Chris MacIntosh is founder and author of Capitalist Exploits. He’s about as contrarian as you can get… always calling it like it is, without any B.S.

He shares what you should be buying—and avoiding—to make asymmetrical returns [20:17].

Remember, what gets you the most bang for your buck isn’t always the popular pick…

Chris MacIntosh

Ep. 57: Contrarian investor shares how to get the most bang for your buck

The Mike Alkin Show | 57

Contrarian investor shares how to get the most bang for your buck

Announcer: 00:00:08 Free and clear of the chatter from Wall Street, you’re listening to Talking Stocks Over A Beer. Hosted by hedge fund veteran and newsletter writer Mike Alkin, who helps ordinary investors level the playing field against the pros by bringing you market insights and interviews with corporate executives and institutional investors. Mike sifts through all the noise of mainstream financial media and Wall Street, to help you focus on what really matters in the markets. And now, here’s your host, Mike Alkin.

Mike Alkin: 00:00:39 It’s Tuesday, April 16th, 2019. Hope you’re doing well. It’s the day after tax day in the US, got that out of the way. Always feels good, it’s always a pain in the ass putting together the packet my accountant sends me three months, four months prior. All that prep stuff you have to do and of course I procrastinate and always wait. Such a pain in the ass. But get it done and here we go, onto a new tax year.

Mike Alkin: 00:01:13 So I know people are expecting, at least those of you who don’t fast forward through the first 10 or 15 minutes of the podcast, which I expect many of you do because you don’t really particularly care to hear about the personal stories or the sporting commentary. And as you know we are in the thick of the NHL playoffs, and my wife said to me last night, think it was last night. Yeah. I walk into the kitchen in between periods of one of the games and I said, “It’s unbelievable, the level of play in the playoffs is just absolutely crazy. It just doesn’t get better than this.” And she looked at me and she said, “You are such a broken record. Do you have anything else to say during the NHL playoffs?” I said, “No.” She said, “Okay, good. Enjoy.”

Mike Alkin: 00:02:10 It is the first round and you just have the 16 teams fighting it out, right? To advance. And the level of play is just, it’s stupendous. The level of intensity that comes is just really, it’s fantastic to watch. The action, the short shifts, the 45-second shifts when the new guys are on so they’re constantly bringing energy and the crowds are going crazy. And there’s been some really interesting surprises, right? I mean it’s … Tampa Bay, down 3-0? I mean who would’ve expected that Columbus was going to be up 3-0 on Tampa Bay? Tampa Bay had dominated the NHL, they won the Presidents’ Cup, they ran away with it and they look like a team that’s not played before, like they’re just meeting for the first time in training camp. It’s like they literally forgot how to play, so it’s crazy.

Mike Alkin: 00:03:05 And then you have the Capital-Hurricane series, right? Caps went up 2-0 in Carolina last night the crowd was out of their minds. It was fantastic watching. Hurricanes won 5-0. Then a really good Nashville-Dallas series. The Avalanche are surprising the Flames, they’re up 2-1 on them, they dominated Calgary last night. So it’s just been one after the other. It’s just great hockey.

Mike Alkin: 00:03:33 Oh yeah, I forgot. My Islanders up 3-0 on the Penguins? I wasn’t going to mention it because I can’t, because they could easily lose four straight to Sid Crosby’s Pittsburgh Penguins, and I’m afraid I’m going to jinx it so no gloating, because there’s nothing to gloat about until you’ve won your fourth game. Because you’re playing a great team, they’ve got a home game tonight in Pittsburgh, down 3-0, I can’t believe that they’ll come out anything but just absolutely flying. The Islanders are playing well and I’m just holding my breath and we’ll see where it goes. So playoff hockey is here, pretty exciting stuff. Then again, if you don’t watch it I’m sorry to hear that. So.

Mike Alkin: 00:04:29 Also, yesterday, people where I was reading about on Twitter, a lot of people anxious about Section 232 and uranium. On Sunday the Department of Commerce sent their recommendations under Section 232 on their investigation regarding their recommendations to the White House to President Trump on the petitions filed by Ur-Energy and Energy Fuels on the ground of national security. Those two US uranium miners are asking that a quota be imposed on US utilities to buy 25% of any uranium from the US miners because the US miners’ production has imploded. They feel as though the Kazakhs, Russians, and Uzbeks are sending in cheap uranium, and that’s been, since July of ’18, that’s been in the hands of the Commerce. They had 270 days to investigate, which they did, and they sent their findings to the White House and some people are hoping that you might actually know what those findings were and that is not the process.

Mike Alkin: 00:05:34 Once sent to the White House they have 90 days to make a decision on what they’re going to do, and they could take the Department of Commerce’s recommendations at full face and implement those, or they can take none of them, or they can take some of them. They could do whatever the heck they want. It’s in the White House’s hands as to whether or not they want to reveal before a decision is made what those recommendations are. But fret not, because we are, a couple of things. One, we know it’s within 90 days and it’s already been since January of 2018 when these two US miners filed the petition. It was July when the Department of Commerce decided to pick it up. So what’s another 90 days if it went that far? Which I don’t suspect it will, but I have no basis for that, but I don’t believe that the President will take that long to figure it out.

Mike Alkin: 00:06:30 There have been massive lobbying efforts on both parts, obviously the US utilities have a much bigger lobby that the US uranium miners. But the US miners have some pretty good arguments. So we will just see how it plays out, but you’re closer to an answer than not. I suspect because it’s uranium and uranium is a sexy topic, right? I mean, think of Uranium One and all the press that came about. Even Trump himself would talk a lot about that. But might I suspect the press will dig in and will try and come up with what they can on it, and you would probably see, I would not be surprised to see what some of those recommendations have been, or are, start to come out over a period of time.

Mike Alkin: 00:07:16 I’m indifferent. For me, 232 has created a pause in buying of uranium at the utility levels in a significant way, in a major contracting way, and I think it’s created uncertainty in markets, and I don’t like uncertainty. Any market doesn’t like uncertainty, they want to … For good, better, or indifferent, just let us know what it is and then we could plan accordingly. Markets like certainty, and as you get closer to a decision, whatever it is, after we get a decision, that will lift the veil of uncertainty and then the market could move forward. I think that’s healthy for price discovery. And price discovery is what’s been lacking in a significant way in the long-term market in any meaningful contracting way in terms of, since we’ve had major production cuts. I mean you’ve had some contracting take place, but I’m talking about size contracts and lots of them.

Mike Alkin: 00:08:16 I think that’s going to be an eye-opener for those who are involved in the industry that have really had it good for quite a number of years, and they’ve done very well. The utilities have done a wonderful job of staying out of the market because they haven’t had to be. There was, post-Fukushima in 2011, there was a heck of a lot of uranium in the ground and the US uranium miners … I shouldn’t say US. The global uranium miners were still producing and spending on capital in 2011 and 2012 and still advancing projects because they figured when 54 reactors in Japan went offline, 13% of global nuclear power demand went offline in Japan after Fukushima, after the accident there, that they would have to come back online because it was almost 30% of Japan’s electric grid. But they were resourceful, the Japanese, and they brought in liquefied natural gas and they were able to substitute and it’s just now that you’re really starting to see any type of uptick to those with nine reactors online, and many more slated to come online over the next few years.

Mike Alkin: 00:09:27 But the uranium industry anticipated that happening many, many years ago and it didn’t. The uranium industry was looking forward to the ending of the Megatons to Megawatts Program, which was sending in upwards of 20 million pounds a year into the secondary market, and all that was, was from ’93 to 2013 you saw the Russians and the Americans, where the Russians were down-blending intercontinental nuclear weapons from highly enriched uranium down to low enriched uranium, and that was coming into the market. That ended in ’13 and the miners were anticipating that, “Oh geez, look at that. The Japanese will come back online, this program will end.” But the Japanese didn’t come online in any way, shape, or form that people anticipated and then the Department of Energy and the US didn’t quite fully replace what the Megatons to Megawatts Program was providing, but they were selling upwards of six, seven million pounds a year and things just got delayed.

Mike Alkin: 00:10:33 And it wasn’t until, really, small cuts in ’16. But then 2017 and 2018, you’ve seen significant supply come offline. But during this time, you haven’t seen, since these big 25% of global supply has come offline and production cuts in the secondary sources of supply, you’re seeing a reduction in the amount of underfeeding, which is a secondary source that happens at the enrichment plant. That was a huge amount of supply that came into the market, upwards of 20 to 25 million pounds a year, that the market didn’t really anticipate. And I won’t get into the physics of underfeeding, but essentially when there’s excess capacity in the enrichment process, they can extract some extra uranium, and it winds up as enriched uranium product as an end-market competing with mine supply.

