It’s hard to overstate the importance of fracking.

Hydraulic fracturing—commonly known as “fracking”—is the revolutionary technology that drills horizontally through hydrocarbon-rich veins of shale, and then uses hydraulic pressure to fracture the dense rock. The fractures allow previously trapped oil and gas to flow and be collected.

It sounds technical… but the result has transformed America’s energy sector.

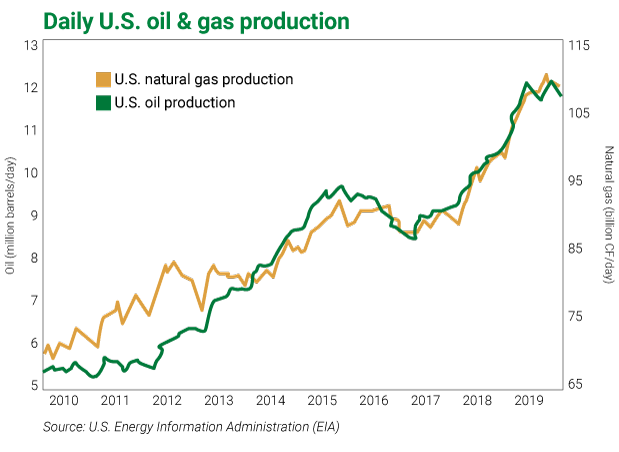

In the last decade, U.S. natural gas production—as measured in cubic feet (CF) instead of barrels—has soared 56%. And oil production has skyrocketed by 118%.

In an industry once dominated by the Middle East, the tide has shifted…

The United States is now the world’s No. 1 producer of oil and gas… ahead of Saudi Arabia, Russia, Iran, Venezuela, and every other major oil-producing nation.

America no longer pays high prices to foreign energy producers. Domestic energy production enriches America. It also creates tens of thousands of high-paying jobs throughout the oil & gas industry.

Picking an energy producer that will flourish in this environment can be tough. Fortunately, we have a few ways to take advantage of America’s energy abundance.

We can do well with companies that support energy exploration and production… benefit from cheaper feedstocks (the raw materials used in refinement)… or build the infrastructure needed to distribute vital gas supplies.

But first, let’s consider an important geopolitical factor that’s creating risk for the global oil industry while driving U.S. production…

American energy independence, global disruption

Over the past 50 years, the U.S. has spent trillions to protect the supply and distribution of Middle Eastern oil. Thanks to America’s newfound energy abundance, those days are over…

Last June, President Donald Trump told allies to protect their own oil tankers in the Persian Gulf. Then in October, the U.S. withdrew forces from the Syria-Turkey border. Today, about 45,000 U.S. troops remain in the Persian Gulf region in support roles… a number that will decrease in the coming years.

No country in Europe or Asia has an army capable of reestablishing order should a war break out in the Middle East. And only Japan and the U.K. have the naval capabilities to protect long-range oil shipments. What happens if a future war affects oil and gas production in the region?

If every country has to fend for its own energy needs, supply disruptions would wreak havoc on South Korea, China, and most of Europe. It would force the shutdown of entire industries… particularly energy-intensive manufacturing (chemicals, plastics, and possibly steel).

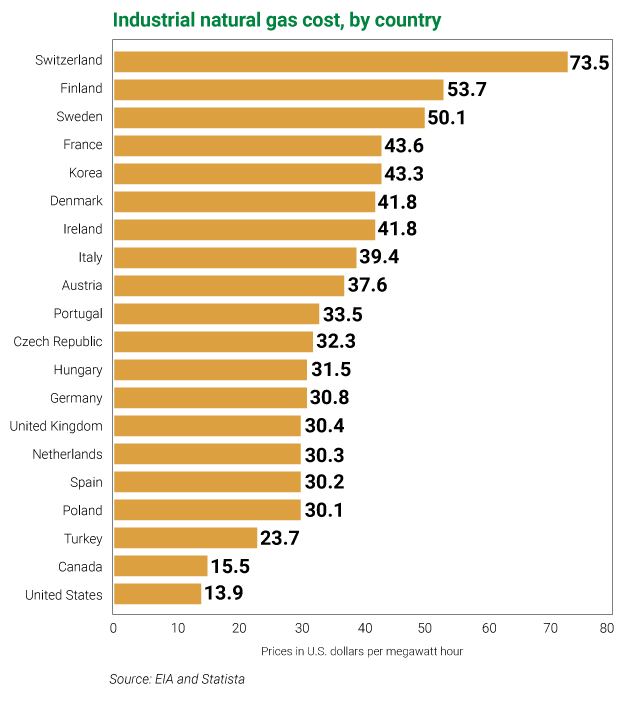

Heavy industry in Europe and Asia cannot risk being cut off from energy supplies.

