Frank Curzio

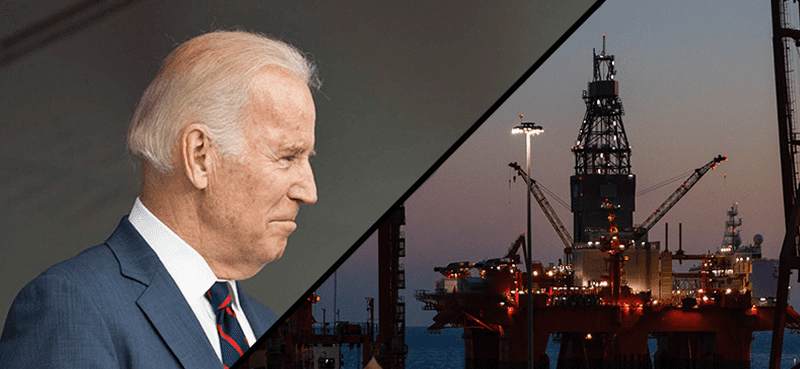

Biden vs. Big Oil: How to play the faceoff

At this point, it’s basically certain we’ll see a recession in the near future… The Fed has no choice but to cause one in order to tame inflation.

But while we may be (technically) headed for recession, I explain why it’s not as scary as the media makes it sound—and why now’s the time to start picking away at great opportunities. For example, small caps are historically cheap… and one country is ripe for investment.

Turning to oil… Daniel and I break down the comedic standoff between oil companies and the Biden Administration—and share several of our favorite energy plays.

Wall Street Unplugged | 910

Biden vs. Big Oil: How to play the faceoff

Announcer: Wall Street Unplugged looks beyond the regular headlines heard on mainstream financial media to bring you unscripted interviews and breaking commentary direct from Wall Street right to you on main street.

Frank Curzio: What’s going on out there? It’s Wednesday, June 22nd. I’m Frank Curzio, host of the Wall Street Unplugged podcast, where I break down headlines and tell you what’s really moving these markets. It’s Wednesday, so I’m bringing on my buddy, Daniel Creech. It seems like a while since we did a podcast together, right? I don’t know.

Daniel Creech: Well, we do back-

Frank Curzio: Did we do one last week?

Daniel Creech: We go back and forth.

Frank Curzio: Yeah. I don’t know.

Daniel Creech: You’re traveling a lot, I was traveling a lot. But it’s Wednesday. Wednesday is the best day of the week. It’s great to be here.

Frank Curzio: Why is Wednesday the best day of the week?

Daniel Creech: Because you and I are on here talking about stuff that moves markets.

Frank Curzio: That’s a good answer. I like that. I like that.

Daniel Creech: You got to like this. Wednesday’s the middle of the week. There’s a lot of good things with Wednesday, the week’s coming to a close. Everybody that’s working different hours is like, “BS, my week’s just started.”

Frank Curzio: I know, right? And not to mention that we had Monday off to a brand new holiday, which is cool. I won’t get into that, but I talked about that a little bit yesterday. But anyway, I wanted to start off with asking you, by the way, Daniel is a senior analyst at Curzio Research. I want to start-off by asking you a very simple question, because it seems really difficult for people out there. Are we going into a recession, or not?

Daniel Creech: Yes. Next question, Frank.

Frank Curzio: Okay. Now, let’s move on to… The talk of recession, and they have Powell on the stand, and they’re ripping him apart, telling him how shitty of a job he’s done. We already know. I hate that they talk about the past. Let’s talk about the future, what are we going to do? Talk inflation. On the recessionary front, I want a highlight of what the big banks are saying, because this is important. First of all, a recession is defined by two straight quarters of negative GDP. We had one last quarter. It’s probably not going to be this quarter, so we’re not going to have an actual recession, a definition recession, probably this year. But a lot of people are predicting in 2023 and 2024, when we see two straight quarters of negative GDP growth.

Frank Curzio: With that said, Citigroup raised their odds. They say they see a 40% chance of recession. Deutsche Bank sees a 40%. Goldman’s 48%. EVA Corp sees no inflation, and a Wall Street Journal survey of top economists, which was published only three days ago, Daniel, shows that there’s now a 44% likelihood of recession in the coming 12 months, where in May, it was 30%.

Daniel Creech: Whoa.

Frank Curzio: You’re getting these surveys everywhere, and I find it kind of funny. To me, it amazes me that we’re placing so much emphasis on this one data point. And just to put this in perspective, in December 2007, the Wall Street Journal survey that just said 44% likelihood recession. In December 2007, the month preceded 2007, 2009 recession, that’s when it began, economists assigned just a 30% probability. In February 2020, that’s the last recession, they assigned 26% probability.

