Rising interest rates are the biggest story of 2022.

As you surely know, the Federal Reserve has been hiking rates to combat inflation… which is stuck at a 40-year high.

Higher interest rates create pain for investors. They lower the value of investments—stocks, bonds, and pretty much everything else. That’s why we’ve seen declines across every major asset class since the start of this year.

However, there’s one industry that actually benefits as interest rates rise: insurance.

As I’ll explain, the higher rates go, the greater the growth for insurance companies. History shows these stocks can be excellent performers in a rising-rate environment.

Today, we’ll take a quick look at the last two periods of rising interest rates… and how a couple of insurers performed during those periods. Plus, I’ll share my favorite “one-click” way to buy a bunch of insurance stocks as they benefit from higher interest rates.

Rising rates are great for insurers

In general, rising interest rates are bad for investors. As rates rise… safer assets like short-term bonds and certificates of deposit (CDs) start to offer decent returns—pulling money out of riskier investments.

For example, six-month Treasury bills currently yield over 2.6%. That might not sound like much… but it’s a huge improvement from a year ago, when these bills were yielding less than 0.1%.

In short, investors can safely generate a 2.6% return while taking zero risk right now. That puts pressure on stock and bond prices… but it also creates an attractive situation for insurance companies…

You see, insurance companies are constantly raking in cash as their customers pay their policy premiums.

Insurers take this steady cash flow and invest it—typically in bonds. And when rates are rising, it means cash can be invested in bonds with higher coupon rates… leading to bigger profits on the bottom line.

This intuitively makes sense. Most insurance companies don’t make a lot of money on their core insurance business. After factoring in the costs to run the insurance business, most insurers keep less than 10% of their premiums as profit. You can check how profitable a company’s core underwriting business is by looking up their “combined ratio,” which adds up all the claim-related losses (plus business expenses) and divides by the premiums the company earned. Only the best insurance companies can push this ratio below 90% (meaning they’re keeping 10%-plus of the premiums).

By contrast, insurance companies get to keep all the money they make investing the cash.

And the higher interest rates go… the higher the returns on the bonds they’re buying.

That’s why the current environment creates a major tailwind for insurance companies. They’re going to earn a lot more money now that interest rates aren’t stuck near 0%.

And keep in mind, insurance needs stay in demand all year round, so there’s a constant need for insurance companies to keep investing the new capital. More funds in the company coffers relative to policy liabilities (what they owe) improves their financial strength and allows them to return capital to shareholders through dividends and share buybacks.

Put simply, now is a great time to buy insurance stocks.

History shows these stocks outperform when rates are rising

Rising rates aren’t a unique situation. History shows plenty of periods of rate raises that lasted months… and even years.

