Some stocks can make you rich…

While others will make you average.

As an investor, my goal is finding tomorrow’s best stocks… today’s outliers positioned to take off over the months and years ahead.

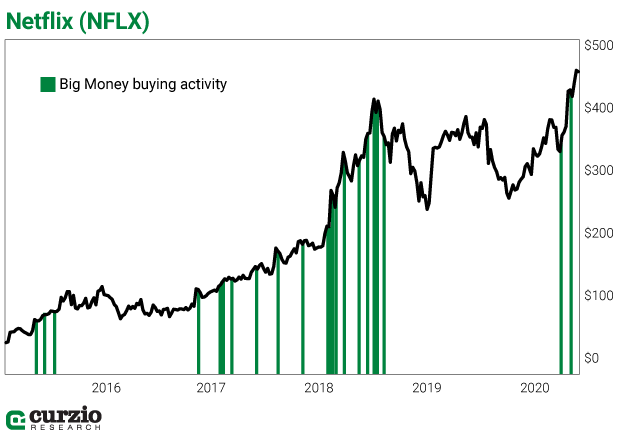

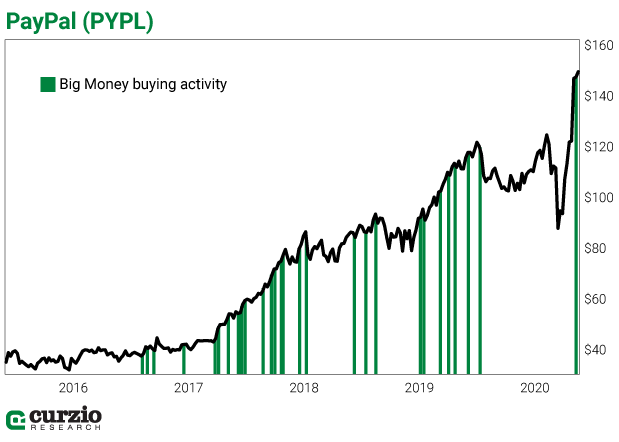

I’ve personally found dozens. And whether it’s the next Netflix (NFLX) or PayPal (PYPL)—full disclosure, I own both—the best stocks have three traits in common…

The best stocks have great technicals

Generally speaking, technical analysis uses price data and statistics to evaluate an investment. So when people use the word “technicals” to talk about stocks, it can mean a few different things.

As for the best stocks, the technical we’re looking for is easy to understand…

Find stocks that go up over time.

Think about it. Every big-time stock you’ve ever salivated over… chances are, its price kept going up. That’s because the best stocks make new highs year after year.

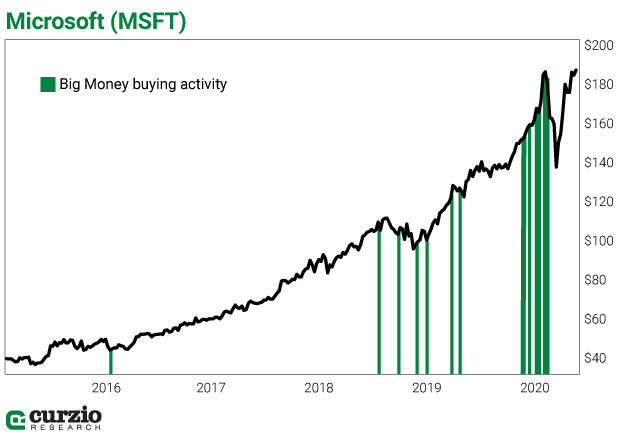

A classic example would be one of the best-performing stocks ever: Microsoft (MSFT).

I’ve held Microsoft for years… through bear markets and bull markets. And year after year, the company’s stock price has continued to rise.

But technicals like a history of rising prices are just one piece of the puzzle…

The best stocks have great fundamentals

Although technical analysis focuses on price movements and trends, stocks are more than just lines on a chart…

Fundamental analysis looks at the bigger picture when evaluating an investment. Things like economic factors and industry conditions can all come into play when determining a stock’s value or worth.

The good news is, the best stocks share two fundamental traits:

- Revenues grow each year.

- Earnings grow each year.

Finding stocks with consistent, year-over-year earnings and revenue growth won’t make you the next Warren Buffett… But it’ll help you start separating the good companies from the duds.

The best stocks not only rise in price year after year, they also grow earnings and revenue. Find a few outliers with incredible returns, and you can more than make up for your losers.

But whether you’re looking at technicals or fundamentals, the best stocks share a third characteristic… an underlying element that can have an influence on price, revenue, and earnings.

The best stocks have Big Money support

Big Money investors—money managers and firms with deep pockets—are constantly looking for amazing stocks to buy… the outliers.

And Big Money investors have the research budgets and technology to give them an advantage when it comes to spotting the best investments before anyone else. So when Big Money pours into a stock or market, it’s worth a close look.

At my firm, Mapsignals, we try to look for this activity.

When an investment checks all three boxes—great technicals, great fundamentals, and Big Money support (the most important)—it triggers a Big Money “buy” signal.

The charts below show the price of Microsoft, Netflix, and PayPal since roughly 2015.

The green bars are when this buy signal was triggered—the Big Money was buying shares at the same time the stocks showed solid technical and fundamental attributes.

(The more green you see, the more buying there was from Big Money investors at the time.)

You might not find these three traits in every winning stock, but the takeaway is this:

The best stocks out there look and act the same in just about any market conditions… That’s what makes them outliers. They have year-over-year increases in price, revenue, and earnings, and they’re often driven higher by waves of Big Money support.

If you want to make money investing, stop chasing the market… follow the Big Money and ride the waves instead.

Editor’s note: Last week, Frank released an updated COVID-19 special report to his Curzio Research Advisory subscribers. This exclusive report deep-dives into the winners and losers of the evolving COVID-19 crisis… and the best ways to prepare—and profit—in the New World Order economy.

If you’re not already a member, you can get immediate access to this report—along with a RISK-FREE trial of Curzio Research Advisory—for just $49… but only for a limited time.