Back in the summer of 1971, President Nixon shocked the world when he announced the U.S. dollar would no longer be backed by gold.

It was the end of the Bretton Woods system… and the end of an era.

From 1944 until 1971, world currencies were tied to the U.S. dollar. Foreign banks could then exchange their dollars for gold at $35 per ounce.

This system worked for decades to stabilize global currencies… but eventually, the amount of U.S. dollars in circulation began to exceed U.S. gold reserves. This became especially problematic as foreign nations became skeptical of the dollar’s value—and the U.S.’s ability to meet its obligations.

In short, countries around the world began clamoring for gold—depleting half of our nation’s gold reserves… and putting the U.S. at risk of a “gold run.”

At the same time, we were dealing with unprecedented inflation. In an effort to stem both of these issues, the Nixon Administration enacted a drastic new economic policy—which included ending the dollars-for-gold global exchange system.

After Nixon got rid of the gold standard, the limits on the price of gold were removed… allowing the yellow metal to soar as investors sought a safe haven.

Over the course of the decade, gold beat all other major assets… And by the end of the 1970s, the price of gold was up more than 1,000%.

This makes sense—gold has long been the go-to safe investment during economically uncertain times.

So it also makes sense that the yellow metal languished once the economy stabilized in the ’80s… before drifting down to its eventual low in 1999.

Since then, it’s up nearly sevenfold.

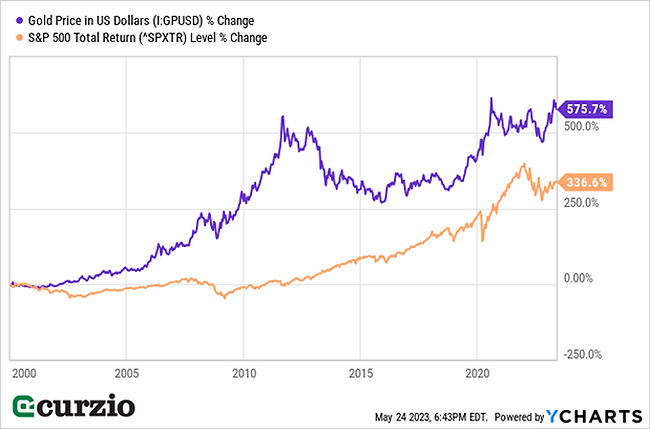

In fact, gold—an old-school, non-dividend-paying, unproductive asset—has outperformed the S&P 500 by a wide margin so far this century (as you can see below).

And now, it’s getting ready for another bull run.

Today, we’ll look at why… and I’ll share a simple way to take advantage of the situation.

One of the best ways to protect your assets in today’s economy

If you’re struggling with today’s stubborn inflation… you’re not alone.

In a recent Gallup poll, inflation was mentioned more than three times as often as any other problem… with 35% of Americans calling it their family’s top financial concern.

It makes sense, considering we’re currently seeing some of the highest inflation levels since the Nixon Administration 50 years ago.

Yes, inflation has come down off its 40-year highs… and is no longer approaching double digits. But the problem is far from over.

In fact, the Consumer Price Index (CPI) has been rising at an average of 5% for the past three years. This translates to a cumulative total of over 18%. In other words, what cost you $100 in April 2020 would now cost you $118.32 (as of April 2023).

That’s bad news for consumers… But it’s good news for gold.

Persistent inflation, market declines, and economic distress all work in gold’s favor as investors clamor for a reliable way to preserve the value of their money.

We saw this play out in the inflationary era of the ’70s—and several times more recently…

During the COVID pandemic (and resulting recession) of 2020, gold broke out to a new all-time high, hitting an intraday price of over $2,089 per ounce.

During the bear market of 2022, gold was the only major asset to post positive performance—adding 0.4% last year while the stock market lost more than 18%.

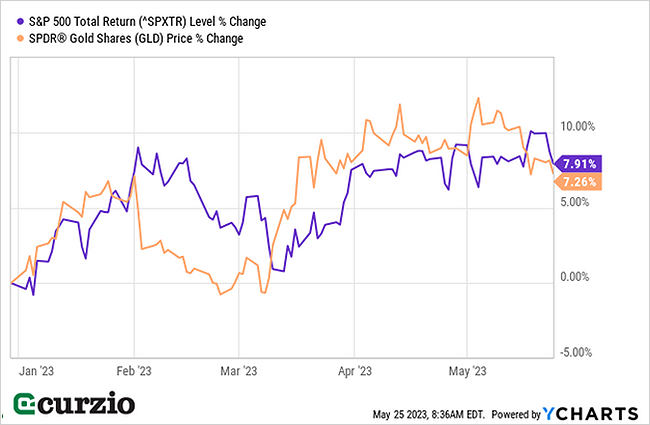

And this year, investors flocked to gold in the wake of the banking crisis… pushing the yellow metal back towards its COVID-era levels. It’s currently trading just a few percent below its all-time highs.

Gold’s outperformance has faded a bit over the past month as the stock market rallied off its lows and inflation showed some signs of abating. But it’s still up about 7% for the year, as you can see on the chart below.

And it’s got way more upside ahead.

As investors prepare for a coming recession, they’ll increasingly look to gold to preserve their wealth—and make money—even in the worst economic conditions.

In short, gold is about to get a boost in demand as investors look for a safe place to park their assets and protect their purchasing power.

One convenient way to play gold’s upside is with SPDR Gold Shares (GLD), a popular exchange-traded fund (ETF) that tracks the precious metal’s performance. When gold goes up, so will this fund. And because it’s an ETF, it’s as easy to buy and sell as a stock.

Conclusion

With its millennia-long history of reliably storing value, gold remains a great way to protect your wealth against economic uncertainty. It’s one of the best defenses against inflation known to man… and one of the safest assets you can buy.

And with sticky inflation and an inevitable recession ahead, it’s set to rise even higher from here.

If you don’t have exposure, now’s the time to get it. And one of the simplest ways to do that is with GLD.

P.S. For more of my favorite assets for this perilous market—from precious metals and consumer goods to energy and healthcare—make sure to join us at Unlimited Income.