Frank Curzio: I’ll give them a little bit there because with lockdown and everything, which is going to go down as probably the biggest mistakes we’ve ever made in our country’s history. As we’re seeing right now with the money printing, the labor shortage, supply chain shortages. The health effects of everything. Probably the worst thing as a country we ever did and the dumbest thing we ever did, which we’re realizing. I don’t think you could argue that or debate that anyway. But to put this in perspective, when the Wall Street Journal surveys these top economists and they say 44%, Daniel, and their highest rating is usually a 38%, this is saying there’s 100% of recession. 100% chance, right?

Daniel Creech: Yeah, absolutely. We’ve joked about this for some time now, because this is just the perfect illustration of the difference between government data and or any data that you must take with grain of salt and reality. To your point, technically definition two negative quarters back to back. We’re not going to hit it. If we come in at 0.1 or whatever, and we’re technically not there, is it too easy to just harp on everybody, Frank, and talk about how out of touch everybody is that is supposedly the smartest people in the room? Because if you ask your regular folk like me and you, does it feel like you’re in a recession already?

Daniel Creech: If this isn’t a feel like, what is? Is it $8 a gallon instead of five for gas? Is eggs and meat going to continue to go up? Do they have to go up another 30% from here to make it feel worse? Remember last year, the administration had a great time pointing out that the 4th of July cookout was 16 cents lower than previous year. That was a big savings. That goes again with a great idea of the gas tax holiday, which would only lower prices by roughly three and a half percent.

Frank Curzio: And we’ll get into that.

Daniel Creech: Anyway, we’ll get into that in a minute. The back and forth, I think it’s good for this reason. I think your average Joe, who is starting to… And I don’t have anything against average Joe’s. I love the Joe Walsh song, Ordinary Average Joe, that’s me. I think it’s good for the sense of, unfortunately, it takes pain for people to pay attention to certain things. We do our best to make economics and politics entertaining to pay attention to, how to make money and profit, but it’s a tough uphill climb because it’s not always exciting.

Daniel Creech: You got to try and do your best, but when markets dropped 30%, Frank, even the guy that doesn’t really give a crap about money might start to pay attention, because now, you’re starting to feel it in the economy. And what I hope that comes out from all this is that you see Janet Yellen recently, a couple days ago, says she doesn’t think recession is at all inevitable. You go back and forth between banks and when it’s going to happen and all that. I think it’s good because it only highlights the out of touchness that our, quote, unquote, smartest people are. And I think people will take more interest in their own, and I think that’s good for the long-term. It’s very painful in the short-term, but I think it’s great for longer term investors.

Frank Curzio: As I put on CNBC, and I see these politicians, I see the Fed, and then I see UBS saying we don’t see US a global recession in 2022, 2023, yet the congressional budget office… And this is last month. This is recently a couple weeks ago. They said GDP, they’re expecting at 3.1% in 2022, 2.2% in 2023, then 1.5% in 2024. Inflation, based on a CPI, they’re expecting to end the year at 4.7% in 2022. Good luck with that. And then, in 2023 and 2024, to go back down into two percent. The unemployment rate to be below 4% for the next three years, the Fed funds rate to only go up to 1.9% in 2022, maybe you’re right there.

Frank Curzio: Actually, you’re not going to be right there, it’s going to go a lot higher than that. And 2.6% in 2023, this is a month ago. When I look at this, all I see is bullshit. I think they look at people like the average Joe and say, “Hey, these guys are such fucking idiots. They’re not going to know the difference anyway, so let’s just say whatever the hell we want.”

Daniel Creech: I agree with that. Of course, they look at us like that.

Frank Curzio: That midterm election is coming, so let’s… Because recession is a word that everyone identifies with. In our line of business, we could say we all feel like we’re in a recession right now, with the NASDAQ down over 30%, Bitcoin down 70%, most of your assets coming down, home prices coming down. I can keep going and going and going. You’re seeing net household wealth actually is lower year-over-year for the first time. That’s a signal of recession. Everything spells recession right now. Yes, there’s some highlights, where earnings are staying up pretty strong.

Frank Curzio: Believe it or not, earnings, and people don’t know this, but earnings for S&P 500 are expected to grow year over year, which is insane. Think about what’s going on right now. That means a lot of these guys have not lowered their estimates low enough, but you’re seeing bank loads rise. There are pockets that are okay and home prices are staying a little bit firm. They are starting to come down a little bit because there’s low supply, but mortgage rates, of course you’re seeing mortgage demand. Mortgage demand for lending is coming down with rates higher. But they look at the average person and say, “These people are just going to believe whatever the hell we say.”

Frank Curzio: And we’ve gotten in trouble a lot by just really digging in and doing the research, Daniel, and going to different places and seeing it during COVID, during fracking, during different things and getting ripped apart because people just watch TV and believe everything they hear. But to see these assholes on TV just saying, “Oh, it’s a 44 percentage,” no one has higher than really a 50%. I think Goldman’s a little bit high than… No, Goldman’s at 48%.