Mike Alkin: 00:11:20 So for a host of issues that you saw a significant amount of excess supply. Well now since 232 petition was filed in January of ’18, it’s really created somewhat of a big, major pause in major contracting that’s going to need to occur, because you’re seeing a contract expiration waterfall at the utilities. And typically, these contracts are seven, eight, nine, ten years. And if you look back at history, the prices and the long-term contracts at the big prices are typically signed at peaks, and they’re not signed at bottoms, right? Kind of counterintuitive. But you see big contracting when prices are high, and that’s because the utilities are [inaudible 00:12:08] about the security of their supply, more so than the price they pay for the uranium.

Mike Alkin: 00:12:14 And they’ve been very smart, the utilities. They’ve stayed out of the market. You’ve had the global financial crisis, which created low interest rates, it created a market for some of the investment banks to step in after Fukushima melted down, for the investment banks to come in and create what’s called a carry trade, where they would go and tell the utility, “No need to sign a seven to ten year contract, you don’t know where the price of uranium’s going to settle in. So why don’t you just buy a short-term deal with us, and we’ll carry it for you on our books? Let’s enter into a two-year agreement, three-year agreement. We’ll enter into it, contract it with you, we’ll carry the uranium so they’ll go out into the market and buy it, and then figure out where you are in a couple of years.”

Mike Alkin: 00:12:56 That was a gold mine for the utilities, they were like kids in a candy store because they didn’t need to go out and secure these long-term deals, and it worked out well for them. Too much supply, the miners were slow in reacting to take production offline, and you had a significant supply and demand imbalance, with much more supply than needed for many years. But things happen, right? When you get to a price where the cost to extract it far exceeds the cost you could sell it for, you need to have production cuts. That’s not rocket science. That’s basic, right? Economics 101 and you’ve seen that happen now.

Mike Alkin: 00:13:34 But when 232 came, that created a lot of uncertainty. So real price discovery in the big portion of the market has, where you’re going to see all these contract, is occurring … Hasn’t been able to occur, when it should be occurring. It’s at a time where the major contracts are starting to expire, and you’re seeing the utilities need to be uncovered, meaning, how much are they going to have that’s not under contract? And that’s starting to accelerate in 2020 through 2023 through 2025, and the reason that’s important is it’s a couple year fuel cycle. You can’t just order up uranium. “Yeah I need it tomorrow, send it to me.” No, it goes through a fuel cycle which is 18 to 24 months.

Mike Alkin: 00:14:19 So the timing of price discovery is occurring as you’re starting to see the waterfall of contracts expire, and that will be accelerating over the next few years. And I think that’s what the market needs to heal. As for 232 itself? My view is that there is a significant deficit of uranium. My team’s view, our in-house view, is that there’s a significant deficit that will be here for many years, many of these projects that are needed to drive the supply for the demand that’s coming from the developing world is going to require new projects. Not just existing projects, and some of these existing projects wind down over the next few years, so you need new supply. And that new supply can’t come online. None of these projects could get financed unless you get $50. There’s one out there, two out there you’ll see they can do it at lower. There’s a small, but not to make a dent.

Mike Alkin: 00:15:18 So you’d need the price to go higher going into a period where contracts are starting to be uncovered. And now as 232 lifts, we get some certainty as to what it is, you start to get price discovery again, and that’s what heals markets. And that’s where our house view here is, that you see a significant change in buyer psychology over a period of time.

Mike Alkin: 00:15:43 Anyway. 232 or not, there’s going, with the deficits we see, whether you’re a US miner or not, you’re still going to be okay. If you are capable, if you have real projects, if you can go into production you will be fine wherever.

Mike Alkin: 00:15:57 Anyway, that’s our view. I was seeing a lot of traffic yesterday. “Do you care? Oh I’m so anxious!” I don’t. Who cares? It’s another couple of months or not even. You’ve been waiting this long, just … You’re in this trade, if you’re in the uranium trade to make hopefully many multiples of your money, and the asymmetry is there, who cares? You’ve already waited a year and a half? Two years, building positions? What’s the difference? Another couple of months, or a month. Or three months, doesn’t matter.

Mike Alkin: 00:16:31 Anyway, that’s my view there. Abridged version, of course. There’s enough stuff out there if you want to YouTube what my overall, more detailed view is. But so obviously, right? Uranium is contrarian, and it’s just how I like to think about investing. What’s the point for me, my view. I’m not saying it should be your view, is: if I’m going to put money to work, I may as well put it in things where there’s a handful of things that there’s some asymmetrical risk/reward. Because I’m terrible at trying to figure out which way the market’s going. I mean I have a risk on/risk off view. Is the market risk/on or is it risk/off? What would make it switch? But in terms of putting money to work, managing a diversified portfolio you’re basically going to do what the index does. You’re not going to generate alpha, which is performance above the index. It’s hard.

Mike Alkin: 00:17:30 So I look for those things where people hate, and then dive deep and say, “Is there anything interesting?” And anything asymmetrical, anything changing underneath the surface, anything that people are really relying on a recency buy because that’s what’s been going on, so that’s going to continue. And sometimes when that happens, lethargy sets in. Apathy, and you can find some interesting opportunities. That’s how I found uranium a few years ago.

Mike Alkin: 00:17:58 SO one of the guys that I talk to that I think is really smart at that is on the other side of the world. He has a three, four, five year time horizon and that’s how my view … these things, if it was obvious, it would happen right away, you wouldn’t have the opportunity. So when you look at things over a three, four, five year period, that’s when the real healing can take place if it’s already started and people aren’t paying attention, right? You’ve got to just keep doing your research and digging deep and finding out what’s going on, and finding out what metrics in any industry matter. But that’s when you start to think about it. I started talking publicly about uranium in I think it was April, May of ’17? So here we are, two years now, so we’re getting into our period.

Mike Alkin: 00:18:45 And in the interim, the price of commodities have gone up. Stocks gone up and down a little bit, but I’ll take up or down a little bit, if my work is right with the upside is, who cares if you’re sitting on money that’s not going anywhere for a little while? Or you could put it to work trying to slug it out with figuring out whether or not XYZ Company’s going to do anything. That’s part of an index that’s going to just move around and you’re going to be like the tail of the dog. My view, not saying it’s right. It’s just my view.

Mike Alkin:00:19:21But somebody who has a similar view, and has a contrarian bent to him and incorporates a lot of geopolitical thinking into it, is somebody that I think is worth listening to. And he’s our guest right now. And his name is Chris MacIntosh and Chris runs Capitalist Exploits, capitalistexploits.com or .at. Lives down under, former venture capitalist, now manages his own money. Has a couple of really good newsletters on deep value, he has a resource newsletter called Resource Insider run by a really sharp guy who I know very well, is Jamie Keech who is a mining engineer and sniffs out the BS that happens in the mining space. Really just sharp guys.

Mike Alkin: 00:20:13 But Chris is going to come on and we’re going to talk about some geopolitics, and some contrarian thinking.

Mike Alkin: 00:20:18 Chris MacIntosh. Thanks for joining, buddy.

Chris MacIntosh: 00:20:21 Thanks for having me, Mike.

Mike Alkin: 00:20:22 Remind people where you’re calling from.

Chris MacIntosh: 00:20:26 I’m calling from [inaudible 00:20:28], which is at the bottom end of the earth, in a little-known place that I hope kind of stays little-known. New Zealand.

Mike Alkin: 00:20:37 So it’s a little bit of slice of heaven?

Chris MacIntosh: 00:20:40 A little bit of my slice, yeah, exactly. So that’s where I’m calling from. You’re from the big smoke and sometimes it’s a little bit patchy at times, but nevertheless. We manage to connect.

Mike Alkin: 00:20:54 Yeah, we did. Absolutely.

Chris MacIntosh: 00:20:57 So what’s on your mind, Mike? What are we going to talk about today?

Mike Alkin: 00:20:59 Well, you know. So for those listeners who are not familiar with Chris. Chris has a great background. A former venture capitalist, now runs his own fund, his own money. And has a great newsletter called Capitalist Exploits. And Chris is a guy after my own investing heart because he takes a time horizon of three to five years, he could give two rats’ asses, excuse my French, about what the market thinks. He looks for deep value, he looks only for asymmetry, otherwise he doesn’t put his money to work, and we’re going to talk about that. And he’s got a great skeptical eye. And so while he doesn’t short sell, because he likes to keep his sanity, he does bring the eye of a skeptic and looks at things both through the long and short lens, but expresses the view in very long-time horizon in deeply out-of-favor companies and industries.

