Tomorrow is the first day of the annual U.S. Fed symposium at Jackson Hole.

And the market is paying attention…

Historically, this meeting is where important policy changes are introduced.

In August 2010, for instance, then-chair Ben Bernanke proposed a second round of quantitative easing (QE2) to help the economy recover from the Great Recession… months before the policy was formally announced in November.

This year, U.S. central bankers were planning to meet in person at their usual venue, Jackson Hole, Wyoming, to discuss “tapering,” or gradually removing stimulus money from the economy.

But 2021 is not your usual year.

Just a few days ago, the Fed announced the annual meeting will be held virtually, just like it was in 2020.

The market took the news as a bullish sign… enough to rally to new records.

That’s because if COVID-19—the reason the Fed unleashed its latest round of QE—is still a danger to the economy, there’s little threat of Fed tapering… at least not anytime soon.

Today, we’ll talk about the eventual withdrawal of Fed stimulus… the first market “taper tantrum”… and how to prepare for some related—but even bigger—risks to your portfolio.

Let’s start with the basics…

Currently, the U.S. Federal Reserve Bank buys $80 billion in Treasuries and $40 billion in mortgage-backed securities (MBS) on the open market every month.

This “easy money” strategy supports the banking system and the economy by keeping interest rates (both long and short term) low.

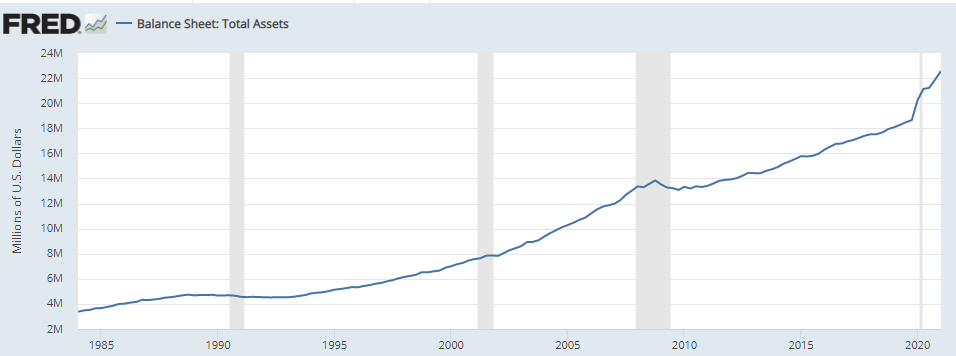

The Fed’s first round of monetary easing (known as QE1) began in November 2008. Since then, the central bank has continued to combat economic crises (like the Great Financial Crisis, the Great Recession, and COVID) with QE measures. As a result, the Fed’s balance sheet has exploded (as you can see on the chart below).

Assets on the Fed’s balance sheet

Click to enlarge

These purchases would be the first to go when the Fed begins to discontinue its easing policies… before any interest rate hike.

This is why the market is always watching out for a “taper”: a pullback in the Fed’s bond purchases. The removal of the proverbial punch bowl could quickly deflate financial assets and send major indices down.

But it’s also the main reason the Fed would be very careful with this tool.

Removing the stimulus too quickly risks killing the market… and derailing the economic recovery.

So as long as the economy needs support (or for as long as policy makers can justify it), a taper isn’t likely to happen.

And if it does, with surging COVID cases and weakening consumer optimism, it’s likely to be a slow taper… In other words, the Fed will continue to buy at least some U.S. debt and other bonds for quite some time.

Look at the chart above again…

The size of the Fed’s balance sheet has never declined by any significant amount… In other words, the Fed has been unable—or unwilling—to unwind its asset purchases.

There’s no reason to believe tomorrow will be any different: It’s much easier to start providing stimulus than to reduce it or stop… and it’s almost impossible to fully take it away.

Especially if the market reacts poorly to such attempts.

In 2013, after the Fed announced it would stop QE2, investors started dumping stocks—sending the broad market down 2% in a month—and the term “taper tantrum” was coined.

But investors primarily sold assets that would be hurt by higher long-term interest rates, such as bonds and income stocks.

Real Estate Income Trusts (REITs), a group known for its slow growth and high dividend, lost 12.5% in a couple of months… with utilities following closely.

Mortgaged-backed securities also took a big hit. As long-term interest rates jumped in 2013, the 30-year mortgage rate rallied—ending the year nearly 34% higher than May levels.

By the end of 2013, the S&P 500 recovered all of its May-June losses… and rallied 16%.

Income sectors, however, ended the year deep in the red.

The 2013 tantrum is exactly the kind of reaction the Fed wants to avoid at all costs.

Nobody wants a crash on their watch—least of all, this Fed… which has been steering the economy through the COVID crisis.

Again, history can be our guide.

After the original taper tantrum, the actual tapering was announced in December. It took the Fed 10 months to reduce its $85 billion monthly Treasury and MBS buying to zero.

This time, the buying program is larger… and the unwinding will take longer.

Even if the Fed does discuss tapering in Jackson Hole, it’s unlikely to start before year-end.

In that case, the gradual reduction of new purchases will last at least until the end of 2022 (or longer).

The biggest danger is the removed price support for long Treasuries and mortgage-backed securities, followed by higher long-term interest rates and higher mortgage rates. This, in turn, can hurt the booming housing market (a major winner in 2021, thanks to record-low mortgage rates).

Slow-growing income stocks could lose… But the S&P 500, if history is any guide, shouldn’t suffer much—if at all—in most tapering scenarios.

On the other hand, the market is very expensive and has more than doubled off its 2020 lows.

A negative event—such as a rush to taper—might be a trigger that starts a downturn.

Here’s how to prepare…

Make sure you own stocks that can withstand moderate inflation… have strong balance sheets… and can grow revenues, profits, and payouts in any environment.

I talked about a few of these stocks—and funds—here and here. And how to get portfolio insurance here.

Chairman Jerome Powell will speak tomorrow morning… but market action alone will tell you whether tapering is in the cards for 2022.

Tapering isn’t a reason to panic… but the double risk of higher rates and lower stimulus endangers our historic S&P rally.

Have some hedges in place… and invest in stocks with strong pricing power and growth potential.

P.S. Certain dividend stocks offer great protection against inflation… especially those that can increase their payouts.

And my Unlimited Income advisory gives you access to the best dividend-growers in the market… without sacrificing growth.

Become a member today… and start building a portfolio that can weather any market.