Frank Curzio: We’re fucking going into a recession. The Fed is forcing a recession. They have to force a recession. They have to raise interest rates. We’ve been saying this for 12 months. And then finally… I mean, for 18 months… but once they started raising rates, they have to force a recession and take money out of all this massive leverage, which is going to be trillions out of the market. They have to force a recession because inflation keeps going higher and higher and they don’t know what to do about it. They’re confused.

Frank Curzio: The whole recession and trying to avoid the actual word recession heading into midterm elections, I get, but as an investor, like you said, Daniel, I’m not telling you not to buy stocks. I’m not telling you, it’s not going to get worse, because it’s going to get a lot worse, but you have to look at what’s going on, where you’re seeing that 30% decline in NASDAQs. You’re seeing the average PE ratio right now, the average PE for the S&P 500 is trading at 15 times, which is lower than the five-year and the 10-year on average in history. And maybe those earnings come down, we saw more companies lower earnings than any other point I think since 2009 or 10.

Frank Curzio: So you’re seeing that come down, but you look at Walmart, Target, lowering their prices, M2 growth slowing from 27 to up 6%. You’re seeing it in global yields. You’re seeing the bond market crash. To me, when I see shit like this and all the bullshit, it actually pisses me off. It pisses me off personally, but I want you to use this to your advantage because you’re looking at small caps trading at their cheapest level almost in 25 years. You’re looking at money starting to solely pour into you look at insider buys through the roof.

Frank Curzio: And again, I’m not saying it’s not going to get worse or you’re not going to get hit 10, 15% from you. But I do know in two years from now, it’s going to be a lot higher because inflation’s going to crash. It is going to crash. It’s probably going to happen a lot sooner than expected. You’re seeing it right now. You’re seeing it in different pockets, where home prices are coming down. The Walmart, the Targets, again, the M2 growth has slowed dramatically, dramatically. And a lot of this is priced in. If you’re looking at stocks and saying, “Holy shit, inflation’s out of control,” it’s been out of control, and that’s why the stocks are down 30% plus, and a lot of stocks in your portfolio are down 50, 60% and a lot of shit.

Frank Curzio: You have to look at it that way. You can’t signal the same exact risk going on and say, okay, it’s… You have to look at everything that’s happened since then. And now, for me, seeing companies raise their dividends, you’re looking at oil stocks really freaking getting destroyed, down 20, 25%, some down 30% in the past two, three weeks. Everybody was pouring money into there thinking everything’s okay, but when it comes to recession, guys, ignore the bullshit. Just say, “Okay, we’re in a recession. How am I going to benefit?” It’s going to probably result when you say the word recession, maybe stocks come down a little further. It’s going to be like this fear factor.

Frank Curzio: But man, there is a lot of stocks at trading below 10 times earnings. I covered it yesterday because of the game plan. China is starting to grow again. I’d start looking at China, maybe an ETF there, small caps. Again, more companies in history are trading more cash than market caps are in history. It hit 10%. That’s in history. That’s not in the past few years. That’s more than COVID, that’s more than in tech bubble bursts, 87, in history. A lot of this is being priced in and again, it could get a lot worse, but all the measures that the Fed’s putting in place is doing everything they can, and it will result in inflation coming down, because people aren’t going to be able to afford these crazy prices.

Frank Curzio: And now, it’s looking like safe havens, like oil are also getting hit. Now, is that going to stay that way or not? And you’ve been covering the oil industry a ton and reading everything, Daniel, about the oil industry, but what’s going on there? Would you tell people to invest in these companies? They increase their dividends. They’re reporting massive earnings, but yet, you’ve just seen this transition as maybe I should lighten up on oil over the past couple weeks.

Daniel Creech: I think that the pullback in oil right now is a good entry point if you want to look to add exposure, or if you don’t have any exposure yet. I think the only better, I’m going to mess that up, Frank, the only better opportunity on a pullback would be a cease fire announcement between Russia and Ukraine, which I don’t foresee happening very soon. I was dead wrong on that. I’ve bought into what they were telling you-

Frank Curzio: You think it would be positive for oil or negative for oil prices?

Daniel Creech: I think it would be-

Frank Curzio: Oil prices go up on that or down?

Daniel Creech: No, I think they would go down, which would mean that would be the only better entry point, because I think you’d get a pullback. If you have an announcement of a cease fire, I think everything would pull back and that would be a good time to get in, because the logistics and the inner workings are not fixable just because… Your supply and demand isn’t going to balance just because of Russia.

Daniel Creech: For instance, let’s say Russia and Ukraine announce tomorrow that they have a cease fire. Well, if the world government’s followed through and 24 hours later, which they never do anything that quickly that would amount anything, but if they followed through just 24 hours later and removed all sanctions, how long does that take to get through the pipeline and all that kind of stuff? It’s not going to happen. I think that this is a good one. If you don’t have any exposure, you want to increase it for a couple of reasons. One, remember the Panama Papers leak, Frank?

