Editor’s note: Today we’re sharing another income-generating strategy from our newest analyst, Genia Turanova.

With nearly two decades of experience as a portfolio manager and editor for multiple award-winning advisories, Genia’s income investing track record is tough to beat… and that’s been during some of the most volatile markets in Wall Street history.

Last week, Genia told us how to profit no matter who wins the trade war…

Today, she shares a simple checklist to help you sniff out the companies hiding disaster behind their dividends…

Every investor makes mistakes.

Even legends like Warren Buffett and Berkshire Hathaway…

In 2015, Berkshire Hathaway-owned H.J. Heinz (the ketchup maker) merged with Kraft Foods to become Kraft Heinz (KHC). The newly formed food company was the fifth largest in the world and the third largest in the U.S… But it still turned out to be a disappointment. Berkshire lost a lot of money on its KHC position—including a $4.3 billion loss in just one day.

That happened on February 22, 2019, when Kraft Heinz took a whopping $15.4 billion write-down for the Kraft and Oscar Mayer brands, and other assets. Worse yet, KHC announced it was cutting its dividend by half.

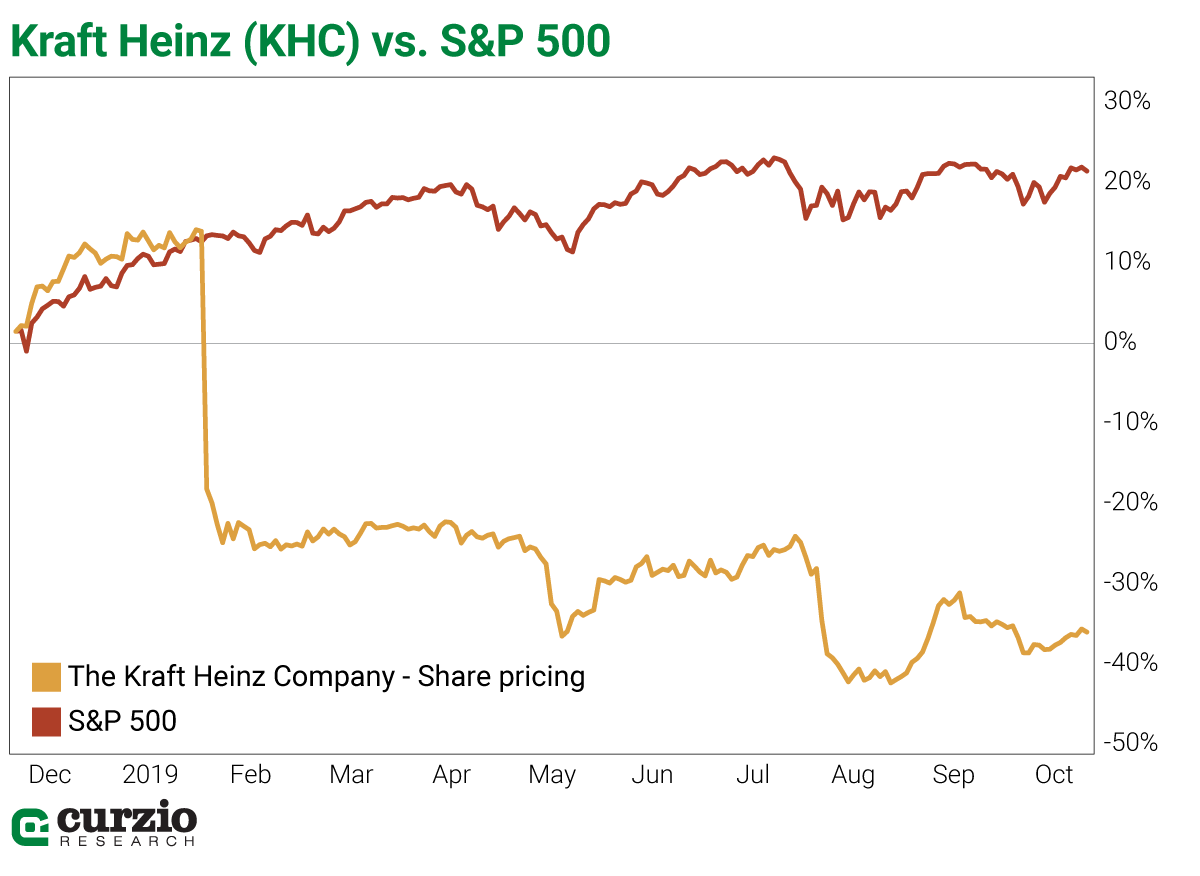

The market sent the stock down 27% on the day, as investors big and small reassessed the company’s value and future. Even Warren Buffett lamented that he’d probably overpaid in the merger.

The Kraft/Heinz merger didn’t create much in terms of cost savings or synergies, and the value of the combined company’s major brands has failed to materialize (hence the write-off). Adding to the list of troubles, KHC disclosed an SEC investigation into some of its accounting practices.

