Meme stocks have taken the market by storm.

From GameStop to Bed Bath & Beyond… and now to AMC and Clover Health… prices are skyrocketing in a matter of days—if not hours.

It might be tempting to join the crowd… or bet against it.

But while the former can be as easy as pressing the “buy” button… the latter isn’t as simple as it might seem… which has contributed to the meteoric rise of the meme group.

Today, I’ll tell you why betting against the meme crowd is so difficult… and discuss the pros and cons of one options-based strategy that, at least in theory, helps you profit from volatility…

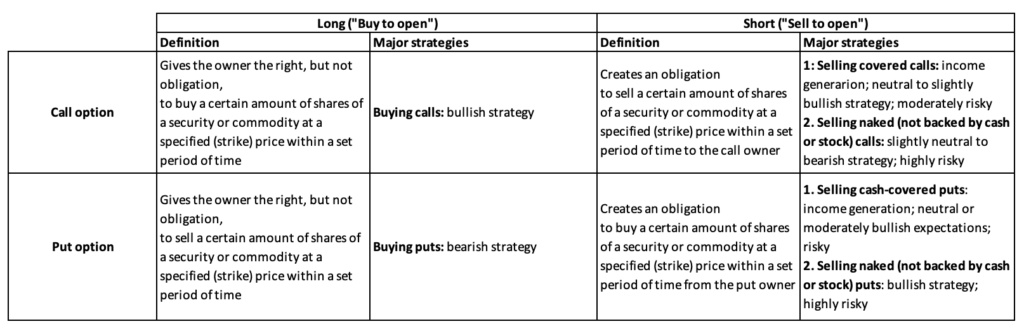

But first, a quick option refresher.

An option is a financial instrument that gives its owner the right, but not the obligation, to buy (call) or sell (put) a security at a specific price until the contract expiration.

The contract seller, on the other hand, takes on the obligation to deliver (for calls) or to buy (for puts) a stock from the option owner—if the predetermined conditions are met.

Among other things, option prices depend on the asset’s “implied volatility.”

Implied volatility reflects how expensive an option is. A higher implied volatility means that traders expect the stock to move a lot (up or down) in the future. That’s why it’s called “implied” volatility: it measures how much future volatility is implied by the option price.

All else equal, the more volatile the underlying stock… the higher the option price.

When a meme stock hits the radar of a group like Wall Street Bets, massive buying leads to a price jump. This also sends the implied volatility of the options soaring.

Earlier this week, for example, Clover Health (CLOV), a small-cap health tech company, became a meme stock. On Tuesday alone, CLVR was up 86%… and at one point during the trading day, it was up over 100%. Trading volume was nearly 30 times (30x) the average… and implied volatility jumped.

