You’ve probably heard the Warren Buffett quote, “Be greedy when others are fearful, and fearful when others are greedy.”

It’s a simple enough concept: When everyone is buying an asset (or being “greedy”), the asset’s price often gets pushed beyond what the asset is worth… often resulting in a market pullback. And when everyone is selling (or “fearful”), an asset’s price can be pushed to rarely seen bargain levels.

Big buying in stocks and exchange-traded funds (ETFs) can be a great thing for markets long term. But when things get grossly overbought—like now—it’s rare… extremely rare. And while I’m not saying it’s time to panic, history indicates this extreme overbuying might be bad for stocks near term.

It’s like when you’re speeding down the highway and see brake lights ahead…

Slamming the brakes means stopping too hard, too fast. Instead, you tap the brakes and adjust your speed. You may not reach your destination in record time, but you didn’t drive headfirst into a crash or come screeching to a halt.

So it is with the stock market: When overbuying becomes extreme, the market tends to pump the breaks and pull back. The good news is, this means better entry points are likely in the weeks ahead…

Big Money ETF buying is off the charts

Last week, I told you how “mom and pop” appear to be buying ETFs in droves—a warning sign a market top is near. I also pointed out that big ETF buying usually lasts for weeks, and that’s precisely what’s happening…

Last week, we clocked a new record for ETF buying! But as you’re about to see, when ETF buying is breaking records, market tops tend to follow.

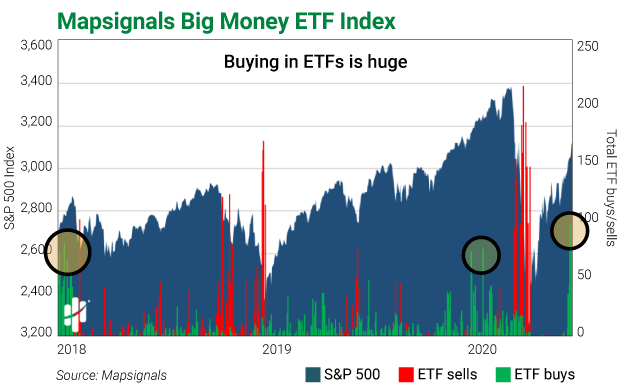

Below is the Mapsignals Big Money ETF Index vs. the S&P 500, going back to January 2018. It measures big unusual ETF buying/selling activity. The green bars represent the total number of ETFs being bought each day, and the red bars are ETFs being sold. All of this is our best guess on retail investor positioning, based on current data.

I’ve circled three areas of extreme buys:

As you can see, the level of buying last week was monstrous. In fact, Friday (June 5) was the single largest day of buying we’ve tracked in more than 30 years.

More importantly, the last two times this happened, a market pullback followed… That’s the sign we need to pay attention to. Those are the brake lights up ahead.

But it’s not just ETF buying that’s off the charts…

Big Money buying in stocks is breaking records, too

In simple terms, ETFs are a way to buy a basket of stocks with a single investment. So, if ETFs are getting scooped up at a record pace, the stocks they hold are being scooped up, too… And that’s exactly what’s happening. Investors are getting greedy.

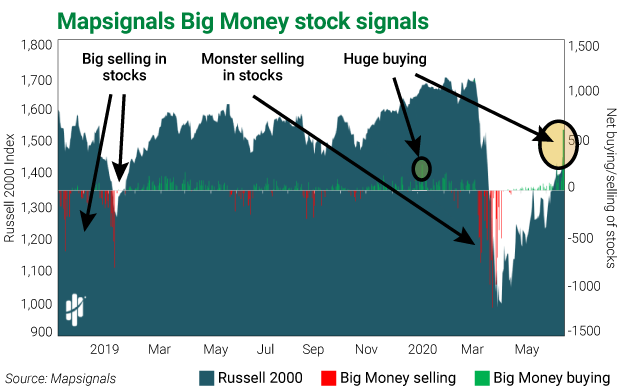

Below is a Mapsignals chart of Big Money buying and selling signals. These signals are our educated guess as to the real flow of money. A green bar means a day of net buys, and a red bar means a day of net sells.

Look how Friday was a huge green bar:

For context, I circled a prior large green bar. What’s important is how the market had trouble breaking out much further after that day (notice the drop in green bars that follow)… That’s exactly what I see on the horizon right now.

Bottom line: The level of buying in stocks and ETFs is staggering. It also likely won’t last. Looking back, record-breaking buying days like Friday tend to forecast lower market returns in the near term.

Just like a speeding car must slow for brake lights ahead—or risk a crash—an overbought market will slow down, too…

Because history shows that when investor greed sends prices higher, it’s only a matter of time before greed becomes fear… and market pullbacks become new opportunities.

Editor’s note: Greed may be inflating some stock prices beyond their value, but there are still fantastic opportunities in today’s market…

Members of The Dollar Stock Club receive expert investment insight—from all corners of the market—on stocks you won’t hear about anywhere else… All for the ridiculously low price of just $1 per stock pick.