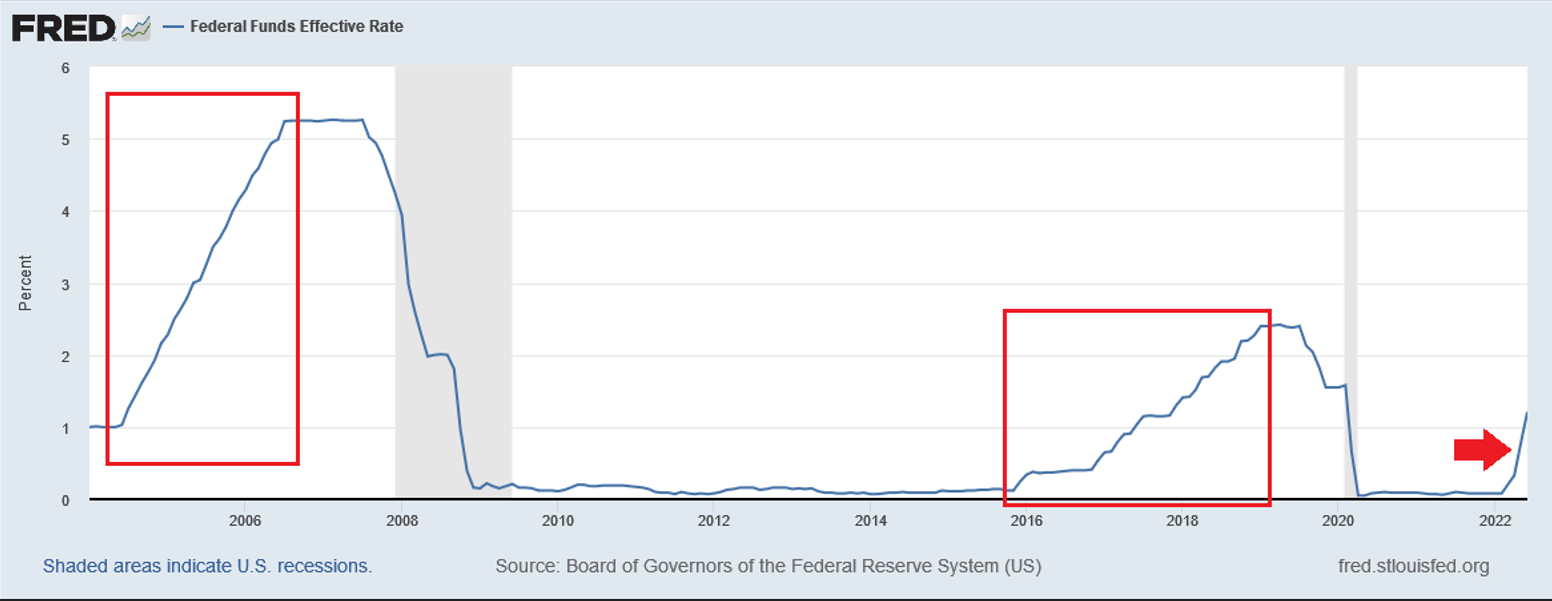

To keep things simple, let’s focus on the last two periods of sustained rate hikes: May 2004–August 2006 and November 2015–April 2019.

Below, I’ve included a 20-year chart of the Federal Funds Effective Rate—the one rate the Fed adjusts when it wants to raise (or lower) interest rates. The red boxes show the two hiking cycles we’ll be focusing on…

With these two periods in mind, let’s check how insurance stocks held up historically…

As I mentioned above, insurance companies benefit from rising rates because they make more money on the bonds they buy. Two perfect examples are W.R. Berkley Corporation (WRB), which provides commercial insurance and reinsurance… and Arch Capital Group (ACGL), a specialty insurer and reinsurer.

Below, you can see how WRB stock performed from May 2004 to August 2006, when the Fed raised rates from 1% to 5.25%. If you bought WRB at the start of the cycle (May 2004), you’d have nearly doubled your money as the stock soared 96%. Check it out:

Now let’s check the most recent hiking cycle. From November 2015 to April 2019, interest rates went from 0.12% to 2.42%. If you owned WRB during this period, you’d have scored a 64% return:

Obviously, W. R. Berkley was a good stock to own during the last two periods of rising interest rates. But we need more evidence.

