Editor’s note: Last week, new Curzio analyst Genia Turanova shared a three-point checklist for income investors, part of her ongoing series on generating income in a low-rate environment… and protecting your portfolio in an aging bull market.

Today, she shares her simple sleep-at-night investment strategy for the market’s scariest month… and beyond.

If you’re like me and other seasoned investors, you’re glad October is almost over…

That’s because, historically, October has been the most volatile month in the market. The reason isn’t clear, but there’s plenty of evidence…

Just look at 2018. Fourth quarter volatility triggered a selloff that saw the market decline almost 14%. That selloff started in earnest in October, and the market lost 6.9% in that month alone.

On October 19, 1987—”Black Monday”—the Dow suffered a tremendous 22.61% loss in a single day. It was the largest one-day drop of the Dow Jones Industrial Average, ever. And then there’s the big one… “Black Tuesday”—October 24, 1929—marked the beginning of a five-day market crash and the start of the Great Depression.

Now, these two record-breaking, historic crashes aren’t likely to be repeated, thanks to a system of so-called “circuit breakers”—which automatically halts trading if the market drops more than a certain amount in a single day. But the month has a history of high volatility that can trigger selloffs and crashes in what feels like no time at all.

Personally, I’m glad the month is ending… but I wasn’t worried.

That’s because I follow three simple rules you can use to protect your portfolio through October and beyond…