Frank Curzio: Mm-hmm.

Daniel Creech: We need to come up with a marketing tool about the Chevron papers or the oil letters or Biden’s oil diary or something like that because there’s a saga of one of my sitcom saga basically, going on between, unfortunately, the most powerful industry in my opinion, energy, and the governing superpower of the world, the United States government. Have you been following this back and forth at all, Frank?

Frank Curzio: Yeah, I have. I have. It’s a reason why Exxon and these guys are really coming out, because they’re really pissed off at what the president’s saying and saying that it’s kind of their fault. It’s all their fault. And they’re like, “F you,” basically.

Daniel Creech: Earlier in June, which is now making much more sense. We’re going to talk about the guy behind the scenes here, because unlike I believe that Buffet, or excuse me, Buffet, I’m giving it away, that president Biden is doing everything on his own, I don’t think the Chevron CEO is acting independently, and I like it a lot. A couple weeks ago, early June, the CEO of Chevron did a sit down interview with Bloomberg, and he said some pretty wild stuff, Frank. Do you know where I’m going with this? He used the word never.

Frank Curzio: Yeah.

Daniel Creech: You know what I’m talking about?

Frank Curzio: Mm-hmm.

Daniel Creech: Well, now I got to get the quote in front of me because I don’t want to exaggerate this claim because it’s important. He was talking about the two things you hear most about are drilling, and hey, the administration’s going to say we got plenty of leases that are open to drill, oil companies just are being greedy. They’re not drilling, they’re gouging the customers. Oil companies come back and say, “The leases you quote, they’re not near half that. They’re still tied up in litigation, permitting, all that kind of stuff.”

Daniel Creech: That’s a big difference between getting oil out the ground and getting it refined to where it goes into something like your gas or your truck or your car or your boat, or whatever. The Chevron CEO was calling out the administration, and he says that there hasn’t been a refinery built since the seventies. Did you know that, Frank? I wouldn’t have guessed that.

Frank Curzio: Yes. I knew that.

Daniel Creech: I would’ve hoped that it would have been a little bit better than that, or recent than that. He also said that he doesn’t project another one to get built in the US. Why? Because these are multi-year, multi-billion dollar investments. And when you have a political organization or a group of people that happens to be in power, and this is a quote from the Chevron CEO, at every level of the system, the policy of our government is to reduce demand, so it’s very hard in a business where investments have a payout period of a decade or more, and the stated policy of the government for a long time has been to reduce demand for our products.

Daniel Creech: Why would you invest over a decade, billions of dollars, when you know they’re trying to get rid of your products for energy usage? That’s a huge thing. This was a couple weeks ago he did this. And I think it was because he knew it was coming. Then, the Biden administration writes a letter to all the oil executives, calls them greedy, blames them for everything and says, just like a light switch, Frank, you need to increase your capacity for refining and get more gas out there available to consumers.

Daniel Creech: Well, you don’t have any new refineries being built, and even if they started breaking ground today, who knows how long that would take to get online. And B, the existing refineries that you have that have tried to be expanded and or developed further run into policy permitting, environmental concerns, and all that. Not that any of that is not important, but it really holds back the desire here to really be energy independent. Frank, what is key about Chevron stock out of the other major oil companies when it comes to shareholders and influence?

Frank Curzio: It’s Buffett, right?

Daniel Creech: Buffett.

Frank Curzio: Buffett’s in there, yeah.

Daniel Creech: Buffett owns what, 8% of Chevron?

Frank Curzio: Does he on that much? I don’t know.

Daniel Creech: I believe it’s 8%. That was according to Capital IQ, and I checked the other day. Now, if I’m the CEO of Chevron, I’m going to call Mr. Buffett and I’m going to ask him, “Hey, you do such great job at your annual letters. And people have been reading them forever. And you get to go on CNBC and nobody very rarely asks you difficult questions.” Maybe he was asking for some penmanship favors to write this letter back to the administration, which, I like this tongue in cheek. He says, “Chevron will engage in this week’s meeting with the secretary Granholm. I encourage you to also send your senior advisors to this meeting so they too can engage in a robust conversation. Chevron shares your concerns over the higher prices that Americans are experiencing.” And he says, “Chevron has increased capital expenditures,” meaning money they’re investing to get more oil, “to $18 billion in 2022, which is 50% higher than last year.”

Daniel Creech: The reason I like this as a tongue in cheek thing is because the average person out there has full-time jobs and other lives outside of our full-time job here to study markets, Frank, but they can see through this. And what you want to do here is you want to have exposure to energy companies to fight back against the high inflation. That’s the big takeaway here. Hopefully, it’s entertaining and all that, and we can get you to see that light or make that connection, but that’s the big takeaway here. You finally have oil company CEOs fighting back and standing up and saying, “Hey, this is what’s going on.” The problem for us in the short-term is that prices aren’t going down anytime soon because you can’t bring on refining capacity at very much of a larger scale than now, so that’s aggravating.