Mike Alkin: 00:22:17 So Chris. How do you see the world right now?

Chris MacIntosh: 00:22:26 Well I guess we can come back to the one pounding thing that’s in my head, which is the cash incinerating, vanity machine project called Tesla, but we’ll do it maybe at the end. But.

Mike Alkin: 00:22:44 It’s hard, by the way. I saw on Twitter somebody said this and I agree. Somebody wrote, “I can’t remember what I forgot about Tesla.” I’m like, it’s so every day, it’s so much you have to sit down and say, “My God I forgot so much but I knew it.” Right? It’s just crazy.

Chris MacIntosh: 00:23:01 You know, the funny … Like I said, we’ll come back to it. Suffice to say that I’m really going to miss it. It’s the most entertaining equity I’ve ever watched in my career, bar none.

Mike Alkin: 00:23:17 Me too. Bar none.

Chris MacIntosh: 00:23:17 And for that alone, I’m really going to miss it.

Mike Alkin: 00:23:20 Well for me, and we’ll touch on this. But for me, Chris. For me, it literally is not only the digging into the financials and understanding the fundamentals, right? That’s a whole separate kettle of fish. For me, my jaw drops when I see this carnival barker of a CEO tell the world something, and to watch the reaction of those who follow him blindly. And for me, I kind of understand how cults form now, and understand how people literally are walked off a cliff. So anyway. We’ll touch on it later. So.

Chris MacIntosh: 00:24:04 That’s an absolutely fascinating insight, real time insight into human psychology.

Mike Alkin: 00:24:12 It is.

Chris MacIntosh: 00:24:14 I find it very, very interesting from that perspective. But back to your question. You’re an American. You’re sitting in New York there and you’ve got a ground-like view to what’s taking place there and it’s been on my mind for some time. As you know, I spend a fair amount of time looking at geopolitics, trying to identify large sort of trends in motion. And I look at that and then I look at deep value sectors and particularly where the two sort of collide is where I get more comfortable in taking a position. Because you can have deep value sectors, or something that looks to be, on a relative basis, very cheap. But it can stay cheap for some time which I’m relatively comfortable with given my time horizons, but I do feel like I kind of need to understand whether something is going to get drastically more cheap for some exogenous sort of reason.

Chris MacIntosh: 00:25:27 So I kind of look at a lot of that, and it’s been really fascinating over the last, I’d say the last 10 years, watching what’s been taking place on a political basis in the US. I wrote a couple of articles about this the other day with NATO and the US kind of scaling back, so to speak, in NATO. And some irate subscriber, just a free blog, wrote in saying, “You’re an idiot. Haven’t you just seen that they’ve actually sent some more,” I think it was fighter jets or something or other, “to Europe?” And what you’ve got to understand is that they’re not pulling out, they’re scaling back in what they’re asking the European countries to do, is to pick up more of that hammer to wield it. And part of it, the reasoning for NATO doesn’t exist to the extent that it did post-World War II. Russia’s not the big scary monster that it used to be. It’s more a regional power than a global power, which it was through the Cold War era.

Chris MacIntosh: 00:26:48 And they’re focusing much more intently on China, and you can see this in the current administration, and so that whole interplay is quite interesting. While it’s taking place, it’s been fascinating to look at US domestic politics and how that’s influencing foreign policy. If you go back to, what? Between I guess the 1950s and probably 2015, US domestic politics was basically bipartisan. Neither side liked the other much, but both pretty much agreed on foreign policy in the global world order that America built. And I’d say that that’s now changed. It’s like you’ve got the most partisan that US domestic politics has ever been, in ever. That I’ve ever seen, and you’re seeing that coming through.

Chris MacIntosh: 00:27:51 Just as a side point for any listeners that have not read The Fourth Turning, it kind of goes into … I don’t agree 100% with all of it, but the concepts of The Fourth Turning are certainly true. And you look at what the authors of that book talk about is these demographic groups, you have roughly 20-year generational cycle and how those generations affect politics and they go back into a lot of history showing how that happened. Mostly it’s very US-centric and that’s I guess part of the xx they’re in, because it’s a very US-centered view. Which it probably gets away with in the most part, because the world has been dominated by the US, especially since the 50s.

Chris MacIntosh: 00:28:49 But if you go back. What can hold domestic policy together, US domestic politics together, when it wasn’t so partisan was in large part of it was the Cold War. You had the Commies led by the Russkies, and they were bad. Everyone knew that. And then any country supporting them was sidelined or overthrown if possible, if you think Latin America. And that was kind of that. And so anybody that would’ve rebelled against that would’ve just been shot down, like, “Are you mad? These people have got fucking nukes and they’re going to kill us, and we have to do everything that we can to stop them.” Everybody remembers, well many people remember, the Cuban Missile Crisis and so forth and so forth. And so there was kind of like this imminent potential threat, right? And that was quite unifying.

Chris MacIntosh: 00:29:42 And that doesn’t really exist today, to the same extent. There’s no Cold War now, even though I fear to say that the left in the US is trying the hardest to drum up anti-Russian hysteria. But so far that just seems to be backfiring spectacularly. When you have things like the Mueller Report that came out and you have Cambridge Analytica for example you’ve kind of got all these, it’s not a unifying thing, I guess, is what I’m saying. You’ve now got people who’s either for it, going “Oh yes, Ivan the Terrible has been affecting our elections” and all this kind of nonsense, and you’re seeing it now with the arrest of Assange. Oh he’s a Russian spy and he was part of it and that’s the missing link.

Chris MacIntosh: 00:30:39 Anyway, the point is that it’s very much now you’ve got those who believe it and those who don’t, and then there’s like a whole swathe in the middle who are sort of teetering, like “I don’t know. I kind of thought maybe it’s true and now looking, we’re not so sure.” But generally, foreign policy is now pretty much in a state of flux. There’s a good friend of mine who runs a geopolitical risk firm over in Asia, he tells me it’s in a state of collapse. He’s an American and I’m not so sure but what I am sure is that, because it’s pretty much self-evident, is that the cohesion that existed previously in terms of US domestic politics is now gone. It’s like there is no unifying threat to US interests, and also most Americans have never left the country or don’t even have a passport. So they kind of still think of China, for example, as just some backward place that’s massively inferior to the US.

Chris MacIntosh: 00:31:43 And so even if the current administration is saying, “Hey, these guys are a threat and we need to sort of counter that,” it doesn’t have a unifying … it’s not unifying the whole country where everyone believes that. Some people believe it, some don’t. Again, partisan. And then if you look at what hits the newswires, and I was just pulling up, because I was trying to get some stats on this, now I’m still not sure where to look. But I was just doing random searches going back for various times, like 10-year periods, and looking up, what were the major headlines in western societies and then in the US in particular. And there’s like, in the probably, really in the last two, three years, but it probably happened a little bit before that. There’s like now the issues in the US that are dominating the debate are not at all international. They’re not. Foreign policy just doesn’t affect it at all. It’s like, at the moment, when the radical-ing you’ve got, the debate is about social issues and when-

Mike Alkin: 00:33:07 Yep.

Chris MacIntosh: 00:33:09 … far-left issues like safe spaces, gender equality, recognition of folks who want to ignore their biology or whatever. But basically you know you’ve got people interested in social programs, welfare and taxes. And then I guess the least aggressive of them interested in taxes and pensions and things of that nature, but none of them care about foreign policies. It’s a non-issue, and this is really, really different, and I can’t … you go back even 10 years prior, 20 years prior was massively different. And I can’t really see much of this changing since in so small part due to demographics, and again that’s one of the things that they talk about in The Fourth Turning.

Chris MacIntosh: 00:33:53 And so you’ve got this new demographic crowd coming through, and they’re increasingly in positions of power. I mean Cortez is just sort of one of them that is a fairly-

Mike Alkin: 00:34:06 She’s out of her mind.

Chris MacIntosh: 00:34:08 … good example. Yeah she is, but-

Mike Alkin: 00:34:11 And I think, we’re talking about Representative Alexandria Ocasio-Cortez, who won a Congressional seat representing an area of the Bronx in New York, who is 29 years old and she’s a great story. She’s a college graduate, but she was a bartender, comes from an area that although she didn’t grow up there, she’s from there. But an area that has its struggles and now she represents them, and she unseated a long-time veteran Congressman. Great story, but she’s a hard socialist, and she is, unfortunately, she’s bereft of facts. And when it appears that she doesn’t have her talking points, Chris? She has no idea what she’s talking about. So on cue, on talking point, she’s okay. But when you get her in an interview it’s just mind-numbing.