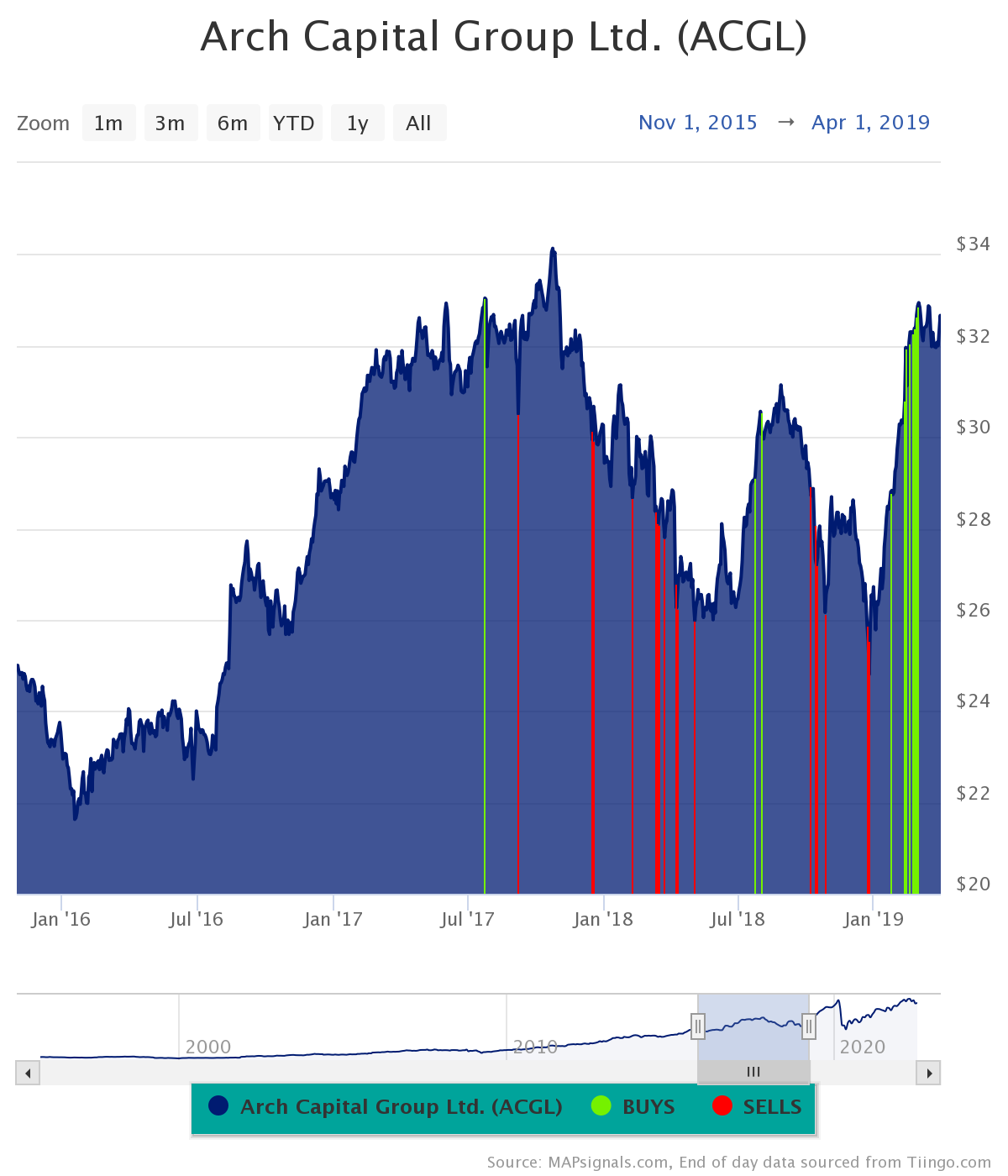

Let’s look at the other insurance stock I mentioned: Arch Capital.

During the 2004–06 hiking cycle, ACGL saw a steady uptrend, gaining 52%:

And when rates rose from 2015 to 2019, ACGL generated a solid 30% gain. (Note how well the stock did for the first half of this period, when interest rates were starting to climb.)

What about now?

As you can see below, WRB is up 40% over the past year. Institutional investors started buying the stock heavily in late 2021 as the Fed hinted it would start raising rates. Note the green vertical bars in the chart. They represent Big Money buy signals. Have a look:

Similarly, ACGL is starting a fresh uptrend. The stock is up 18% over the past year… That’s impressive when you consider the S&P 500 is down more than 10% over the same period.

You should also notice the nine Big Money buy signals since last December. They’re an important sign that ACGL is poised to deliver strong returns during the current rate-hike cycle.

W.R. Berkley and Arch Capital are both solid plays in a rising-rate environment. However, there’s an even better way to play this situation…

A “one-click” way to own more than 50 insurance stocks

The easiest way to get broad exposure to insurance stocks is through the SPDR S&P Insurance ETF (KIE)—the biggest exchange-traded fund (ETF) focused entirely on the insurance sector. It includes a variety of companies involved in different types of coverage (life insurance, auto insurance, etc.) as well as insurance brokers and reinsurance companies.

Put simply, KIE lets you own a little bit of everything insurance-related. It has more than $570 million in assets under management… including positions in the two stocks I mentioned earlier…

KIE holds WRB (2.03% of the portfolio) and ACGL (2.01%)… alongside 50 other insurance stocks. It pays a 1.93% current dividend yield and has averaged a 6.7% annual gain since its inception in November 2005.

As interest rates increase, insurance companies are primed to profit. KIE gives us an easy way to own the entire sector, which should blossom in this rising-rate environment.

History tells us these stocks can easily generate double-digit gains as the Fed’s rate hikes play out.

Editor’s note:

You don’t have to sacrifice growth to find income in this market…

In Unlimited Income, Genia Turanova uncovers safe, inflation-ready assets that deliver market-beating dividends… AND quick capital gains.

For that rare balance of income and growth… join Unlimited Income—risk-free.