Professor and meditation expert Jon Kabat-Zinn once said, “You can’t stop the waves, but you can learn to surf.”

And although he was talking about mindfulness and managing the day-to-day stress in our lives, his advice can also be applied to investing… especially in volatile markets like we’re seeing today.

Sometimes market waves send stocks lower, like in March. Other times, a wave of money surges into stocks and raises the market tide to overbought.

Right now, we’re witnessing a monster wave of buyers flooding into the market… but instead of chasing this wave, we’re better off preparing for the next one.

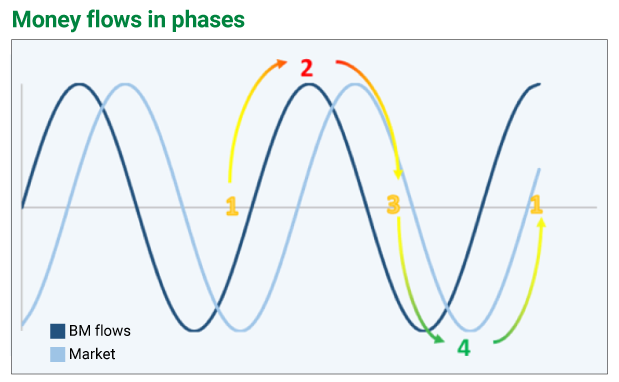

The chart below shows the four phases of Big Money market flows—the buying and selling cycle of Big Money players like large trading firms…

The phases are:

- Liftoff: Big Money buying is huge, and selling is nearly zero.

- Market peaks: Big Money buying slows and selling picks up.

- Fear begins: Big Money buying slows more and selling takes off.

- Peak fear: Big Money buying is nonexistent, and sellers are in control.

I first showed you this chart on March 30. Back then, we were in peak fear… The waves were stormy and troughing, and it was a great time to buy stocks.

Then on April 20, I told you how we were moving away from peak fear and back into phase one: liftoff…

Today, we’re still in phase one and buyers are still in control… but when the Big Money tide starts to crest, you need to hop off the wave before you—or your portfolio—wipe out.

Catching the next wave…

Great surfers and investors know how to be patient.

To catch a big wave, a surfer must first be ready and in position before the wave comes rolling through…

The best investors do the same.

And right now, a massive buying wave is lifting the market.

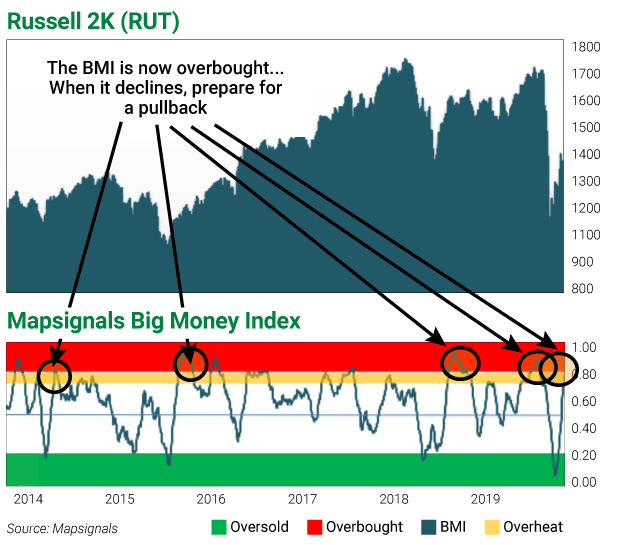

You can see what I mean in the chart of the Big Money Index (BMI) below. The BMI is a proprietary index that measures the buying volume in the Big Money players. (The Russell 2000 Index, the benchmark for 2000 small-cap stocks, is highly correlated to the BMI.)

The circles show overbought periods. Right now, we are very overbought, and the index is still rapidly rising. We need to be patient.

The last two times this happened—February 2019 and March 2016—stocks remained overbought for about two months.

Now, I don’t expect us to be overbought for that long… but we need to let the wave show us when it’s ready to crest.

Stocks can—and likely will—stay overbought for weeks… and just like no two ocean waves are the same, neither are waves in the market. History is a great guide, but we can’t count on things playing out like they did in 2016 or 2019. Especially with COVID-19 thrown into the mix.

Be prepared for an extended overbought period, and don’t waste your energy (or money) chasing waves.

Big Money buying in stocks is lofty and unsustainable right now, and we don’t know exactly when it will peter out… Until then, it’s best to sit and relax.

There will always be another wave.

Editor’s note: In recent weeks, Frank’s received hundreds of questions from worried readers about how to invest today… and for the year ahead. Yesterday, he sat down to address these questions… and share a strategy to help you ride this market’s waves. It’s a strategy that’s already earning subscribers gains as high as 500%-plus.

If you missed the Q&A, watch it here—and see how you can start using this strategy yourself right away.