As I write this, KHC is down 50% in a year, while the market is up 9%.

Kraft Heinz is a good example of what can happen to a company when its business outlook changes for the worse. It’s also a good example of what often happens to the share price when a company cuts its dividend…

KHC’s 50% dividend cut only highlighted the extent of the deterioration of its best-known brands. (As if a $15.4 billion write-off and a $12.61 billion loss weren’t enough.)

Typically, businesses are loath to cut or eliminate their dividends. It’s a signal that the company in question can no longer fulfill its major shareholder obligations. And because cutting a dividend is usually a last-resort measure, it’s often followed by a loss of income and a drop in stock price.

Today, I’ll show you three simple ways to make reasonably certain your portfolio companies aren’t likely to cut their dividend… and protect the size of your income stream.

As bad as KHC might look after a 50% decline in the past year and a 35% drop in 2019 alone, other companies fared far worse…

Take Frontier Communications (FTR), a rural telecom company… It used to pay one of the best dividends in the S&P 500, but evolving wireless technology has led to a decline in its landline business. The company’s growing debt and slowing business have taken a toll.

In May 2017, Frontier cut its dividend by about 2/3… and had to discontinue paying a dividend altogether by October. FTR’s share price has suffered mightily, too—a 98% decline in three years.

FTR isn’t unique in its struggles to adapt to the changing telecom landscape. Many of its peers have suffered, too—and their dividends, once very generous, fell victim to new market realities.

Consider Windstream (WINMQ), another high-yield telecom darling of just a couple of years ago, now in bankruptcy. Windstream used to be a 10% yielder, until it eliminated its dividend in May 2017. Deteriorating business and growing debt contributed to the fallout.

No company exists in isolation. This is why you should always compare its dividend yield to the industry’s or its peers.

Know your dividend

These days, there’s no real need to do a dividend calculation yourself. Almost any modern data source, from Yahoo! Finance to Google Finance to your broker, gives you the dividend yield for the stock of your choosing.

Still, it’s always good to know what goes into a financial number. You’ll arrive at the dividend yield by adding up all past-year dividend payments and dividing them by the stock’s most recent market price.

For example, AT&T’s (T) quarterly distribution is $0.51. So total payments ($2.04) / current market price ($38.23) = 5.3%.

Also, the dividend you see on many data services, including Yahoo!, is a so-called “forward dividend.” This number assumes that the most recent dividend will be paid throughout the year. This way, if a company eliminates its payout, investors know not to expect any dividends in the near future.

For FTR, a comparison with either Windstream or AT&T would have been helpful. While FTR’s dividend has always been generous thanks to the dynamics of the telecom business, for a long while it was about two times (2x) higher than what AT&T, the largest telecom, was yielding. When that difference started to widen, it should have been like an alarm to income investors.

Plus, the market gave fair warning to FTR investors when Windstream eliminated its own dividend.

As you research a new dividend stock or review the one you already own, watch out for three things

- Abnormally high dividend yield. Compare this yield to the industry average and to the company’s peers, and look at the past history as well. Be on alert for dividends that seem too good to be true—they often are. Make sure the above-average yield is the result of growing dividends, not a falling share price. That would have helped with FTR. As the company’s dividend jumped to 20% and more, investors would have been better off without that payout. It wasn’t a cause for celebration… it was a cause for an alarm.

- Growing debt, decreasing cash balance, and deteriorating cash flow. Watching Frontier’s debt snowball would have helped investors avoid the worst of its share price decline.

- Declining revenue and profits. This might seem obvious, but it’s a powerful indicator. The trick is to distinguish between temporary setbacks and long-term trends. For many—if not most—companies that resort to reducing or eliminating a dividend, a long-term business decline is to blame.

Frontier, for example, had been losing money since at least 2015. Windstream, too, was losing money for years, and it lost a lot of it. In 2016, the company lost $20.53 per share (and more than $60 per share in fiscal year 2017). In the first quarter (Q1) of 2019, the company reported a $2.3 billion loss.

Taken on their own, these indicators won’t guarantee that the company in question faces immediate or inevitable trouble. Nor will they protect you from a disaster like Kraft Heinz this February. Nobody, not even Warren Buffett, can be protected from all market surprises.

But this checklist will help you weed out your weakest holdings and avoid taking on others. This is always a good thing, and it could be especially helpful in a market trading near all-time highs and/or an economy nearing recession.

Plus, this checklist can help you sleep better if you own, say, AT&T or Verizon (VZ). Over the past decade, the average yield is 5.6% for T and 4.8% for VZ—very close to the 5.3% and 4.0% these giants pay today. And their businesses are doing fine, too, with revenues and profits steady.

Even though these are also high-yielding telecoms, their dividends are safe in this market.

Next week, I’ll share more ways to protect your portfolio as this bull market ages…

| Genia Turanova Analyst, Curzio Research |