Frank Curzio: I want you to forget politics for a second, which is very difficult to do. I want you to forget what side of the aisle you’re on, because it doesn’t matter.

Daniel Creech: You talking to me or the audience?

Frank Curzio: I’m talking to everybody, because I know you’re not going to do that, but I want you to forget what side of the aisle you’re on. Now, the person coming in gets elected, and as he’s campaigning, and a year or two before he gets elected, this is what he says. Quoting, “We are going to get rid of fossil fuels. No more coal plants. We should put them in jail,” when he was talking about fossil fuel executives, I’m quoting, “We should put them in jail. I’m endorsing a fracking ban when I get elected.” Whatever party you’re from, this person is about to control. They’re going to control the entire government. The entire government, all three branches, and this is what he’s saying, and this is what he’s doing.

Frank Curzio: If you are an oil company, how to… I’m not going to curse. I want to curse to get the emotions out of me. How the hell are you going to go, like you said, put pedal to the metal and make these massive, massive investments when you know that this person coming in is totally against your industry? How do you do that as someone who runs a business? And for Biden to say what he is saying right now like, “Oh, I’m letting these guys drill. And I’m opening up federal lands and all this investment, all this money they make, they’re giving away in dividends and oil prices going higher and they’re buying back stock.”

Frank Curzio: What the hell? What do you expect them to do? When you invest in these oil investments and invest in oil fields, this takes years of CapEx. A massive amount of money comes in and you are forcing people, and you have these asshole, and I hate to say this because it’s in my industry, and I won’t even name them, but the companies that own these massive ETFs have incredible voting power. And now, you’re forcing people who hate to drill on the board of Exxon Mobil.

Frank Curzio: What do you expect them to do? To really be blaming the oil companies, again, it goes back to what I was saying earlier. You’re looking at the people saying these people are a bunch of freaking idiots. They’re going to believe anything I say. They’re not going to do the research. They’re not going to look into this. We’re going to make this a Democrat-Republican thing, and they’re rich oil companies and they screw everybody in the margins, and the funny thing is just the grandstanding that’s been taking place from Biden and the Democrats.

Frank Curzio: And I get it’s ahead of midterm elections, so you’re going to make a big deal. Call out oil companies, how they should produce more even though you did everything in your power to prevent that. To wean America off fossil fuels, you’ve been elected. Going after the refiners and their margins, this I think is hilarious because the reason why their margins are so high, these refiners, is because the White House has sold 150 million barrels from the strategic oil reserve, petroleum reserve.

Frank Curzio: I don’t want to get too technical, but that oil is really, really high quality oil. It’s called medium sour. It’s like oil from Russia and the Middle East. It’s the best, so it doesn’t require lots of refining. When they’re selling it, who the hell’s buying it? Marathon and Valero is buying the shit out of that oil, meaning it’s requiring less refining, and they’re increasing their margins.

Frank Curzio: Now, because you’re releasing out of the strategic oil reserve, you’re starting to attack the refiners because their margins are so high and how they’re price gouging everyone. Now, again, you’re releasing that oil from the strategic petroleum reserve, which I find amazing, which by the way, there’s calls when it comes to this that by October, we’re going to be at 40-year lows. 40-year lows. When you’re looking at oil in general, when you’re looking at strategic oil reserve being depleted right now, what’s going on. It’s insane to me. It’s going to be a low 358 million barrels by the end of October. It was 600 million to start the year. That’s how much oil were released, oil reserve, petroleum reserve.

Frank Curzio: When you look at that, how much it’s being depleted, I look at Russia and all the sanctions and everything we place, Russia right now is in a massive position of strength. Massive position of strength. They can go to US and say, “Okay, here’s what we’re going to do.” We’re hearing a lot of insiders are predicting that the latest round of where they’re taking over after they take over this certain part, that there could be peace negotiations. They can go to all the countries right now. They can go to everybody. They can go all of Europe, they can go to the US, and just say, “Hey, we’ll do the negotiations, and we’ll stop this war, and we’ll have a peace agreement if you buy 300 million barrels of oil for us at a certain price.” We won’t announce it publicly, just like whatever, the Cuban missile crisis, all that shit.

Frank Curzio: But they’re in such a position, you’re going to see food prices come down. You’re going to see oil prices come down and Russia, again, US and Europe are still going to say Russia’s the enemy, they’re the worst ever, they’re going to shit on them. They don’t ever shit on China because everybody’s getting paid, but they’ll shit on Russia. And this is their opportunity. I really think in the next couple months, it’s going to benefit Russia. It’s going to benefit everyone. If they’re in that position to do that. We’ll see. And a lot has to do with oil and food prices. That could be a massive, massive catalyst for stocks. We’ll see, because you can’t continue at this rate where you’re just throwing oil out there.