Mike Alkin: 00:35:13 But she has four million Twitter followers.

Chris MacIntosh: 00:35:16 Mind-numbingly stupid is some of the things that she comes up with and they really, I mean this is comedy 101. It’s really funny.

Mike Alkin: 00:35:22 I know. It’s crazy.

Chris MacIntosh: 00:35:26 The fact that the electorate actually get to see that and don’t find it either overwhelmingly funny and absurd at the same time, points to that very thing that I’m talking about. You’ve got entire generations now who look at this stuff and go, “Oh, okay. Well that’s probably how I think.” And you and I look and go, “That’s absurd. That’s ridiculous. It’s nonsense.” But that’s not how everybody … Look, Mike. The things that people are obsessing about at the moment are things like the silly actor who staged a hate crime and got off scot free. Or it’s how a Supreme Court justice may or may not have acted when he was a fucking teenager in high school. This is rubbish, this is nonsense.

Chris MacIntosh: 00:36:21 So while that’s taking place, nobody’s even thinking about what happens in foreign countries and how foreign policy should or shouldn’t look, right? It’s too hard, that’s too complex. We don’t want to talk about that, we want to worry about whether someone did something naughty when he was a teenager and, I don’t know. Smoked pot or got jiggidy with some girl he shouldn’t have. I mean, it’s just … It’s Kardashian stuff. But that’s what’s dominating the debate.

Chris MacIntosh: 00:36:53 So we can kind of laugh at it and lack. But what’s interesting, and what I’ve been thinking about. I’ve got this thing now for my wall in my office here, I’ve been staring at it a moment. There are various things that I’ll look at and one of the main things that is interesting post-World War II, and of course the Brits held it before that, was the shipping lanes of the world and you can point and bitch and moan about everything that you don’t like with respect to the British Empire. But what the British Empire did, it did many terrible things and many good things, just pretty much like any ruling power. One of the good things that they brought apart from a legal system to many parts of the world that is probably the best that we’ve come across was that they controlled and opened up the shipping lanes, and they protected them for trade.

Chris MacIntosh: 00:38:02 Now they did that for their own reasons, I mean it wasn’t like they were just being nice to everybody. That’s not it at all, they took their slice, as have done Americans. But we’ve had this period post-World War II, essentially the American Navy, has provided the safety of those shipping lanes. You know, they’ve … Again. I’m not naïve to how this happens and that they have not extracted their bounty with favorable trade deals, ensuring US companies are the ones that sell military hardware to allies, or that US companies get to extract the resources and so forth. I’m not naïve to any of that, I’m just pointing out that this is the way that the world’s worked and it’s increasingly changing and that the political world to maintain that status quo is lacking from what’s in the US. Again, part of this domestic politics we were just talking about, which is very partisan.

Chris MacIntosh: 00:39:02 And it’s definitely lacking in the next generation coming through. Like, the Cortezes of this world? They have no fucking idea of how trade takes place, and what it takes to maintain the stability.

Mike Alkin: 00:39:14 So just for context, Chris. Amazon wanted to come to Long Island City for headquarters, too. Long Island City is right outside of Manhattan, right on the other side of the East River, and it was going to bring 28 billion dollars over a number of years in revenue to the city. And Long Island City’s being built up with some nice housing and for years and years and years, it was a little bit run down. But now it’s starting to really turn, and part of New York state and New York City getting them here was three billion dollars in tax breaks.

Mike Alkin: 00:39:53 Well. Ocasio-Cortez and her socialist agenda went berserk and put so much pressure on it, and her argument was, “How dare you give three billion dollars to this big company?” Now they were bringing thousands of $150-plus thousand dollar jobs to the area, and-

Chris MacIntosh: 00:40:16 But then, you’re not giving them three billion, you’re giving them three billion in tax breaks.

Mike Alkin: 00:40:21 You give it in tax breaks, but she didn’t know that. She literally said, “We should take that three billion and put it towards infrastructure, that’s what we need. Instead we’re making them people rich!” And people came out and said, “You’re joking, right? Do you understand we’re not writing them a check? That’s a tax break generated-”

Chris MacIntosh: 00:40:39 It’s money that’s not yet earned.

Mike Alkin: 00:40:42 Right? It’s money centered, and plus it’s a reduction in … But they’re still going to be generating massive amounts for the economy. She didn’t understand it, and Amazon said, “Go scratch yourself. We’re moving somewhere else.” So that’s, when you talk about trade, that’s what you’re dealing with.

Chris MacIntosh: 00:40:57 Yeah, just a complete lack of understanding. I mean if she can’t understand that, which is really, like basic 101, I think my 13-year old son can figure that one out and [inaudible 00:41:13] could.

Chris MacIntosh: 00:41:14 There’s no ways you’re going to have any decent level of understanding of how international trade takes place, and what it requires to maintain that trade, and why … I mean on the face of it, it’s difficult to bring this to the public eye. You’ve got for example, and I’m not making any, I’m not saying this is right. I’m just saying this is the way that the world works. Part of the reason that the US has always been friendly to the Saudis is not because they necessarily agree with the fact that they chop off people’s fucking heads and that they treat their woman like shit. It’s because the greater enemy to them is Iran, and they need to have a regional ally within the Middle East to be able to counter that threat.

Chris MacIntosh: 00:42:14 And the same is true around the world. You know-

Mike Alkin: 00:42:18 Yeah, what’s that? The enemy of my enemy is my friend, right? Or keep your-

Chris MacIntosh: 00:42:21 Exactly. Precisely. And so that’s kind of always been the way that the world’s worked, that’s why they still provide military hardware and xx to Egypt and many of these other countries, which you might look and go, “What the hell is that all about?” And again, I’m not saying that one is right or wrong, it’s very difficult to actually on a moral grounds, you just say well none of this is good. If you kind of think about what’s going on in Syria, right? The US were backing ISIS. That’s been evidenced. But the reason that they were originally backing ISIS is that they were trying to overthrow Assad, and you could say, “Well, he’s a bad guy.” Well sure, he’s a complete moron. He’s lorded over many of the other tribes within that region, and he’s not a good guy if you want to point like that. But then they’re backing a side which is even worse and, you know.

Chris MacIntosh: 00:43:40 These are difficult things on an international playing field, but when it just comes down to trade routes, you’ve got to have trade routes open so you can move your goods to market. It’s that simple. There’s a couple of areas within the world that are critical for that. Panama Canal, super important, right? That’s why the US have been in there and exerted their influence. It’s also rather personal for the Chinese, who want to go in and build a new canal, that they’re building, which would change the whole power dynamic. And then of course there’s the Strait of Malacca, which is super important for the Chinese which is why they’ve put a lot of effort into relations with Indonesia and Malaysia and Singapore. That’s also why the US are very, very heavily influential to those countries, because at the moment they have them still in their sphere of influence, right?

Chris MacIntosh: 00:44:43 Anyway. So all of this kind of stuff going on, and then you look at the current clutch of politicians and demographic groups coming through and you realize, again we’re kind of pointing to Cortez going all nutty. But she’s just a manifestation of some of that, and those people don’t have the intellectual capacity to understand half of this stuff in the first instance. And even if they did, whether they have the political sort of will to keep that status quo is highly questionable. I’d say it’s probably not going to happen.

Chris MacIntosh: 00:45:22 And we’re kind of already seeing a lot of this, Mike. If you think about what’s happened just in the last two years? Americans have basically abandoned some of their alliances, many, and other geopolitical agreements have taken hits. NAFTA, NATO, World Trade Organization. Deals with Cuba and Iran off the table, and Turkey. Both the Koreas. And that’s just in the last two years, these are many different things. If you look at what’s taken place over the last 10 years? What’s happened in the last few years has been an order of magnitude much higher. And-

Mike Alkin: 00:46:03 We’re very much-

Chris MacIntosh: 00:46:04 [crosstalk 00:46:04].

Mike Alkin: 00:46:07 We’ve very protectionism. Yep. Protectionist.

Chris MacIntosh: 00:46:10 While all that’s taking place you’ve had China just quietly going about making their inroads just on investment basis. They’re pretty much, they are the major player in Africa now. They’ve recently become Brazil’s largest trading partner, they’re the largest investor in places like Pakistan, Greece, and now Italy. And this isn’t a coincidence, right? Italy and Greece, you have Italy with a debt to GDP I think is like 120%? Greece is 189. They’re the worst within the EU, so they basically need help, right?

