Election season is here… and the rhetoric is heating up.

You’ve probably been seeing political ads all over social media and broadcast during sporting events. I know I have.

This got me thinking about the interesting ways the market acts during election years.

You might have heard that September tends to be a weak month for the markets. That is true—and if you single out election years, September performance is even worse.

But there’s more to the story…

This isn’t the time to duck and hide. Now’s the time to get a game plan. The Big Money is well aware of September’s historical performance. And that’s where the opportunity comes.

But, before we get into my election data, let’s go over what’s happening now in the market…

The S&P 500 (SPY ETF) is down 4.96% month to date. That’s a big change from what we’ve seen the prior two months: July and August had monster performances of +5.89% & +6.98%, respectively.

But, the weakness this month actually mimics Septembers of the past. Going back to 1990, the S&P 500 has an average return of -0.34% for the month of September. If we drill down further, election years in that time period returned -0.85%.

So, is it time to sell everything and run for the hills?

The answer is no, and here’s why…

I live and die by data. It takes the emotions out of investing.

Specifically, I’ve learned to follow what Big Money institutions are doing with their portfolios.

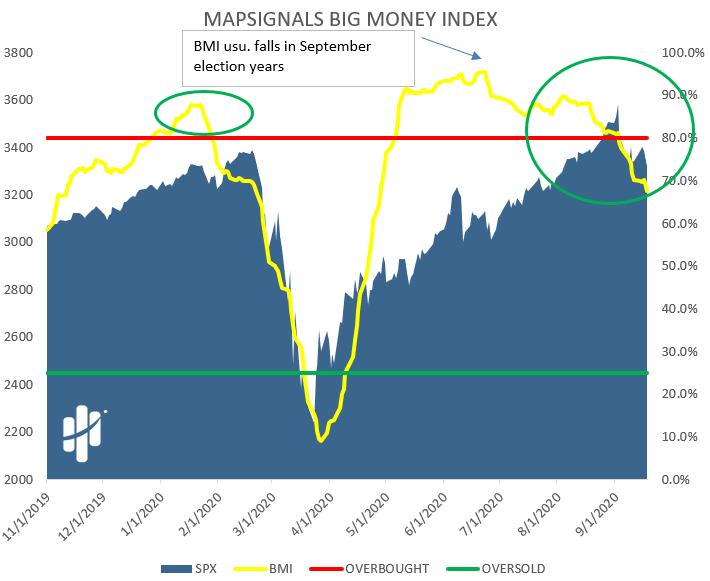

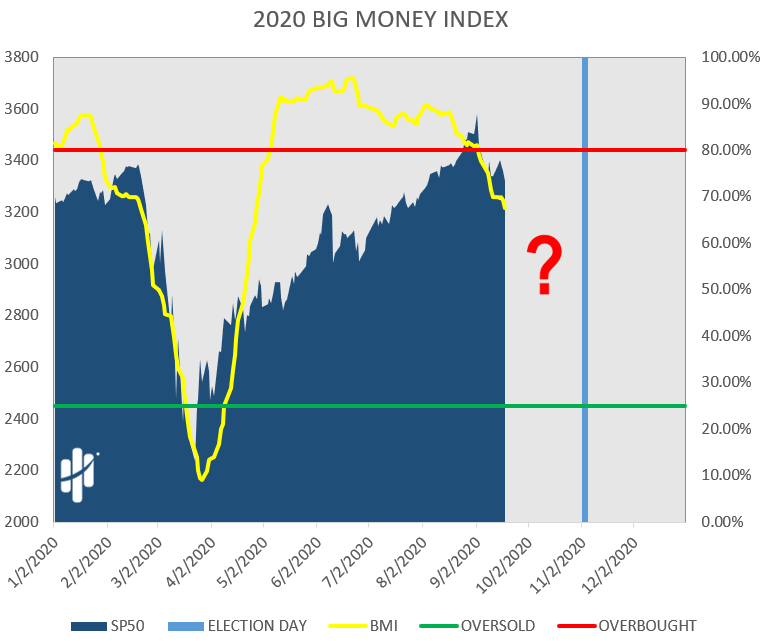

A great way to gauge this activity is the Big Money Index. If the index is falling, selling is picking up. If it’s rising, buyers are stepping in. Generally speaking, investors want to be on the right side of the trend.

The trend is down right now:

But check this out…

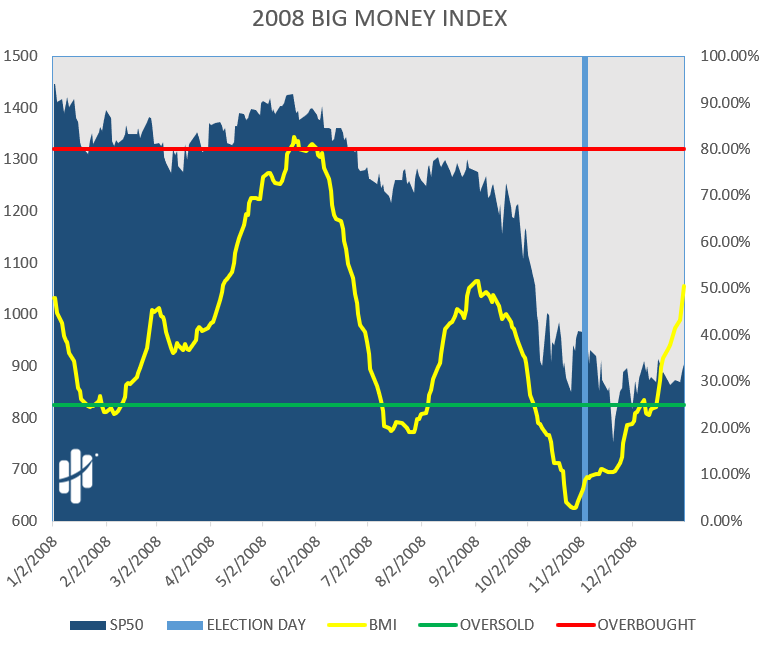

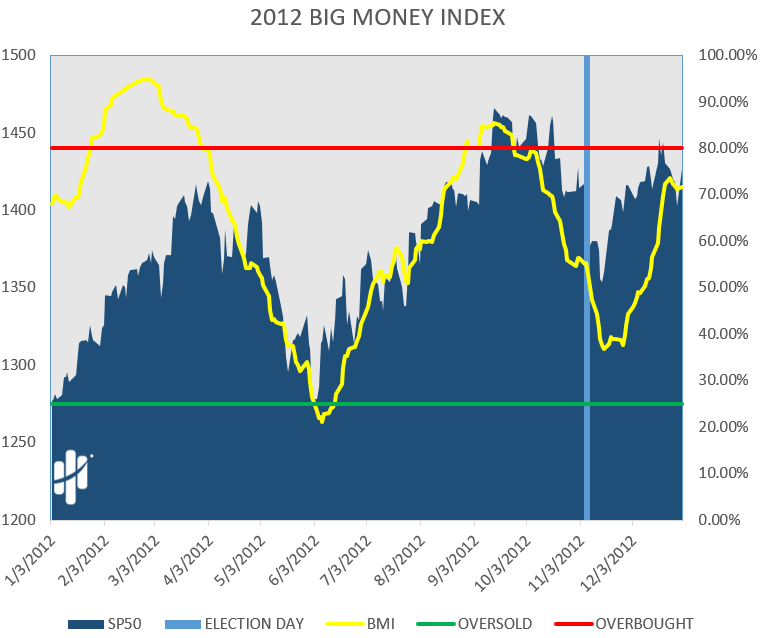

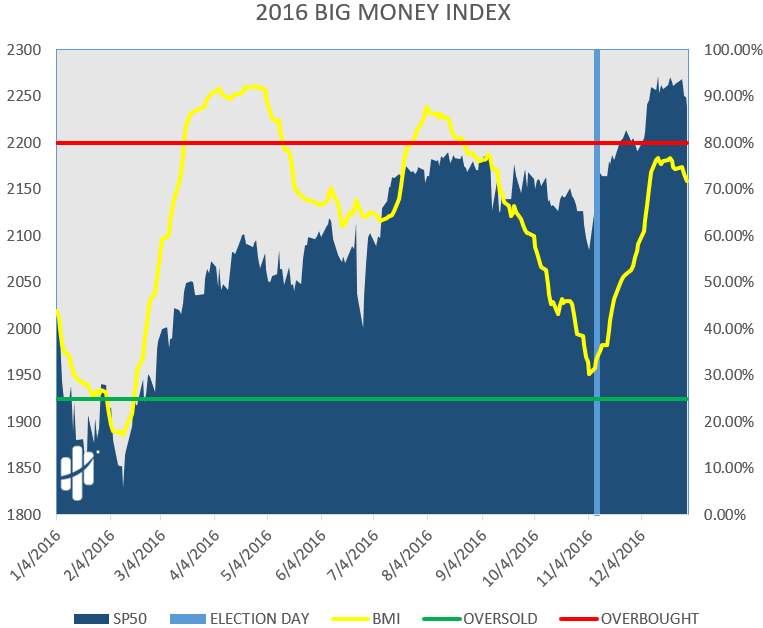

Election years tend to see a falling BMI heading into the election… and a rising BMI afterward. In simple language: Big Money sells stocks before elections, and buys after.

To show you what I mean, below are the last three election years. The blue line is Election Day.

For context, let’s take a look at today’s BMI with the same framework:

It looks eerily similar to prior elections. And that’s why I believe a great setup is ahead for stocks.

The bottom line is this: Yes, September tends to be bad for stocks… but after Election Day, buyers usually step in. If history is any guide, start making your buy lists now.

Which candidate wins, on the other hand, is anyone’s guess.

Editor’s note: Until Friday at midnight, we’re offering Frank’s offering Frank’s elite small cap advisory, Curzio Venture Opportunities, at an insane 60% discount.

We’re already seeing incredible gains across the Venture portfolio… But thanks to the Fed’s latest actions, Frank predicts a HUGE move in a certain group of small-cap stocks—one that could make smart investors an absolute fortune.