1. Do nothing

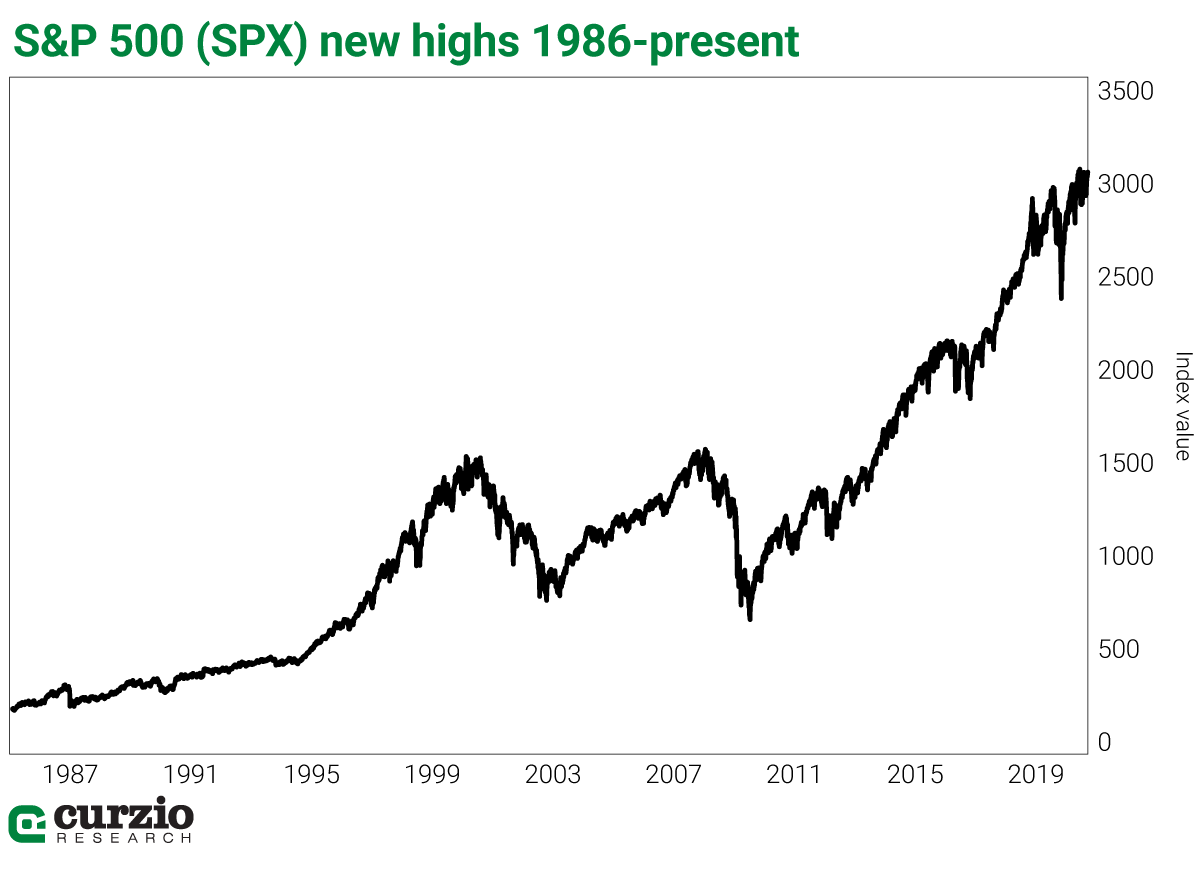

Based on history, the market has never moved into a bear market territory directly after rallying to a fresh high. Take a look…

According to Bloomberg, there were 16 times when S&P 500 index declined 5% or more within two weeks of a multi-year high. Out of these 16 times, 10 saw the index rebound and move higher. The remaining six times, the market fell into correction—but recovered later. There hasn’t been a single time the market dropped into a bear market selloff (a decline of 20% or more) within a few months of a fresh high.

Let me say this again: New market highs are a positive indicator. Over the past 90 years, no bear market has begun right after new highs.

Today, the market’s current year-to-date gains remain intact, and stocks continue to set records. A new record close will be a very positive indicator.

Seeing a new market high, therefore, should make you feel less anxious about the possibility of an immediate selloff.

And here’s another history lesson: Every selloff has been followed, sooner or later, by a recovery or a rally. As you can see from the chart above, the market—despite all the troubles—has stayed on a long-term uptrend over the years. Further, bull markets tend to last much longer than bear markets.

Staying in the market and “doing nothing” is one of the best long-term strategies you can execute.

While concerns about volatility and corrections might be legitimate, the stock market still remains the best long-term mechanism for growing wealth.

2. Stay diversified

A well-diversified portfolio—one that has holdings from different sectors and, possibly, a diverse number of countries—is less risky than a portfolio concentrated around a few large positions.

(In a future update, I’ll show you why diversification works—and when it doesn’t.)

3. It’s OK to hold cash

Some investors might want to increase the size of their cash position when the market is volatile. As long as they’re mindful of the need to diversify, there’s nothing wrong with selling a winning position or two, taking a loss on the weakest holding, or reducing the size of the riskiest or worst-performing positions. When times are tough, cash is king.

Of course, some investors have enough time to wait out a selloff. But for some, time is critical. Everyone’s personal situation is different, and every investor must decide by herself how much cash she needs, whether to take a gain, or how much of a reduction to execute.

It’s also important to remember that cash, while the safest option available, carries literally no appreciation potential. Cash carries no risk, and promises no return. But increasing the size of your cash position is a legitimate safety move which, most importantly, lets you keep some of your powder dry.

I also suggest keeping a list of your target positions handy. If the market or your targets go on sale, start deploying your cash to buy new investments. As this bull market ages, we’ll likely have a few more selloffs… even if the market remains on the uptrend. A higher cash position allows you to use these selloffs to your advantage.

October can be an unpredictable time for the market… Uncertainty is high, and some of the worst market crashes in history have happened during the month. But history also shows when the market reaches new highs, there’s very little chance a bear market will immediately follow.

Those are good odds, but we can do one better. By following these three rules, you’ll be prepared for the good times and the bad. By staying invested, diversifying your portfolio, and holding some cash, your portfolio will be prepared for bull markets, bear markets, and the corrections in between.

Next time, I’ll discuss even more ways to protect your portfolio as this bull market ages. Stay tuned…

| Genia Turanova Analyst, Curzio Research |