Mike Alkin: 00:46:48 Yeah. Yep.

Chris MacIntosh: 00:46:48 They’re also coastal countries, which give the Chinese access into the EU. And the other thing that you realize is the Chinese have refused to deal directly with the EU, but they rather choose to deal individually with member nations, which the EU is pissed off about and they don’t like it at all. But if you go back, it’s just divide and conquer and you’ve already got this fractioning within the EU.

Chris MacIntosh: 00:47:18 And with that investment in trade will come politics of power. It’s interesting, I read an article the other day and someone wrote and say, “Ah, you don’t understand. The Chinese are not expansionist.” I’m like, “Fuck off. Everybody’s expansionist.” Like, you know? It’s human nature. If you’re a fighter and you’re trying to make it into the top 10. Let’s say you’re MMA or something like that. And you make into top 10. You’re like, “Wow, I made it into the top 10.” Your aspirations change, you know? You’re like, I didn’t think I could get into the top 10, and then you start thinking could I get into the top five? Could I be the best? It’s like, are you expansionist? You might not have originally been, but you become expansionist when you see that the opportunity is available. That’s human nature.

Chris MacIntosh: 00:48:13 So the idea that China is different in that respect to every other human group on the planet is, to me, just silly. So you’re going to see in the next few years, I think you’ll see that there’ll be pressure on some of these countries to side with China on various issues. That could be them, when they stand at the UN to discuss their claim on Taiwan, things like that. And you’ll suddenly have a couple of these countries going, maybe it’s Italy, maybe it’s Greece, maybe it’s both, maybe it’s Brazil, where they go, “Yep. We’re okay with that.” And the world will be shocked. Watch for it, I think it’s coming.

Chris MacIntosh: 00:48:57 And what’s interesting, again. It’s like a little, well that’s all well and good, but what does it mean from an investment standpoint? Think all of this very much comes back to, there’s increasing protectionism. There’s a change-up that’s taking place and it might last for the next 20 years of a global reordering, and that’s likely to be volatile. And I think that the biggest beneficiary out of this is likely to be energy, because with a threat to trade, for example, routes being negotiated if you sort of think South China Sea? I know that most Americans kind of don’t watch this stuff, but that’s a huge fucking issue and that’s a big issue in Asia, if you read any Asian publications and you speak with anyone there it’s a big, big issue. This is major, and people are not paying a whole lot of attention to it.

Chris MacIntosh: 00:50:00 But in any event, the critical importance of energy, that looms larger than any other. I mean, you can do without imported bananas or your French wine or a pair of socks made in Vietnam, but you’re completely screwed without energy. And so that, I think. And then you look at each of these countries’ energy makeups, and China in particular, are not energy independent.

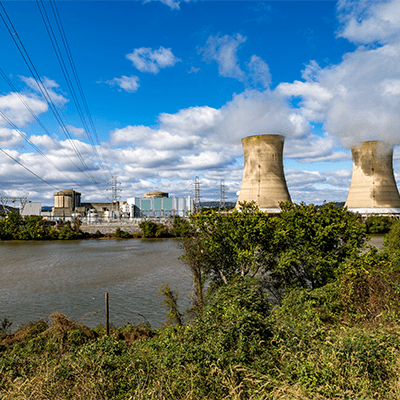

Chris MacIntosh: 00:50:28 Speaking of that, I don’t know if you saw the two things that happened. Nuclear Energy Leadership Act, that was just reintroduced into the US Senate.

Mike Alkin: 00:50:44 Yes it was.

Chris MacIntosh: 00:50:45 Ol’ Billy Gates is championing it all. He’s always been a proponent of that.

Mike Alkin: 00:50:50 Right. And it’s fascinating because Nuclear Energy Leadership, if you think about it, the US has completely lost its leadership role in nuclear energy, right? They have lost there in technology and building, they hardly mine it. They only have one conversion facility, they have no owned enrichment. Yet the thing is, in the past if you wanted to be a nuclear power, and you wanted to get on the electric grid with nuclear power, you needed the US to sign off on it. And why was that meaningful? Because it prevented proliferation. Because the people, if they had to come to you, you could control whether or not they got it. Now they’re like, “Okay. We’ll go to the South Koreans, the Russians, and the Chinese. Go scratch yourself.” And so they’ve let their role in leadership just implode.

Mike Alkin: 00:51:48 So now they’re, you know sometimes you hear too little, too late? All of a sudden somebody woke up and decided they needed to do this, when the reality is the Russians and the Chinese have been vertically integrating the whole nuclear industry, the whole fuel cycle, for quite some time now. And they just seem to get it so much more in terms of thinking ahead and thinking strategically in energy.

Chris MacIntosh: 00:52:18 Because they’ve also needed to.

Mike Alkin: 00:52:21 Necessity, out of necessity, right?

Chris MacIntosh: 00:52:22 Yeah. For the timing-

Mike Alkin: 00:52:24 Necessity breeds invention.

Chris MacIntosh: 00:52:25 Yeah, yeah yeah. And on that point, the Chinese have just approved investment of a whopping 12 billion dollars in the construction of new nuclear power facilities. Now if you come back to what we discussed before it’s like, yep. Geopolitics in China. Remember, these poor slobs, they don’t have any energy, really. I mean they’ve been with coal.

Chris MacIntosh: 00:52:46 And it’s to begin with shipping lanes, and access to markets is really pretty important for them, it’s critical really. So they’re going to continue I think on multiple fronts to address that problem. Domestically they’re going to use nukes, but they’re also going to be assuming more control in the South China Sea and working to secure deals with countries in the Strait of Malacca, Malaysia, Singapore, Indonesia like I talked about. And it’s also why they’re investing heavily in Pakistan, trying to build themselves a land route to get to the Arabian Sea.

Chris MacIntosh: 00:53:14 But if you go back to this investment that they’ve just put forward, I looked at the numbers. They’re going to build six to eight per year to get to 20, 30 and the current talk. If you put numbers into perspective, this is going to be 66, I think it is, new reactors built, and they’ve already got I believe it’s 45. You can correct me on that. They’ve already finished them.

Mike Alkin: 00:53:42 Yes, that’s right. Yep. Yep.

Chris MacIntosh: 00:53:44 And the extra demand for that is going to be about 70 million pounds of yellowcake per year, from when you look at the previous stuff, again. You’re the expert in this stuff, but they normally get all the inventory for about six to seven years, and of course they don’t produce their own uranium so they’re going to be buying it.

Mike Alkin: 00:54:09 Well because they have very little indigenous uranium. They will never put themselves in position to hold what a western utility will be, which will be two to three years of inventory. That’s just not happening.

Chris MacIntosh: 00:54:22 No, because it’s a geopolitical risk.

Mike Alkin: 00:54:24 Exactly. So I mean, you’re talking at least a decade plus, I mean they’re not going. They are a voracious buyer of uranium, because they will not allow themselves to be put in that position.

Chris MacIntosh: 00:54:40 No. No. It’s a little like if you go back pre-shale, the US had massive supplies. After the oil shock, they went “Holy shit, we can’t do that again.” That really was a wakeup call, something that started building up inventories. And so it’s the same methodology, just not going to royally come after uranium. But I got it figured, if you take six or seven years and take that 70 million pounds, that’s 400 million pounds. And that doesn’t include existing stuff, the existing reactors. That’s what they’re going to have to buy, and this came out just a couple of weeks ago, I think it was, and no one’s even paying any attention to it. The equities have hardly moved.

Mike Alkin: 00:55:44 Absolutely. Well because everything’s focused on the Section 232 in the US. You know, Section 232 of the US Expansion Act, the trade act, so they’re waiting on that ruling, which was sent to the White House today from the Department of Commerce. But yeah. No that’s … But look. Energy is everything, right? I mean without energy, nothing happens. Commerce doesn’t happen, manufacturing doesn’t happen, it’s so critical in everything.

Mike Alkin: 00:56:16 To your point, where you’re saying from a geopolitical standpoint, I couldn’t agree with you more. So how do you play it? How do you express the view?

Chris MacIntosh: 00:56:27 Well I guess uranium was kind of an easy one.

Mike Alkin: 00:56:36 Full disclosure: Chris is an investor in my uranium fund, so. Full disclose that, yeah.

