Rarely do we get to see a market freefall like we’ve seen the past month…

It’s been epic, and preparation is critical if you’re going to succeed in this type of environment.

If you can step away from the negative headlines and focus your attention on scooping up great companies, you’ll likely be very happy months from now.

That’s how I’ve been playing it.

A couple of weeks ago, I discussed how I was going to buy big once my signal turned green…

And I did.

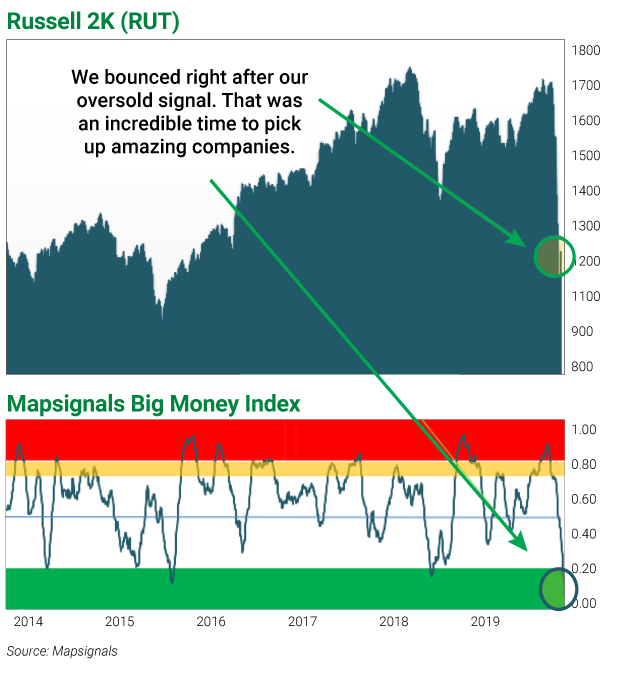

This signal went oversold on the morning of March 19.

Below, you can see the Big Money Index (BMI), a proprietary index that measures the buying volume (with a few price relationships) in large trading firms, or the “big money” players. (The Russell 2000 Index, the benchmark for 2000 small-cap stocks, is highly correlated to the BMI.)

If the BMI is going up, big money buying is increasing. If it’s going down, big money selling is increasing.

Historically, when this rare signal turns green, the market is deeply oversold… and it’s wise to buy great companies.

But this green signal rarely lasts long.

Am I calling the bottom? No.

I’m calling for opportunity.

I’m pointing to a data point that has guided me in the past. And since it went green, market returns have looked like this:

iShares Russell 2000 ETF (IWM): +12.89%

SPDR S&P 500 ETF Trust (SPY): +9.27%

Invesco QQQ Trust (QQQ): +8.26%

Generally, this signal has worked like clockwork—and right now it’s living up to expectations.

Bottom line: When this index starts to turn up, markets will soon follow.

When will markets get the “all clear”?

When you look at thousands of stocks each day, patterns start to emerge…

I’ve seen many pullbacks over the years, so I have an idea of what to expect… from a data standpoint.

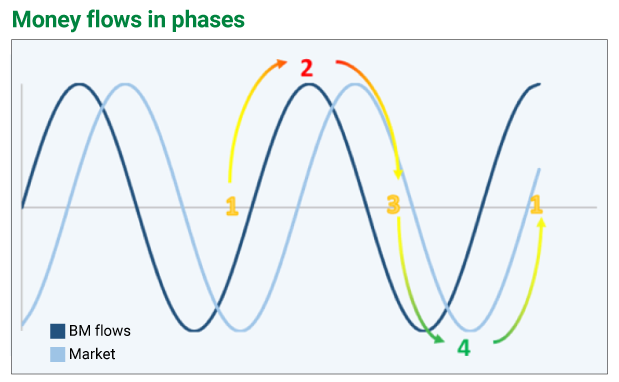

Big money flows in phases.

- Liftoff: Big money buying is huge, and selling is nearly zero.

- Market peaks: Big money buying slows and selling picks up.

- Fear begins: Big Money buying slows more and selling takes off.

- Peak fear: Big Money buying is non-existent, and sellers are in control.

Check it out:

When a market is oversold, we are in phase four—peak fear—like now.

Media headlines are usually grim, and it can be scary.

But you want to be greedy in these periods… This is when I go shopping for great stocks.

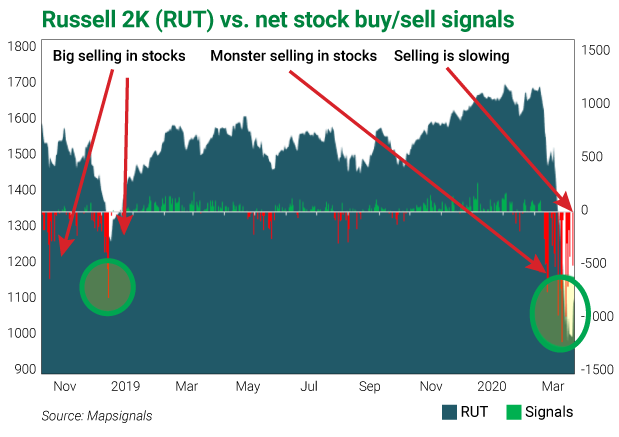

Another sign of oversold conditions is a slowdown in selling. Sellers must get out of the way for markets to lift.

Let’s look under the hood at the net buys and sells in stocks. Green bars mean there were more buys than sells, and red bars mean more net sells than buys.

As you can see, epic selling in stocks is slowing…

Once selling dries up, buyers will lead us higher… then phase one—liftoff—will begin to take shape.

So, what can we expect over the next few weeks?

We’ll likely see more zigging and zagging, but the market will ultimately move higher.

In the meantime, I’ll keep picking spots to buy on dips…

If you missed it, I gave away a few of my favorite long-term names to Frank’s audience recently on Wall Street Unplugged.

I’m not going to miss out on this opportunity to buy bargains… and you shouldn’t either.

Editor’s note: Luke recently joined Frank as a first-time guest on Wall Street Unplugged. If you want to learn more about Luke’s market outlook… his unique trading system… and his favorite long-term stocks to buy today, listen to this fantastic interview: Could we see a short-term shutdown in the stock market?