Over the past two decades, I’ve answered my share of panicked phone calls from clients about a 50% stock price decline for no apparent reason.

In most cases, I was happy to ease their minds…

If you see a huge share-price drop on a single stock, chances are it was due to a stock split. In which case, a 50% decline is automatically combined with the doubling of the number of shares. This translates into an unchanged total position… and no reason to panic.

But what if the opposite happens, and your stock suddenly soars five-fold on no news?

This may be due to a “reverse split”—it’s often a death knell.

Let me give you some examples…

Why a split?

In 2014, Apple (AAPL) executed a 7:1 split.

Translation: that year, Apple’s share price rallied to about $700 per share—too expensive for the average retail investor. The company then decided to reduce the share price by the factor of 7. And, at the time of the split, the company issued seven times more shares.

The post-split share price was brought down to about $100 per share.

The net result for a shareholder would be that she owned 7x the number of shares… with each share worth 1/7 of its pre-split market price. All said, the total amount invested wouldn’t change.

Much more common are 2:1 splits. In such a split, the number of shares you own doubles and the stock’s price is cut exactly in half. Again, the net result is the same dollar-size position… but a more liquid stock. Per-share profits, too, are cut in half… and subsequently the per-share dividend. From a valuation point of view, the company will have the same P/E and dividend yield post-split as it did before it.

In other words, a stock split does nothing to the stock’s fundamentals, its outlook, or the size of your position.

So why bother? Why does a company split its shares if nothing really changes?

Traditionally, it’s been done to make a stock more attractive to investors of all kinds… and to make it more affordable to buy a “round lot” of shares (multiples of 100).

There’s some psychology involved, too: The stock looks cheaper and more attractive purely because its “price tag” is now lower.

By itself, however, a split isn’t a bullish indicator. Whether or not a company in question can continue to grow will determine its fate, not the price tag on its shares.

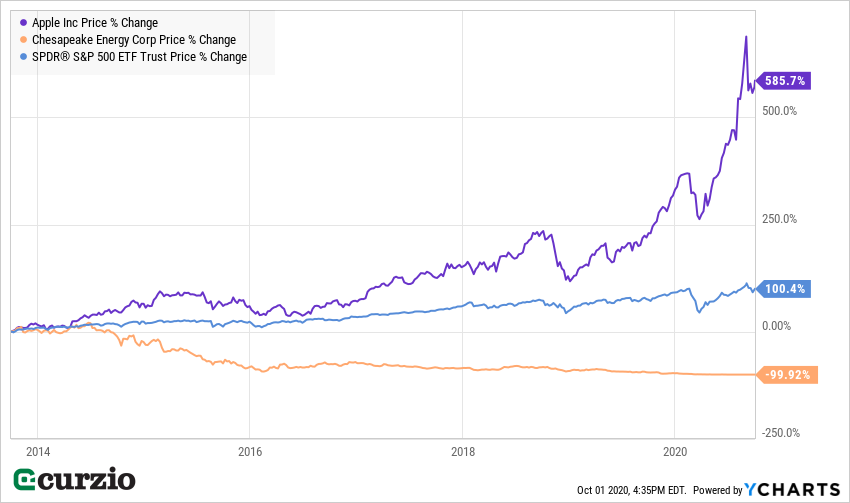

For example, in the year immediately preceding Apple’s 2014 stock split, it rallied nearly 50% (hence the need for the price-reducing split), while the market was up only 19%. It also outperformed the following year (as you can see from the chart below).

But its growth then slowed… and it gave up most of these gains. From June 9, 2014 to June 9, 2016, Apple performed almost exactly in line with the market (up 8.4% vs. the market’s 6.4%)… The post-split effect, if there was any, had fully faded in two years.

Why a reverse split?

Typically, a reverse split is done to raise a company’s share price. For example, a 1:10 reverse split for a $0.50 stock would translate into a $5 per-share price… and a portfolio position size of just 1/10 number of shares. The total amount will remain the same… but the stock will seem more attractive because it’s no longer a penny stock.

Moreover, reverse splits can be a last-ditch play for a company to remain listed on a stock exchange… where standards—such as the per-share value—require meeting a certain threshold.

Often, reverse splits only prolong a company’s inevitable demise.

One stunning example is Chesapeake Energy (CHKAQ), a now-bankrupt oil & gas company. A 200:1 reverse split this past April meant an immediate jump in per-share price (from less than $0.10 per share to about $20 per share) but a much smaller position for shareholders. Every 200 shares on one’s account translated into just a single share of post-split Chesapeake… with the difference paid in cash.

In the long run, you’d never be able to tell, based purely on a stock-price chart, exactly when a stock has executed a split (or a reverse split, for that matter). But often, a stock split is followed by more long-term share-price gains… thanks to the combination of a stock’s overall strength and the market’s long-term upside–like for Apple in the chart below.

This year, however, stock splits became all the rage, with traders speculating on post-split boosts.

Apple, after announcing on July 30 that a new 4:1 split would occur on August 28, went on a wild ride… as did Tesla (TSLA), whose own 5:1 split went into effect on August 31. In the past three months alone, TSLA has more than doubled… while AAPL is up more than 20%.

Apple rallied on the heels of its 4:1 split announcement (its first split since 2014) as the stock jumped to $400 and above. (Note that, thanks to its 4:1 stock split, the $400 per share pre-split price translates to the split-adjusted $100 per share in today’s trading.)

But this price action can’t be viewed alone. Consider Apple’s quarterly revenue for its fiscal third quarter (Q3), which jumped by 11% year over year (YoY)… and that its $2.58 per-share profits beat the consensus of $2.09 by a wide margin.

Moreover, the stock has already given back half of its crazy post-announcement gains from July 30–September 1. In a few short weeks after announcing the upcoming split, APPL rallied 39.5%… now given up about half of those gains.

The gains on TSLA are even more abnormal. I suspect its rally has little to do with its split… and everything to do with market bullishness about TSLA’s long-term story and its potential EV market dominance. This year alone, TSLA is up more than 430%… and most of these gains happened pre-split.

We’ve had a couple of splits that failed to move a stock up sharply… or at all.

Just this Tuesday, McCormick (MKC) announced a 2:1 split.

At the same time, the company said it earned $1.53 in earnings per share—just a penny better than expectations. The stock has yet to rally on the announcement… and it might not, given its limited growth prospects.

The bottom line is this: Don’t mistake stock splits for risk-free gifts. By itself, a stock split doesn’t mean a company will remain on an uptrend… And taken on its own, a reverse split shouldn’t necessarily mean trouble ahead.

Whether it’s a long-term investment or a short-term trade, watch for splits. And do your homework.

Editor’s note: Genia’s readers are among the first to know how market moves will affect their portfolios… and how to use them to their advantage.

Her newest investment advisory, Unlimited Income, was designed to profit from a huge transfer of wealth into a certain type of income asset…

If you’re looking for the safety of income—without sacrificing growth—Unlimited Income is how to to get it.