Chris MacIntosh: 00:56:42 So that’s how you play it. But I think it goes beyond uranium. So if you look at, think about it like this. We’ve had these open supply lines around the world, where countries can … Germany’s a perfect example. The complete morons over there decided that they were going to reduce their carbon emissions, so they got rid of all the various [inaudible 00:57:04] uranium, which they’ll now just buy from the French, so they’ll just pay premium for the same stuff, where they buy their electricity. And it’s like, these morons going, “Oh, yeah, we’re reducing our impact on the world because we don’t see it.”

Chris MacIntosh: 00:57:24 It’s a little bit like, there’s some stupid Australian politician the other day comes out saying, some woman, and she’s like, “No, we need to have,” she went into some city and said every Australian family could have an electric vehicle. Now for starters that would just collapse the grid, okay? Like it, you know. Secondly, 85% of Australian electricity comes from a combination of burning dirty fucking brown coal and natural gas, which is way worse than gasoline. Okay? Just because you can’t see it coming out of the back of your bloody car doesn’t mean that it’s, you know.

Chris MacIntosh: 00:58:11 Anyway. Back to our German friends. Somebody put something in their beer or on their bratwurst because that was the dumbest move ever, and they basically are energy dependent on Russia.

Mike Alkin: 00:58:28 What Chris is talking about, if you don’t know, is that Germans have decided to reduce their dependency on nuclear power for a while now, and they still get a big chunk of it from coal. But their renewables, wind and solar, have become a much bigger part of the mix. And it’s been a disaster for them.

Chris MacIntosh: 00:58:49 Well their CO2 emissions have gone up 50%.

Mike Alkin: 00:58:53 Yep.

Chris MacIntosh: 00:58:56 They’ve gone up, and the cost of electricity has gone up. Why? Because they’re importing all of it. And-

Mike Alkin: 00:59:00 Chris, their electricity has risen almost 50% since ’06. Their electricity is two times more electricity than France’s electricity, and France derives 75% of its power from nuclear power. I mean it’s just staggering when you think about it. And the emissions, right? In 2016 the German electricity emissions are 43% higher than what they were. I’m like, are you kidding me? But yet they wanted to get away from nuclear.

Chris MacIntosh: 00:59:33 Yep. It’s just [crosstalk 00:59:35].

Mike Alkin: 00:59:35 They are the poster child for energy policymakers on what not to do.

Chris MacIntosh: 00:59:40 Yeah. Absolutely. And so when, you can sort of get away with that until the pressure’s really on. Prices go up and they’ll just tax people more and so on and so forth. But wait until, like, a real fucking skirmish breaks out, and you realize that, again. If you go back to the US when they had the oil embargo, that was a big shock and was like a wakeup call. It was like, “Bloody hell, we need to make sure that we are actually secure in our energy supplies, because if we have to go to war, you can’t fight a war without energy.” If you can’t fuel your army and you can’t move them, you’re stuffed.

Chris MacIntosh: 01:00:21 Europe has been fighting, like this period of relative calm post World War II, if you go back over history it’s an anomaly. People don’t realize what a massive anomaly it is and thank God for it, because none of us want to live through a period that is war-torn. But you realize that it’s a fragile, a super, super fragile situation that people have just gotten complacent about. And then you see all this political fractioning within the European Union and it’s like, that’s where you have this asymmetric play. Because they’ve let their guard down on many, many fronts, energy in particular. And you see these alliances slowly being built, like the Chinese going into Italy and Greece and so on, so forth? It’s not long before they go, “Oh, you know, that investment we made there? By the way, you’re okay if we put a nuclear military submarine in the harbor there? Greece? You guys all right with that?” Yeah, of course you are.

Chris MacIntosh: 01:01:35 Then it’s like, oh shit, okay. We realize now what we actually just bought into. And so military spending is one thing I’ve argued is going to be on the increase in Europe partly because the US has said, “Look, we’re stepping back. You guys need to, anyway. You have to. The hell with it, we’re not paying the bill anymore, not to the extent that we were.” So that’s kind of forcing them in that respect anyway. But secondly, when they start looking at each other, eying each other going, “We’re not so happy with our neighbors,” and then you look at the history. I mean, twice in the last hundred years, Europe’s gone to war and twice it was Germany. So Germany is now calling for a military. Previously France was never, France doesn’t like that. France has twice been invaded by Germany. So people forget these old cultural dividing lines, and again you come back to, well how do you play that? Well I think energy is a big, big factor.

Chris MacIntosh: 01:02:43 We saw how quickly the tide turned on that relationship between the EU and Turkey, and what it looks like now? It’s night and day, and people think “Oh that couldn’t happen to all the other EU member countries.” The hell it couldn’t, given the right circumstances. So I think energy is, and it’s going to be dependent on particular countries. So you kind of look at each country and go, what’s their energy makeup look like now? Where do they get it from? Who are their allies? What do they supply or each supply, so on and so forth. Now in some of these countries, certainly in the EU, they’ve gotten rid of things like coal. Germany’s a good example. They’ve come out now and they’ve said, “No coal at all,” I can’t remember the year, I think it’s 2025? Pretty soon. Coal companies now in Germany are free, literal almost. Because they’re going to go bankrupt. They will.

Chris MacIntosh: 01:03:52 Now we’re not yet investing, but we’re watching super, super close. Because if you look at that, imagine for a minute that Germany had a big wakeup call from potential military antagonism towards them. You tell me how you’re going to react, if you’re a military general. I tell you what you do: you turn your fucking coal power stations back on, because you’ve got to have energy and you ain’t going to put yourself, like if it was a Russian, say threat. It’s not like … You’re going to quickly try and diminish that threat as fast as you bloody well can. You’re going to do it with allies, you’re going to see if you can strike other arrangements, get some more energy from France, whatever the case might be. But you’re going to be changing your energy policy faster, as quickly as you can start putting men on the border.

Chris MacIntosh: 01:04:45 So it’s one to watch. And again, that’s kind of where you find these asymmetric setups. Again, I’m not saying we’re in it yet, but we’re watching this and many, but I’m just giving an example. That stuff’s free right now, because they’ve said it’s going away. So every investor out there is going, “Oh. These guys are going to zero.” I mean it’s now just liquidation value and what can you strip off the assets for and sell them off to someone else. So I find that’s pretty fascinating, because as the world’s getting more politically contentious, many of these assets are getting cheaper and cheaper.

Mike Alkin: 01:05:30 Well you mentioned shipping, I know that you’ve done some good work on shipping. How are you thinking about expressing it through an investment standpoint?

Chris MacIntosh: 01:05:41 So shipping’s kind of an interesting one. It’s not all shipping that necessarily interested in. So dry bulk is still looking weak to me, but product tankers are pretty interesting. If you pull out all the geopolitics it’s just a cyclical industry, and it’s one which has had like zero capital investment for some time. Most of the big players have either gone bankrupt or they’ve gone through restructurings of some sort, the debt holders became equity holders, and it’s just been a liquidation in the sector. Even the shipping yards that actually produce these things have been closing up shop. So I like that because what it means is bringing supply back on is not so easy. You can’t just call up the shipyard and say, “Okay, give me a few cab sizes and I need them ASAP.” It’s like they don’t even, they’ve closed up shop and not there anymore.

Chris MacIntosh: 01:06:53 So that’s a good thing, and while that’s all taking place, we’ve had tanker rates. Tanker rates are slowly ticking higher. Look, we’ve got maximum pessimism in that sector We’ve had 12+ years of falling prices? Baltic Dry, which is one of the measures you can use, that’s down 640, or somewhere in there, today. In context, it’s only been lower three or four times in the past 35 years that I can get data for. Back in 1985, then again 2015 and 2016 where it’s just bumping and grinding along. And the sentiment in the sector is just toxic, it’s absolutely toxic. I saw something the other day, a large European firm that has for many, many years been sort of a stalwart in terms of the analysis of the sector said, we’re just giving up on it. Said we’re not covering the sector anymore.

Mike Alkin: 01:08:16 Right. I mean, could there be a better setup than that?

Chris MacIntosh: 01:08:17 Yeah, yeah. Yes, it’s kind of got all of the metrics. Unless we stop shipping stuff, we’re going to need ships, and it’s massive capital in terms of … Here’s the interesting thing, Mike. To go out and build one of these, the cheap ships are 30 million dollars, expensive ones are a hundred. Hundred million bucks, right? This is never an equity-finance type of business, it’s always debt-financed because it’s so damn expensive. And then you look at some of these companies have got no debt and you go, how the hell does that work? How do you have a fleet of tankers which cost, let’s just say for shits and giggles a round figure of 80 million bucks? A fleet of these things. How do you have that where there, they’ve got no debt?

