It was a record-breaking holiday season for consumers and retailers—on several fronts.

For one, ecommerce sales hit a new all-time high of $222.1 billion for the last two months of 2023. That’s up nearly 5% from the same period last year.

That growth might seem impressive… but the numbers are more dubious than they appear at first glance…

Most of those sales were driven by massive discounts on electronics, toys, and apparel. And the use of “buy now, pay later” options also hit an all-time high—at 7.5% of overall online spending.

Meanwhile, retailers that cater to more affluent consumers (including Williams Sonoma, Apple’s retail division, Bloomingdale’s, and Nordstrom) just had their worst holiday season since Bloomberg started tracking the data in 2017.

Put simply, the latest retail numbers clearly show that consumers are hurting. They’re reluctant to spend big on discretionary items right now. And when they do spend, they’re delaying or spreading out their payments rather than paying upfront.

While we’re all feeling the pinch from this tough environment…. as investors, we can find ways to profit from the situation—as I’ll explain below.

But first, let’s take a look at the three main factors driving this trend…

1. Inflation is driving up the cost of living

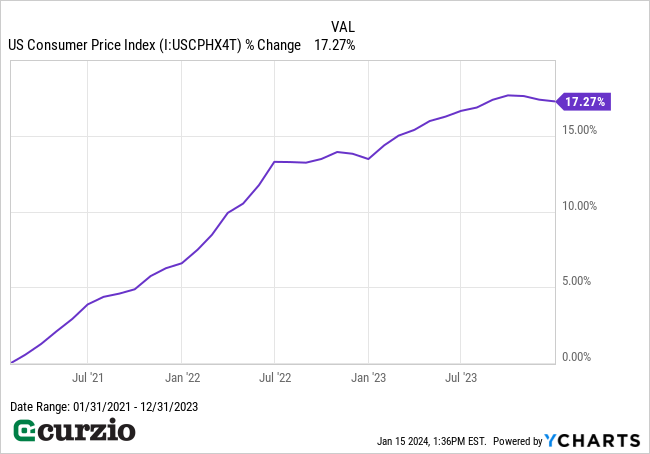

As you surely know, inflation has soared since the pandemic—raising prices across the board and reducing consumers’ purchasing power.

Over the past three years, the Consumer Price Index (CPI) has jumped more than 17%, as you can see below.

And though inflation has started to slow, it doesn’t mean that prices are falling (or even holding steady).

Put simply, the prices of most goods are still rising… just at a slower pace.

And considering the Fed’s 2% inflation target, the overall cost of living is set to keep moving higher… and put more pressure on consumers.

2. Consumer debt is out of control

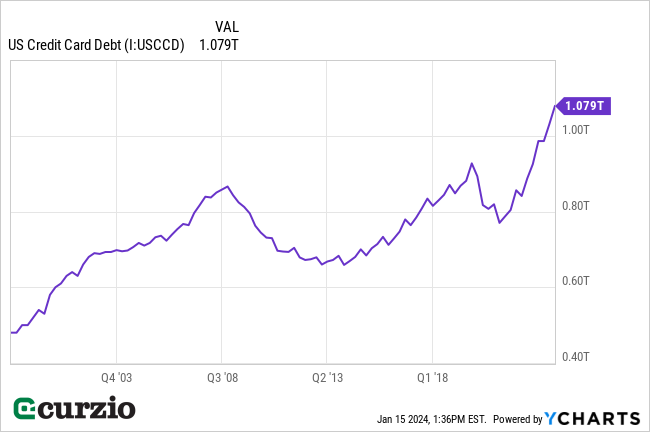

A few months ago, U.S. credit card debt topped $1 trillion for the first time in history.

And that number just keeps growing.

As you can see below, the country’s total credit card debt is now $1.079 trillion. That’s a 16.7% increase vs. last year… and a 34.2% surge vs. two years ago.

Even more troubling, credit card delinquency rates are sitting at 2.98%—the highest level since 2012.

So why are consumers suddenly struggling to handle their debt loads?