Frank Curzio: They have no solutions. An 18 cent tax, like you said, is three and a half percent tax. Yes, gas prices are still going to be up 70% year-over-year, which is incredible. They were hovering around $3, and now what, they’re going to be 4.80. Is that your solution? But he has to say something because midterm elections are coming up.

Daniel Creech: That’s good though, because for every 10 gallons of gas you put in your car, what, that’s a buck 80 in savings.

Frank Curzio: Yeah, I know. And that’s going to help you tremendously.

Daniel Creech: Big deal.

Frank Curzio: The thing that surprised me, we’ll talk about the general state of the industry, but the returns on oil stocks, oil’s down pretty close to 100 dollars, down 20% off its highest two weeks ago, 120, and the selloff, like Pioneer raising its dividend. It doesn’t get better than that for companies like Pioneer. It went from 288 to 230 down 20%. Exxon was 105 three weeks ago. It’s 88. You look at Marathon was 33. It’s 23, that’s 30%. Halliburton, 43 to 31. That’s a 30% decline. How do you own these oil stocks thinking, “Hey, I’m safe.” And if you owned them a while ago, you’re fine. You kicked ass on these things.

Frank Curzio: But a lot of people have been coming in lately because they’re looking at the dynamics of oil and saying it should be $150, going to go a lot higher in all these stocks, but necessarily that doesn’t really translate into higher oil stocks. Now, if the commodity rises, it doesn’t always… Look at gold. Gold has held steady, and trading there is all time high. I don’t know where it today. Say 1900, close to 2000. I could tell you if you’re looking at gold stocks, they’re down incredibly, so it doesn’t always translate into that.

Frank Curzio: It should translate into higher profits, but it’s interesting to see this trend. I don’t know why it’s coming down. Is it because they’re going to be attacked, they’re going to be taxed at a higher rate? Is it the recession and people think demand’s going to fall off a cliff? But just to see these things really come back, they should be trading a lot higher for where oil prices are even $100, which is incredible. I was just surprised to see that move.

Daniel Creech: Well, to your point, they had a massive run up higher, so there has to be… You can’t fault anybody that’s been in it for a while to have some profit taking. Oil did drop significantly. You have a lot of political headwinds. You have a lot of headlines that are trying their best to get the price of oil lower, and it has been, but now… You’re right, Frank, if you bought, a month ago, oil stocks, you’re upset because you’re down 20 some percent on, like you said, what’s supposed to be, well, it is a great industry. It’s a great quote, unquote safe haven for things like that. Now, what do you do? Well, you have to evaluate that personally, but the bigger picture there is because of the volatility you’re going to have across the board.

Daniel Creech: That’s why you want to scale into decisions over time here. I think that’s the big takeaway. If your thesis have changed on the oil companies, and you’re down 20%, and that was your stop, sell and move to the sidelines and look again later. However, if your thesis hasn’t changed and you’re only down because the entire market is down, I would pay close attention, and I would think before selling in that scenario. Like I said, most people are buying month over month or every couple months as they get paid or they have some source of income, and I would definitely look to fill up those different buckets however you see fit. Because other than the price and other than the headlines that you read, nothing has changed in the oil markets and nothing will change for a long time unless policy changes. And the odds of that of to happen are very, very low.

Daniel Creech: Therefore, just don’t get run over. You don’t have to play in the industry and profit if you don’t want to, but don’t ignore that and the impacts that policies and things like that have on consumers. And I know we don’t have time today, but next podcast, whenever that is Frank, we’ll talk about the similar situation in metals and everything else. Because these are rinse and repeat recipes and we want to be able to help notify those and help as many people as possible benefit from that when they happen.

Frank Curzio: As you were talking, I was just seeing, because they have moved up considerably oil, but they also came down considerably. You’re saying, “Wow, they made a nice move to the upside.” They have made a nice move to the upside, but when you compare markets and you compare, the margins are much greater now than they’ve ever been. They’re drilling for much, much cheaper. But we compare the certain times when we’re looking at, let’s say 2014. You have 2013, oil prices were pretty much 90 to 100. It went up to 107 in 2014. If you’re looking at the XLE, which is one of the largest oil ETFs, I think it’s produced drillers, stocks are still down 30% from those levels and we’re looking at 107. We’re looking at where prices are today.

Frank Curzio: They’re down considerably. Their margins are greater. They’re generating more profits, and just to see this pullback, believing that oil prices are going to maintain these levels or go higher, for me, it’s a big surprise. It really is a big surprise. It just tells you that when you’re in a leveraging process, even the good names might be sold off. Microsoft’s been putting up great numbers. Microsoft put up great numbers, and they’re down what, 20% plus? I know you have the Facebooks and the Netflix’s are down a lot, lot more than that. 30% plus, 35% plus. Maybe more than that, but you’re going to see good names get hit when there’s the leveraging process taking place. And this is one of the areas where everyone was rushing into. But just to see that massive decline is interesting.

