On Friday, The Wall Street Journal reported that ExxonMobil—the largest U.S. oil company—is eyeing a deal to acquire independent energy firm Pioneer Natural Resources (PXD).

And while the talks were preliminary and informal—and the deal is far from certain—the fact that Exxon and Pioneer were talking is, in itself, huge news.

For one, if it were to go through, it would be one of the biggest M&A deals in the sector—ever.

For another, it highlights a shift in how giant oil companies are spending their money.

Today, I’ll explain why this news could be the start of a landgrab across the sector as Big Oil scoops up smaller players… why Pioneer, in particular, is such an attractive acquisition target… and why Pioneer shareholders stand to benefit even if Exxon doesn’t pull the trigger on the deal.

Let’s start with a look at Big Oil’s huge cash pile…

Why we could see a Big Oil landgrab

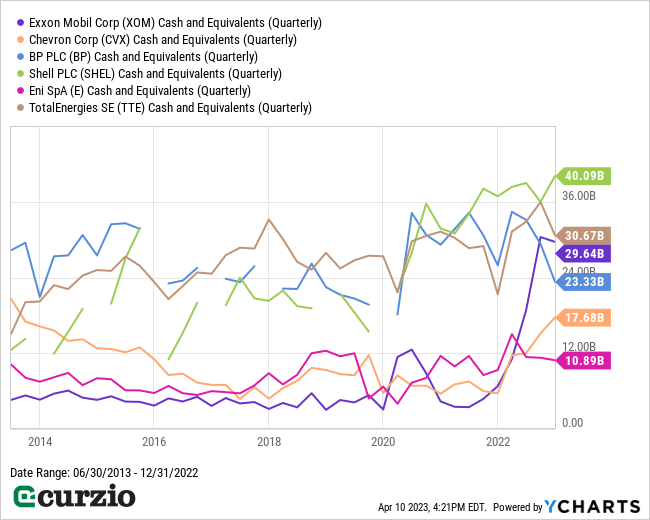

After two years of rallying oil prices, the world’s biggest oil companies are awash in cash.

Today, Exxon is sitting on nearly $30 billion of cash and equivalents, based on its latest balance sheet. That’s up almost 10-fold from July 2021… and less than $12 billion away from the record $41.4 billion it had back in 2007.

As you can see from the chart below, the world’s six leading energy companies (Exxon, Chevron, BP, Shell, Eni, and Total) have amassed more than $150 billion in cash. That’s almost double what they had a decade ago.

Put simply, oil giants are in great shape right now…

And they’re looking to put their money to work.

Instead of ramping up spending on exploration, energy giants are looking for ways to boost future production without taking on a lot of risks…

You see, finding new oil has always been an uncertain endeavor. And that’s especially true today, when new reserves are harder and more expensive to find. In fact, it’s not uncommon for major oil companies to call it quits on a big exploration project, even after spending billions of dollars over many years. Just last week, for example, Exxon abandoned its offshore Brazilian exploration efforts after failing to find oil there.

In short, the simplest way for Big Oil to grow is by buying smaller, established companies with already-discovered assets.

That’s why mid-tier producers with quality assets are becoming attractive targets… and why every investor should be scouring the sector for buying opportunities.

Pioneer, in particular, is an ideal acquisition target—in fact, back in the February issue of Unlimited Income, I predicted Big Oil would soon be eyeing Pioneer and its prime asset base.

But even if it doesn’t get acquired, it’s in the perfect position to profit from rising oil prices… And investors should own shares regardless of a potential acquisition.

A must-own income stock for higher oil prices

Pioneer owns a prime position in the Permian Basin—the country’s largest oilfield, which accounts for nearly 40% of all oil production in the U.S. and almost 15% of all our natural gas output.

And thanks to its status as an early mover in the Permian Basin… Pioneer is now the largest company currently operating in the area, producing almost twice the oil of its next largest competitor, Diamondback Energy (FANG).

