Are you surprised by the market’s strong showing this month?

Even though we’re less than three weeks into the new year, the S&P 500 has already logged a very respectable 3% return. And that’s after delivering a massive 30.4% in 2019 (33.1% if you count dividends).

Just last Wednesday, the Dow closed above 29,000 for the first time ever. By Thursday, nearly 72% of the Nasdaq had pushed higher and only 26% had declined. And for the NYSE, 75% of all stocks listed there advanced, while only 23% declined.

Of course, the market doesn’t just go into a tailspin because of high valuations. It needs a reason to start worrying about tomorrow. But expensive markets leave less room for mistakes… and tend to be less forgiving.

One small sector downturn or a bad quarter can wipe out a portfolio… even in bull markets like today. Thankfully, it’s relatively easy to create downside protection.

And there are three things you can do right now…

I’ve said it before, and I’ll say it again: One of the strongest bull indicators is recent strength—and we have that in spades.

Of course, this month, the market also has “the January effect” behind its back—stocks rise about two times more often than they fall during the month of January.

Market history, market psychology, and a moderately strong “Goldilocks” economy have all come together for us investors.

But we can’t ignore the fact that as the market rallies, it keeps getting more expensive…

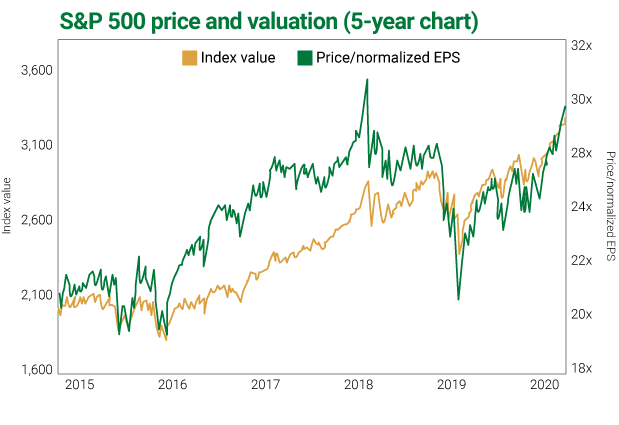

The chart above plots the value of the S&P 500 index versus its price-to-earnings (P/E) valuation.

For today’s analysis, I used the so-called “normalized” earnings. That is, only those profits generated from continuous operations of S&P 500 member companies are included. (I’ve excluded the gains/losses from discontinuing operations or one-time events such as an asset sale.)

As you can see, the market now trades at a new all-time high.

Over the past 15 years, we’ve seen this normalized P/E as low as 9.5 (in late 2008, the middle of the Great Recession) and as high as 30.2 (January 2018).

Today, this normalized P/E is about 29.4—not the highest it’s been in the recent past, but still well above the five-year average of about 24.9.

I can’t tell you what the magic number for P/E is—when it gets too high and the market starts selling off—nobody can. But one thing’s for sure: As the S&P has rallied, corporate profits have failed to keep up…

And while a rising market P/E doesn’t necessarily prevent the market from climbing further, expensive markets are more vulnerable to declines.

As the markets continue to climb, some caution is warranted… Here are three things you can do today:

- Diversify

Diversification is fairly easy to accomplish, and usually doesn’t require expanding your portfolio too much. If you’re holding positions in several different market sectors, plus some bonds, alternative assets (and cash), you’re likely diversified.

Just make sure your portfolio isn’t overly concentrated in just a few positions. Having a concentrated portfolio makes you vulnerable to stock-specific declines. But if you diversify properly, one or two problems—like a bad earnings report or a sector-wide decline—won’t wreck your portfolio.

- Own income stocks and reinvest dividends

Income stocks can be expensive and are vulnerable to selloffs… but companies that can afford to pay dividends tend to have profitable businesses and steady cash flow. You want to hold the best such companies, especially for the long term… and reinvest the dividends.

Regardless of what the market is doing, by plowing your dividends back into the same stock, you’re increasing the number of shares you own and the amount of future dividends. And when the market declines, reinvesting dividends allows you to buy more of the same stock at cheaper prices. You’ll get more shares—and earn more dividends in the future.

- Utilize “market insurance”

Market insurance, such as buying a put on a stock you already own, can create protection for individual positions you don’t want to sell. It also limits your downside in case of a selloff and allows you to benefit from your long position even if it declines.

Investors can also employ more aggressive insurance, such as selling stocks short or buying put options outright. These hedging strategies are more aggressive, but they can make you money when most of the market is losing it.

In many cases, selling a stock short can make more sense than buying a put option. Unlike a put option, shorting a stock is less time sensitive. It can be a good strategy when you’re betting on a decline, but not on the timeline.

Buying a put on a stock you don’t own is the most aggressive hedging strategy—the put can expire worthless if the stock doesn’t decline. But owning a put can be worth it: You only risk a relatively small amount, but you stay to make money when long investors lose it.

Understanding your timeline and potential upside and downside is critical when selecting a method to protect against a decline.

Staying invested is the best long-term strategy. But with the markets getting more and more expensive, now is also the time to think about market defense and downside protection.

Whatever hedging method you choose to “insure” your portfolio, make sure you’re diversified, reinvest your dividends, and know how much of a downside you’re willing to accept.

This record-breaking bull market is already setting new highs in just the first month of 2020… but it can’t run on forever. Is your portfolio prepared?

To a healthy portfolio,

| Genia Turanova Editor, Moneyflow Trader |

Editor’s note: Whether the market is breaking new records or taking a turn for the worse, The Dollar Stock Club’s weekly recommendations are analyst-tailored to help you take advantage of current market conditions. Genia’s own Dollar Stock Club pick is up nearly 6% in just one month… and pays a hefty dividend.

To find out more about The Dollar Stock Club… and how you can subscribe for just $1 a week… click here.