If they build plants in America, they’ll likely never run out of energy… and they can buy gas at half the price of almost anywhere else.

Energy-intensive industries can save substantial production costs by building new capacity in America…. And they’re doing just that.

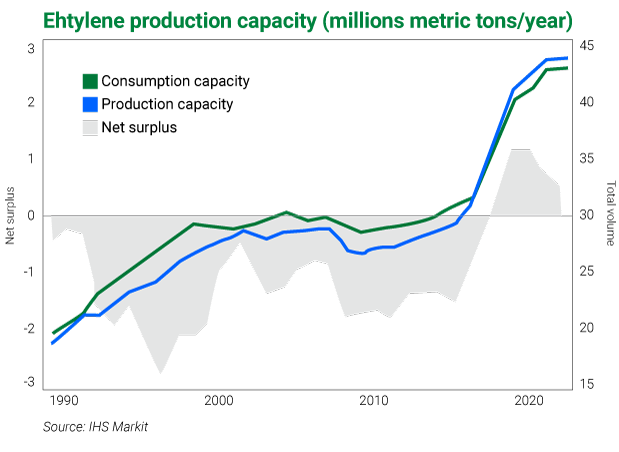

For example, cheap natural gas is attracting massive investment from the petrochemical industry. Natural gas and gas liquids contain ethane, a critical feedstock for ethylene and other chemicals. Cheap ethane has led to a construction boom in U.S. petrochemical plants.

Since 2014, companies from all over the world have built petrochemical facilities near major U.S. shale basins… Today, they’re expanding capacity. In total, 11 new facilities are being built or completed and more are on the drawing board.

Low-cost natural gas also led companies to build nitrogen fertilizer plants, including one in North Dakota’s Bakken basin—one of the largest U.S. deposits. Natural gas is a feedstock for nitrogen fertilizer, and close proximity allows the plants to utilize some of the excess gas that’s “flared” at shale deposits. (Flaring is a controlled burn of excess natural gas that occurs when a drill site can’t process or contain the excess.)

Unlike petroleum producers, natural gas producers can’t ship their products via rail when pipelines are at capacity—they must flare. It’s not an ideal solution, but there often isn’t much choice. So when increased production is inevitable, natural gas companies must adapt and build pipelines to capacity or risk losing money… That’s good news for infrastructure.

From landlines to pipelines

Infrastructure development company MasTec (MTZ) currently has a huge backlog of gas pipeline projects. And because of excess U.S. supply, oil & gas infrastructure projects will keep MasTec busy for years to come. But that’s not MTZ’s only focus…

MasTec’s other infrastructure specialty is getting busy again, too. Both government and private industries are building nationwide 5G wireless networks. And MasTec is actively building a 5G order backlog.

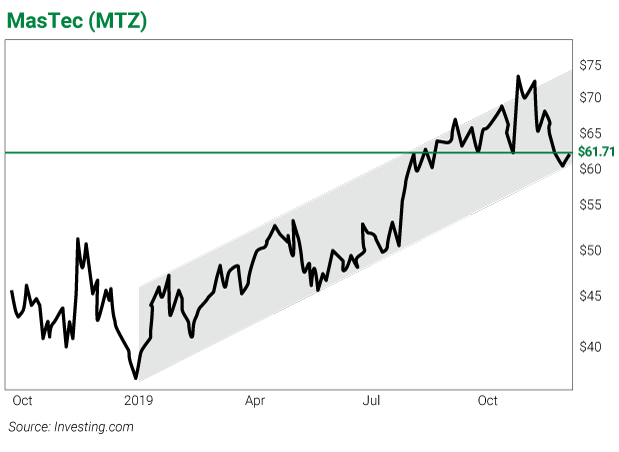

The company’s profits have grown at about 12% per year since 2014, and analysts expect that pace to continue for the foreseeable future. The stock is now trading at a forward price-to-earnings (P/E) ratio of about 11.0—less than the expected growth rate. That makes MasTec a bargain. Take a look…

After soaring above its trend earlier this fall, the stock has corrected. Then the stock traded down to the bottom of the channel and bounced off the trendline last week…

The “trend channel” above follows a 60% per year appreciation rate. This is roughly equivalent to MTZ’s appreciation since a February 2016 low. In the long-term, this kind of appreciation will not be sustained… but considering MTZ’s cheap growth-P/E comparison it has room to run higher.

MasTec has a guaranteed backlog of gas pipelines and 5G infrastructure builds. And as more companies turn to the U.S. for their energy needs, these backlogs will only get larger.

This price dip is the market is giving you a chance to get on board a juggernaut growth stock at a bargain price.

All the best,

![[signature]](https://www.curzioresearch.com/wp-content/uploads/2019/09/SKoomar-sig-1.png)

Steve Koomar

Editor, Vigilante Investor