Frank Curzio: What scares me is not only is everyone bullish on energy, you won’t find someone that’s not bullish on energy, Daniel, but everyone and their mother has said, “You got to buy this dip.” And to me, being in the market for 30 years, it makes me a little nervous. I like when people, just like right now, the whole world is completely bearish. I’m picking away. I see stats that make a lot of sense and I’m looking two years out. I don’t know what the hell’s going to happen in the next six months, because it’s so crazy. But I do know inflation is going to moderate considerably over the next six months and going forward, which is what the Fed’s doing right now. And it will happen, especially if we can get something with Russia and Ukraine, and I think that’ll be huge. With the bottleneck, with not just supply chain concerns, but the rising prices of food, which is more significant than energy.

Frank Curzio: People are not going to have access to food soon. That’s how high food prices are going to go based on increased fertilizer price and stuff. I covered that, but it is interesting in oil. It’s a great argument of should you start picking away, and what do you pick away at, Daniel? Do you get more aggressive here because Exxon’s down 20%, but yet the aggressive ones are down 40%. The average is down maybe 30%. Are you going, “Hey, now it gives me an opportunity to buy these big cash cows that are going to pay me dividends,” and stuff like that, or should I get more aggressive, where it’s going to give you a chance to really buy some of these aggressive names, but it seems like more of a market call than an individual stock call where everything got nailed in this industry.

Daniel Creech: Right. I wouldn’t make it very difficult. I would be boring with this. I think you can buy the big ones. If want to look at some of the, like you’ve pointed out in the past, when the things that sell off hard, when things reverse, they typically go up the highest and you can make a lot. With the new environment we’re in, this new inflationary, higher interest rate thing like that, I would keep it simple. I would buy, hell, I’d even buy, I’ve been talking about, and I’m still down on it a little bit in my account, but Berkshire Hathaway, I think is one of the best stocks for inflation in inflationary times. You get a lot of exposure through other businesses there like Chevron. But I really think that you could look across the sector.

Daniel Creech: I heed your point on, and I could be wrong in the short-term, about it is odd when the consensus you’re a part of the herd, because I’m bullish on energy like a lot of people have. I have been for some time. I just don’t think that even though you get a lot of people calling for it, yeah we could see more sustained lower prices or whatever, but I don’t think just because a lot of people get bullish on it that that trend has run its course. And I’m not saying you’re saying the run is over. I say all that to say you can be boring and still make really good returns I think over the next year, at least.

Daniel Creech: Just like Dollar Stock Club, we put ExxonMobil in there because of the board members that you talked about earlier getting elected. And it’s done very well about a year. I think we put that in June of last year. And yeah, it’s off from its all-time highs, but again, it’s great to see a situation where if you only bought in the last month, you’re down. Because a lot of those oil, year-to-date you don’t even have to capitalize on them. If you just bought at year-to-date, a lot of those companies are up tremendously and you offset that with 30% declines in major market indices. I think that’s great.

Frank Curzio: I think it’s funny that you said Exxon, I’d stick with the boring companies. The boring company that’s about to generate 400 billion in revenue. The boring company that’s going to generate 44 billion in free cash flow. In free cashflow.

Daniel Creech: 44 billion in free cash flow?

Frank Curzio: In free cash flow.

Daniel Creech: Nice.

Frank Curzio: Which is up from 36 billion in 2021. That’s projected this year. Just to put that in perspective, if I had to guess, that’s probably 44 billion net free cash flow for Exxon, by the way, pays a 4% yield of trading at eight times forward earnings where the market’s trading at 15 times forward earnings. Again, oil companies in general trade, 10, 12, so it is at a discount. But you’re looking at 44 billion in free cash flow is probably a greater market cap than at least more than half the companies in the S&P 500. That’s what you’re generating in free cash flow.

Frank Curzio: You’re talking about a company that could literally buy the solar industry, the wind industry, all if they wanted to do all that stuff. All this massive amount of money that can go into drilling like crazy, but how are they supposed to when we have an administration that’s totally against it, and you say you’re against it a year before you were running. And now that you’re elected, a year and a half in, almost two years in, and now you’re yelling at these companies of why they’re not drilling more, why they’re not drilling more. As someone who runs a company who you’re obligated to your shareholders, how could you increase production in the US?

Frank Curzio: And it’s kind of amazing, because you could say, “Well, how do you play this?” And like you said, Daniel, you’re looking at oil companies, should we buy them this pullback? For me, the best play on oil right now is to buy coal. Is to buy coal. Everyone’s increasing coal right now. They’re not allowed to say it, but if you look under the hood and you look at all these companies and even looking, especially in Europe, especially how much in China. The amount of production of coal across everything, and Europe’s more of a consumer of coal, but you’re seeing coal ramp up. You’re going to see uranium ramp up. Let’s ramp up these things.