Chris MacIntosh: 01:09:19 And the answer is that they’ve gone through so much of restructuring that the debt’s been wiped out. And you what else? That’s interesting because anything on a going forward basis means that they can still take on debt if they wanted to. But at the moment they’re not interested in taking on debt because no one wants to play. Not in the debt markets, not in the equity markets, nothing. And they’ve been bitten for 12 years in a row that they’re just … Even if you were the CO of a company and said, “You know what? We’ve got to go out and we’ve got to kill this now. We’re going to take on some debt, we’re going to increase the number of tankers, and …” blah blah blah. Your shareholders are going to look at you and just fire you.

Chris MacIntosh: 01:10:10 So it’s kind of-

Mike Alkin: 01:10:14 What are a couple names? I know companies had a [crosstalk 01:10:18]-

Chris MacIntosh: 01:10:17 Yeah, we like-

Mike Alkin: 01:10:20 … [inaudible 01:10:20] Scorpio, right?

Chris MacIntosh: 01:10:21 Yeah, Scorpio we’ve been talking about with [inaudible 01:10:24] a good mate. So there’s Scorpio, we’ve got … Let me get my list here. The other thing in the space is that there’s new regulations coming in for a lot of these shipping companies, and that to me is going to be a bit of a catalyst because there’s a bunch of ships out there that aren’t compliant. At the moment they’re basically, you could call them supply, right? And by 2020, they’re not going to be supply because they’re not compliant. And for many of them they’re too shitty and old, so they’re not going to actually necessarily do anything with them, right?

Chris MacIntosh: 01:11:24 So yeah. I mean, one of … I’ll give you one, probably my top one in that space is Star Bulk Carriers, it’s just one that’s got almost no debt, I know Howard Marks loves it as well, with Oaktree Capital. And Howard’s, never met the guy but he’s a legend, and-

Mike Alkin: 01:11:51 He is.

Chris MacIntosh: 01:11:51 … a phenomenal deep value, long-term investor. There’s a couple of catalysts there that I think could work in our favor. One is called IMO 2020, which is like a new regulation. The idea behind it, Mike, is to reduce A-1 sulfur pollution, and what it means is that they’re trying to reduce the sulfur from what’s in the fuel. I think the current is like 4% and they want to take it down to like, a half a percent. So there’s a bunch of ways for companies to actually do this. They can install these what are called scrubbers that will reduce the sulfur from … Because that’s from burning bunker fuel which is, basically, bunker fuels are like your shitty, heavy … like oil. If you can, think of the various grades of oil.

Mike Alkin: 01:12:56 That’s nasty, yep.

Chris MacIntosh: 01:12:58 Yeah, yeah, it’s like tar. If you’ve seen it, it’s really gross stuff. It’s one of those liquids that you can imagine in a horror film. Someone would get dunked into it and then, you know.

Chris MacIntosh: 01:13:10 So those kind of cleans that. What that means is that a lot of these ships have got a lot of downtime to actually have these things installed, so that’s going to mean that there’d be less ships in the water, which gives you a tighter supply market anyway.

Mike Alkin: 01:13:32 It gives you a better price.

Chris MacIntosh: 01:13:35 Yeah. And then the other option is for these ships to, and this is from what I can gather talking to the industry, is the more popular one. Is to switch to a low-sulfur marine gas oil that they can use. But the issue here is like, with no change in the current pricing conditions for shipping, this puts companies in a situation where they’re going to lose money. So you’re kind of sitting there going, “Well, we could spend all this money on scrubbing.” Expensive, downtime, and they’re not in a position really where they want to be doing this, no company would be. Or you got a different fuel we’ll use, and that puts us into a situation where we lose money. So the numbers on using that low-sulfur marine gas oil, I was looking at Wood Mackenzie which are kind of the standouts in the space for analyzing those kind of stuff. They reckon that it’s about a 50% increase on fuel expenses. So there’s no easy answer.

Chris MacIntosh: 01:15:05 Well the other thing that I’ve talked to some industry experts about is just reducing speed. So taking, because they travel also about 12, 13 knots. Taking it down to about 10 knots. But that’s basically just tighter supply, because if you took the industry and you say … Okay let’s say that they did that. It works out at around, I think it was around … I was running the numbers and don’t quite … almost, roundabout a 20% supply destruction, overnight, if all the companies did that.

Chris MacIntosh: 01:15:53 That’s like I don’t see any answer to that particular problem, so we’re pretty focused just on companies that can make it through these difficult times. Like I said, many of them are going away. It’s been a decimation in the sector so there’s not a whole lot left. But then all of those that are left, we’ve obviously been looking at those that have got debt and those that don’t have debt. Obviously in an uptick those with debt are going to perform better because it’s leverage. But we are concerned with just having the ability to make it through this period.

Chris MacIntosh: 01:16:41 So we’re watching that space and we’re invested in a bunch of names, and we’ve got another list that are a bit more leveraged so we’ll kind of watch them because as the supply tightens … it’s cyclical, and the capital’s going to come back into the space. And if you look at how these shipping … The whole shipping thing’s really fascinating. It’s a sector where it goes through periods of time where it just makes, like terrible money. It’s horrible business. And then it goes through periods where it just prints money.

Mike Alkin: 01:17:29 And human nature being what human nature is, you have peaks and troughs. And people will rush in, and then they rush out. Right?

Chris MacIntosh: 01:17:38 Yeah, yeah yeah. And this is one I’ve been watching for years. You go back, I always look for major bankruptcies. So like you look at these major bankruptcies and I think it was 2004, 2005, that [Hanjin 01:17:56] went bankrupt. Hanjin was the largest container shipping company, and it went belly up. There was a whole bunch, that was just the standout because it was such a huge company. It was like Exxon Mobile going belly up and you’d be like, “What? How’d that … hey?”

Chris MacIntosh: 01:18:26 And that was back, 2004. So I’ve been watching this space for a long, long time. And there’s other sectors I’ve got on my cards now that I’ve been watching for ages. Gold, one of them, we haven’t taken any position in gold mining companies. Not yet, not really. But that’s another one which is being fairly hard hit. So something’s … We’re into that, and I think the tide’s turned. We can see, again many of these companies are not profitable, and they’re not profitable because of pricing, is that powerful. They’re not profitable because their debts got wiped out.

Mike Alkin: 01:19:11 Yep.

Chris MacIntosh: 01:19:12 And it’s much easier to make a profit-

Mike Alkin: 01:19:14 So let’s shift gears. Tesla. Give me your elevator pitch to somebody who has not been following the Tesla story, and let’s … you meet someone for the first time, you’re having lunch with them and they bring up Tesla. “Hey, I just bought a Tesla,” or “I’m thinking about buying a Tesla.” What’s the Tesla story?

Chris MacIntosh: 01:19:44 Well.

Mike Alkin: 01:19:44 As you see it.

Chris MacIntosh: 01:19:47 Back in-

Mike Alkin: 01:19:47 I know how it is as I see it but let me hear how you see it.

Chris MacIntosh: 01:19:51 Yeah. Well there’s kind of two views to this company that I’m seeing. The bullish view is that the product is amazing and everybody loves it, and they’re doing revolutionary stuff. They have a product that is light years ahead of anybody else, okay? And that’s been the narrative. They’re the Amazon or the Apple of electric vehicles, that’s been the narrative.

Chris MacIntosh: 01:20:28 Now I drove a Tesla in, only once, in early … Trying to think now. It would’ve been 2012, ’13 maybe it was? I can’t remember. Somewhere there. Model S. And I was like, that was a cool car to drive. I mean it was fucking quick as hell. It was a little bit weird because it was like, I don’t know if you had them as a kid, those [inaudible 01:21:00] toys, you know the little? And you’d push your hand on the lever and the car would take off, zoom. And if you pulled it back, it would stop just as quickly. So there’s no brake on them, right? You’d race your buddies on the thing and no one had a brake, you just took your finger off the little joystick and that was it.

Chris MacIntosh: 01:21:21 Anyway. That’s kind of what it felt like to me, so I found it a bit odd. But that’s just a matter of having driven a standard [inaudible 01:21:29] vehicle and then driving that. Anyway. The point was I thought it was a pretty cool car. Certainly different, and it was very, very quick. And I’ve driven some bloody quick cars in my life and that was right up there. So I didn’t have any particular antagonism towards the product or anything like that.

