2020 has been a wild year to say the least. Stock markets zoomed… crashed… then skyrocketed to new highs. To say the market has been volatile is an understatement. It seems there’s another challenge facing us every week.

The latest is President Trump, the First Lady, and other high-profile cabinet members testing positive for the coronavirus.

This news sent shockwaves across the globe. There will likely be hourly reporting on their health—let’s pray that they and everyone else facing the virus make a speedy recovery.

These events are just the latest in what is shaping up to be a volatile election year. Two weeks ago, I discussed how the Big Money tends to sell stocks heading into Election Day, and buy after. That theme is once again playing out this year.

So, what can we expect for October?

Let’s look at the data.

Markets fall in October during election years

September tends to be a negative month for the markets… and 2020 continued that trend, with the S&P 500 (SPY ETF) falling 3.74%.

October election years since 1990 are usually red, too—with an average S&P 500 return of -2.45%. While that may be alarming, it’s only half of the story. I’ll show you what I mean in a second—but first, let’s look at where the Big Money sits today.

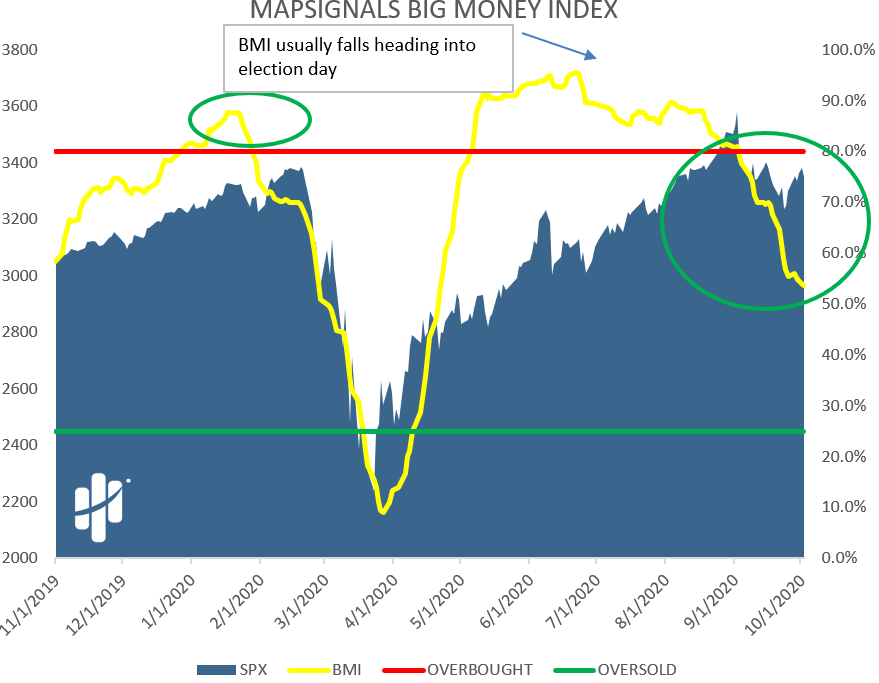

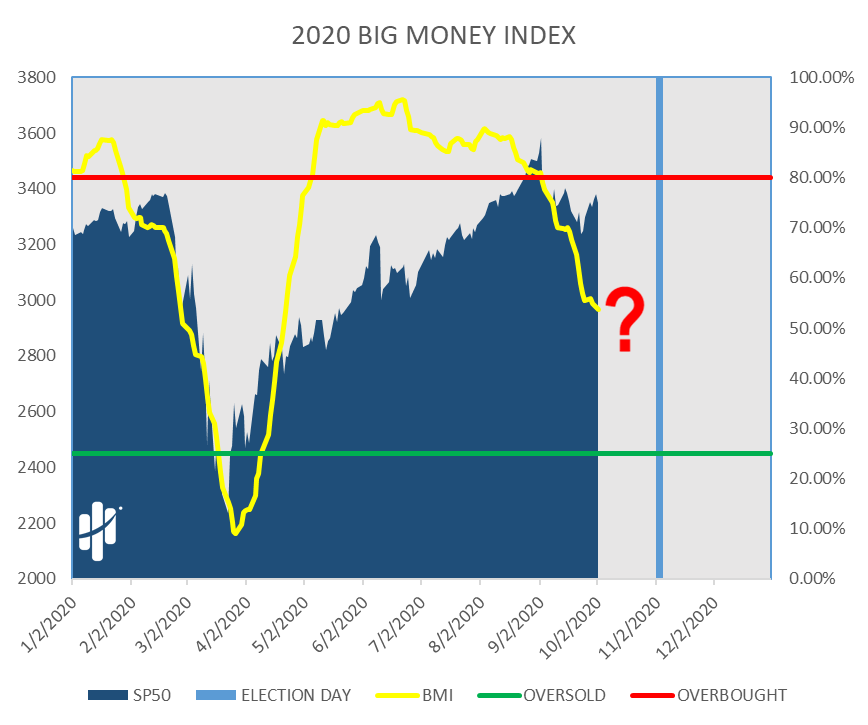

Below is the MAPsignals Big Money Index (BMI), which measures the likely buying and selling of Big Money accounts. If the index is falling, it means Big Money is selling, and vice versa.

