The bronze statue of Charging Bull in downtown Manhattan is a magnet for tourists… and the symbol of Wall Street.

Created in 1989 by Arturo Di Modica, the sculpture is a testament to entrepreneurial spirit and persistence… or bullishness.

It was conceived in the aftermath of the catastrophic Black Monday market crash of 1987… when the Dow lost more than 22% in just a day.

Di Modica spent $360,000 of his own money… and installed the statue without permits near the Stock Exchange building.

It was an instant hit with the public… but was impounded by the city. A few days later, amid public outcry, it was re-installed at its present location at the southernmost tip of Broadway.

As with the stock market, its winning spirit won at the end.

Stock markets reward optimists—And even in a bear market, it’s important to keep a bullish outlook so when stocks charge ahead, you’ll be in a position to profit.

And today, I’ll show you how to position yourself safely.

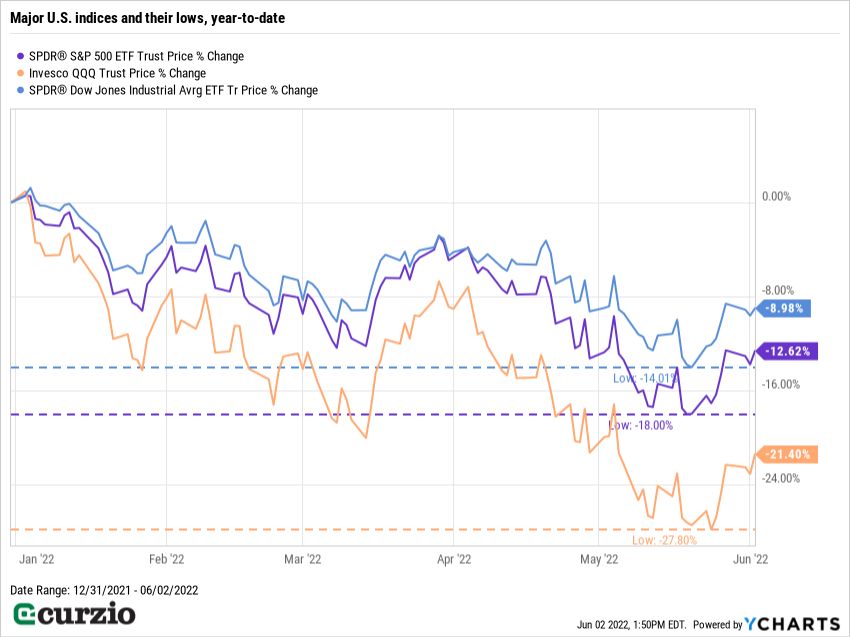

The S&P has been correcting since early January—and flirted with a bear market just a few days ago.

The Fed is in a tightening mood… set to raise interest rates at every remaining meeting of the year. It officially started a process of Quantitative Tightening (QT), or reducing its balance sheet, on June 1.

It might seem that the safest course of action is to step away from the market… to go to cash and wait for an all-clear signal.

Don’t.

Staying in cash when inflation is at 40-year highs won’t do you any good. It would mean losing purchasing power to inflation every day… and would prevent you from benefiting from the power of compounding.

Instead, temporarily increase your cash allocation… And be ready to pounce.

Here are four steps you can take to be ready for when the market bull decides to take off.

1. Make a plan

Have a list of stocks you’d like to own… along with a list of conditions you need to see to make your move. (Small caps are starting to meet Frank’s conditions.)

Those can range from a desirable price target on your favorite stock… to a lower valuation on the entire market.

But whatever signal you’re waiting for, don’t second guess yourself.

Stick to the plan… and to the following 3 rules—they’ll help you stay profitable in any market.

2. Diversify your investments

There’s a reason diversification is the golden rule of investing.

If you invest in a variety of assets… from stocks to commodities to bonds to gold… and even in different countries (you can easily do this with exchange-traded funds or ETFs)… you’ll be spreading your risks while staying open to the gains from all corners of the market.

And own equities across several unrelated market sectors…

You’re reducing overall portfolio volatility.

You can’t diversify away market risks (or “systemic risks”). But by buying a variety of assets that don’t move together (in technical terms, this means their correlation coefficient is less than one), you minimize the effect bad news from Netflix or a tech sector slowdown will have on your total portfolio.

3. Reinvest as many dividends as you can

Just a couple of weeks ago, I wrote about the power of dividends and how to use it to profit in all kinds of markets.

By reinvesting dividends back into the same stocks, you’re playing the market… and making its declines and rallies work for you.

In a falling market, the same dollar amount will buy you more shares.

And in a rising market, you’ll buy fewer shares… but your position will keep growing without pumping in fresh capital.

Ultimately, you’ll be able to grow your position in any market… but more quickly in a downturn.

The larger position you have, the more dividends you’ll be paid next time… translating to a significantly larger stock stake—and more income when you need it.

4. Own some hedges

One of the easiest ways to profit from the market’s decline is to own insurance via the options market.

Put options, for instance, will go up in value (all else equal) when a stock or ETF against which the put is written (the underlying security) declines in price.

Buying a put option gives you the right (but not the obligation) to sell an underlying security at a specific price (strike) before a certain date (expiration).

And while buying a put will cost you money upfront (like an insurance premium), that’s the maximum you’ll be out if the asset doesn’t decline. And if it does, you’ll get paid.

Of course, if you’re wrong about the direction of the asset, its volatility, or the timing of your trade, among other things, your put could expire worthless. So only invest what you can afford to lose on the “insurance premium.”

But if you plan carefully and understand the risks… you can buy protection against a falling market and profit from its downside.

Nobody can time the market, no matter how hard we try.

The market shouldn’t like the new QT policies, higher interest rates, or the slowing economy. But what it hates even more is uncertainty…

Much of this bad news has already been priced in.

Of course, things can get worse: The housing market might crash… the economy might slow… or inflation might speed up.

But post selloff, many stocks—albeit riskier amid the Fed’s tightening—already look like a risk worth taking.

If you want to profit in the long term, you need to be in the market when the bull charges ahead. And you can do it safely if you follow the four simple strategies outlined above.

Editor’s note:

If you’ve been struggling to protect your portfolio—and find ways to profit—Genia’s Moneyflow Trader advisory takes all the guesswork out of it.

In 2022 alone, this portfolio has seen gains like 110%… 60%… 217%… and 271%—in weeks.

“I have Genia Teranova to thank for keeping my head above water, she is the bomb! Anyone who does not subscribe to her product is missing the boat.” —R.R.

Moneyflow Trader was created for exactly this kind of market. Get started here.