Chris MacIntosh: 01:21:52 And when I started looking at the company, it was … As you know in the venture capital space. Venture capital, the idea is you bid on potential revolutionary type of, well certainly within Silicon Valley. Revolutionary type of products that can scale quickly and that are pretty disruptive. Everybody wants the next Uber, Google, whatever, right? And so there’s been a huge appetite for that, and I think a lot of that has fueled Tesla. Even though it’s what, 16, 17 year old company I think it is now? 17 years?

Chris MacIntosh: 01:22:37 So this is not a startup. This is not a young, startup company, for goodness’ sake. But yet it managed to attract the same sort of valuation that you were getting from a lot of these tech “unicorn” I’ll call them, type companies, most of them based on growth. If you look at most of those companies, whether it was WhatsApp or fucking Angry Birds or some of that nonsense, you had user growth that was going through the roof. They hadn’t figured out how to monetize it, necessarily. But there were enough examples where they figure, okay. If you could get enough of those users on board, you would find ways to monetize them after the fact. Okay?

Chris MacIntosh: 01:23:29 So it’s a bit of a hope and see strategy, where it is one that has worked in the past. But then when you have that kind of mentality people start focusing, and this is true in much of the equity markets now because you’ve got growth. Equities have outperformed value for a long time, and that growth doesn’t need to necessarily be cash flow positive. So if you think about WhatsApp or something, well it’s just about getting users on the system. They don’t really give a shit how. If it was free, and they didn’t advertise them and didn’t charge them anything, it didn’t matter. You just want to grab all those users and investors were paying for that growth. So that whole mindset really took on a life of its own, not just within Silicon Valley but within the retail public.

Chris MacIntosh: 01:24:31 The problem with Silicon Valley is that it’s been only open to insiders, right? It’s credit investors and those who have gone connections, blah blah blah blah blah. You can invest in some of the funds but they’re all venture capital funds so again, you’ve got to have a few million bucks behind your name before you can go and touch that stuff, otherwise the regulators won’t let you and so on so forth. So for the average person that’s a retail investor, they just saw all of this going on and they saw all these people getting rich and doing all this amazing stuff. I think Tesla gave them a chance to participate in that same game, or they felt like they had a chance to participate in the same game.

Chris MacIntosh: 01:25:16 Except that Tesla doesn’t meet any of those metrics. There’s nothing revolutionary about what they’re doing. They have now, massive competition from other companies that actually can produce cars at a loss because they have a portfolio of assets they can basically share that loss so that the entire company doesn’t fracture.

Mike Alkin: 01:25:44 Yep.

Chris MacIntosh: 01:25:44 And so that puts them in a very different position. So there’s a whole lot of competition coming now for the company.

Chris MacIntosh: 01:25:52 The other thing was that when you looked at the numbers, they didn’t make sense from the start. A lot of the stuff never made sense. Super, super opaque reporting, almost every quarter, and you know this. Every quarter that goes by, they change something in terms of the way that they’re reporting something. So that’s really hard to actually figure out, what you’re dealing with. Because you’re thinking, apples to apples then the next month it’s apples to pears. Then it’s apples to fucking carburetors and you’re like, “What? I just …” I found it really, really hard to just keep following up with what the reporting is, and to some extent I’ve actually just given up. Because it’s like I’ve seen so much now that I know it’s just nonsense. It’s absolute nonsense.

Chris MacIntosh: 01:26:46 So the financials are spaghetti. I mean, I’ve never seen … it’s financial spaghetti, it’s just a mess. But that’s fine to a retail investor, because they don’t know what a balance sheet is, probably. So who cares? And that’s why they’ve survived, to a certain extent.

Chris MacIntosh: 01:27:07 But-

Mike Alkin: 01:27:08 Right. What do you think about they have 18 billion dollars in long-term capital, commitments mostly to Panasonic. Four billion this year. They have nine, ten billion in debt, right? But who cares about that, right? They’re going to change the world, right until you see his balance sheet.

Chris MacIntosh: 01:27:28 Yeah, you’re right. I mean, all of that’s-

Mike Alkin: 01:27:29 I mean that’s what a bull would say. I’m saying that tongue-in-cheek, sarcastically. I mean to say, it’s a financial calamity, right?

Chris MacIntosh: 01:27:37 I don’t, there’s nobody that … and I’ve tried hard to find a bull that comes out with the actual financials in terms of saying-

Mike Alkin: 01:27:45 They can’t. There’s not a financially numerate argument you can make that supports it.

Chris MacIntosh: 01:27:53 The argument is always around something to the extent of any number of these things: Musk’s a genius, it’s revolutionary, disruptive. Again, it’s all that Silicon Valley type of jargon-

Mike Alkin: 01:28:07 It’s horse shit. I mean I would love to send people to Venus, right? If I had the snake oil skills that he did, I could probably go out and raise capital and do that, right? But there are financial consequences to doing things, and that’s the thing that the bulls seem to completely ignore. That you can dream a dream and do whatever you want, and cost be damned, right? And that doesn’t make sense to me because this is a company that is on the brink of financial meltdown. Yet-

Chris MacIntosh: 01:28:39 Well, this is the interesting thing and look, I got called out on this. I took a short position and you start off with this by saying I don’t normally short, and that’s true. I never short. I will buy puts, and that’s quite unusual for me. If I’m ever going to short that’s how I go about doing it. I don’t mind buying puts in European exchanges because you’ve got [inaudible 01:29:06] because you’ve got a long time frame? The options market out there are way, way better than the US, the US you normally have got two years, which is not really a very long time. People think, oh two years is a long time. It’s not. It’s really not, especially when you understand option decay.

Chris MacIntosh: 01:29:20 In any event. When I look at a company like Tesla, yeah. Again, I got burned way back. I took a very small, I think it was like a one-percent position. I got wiped out and I stepped back and said, “Okay, I coughed that one up, let me keep watching this.” And I kept watching it. And when I look at what’s going on now? You’ve got every imaginable thing that you would expect of a company that is insolvent and in absolute desperation. Everything. You’ve got the price cuts, layoffs. Closing, then not closing stores. Closing service centers, then not closing service centers. Closing-

Mike Alkin: 01:30:10 Hey Chris, a company whose sequential quarter sales were down 31%, right? And their deliveries down 31%. Their profit-making vehicles, the S and the X, down 56%. I mean, that if anything could help subsidize the Model 3. It can’t, but in theory if it could, and those were imploding. What do you make of the behavior of their leader? I mean he seems to be coming unhinged. Here’s a guy who, well I mean he settled with the SEC because of taking Tesla 420 private funding secured, which proved to be inaccurate. Settles with the SEC then they go back to court because the SEC wanted to hold him in contempt, the judge says, “Go put your reasonableness pants on and go try to figure it out.”

Mike Alkin: 01:31:09 And here he is, supposedly negotiating with the SEC. Yet, this weekend, he’s out making bombastic claims. Going absolutely bananas, blaming everyone. The Wall Street Journal, all the reporters, blaming the shorts. I mean, look, as a professional short seller my whole career, when they start blaming the shorts? You know. I mean, I think that’s a big clue for they’re about to implode or something’s going on. But there is, I mean he came unhinged this weekend, and on Twitter. What do you make of that?

Chris MacIntosh: 01:31:46 I think you’ve just got a guy that’s at the end of his tether. If you look at the behavior that … Okay. Let’s set the carnival barker aside for a minute and let’s just look at the company. This is a company which has had more executive departures than a fucking war zone. It’s just phenomenal. I know [inaudible 01:32:17] had a long list that he was building of all the executive departures and again, I’m just giving up. Looking at this, it’s like every day that goes past, it’s an announcement.

Chris MacIntosh: 01:32:27 It’s just not even … And especially those in the finance department. That’s been the biggest loss of executive departures. I don’t know any other company that has had even half that amount of staff turnover that has not turned out to have major, major issues, or has often turned out to be a fraud. So you can take that as any way you like it, but the probabilities are not in favor of Tesla.

Chris MacIntosh: 01:32:57 And then when you look at the leader of this cult, you’ve got a guy who seems to have an ego that just, it governs everything else. When you had the kids in Thailand issue, you know he had to make this big issue about getting on a plane and going out there and getting his silver dildo to get them out and it was just absurd. If you actually gave a shit about something, you wouldn’t make a big issue about it and make sure that the papers were there and everybody was there to see your-

Mike Alkin: 01:33:38 Oh he’s such a blowhard. He’s a megalomaniacal maniac.