The answer is pretty simple…

3. Debt is more expensive than ever

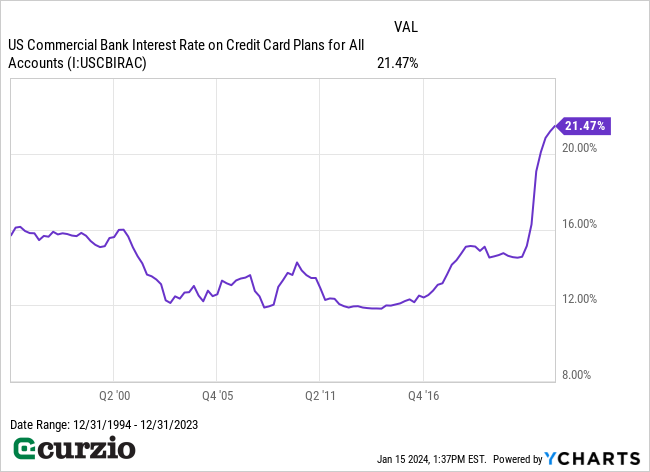

Since the Fed started hiking interest rates back in March 2022, the cost of consumer credit has soared.

Two years ago, the average interest rate on credit cards was about 14.5%. Today, that number has jumped to 21.5%. That’s the highest level on record by far… as you can see below.

The bottom line: Higher rates are making it harder for folks to manage their debt, which is at all-time highs.

Meanwhile, inflation has wrecked consumers’ purchasing power.

It’s a brutal one-two punch that’s forcing consumers to focus on their most important expenses… while cutting back on discretionary spending.

And that spells disaster for discretionary retail stocks.

Fortunately, there’s a simple way to profit from the sector’s inevitable decline…

How to play retail’s downfall

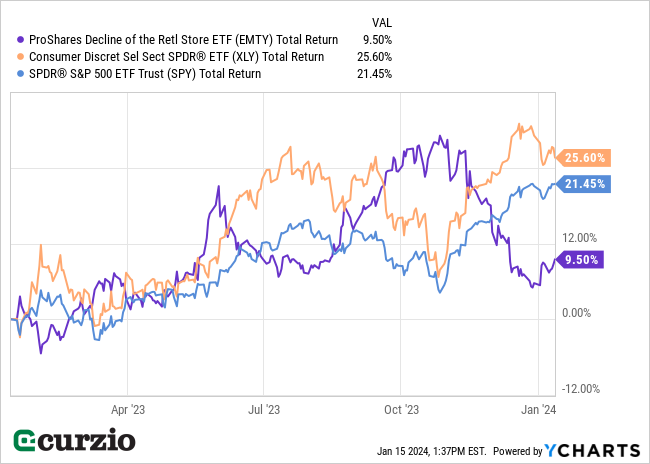

The Decline of the Retail Store ETF (EMTY) is an inverse ETF designed to benefit from a decline in the stocks of brick-and-mortar retailers.

Specifically, the ETF seeks to return the opposite daily result of the Solactive-ProShares Bricks and Mortar Retail Store Index. As its name implies, the index is made up of more than three dozen brick-and-mortar retail stocks.

Put simply, EMTY is designed to go up when retail stocks decline… and down when they rise.

If you look at the chart above, you’ll notice that EMTY is up more than 5% over the past year. That means retail stocks in the index fell about 5%… even as the S&P 500 (SPY) and the Consumer Discretionary Select SPDR ETF (XLY) rallied sharply.

EMTY’s positive performance (even as SPY and XLY did well) is a strong sign of the weakness of the brick-and-mortar retailers. And as the trends I discussed today hit the market in full force, this ETF is set to deliver more gains in 2024.

Conclusion

Consumers are struggling with a combination of rising prices, surging debt levels, and higher credit card rates—leaving them with even less money to spend on stuff.

This situation spells serious trouble for discretionary retail stocks.

The Decline of the Retail Store ETF (EMTY) gives us a one-click way to profit on the sector’s downfall.

P.S. For more of my favorite ways to play downtrends in the market, join us at Moneyflow Trader.