Last week, the two largest U.S. oil companies, Exxon Mobil (XOM) and Chevron (CVX), reconfirmed their commitment to paying dividends.

Does this mean income investors holding these companies—either directly or through dividend-focused funds—can relax knowing that their dividends are safe?

For now, the answer is yes.

But based on industry fundamentals and the news coming from other oil companies, they’re not out of the woods just yet…

The price of oil is the single most important dividend factor here.

And even though the price of crude is no longer negative at $25 per barrel for WTI and $30 per barrel for Brent, it still trades at levels not seen in some 15 years.

Sharply lower demand because of the coronavirus crisis is one reason… oversupply is another.

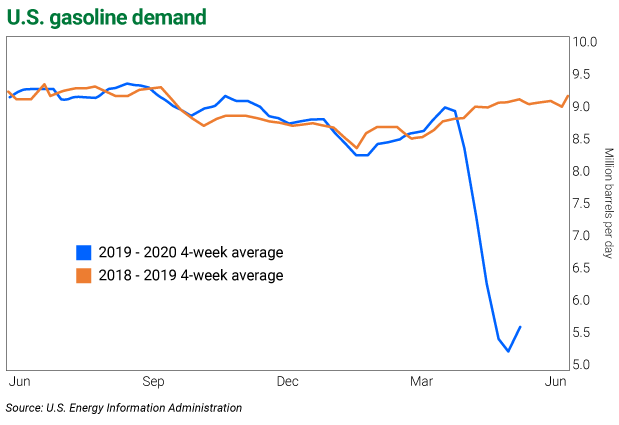

According to U.S. Energy Information Administration (EIA) data, demand for all kinds of fuels is down sharply this year. For instance, gasoline demand in the U.S. is down by more than 40% and, despite a small rebound, still sits near its all-time lows.

And there are other reasons the outlook for oil demand remains bleak…

For one, rising U.S. unemployment doesn’t bode well for energy demand or recovery in the price of oil.

Yesterday, the ADP National Employment Report (often an indicator of things to come in the U.S. Department of Labor’s official unemployment report, releasing tomorrow) showed that there were more than 20.2 million unemployed people in April.

And while St. Louis Fed president James Bullard said yesterday that the U.S. unemployment rate will decline “under double digits” by the end of the year, this doesn’t feel like a bullish recovery outlook to me…

The rest of the world will not be able to replace the lost demand any time soon, either.

Around the same time the ADP report was released, the European Commission said that the GDP in the eurozone will decline by 7.7% in 2020, with Italy, Spain, and Greece contracting by more than 9%… bearish numbers for both oil demand and prices.

And not all companies in the energy patch are positioned well enough to get through this unscathed. Debt loads are becoming too much to bear for many…

Last week, Reuters reported that Chesapeake Energy (CHK), a debt-laden fracker, is preparing for bankruptcy… and this week, Occidental Petroleum (OXY)—saddled with debt after its $55 billion acquisition of Anadarko Petroleum—reportedly hired specialized investment bankers to help with its debt situation.

Then there’s Diamond Offshore (DO), an oil driller that filed for bankruptcy on April 27… and Whiting Petroleum (WLL), a shale company that filed for bankruptcy protection April 1…

These are just a few of the indebted companies that could become victims in the next energy crash… And although there are well-diversified and financially strong oil companies that will survive, not all will be able to maintain dividends during these difficult times.

Last Thursday, Royal Dutch Shell (RDSA) became the second oil major (and the first “supermajor”) to cut its quarterly dividend… a huge 66% cut from $0.47 to $0.16.

There are only five supermajors in the world… Royal Dutch Shell, Exxon Mobil, Chevron, British Petroleum (BP), and France-based Total (TOT).

In supermajors like these—companies that have historically and consistently led the oil sector—not only are huge dividend cuts a bad sign… in some cases they’re unprecedented. Royal Dutch Shell had been able to maintain its dividend since WWII.

The other four supermajors, including U.S.-based XOM and CVX, are sticking with their current payouts… for now. But unlike in the years past, Exxon hasn’t raised its $0.87 per share dividend for the upcoming quarter.

I recommend watching the European supermajors, as the possibility of dividend cuts is real… BP and TOT’s respective 10.6% and 8.3% yields don’t seem sustainable in today’s oil market.

Another possibility is that a dividend will be paid in stock, not in cash. That’s the option Total went for this week… as its board of directors offered (subject to shareholders approval) the ability to choose how the shareholders receive the 2019 final dividend… in cash or in new shares of TOT with a discount.

For the long-term prospects of these companies, cutting dividends isn’t the worst policy. Low oil prices already put significant strain on these companies’ budgets. Lesser payouts would mean better financial flexibility… and stronger long-term outlook.

At current levels, XOM yields 7.8%… and CVX yields 5.6%.

Both U.S. companies reported their latest quarterly results on May 1, and based on what they had to say, I prefer CVX to XOM at this time… both for the strength of its business, and for the safety of its lower dividend payout.

Exxon Mobil’s quarter was very weak, with nearly $3 billion in bad assets written off and the first per-share loss in more than 30 years… And that’s despite producing more oil and gas in the first quarter 2020 than in the first quarter a year ago.

Further, XOM is still struggling to recover from its ill-timed $41 billion acquisition of natural gas company XTO Energy in 2009.

In contrast, CVX is a very well-run company… Its financial condition and ability to pay dividends seems to be the strongest in the industry.

And unlike XOM, Chevron managed to make money last quarter. Its $3.6 billion in profits translates to $1.93 in earning per share (EPS)… up from $2.6 billion in profits and $1.39 in EPS a year ago.

CVX’s fiscal conservatism is paying off. Even though its stock has declined in the past year, it’s done much better than XOM (-23.9% vs. -42.7%, respectively).

When it comes to income, the oil industry isn’t the steady payer it used to be.

The record slump in the price of oil is hard on the entire industry, and some players have already cut their payouts. Not following suit will put many already struggling companies at an even bigger disadvantage, so I’d expect more cuts in the near future.

In an oil environment like today, income investors in the sector need to be looking at more than just high dividend payouts…

To protect your portfolio, stick to the strongest players as much as possible… look at things like profits and EPS, and how they compare to last year.

An oil company bleeding profits can’t maintain an 8%-plus yield for long, especially in today’s COVID-19 oil market.

P.S. Last week’s livestreaming townhall event was full of actionable advice for the months ahead… including one of the smartest ways to invest in volatile times like these. While the market was crashing in recent weeks, my Moneyflow Trader subscribers used this strategy to collect triple-digit gains… five times.

During the event, Frank and I show you just how easy this strategy is to use.

You can also watch this short clip to learn more about Moneyflow Trader—and how you can get my upcoming income advisory FREE.