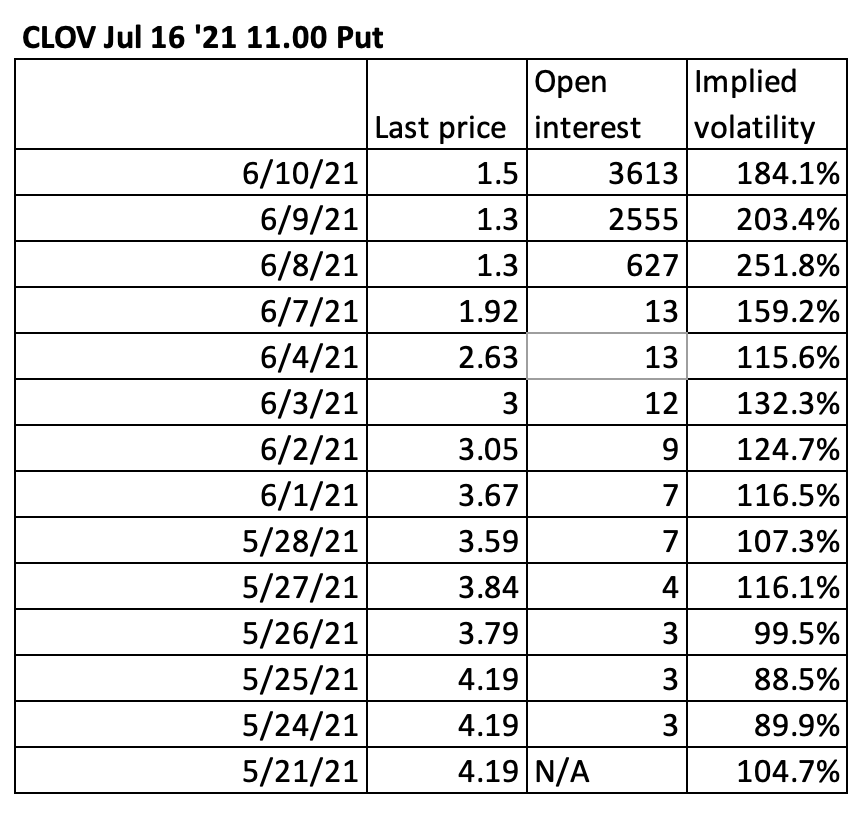

As you can see with the CLOV July 16, 2021 $11 put, demand for options has gone up… with open interest (the number of contracts in existence) going up 1,000-fold in just a couple weeks.

Volatility, too, was consistently on the rise, peaking around 250% on Tuesday, up from 100% or so at the end of May.

Fundamentals didn’t matter. It also didn’t matter whether Clover Health even had a promising business model… All that mattered was that buyers got together and drove the price up sharply.

It’s the same story we’ve seen time and again this year, from GameStop to BlackBerry to Workhorse. The buyers generally target stocks with large short positions (stocks that short-sellers are betting against). The resulting “short squeeze” is a self-fulfilling prophecy: A higher stock price and margin calls lead to short covering… and make it harder to reenter the short… driving the price higher still.

However, most meme stocks can’t stay elevated for long…

As you can see on the above chart, CLOV shares fell sharply the next day. And so did the implied volatility.

This means anyone who bought a CLOV option on Tuesday—whether to bet on further upside (using calls) or on a decline (using puts)—substantially overpaid compared to the next day’s prices… as implied volatility evaporated.

In fact, CLOV options were some of the biggest volatility losers in the entire market yesterday. CLOV options ranked fourth out of yesterday’s top 10 implied volatility declines…

To put this craziness in perspective, even if you bought puts on Tuesday, you ended up barely making a profit (or even losing money, if you didn’t buy near the day’s lows)… despite the fact that CLOV’s share price plunged.

Naturally, as CLOV rallied on June 8, the price of this put dropped. But it stayed flat the following day, even as the stock fell 24%.

CLOV Jul 16 , 2021 $11 Put, May 24-June 10

In other words, despite the stock dropping 24% on Wednesday and 15% more on Thursday, put buyers made very little, if anything, off this drop—because of the sharply lower volatility implied in the put price.

The golden rule of naked put selling

Generally speaking, the higher the implied volatility, the higher the option price… and vice versa.

It’s important to keep in mind, especially for meme stocks—where the level of volatility can change on a dime.

This means it’s harder to make directional bets for these stocks… compared to normal, “non-meme” stocks.

Wait a minute, you might say, aren’t there strategies that benefit from declining volatility?

Yes, of course.

Selling an option can be a great way to benefit when volatility falls. Since option sellers get to keep the premium, they’re happy to see a decline in the value of the option they sold.

A couple of weeks ago, my colleague Luke Downey discussed a put-selling strategy and how to use it to buy stocks for less.

As Luke explained, when you sell a “naked” put option, it means you’re selling a put option contract on shares you don’t have a short position in. That’s what the “naked” part means: you’re entering the trade without any type of hedge to protect yourself. Like any other option sale, you collect the premium upfront. And in exchange, you agree to buy the underlying stock at the strike price at any time before expiration.

Put sellers benefit from high volatility because they can collect more money upfront.

But here’s the rub: As a put seller, you have to be prepared to own the shares.

This is where the risk comes into play: If the underlying security decreases in value, you lose the difference between the price at entry and current price, minus the premium received.

The best-case scenario for the naked put strategy is when the stock price ends up above the strike at expiration.

In the worst-case scenario, you’ll end up buying and owning shares of meme stocks—which isn’t something I would be comfortable with.

Remember the golden rule of naked put selling: Don’t sell a put on a stock you don’t want to own.

Editor’s note:

Options can be a great tool for a number of investing strategies… from locking in quick capital gains to hedging against a falling market. During the COVID pandemic, Genia’s Moneyflow Trader members closed out multiple option trades for triple-digit gains like 220%… 265%… and 508%.

Sign up for Moneyflow Trader… and make options work for you.