Frank Curzio: And you’re seeing it because it’s about profits and it’s about money at the end of the day. And what are you seeing now, Dan? You’re seeing less money going to ESG. A ton of money flowing out of it, going holy shit. All these expectations. And now, you have an administration that’s kind of on its heels. We said we weren’t going to do fossil fuels, but now, you see coal companies increasing coal usage and coal production, and you need that. Just look at the profits. Look at some of these companies, guys. You could do your research. There’s only about three publicly traded companies that you’d know of that you could look at. I don’t want to say it because we have one of them in our portfolio that’s doing well.

Frank Curzio: To me, that’s the play. If you’re buying uranium with high natural gas prices and staying high, if you really think oil’s going to go higher, you have these great oil companies, these totally boring, boring, super boring oil companies trading at mass evaluation, 4% yield at cheap valuations growing like crazy. It’s not so boring when that stock in your portfolio that’s like your snowflake is down $250. What was it, 400? It’s a hundred and whatever it is today, but these things down 78%, those boring companies are very, very good right now. And they’re increasing profits, increasing cash flow. But let’s see. With the headwinds coming in and everyone going against oil companies, it is going to be interesting. But man, a lot of stocks we mentioned. A lot we covered today.

Daniel Creech: Yeah. Handful of oil companies. It’s low hanging fruit out there. You don’t need the bottom to start buying stocks, especially in energy, people.

Frank Curzio: And you’re not going to know when the bottom is, guys. You’d like to buy at the absolute bottom and sell at the absolute top. And I know it’s very difficult when you’re watching, especially watching CNBC right now about all the inflation and destroying. Inflation’s going to continue, and the Fed, just actually Powell, says we have no control over food and energy inflation. And everything you’re looking at, you’re like, “Holy shit. I should just jump off a building.” Before you do that, listen, you have to look at all the facts like I said earlier. Stocks are down incredibly. You’re seeing some things down 70, 80%. A lot of companies are trading near the cash to have in their balance sheets. And you don’t get an opportunity like this to buy a lot of these names.

Frank Curzio: And it’s going to be crazy, you got to hold your nose and just say, “Holy shit,” and buy some of these things, but start picking away here. Only if you have a two-year time horizon. If you want to trade, you trade back and forth. Today, the market opened down a ton, and now it’s up as I’m watching, and we’re about to finish this podcast at 11:00 AM.

Frank Curzio: Trading’s different, but if you have a two-year time horizon, which many investors I’m sure who listen to this podcasts do, start picking away at some of your favorite names, because you’re getting them at 30, 40% discount. Insiders are buying. They’re cheaper than they’ve ever been. They still have good growth bottles. They’re still growing earnings, but yet, there’s just so much uncertainty out there. That’s when you’re able to get stuff cheap, when there’s uncertainty. When things are like, “Holy shit. I don’t know what’s going on.” When things are great, you’re not able to get these massive discounts. Now you are. That’s why you should be picking away. That’s the best advice I can give.

Daniel Creech: Yeah. I think that’s great. Nobody has a crystal ball. You want to scale in. You want to invest. I can’t say that any better, Frank. Good job. We’re good.

Frank Curzio: I appreciate that. I appreciate that.

Daniel Creech: It’s Wednesday. Everybody have a great Wednesday.

Frank Curzio: Have a great Wednesday. I will see you tomorrow, guys. I really appreciate you listening today. Any questions, comments, we’re here for you. Daniel, what’s your email address?

Daniel Creech: Daniel@curzioresearch.com

Frank Curzio: And make sure you send him really nasty emails. He deserves them.

Daniel Creech: I’ve been getting nice ones lately. And questions, like I said, even though if I don’t reply, I read them and I’m working on getting back to a handful of them.

Frank Curzio: We got to get into politics. That’s where you get some of those negative emails.

Daniel Creech: Man.

Frank Curzio: I love your strong opinions on politics. We’re going to talk about politics next week.

Daniel Creech: Well, you were goading me. I was just about to say something really good.

Frank Curzio: We’ll save that. We’ll save that for the next podcast, but thanks Daniel for coming on. Really appreciate it, buddy.

Daniel Creech: Cheers.

Frank Curzio: Okay guys. This is for me again, questions, comments, email Daniel, email me at frank@curzioresearch.com. I’ll see you guys tomorrow. Take care.

Announcer: Wall Street Unplugged is produced by Curzio Research, one of the most respected financial media companies in the industry. The information presented on Wall Street Unplugged is the opinion of its host and guests. You should not base your investment decisions solely on this broadcast. Remember, it’s your money, and your responsibility.

P.S. Guys, right now is one of the best times to buy small caps I’ve seen in my 30-year career…

Which is why today in Curzio Venture Opportunities, we’re scooping up shares in 3 stocks…

Including a new, inflation-ready pick on deep discount after the selloff… and an existing energy pick with massive upside.

Join now… and get ready to ride the rebound in this beaten-down sector.