As you can see, the BMI been in a steady downtrend for well over a month:

That’s what tends to happen leading up to Election Day. Two weeks ago, I showed you three historical election charts (2016, 2012, and 2008). The charts showed a pattern of Big Money selling ahead of Election Day… and buying shortly afterward.

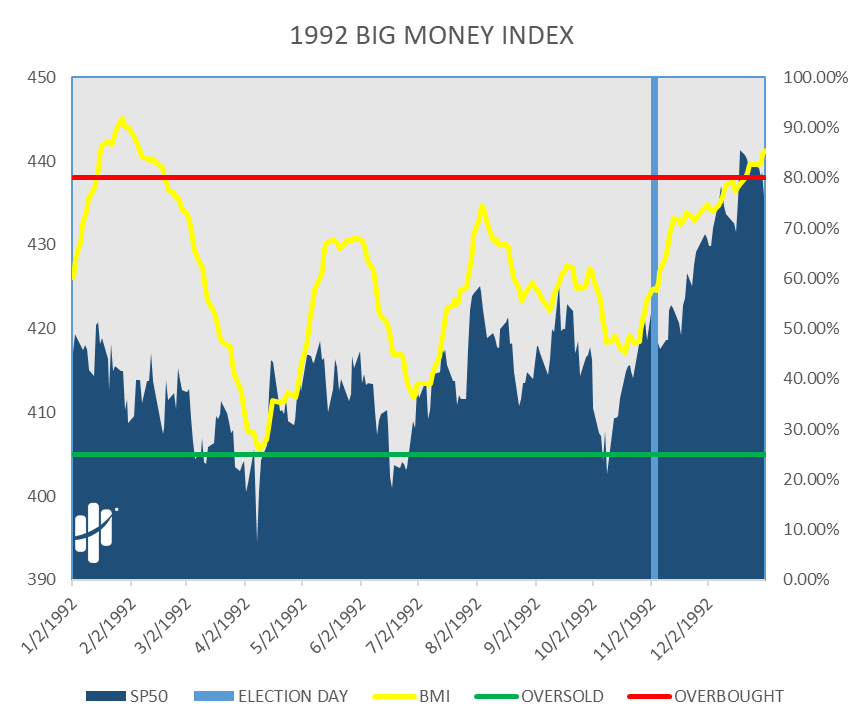

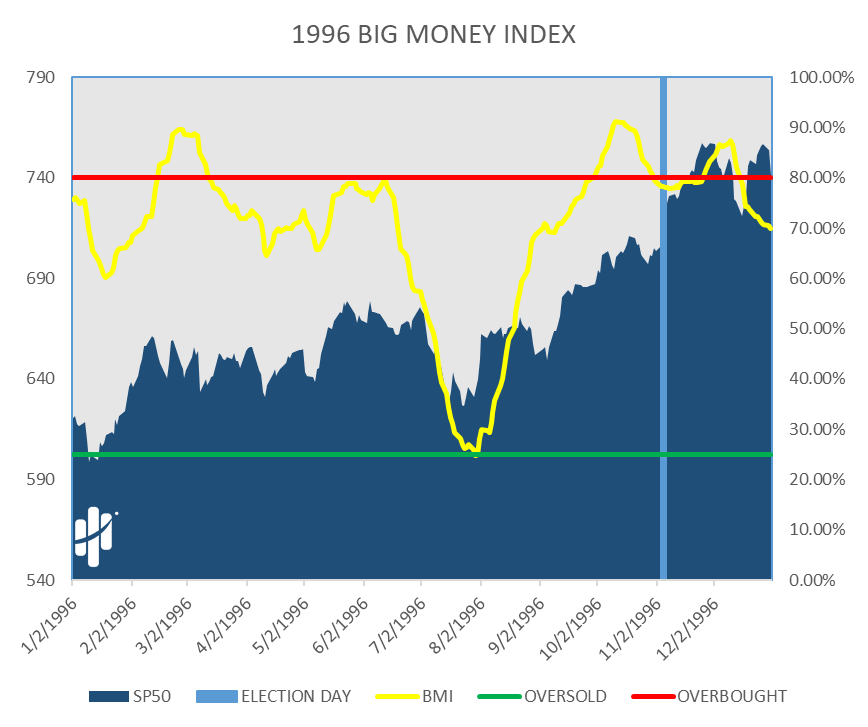

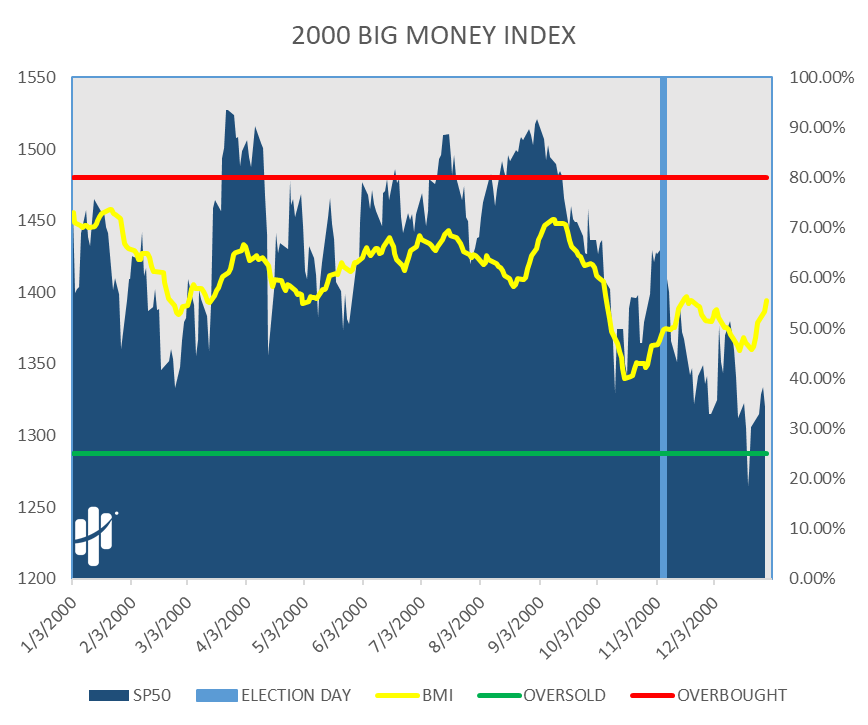

Let’s now look at a few more… The blue line is Election Day:

Here’s 1992:

Now, 1996:

2000:

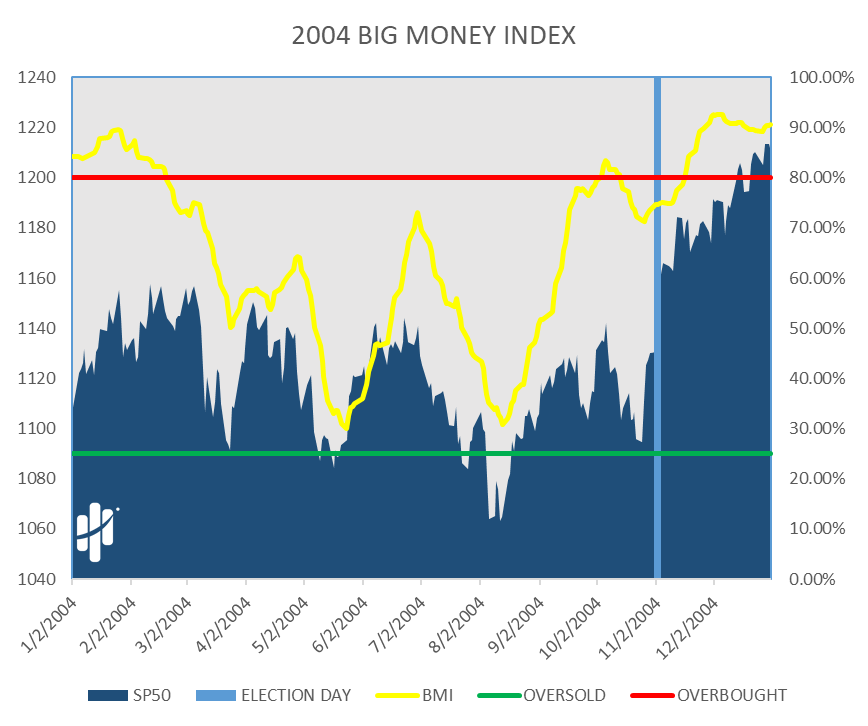

Lastly, 2004:

Two things should be apparent when looking at each of these charts:

- The BMI is under pressure heading into the election

- The bulls tend to step in after the election results are in

Will that happen again this year? There’s no way to know until we get there… But the theme of selling ahead of the election is already in motion. Let’s look at the BMI today under the Election Day framework:

Things look very similar to prior election years. From a data standpoint, Big Money is likely taking some chips off the table heading into Election Day.

And if history is any guide, the buyers will likely show up shortly after the results are in.

Here’s the bottom line: Election year pullbacks are part of the game. Hang in there folks…The bears’ days look numbered.

Editor’s note: A controversial presidential victory could destabilize markets… Luckily, Genia Turanova specializes in profiting from instability. Year to date, she’s posted up gains as high as 6x while many experts lost their shirts… and she’s showing no signs of stopping.

Learn how you can get in on her next triple-digit trade before it’s too late.