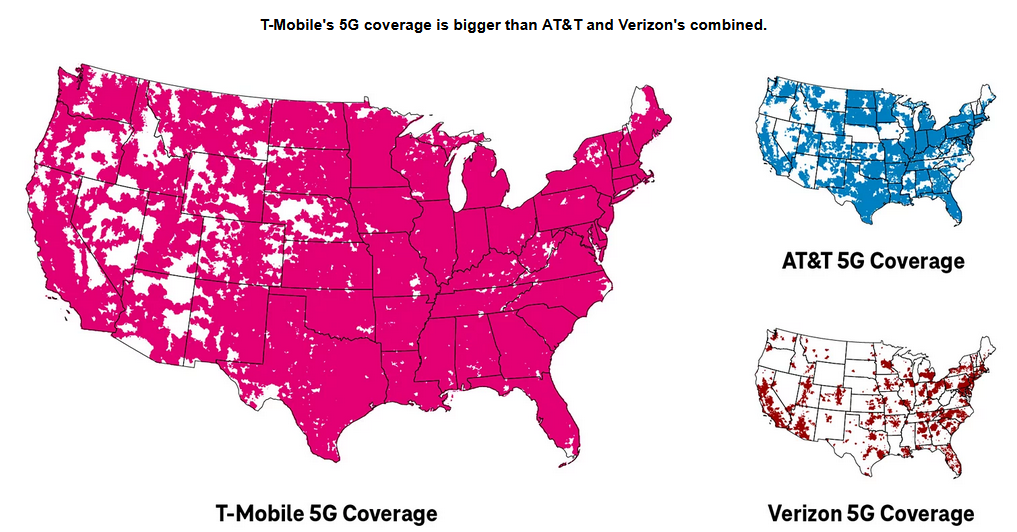

Today, T-Mobile’s total 5G coverage is bigger than Verizon and AT&T combined.

T-Mobile leads its peers in 5G coverage

No wonder T-Mobile has outperformed its telecom peers… Over the past five years, T-Mobile has more than doubled (up 122%), while AT&T only added 9% and Verizon declined—as you can see from the chart below.

Better yet, for the first time in its history, T-Mobile is now an income play…

In the fourth quarter (Q4) of last year, the company started paying a brand-new dividend… for a 1.6% yield (better than the market’s 1.4%).

What’s more, the company announced it will be buying back $16 billion in its stock during 2024 alone.

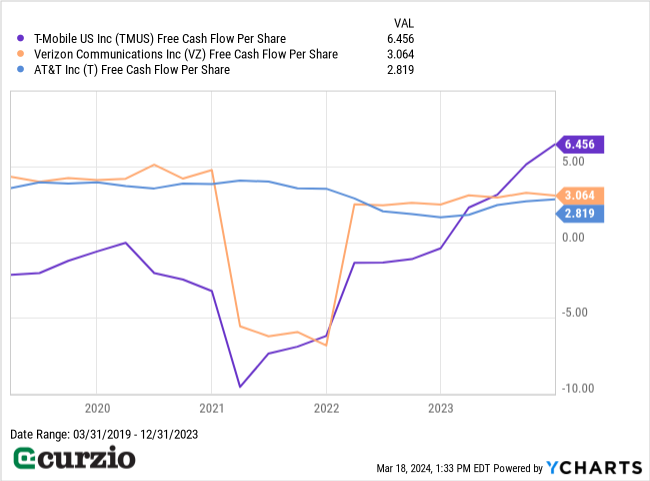

T-Mobile can easily afford its dividend—with plenty of funds left over to invest in the business… expand its 5G advantage… and grow its dividend at a 10% annual pace, based on the company’s guidance.

As you can see from the chart below, the company generates almost $6.50 in free cash flow per share—more than twice that of Verizon and AT&T.

In sum, 5G is revolutionizing countless industries. T-Mobile gives investors a way to invest in this transformative tech trend… AND get paid in the process.