Last week, Fed Chair Jerome Powell shocked the market when he suggested the Fed could start cutting interest rates next year.

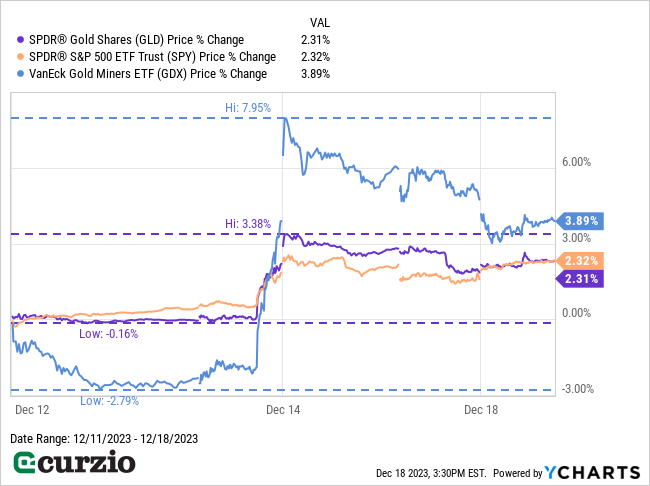

The announcement was a complete reversal from his previous comments… and, unsurprisingly, sparked a fresh stock market rally. Over the past five days, the S&P 500 is up more than 2%… and trading just a few percent below its all-time highs.

Amid this market-wide surge, you might not have noticed another, even more impressive rally…

Gold spiked 3.4% in a matter of hours following Powell’s surprising comments. And like the S&P 500, the yellow metal is flirting with fresh all-time highs.

Meanwhile, gold miners—represented on the chart below by the VanEck Gold Miners ETF (GDX)—have surged nearly 4% since last week’s Fed meeting.

Today, I’ll explain what’s behind gold’s recent strength… why it’ll continue into 2024… and how to invest for maximum profits.

2024 will be a banner year for gold

As you already know, central banks across the globe have been grappling with inflation for the past two years.

Their main tool in the fight against inflation is simple: higher interest rates.

But they’ve also been employing another, lesser-known strategy… buying gold.

Last year, the world’s central banks bought about 1,136 tons of gold. That’s the biggest annual purchase on record (note that data on central banks’ gold buying only goes back to 1950).

Data from the World Gold Council shows that this year’s first and third quarters also saw some of the biggest buying on record. Through the first three quarters of this year, monetary authorities purchased almost 625 tons of gold.

The World Gold Council’s annual central bank survey highlights two key drivers behind this action: gold’s performance during times of crisis… and its role as a long-term store of value.

And with inflation still a problem and geopolitical troubles on the rise, central banks will continue to scoop up the yellow metal in 2024.

It’s worth noting that individual investors are also flocking to gold.

During Costco’s (COST) quarterly earnings call back in September, management noted that its inventory of one-ounce gold bars was getting bought out within a few hours. That’s especially impressive, considering Costco limits sales to two bars per member.

And during its most recent earnings call (December 14), Costco said it sold “over $100 million of gold during the quarter.”

Just like central banks, individual investors are motivated by gold’s ability to maintain value during times of inflation… global crisis… and virtually any source of uncertainty for the world’s financial markets.

And with all three of these factors creating headlines heading into 2024, gold is setting up to have a banner year.

How to profit from gold’s upside

As countless Costco members can attest, one way to invest in gold is to purchase the yellow metal itself. You could also invest in a fund that follows gold’s price action—like the SPDR Gold Shares ETF (GLD).

But gold-related stocks tend to outperform gold during the precious metal’s rallies.

In other words, it’s better to own gold stocks during a gold bull market, since they give investors more leverage to rising prices.

One such company is Barrick Gold (GOLD). It’s the second-biggest gold producer in the world… with some of the highest-quality assets in the industry. Barrick expects to grow its total mine output by almost a third (30%) by the end of the decade… which means its profits are set to soar as it sells its future gold production at much higher prices (as the price of gold rises).

Another good option is Wheaton Precious Metals (WPM). As a gold royalty company, WPM makes money by helping miners finance their projects. For example, it will put up some of the cash needed to build or expand a gold mine… in exchange for a portion of the mine’s future production (which gets paid to WPM over time, just like a royalty).

In short, the royalty model is especially profitable during a gold bull market. As gold prices rise, WPM’s royalty streams become even more valuable. Plus, the company doesn’t have to worry about rising mine costs, which often eat into mining companies’ profits.

If you want to diversify your exposure across the entire sector, your best bet is to buy an ETF that holds a variety of gold stocks. A popular choice is the VanEck Gold Miners ETF (GDX)—where Barrick Gold and Wheaton Precious Metals are the second- and fourth-largest holdings (with 8.9% and 6.4% weightings, respectively).

The bottom line: Gold is poised to keep moving higher next year as central banks and individual investors alike shore up their defenses… If you don’t have exposure to gold yet, now’s the time to get it.