Bitcoin made its debut in 2009, and since then, there’s been uncertainty about reporting digital currencies when tax season rolls around.

Even CPAs involved in calculating income tax returns have had their share of confusion with digital assets.

What makes it more intimidating is the IRS hasn’t declared a tax code with a definitive answer.

But, while the IRS may not have a formal tax code for cryptos, you still have to report them… and you’ll be penalized if you don’t.

So, where does this leave you?

The most important thing is to understand how the IRS sees your cryptocurrency…

In the last few years, the IRS has come to define cryptos as both a personal asset and a potential source of income…

In 2014, the IRS declared tax stipulations on digital currency and cited cryptos as a capital asset—like real estate or stock—and therefore taxable as such… This meant sales of the currency could qualify as capital gains or losses, depending on the situation. (Think of the taxes you pay when you sell a home.)

As of 2020, the IRS now specifically asks about virtual currencies when you file your income taxes If you received cryptocurrency as payment for goods and services, you may have to report it as income. (This rule tends to cover any cryptos that don’t fall within capital asset guidelines. Think taxes taken out of your paycheck.)

However, the IRS doesn’t consider cryptos legal tender for purchasing goods and services—which means…

In some cases, you may be in the clear… In others, not reporting could set you up for fines and back taxes.

To keep yourself in check, keep in mind these general rules for triggering qualifying taxable events.

Taxable events

- Selling cryptos: If you sold cryptos for a profit, you’ll likely be subject to a tax based on your regular income bracket. Think of it like reporting and paying taxes on portfolio gains.

- Exchanging cryptos for profit: If you’ve exchanged one crypto for another and profited from the trade, you owe taxes on those gains.

- Receiving cryptos as payment for goods and services: If you’ve received cryptos as payment for goods or services, the IRS considers this taxable income.

- Exceeding gifting limits: In most cases, charitable gifting is not a taxable event… but there are annual and lifetime gifting limits, and exceeding them can trigger taxes.

Generally speaking, this ranges from about $15,000 annually, up to about $12 million in total lifetime donations. Anything in excess of those guidelines is taxable.

Non-taxable events

- Donating to a qualified nonprofit charity: For-profit and nonprofit charities differ in the eyes of the IRS. If you donate, find out if the charity is a for-profit or nonprofit organization… and be sure to stay within the annual and lifetime gifting limits.

- Buying cryptos with cash: Buying a crypto with cash is not a taxable event. Think of it like buying a stock… you’re taxed on gains—not the initial purchase.

- Crypto transfers: The exchange of cryptos (or transferring between wallets / accounts) is not a taxable event.

Calculating capital gains on cryptos

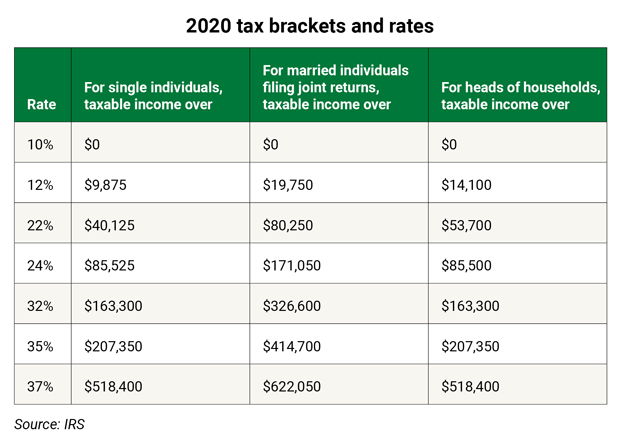

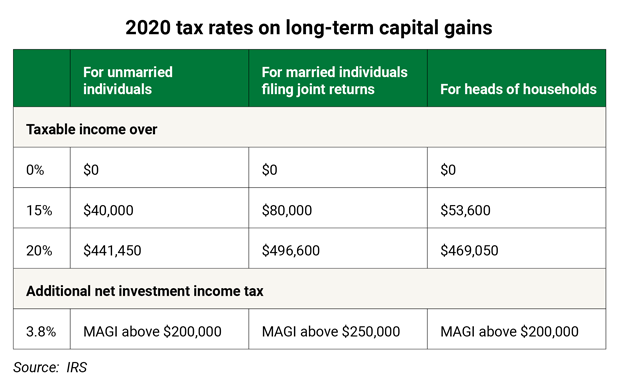

If you’re not familiar with how to calculate your income and capital gains tax brackets, see the charts below.

For example, let’s say you’re a single filer when reporting income taxes…

- Your gross income each year is $100,000.

- Your adjusted gross income is $87,800.

This puts you in the 24% tax bracket, and in the 15% capital gains bracket…

Now, let’s say you bought $1,000 in cryptos over a year ago, and sold them for $2,000 this year…

$2,000 (2020 sell price) – $1,000 (2019 purchase price) = $1,000 (taxable gains)

$1,000 (taxable gains) x 15% capital gains tax = $150 taxes owed

Other factors may come into play when calculating your gains and taxes, but the guidelines and formula above can help give an idea of what you may end up owing.

Adhering to the IRS

The IRS may not have a definitive crypto tax code just yet… But it’s taking a closer look at cryptos and crypto traders.

Keep a record of your crypto holdings and transactions, no matter how small. And make sure you’ve reported any crypto earnings from 2019 and prior years. Not doing so could lead to fees, back taxes, or worse.

And if you’re unsure of what or how to report, seek out a professional tax advisor.