In fact, the company owns over 850,000 net acres in a highly productive part of the Basin called the Midland Basin. That’s almost three times larger than its nearest Midland-based competitor.

If you’re a big oil producer, the Midland Basin is where you want to be. It’s shallower than the nearby Delaware Basin and holds higher-grade crude. That means lower drilling costs and higher-quality output.

Operating in such a well-researched, highly developed oil region makes successful drilling more likely… and less costly. Much of the infrastructure is already in place. And lower production costs mean higher profits… especially when energy prices are rising.

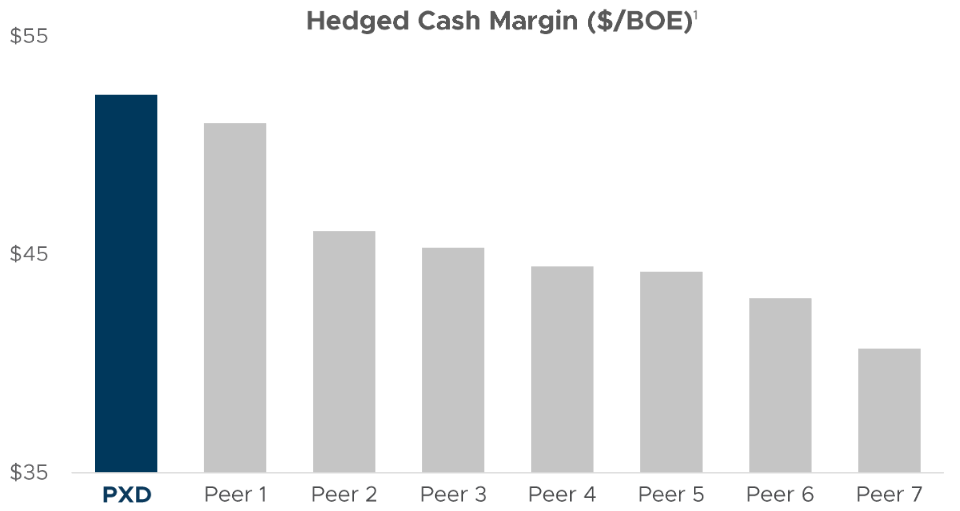

In short, Pioneer’s assets are the best of the best—which translates to higher margins and growing profits.

And as you can see below, Pioneer has the highest margins across its peer group…

PXD has best-in-class margins

Pioneer also outperforms its peers on the innovation front.

For instance, it’s been actively drilling using “simultaneous fracturing”—or simulfrac—which allows the drilling of two wells at once with the same equipment. This technology increases efficiency… and boosts an oil company’s return on investment.

No wonder Exxon is interested in buying Pioneer. It would be great news for PXD shareholders, since an acquisition bid would boost the stock’s price immediately.

But even if a buyout doesn’t happen, Pioneer’s shareholders stand to win big as the company benefits from rising oil prices and its prime position in the Permian.

Plus, Pioneer is one of the highest-dividend payers you can find, with a current annual yield around 13% (vs. just 1.7% for the S&P 500).

Normally such a high yield might indicate financial stress—but that’s not the case with Pioneer. You see, the company pays a variable dividend—it changes depending on the company’s business and finances.

In other words, PXD is paying a high dividend because it’s making a lot of money.

And its variable dividend strategy guarantees the company maintains a healthy balance between investing in production and rewarding shareholders.

Conclusion

Exxon’s interest in Pioneer could be the start of a massive landgrab… as Big Oil companies look to spend their massive amounts of cash on acquiring proven assets.

But whether or not an Exxon bid comes to fruition, Pioneer is one of the best oil companies to own in this market. It owns some of the most valuable land in America’s richest oil field… boasts some of the highest profit margins in the industry… and offers a massive dividend yield, thanks to its variable dividend policy.

In short, PXD is a must-own income stock for anyone looking to profit from higher oil prices down the road.