I’ve taken some heat over the past six months.

Some of my followers thought my bearish call on Apple was crazy. After all, the company was the largest in the U.S. based on market cap (which was over $1 trillion)… It had over $100 billion in net cash on its balance sheet… and its products are loved by the masses.

My call on Apple was not personal.

It’s a great company. I personally own an iPhone 8… three iPads (for my wife and kids)… and broadcast my Wall Street Unplugged podcast to tens of thousands of people every month through iTunes.

But just because a company has great products, it doesn’t mean you should buy the stock at just any price. Snickers is a great candy bar… but most people wouldn’t buy it if stores started selling them for $5 each.

As someone who has been at this game for over 25 years… this is the biggest mistake I see investors make. They love a product so much they believe the stock is a buy at any price.

Apple generates most of its sales from iPhones. Sure, the Apple Watch and HomePod are cool… and Apple generates billions from its cloud services and billions more from its Mac computers. The company is also making a big play into streaming.

Yet, at the end of the day, Apple is an iPhone company. That product accounts for more than 70% of total sales. And iPhone sales are slowing dramatically… a trend that’s expected to last at least through 2019.

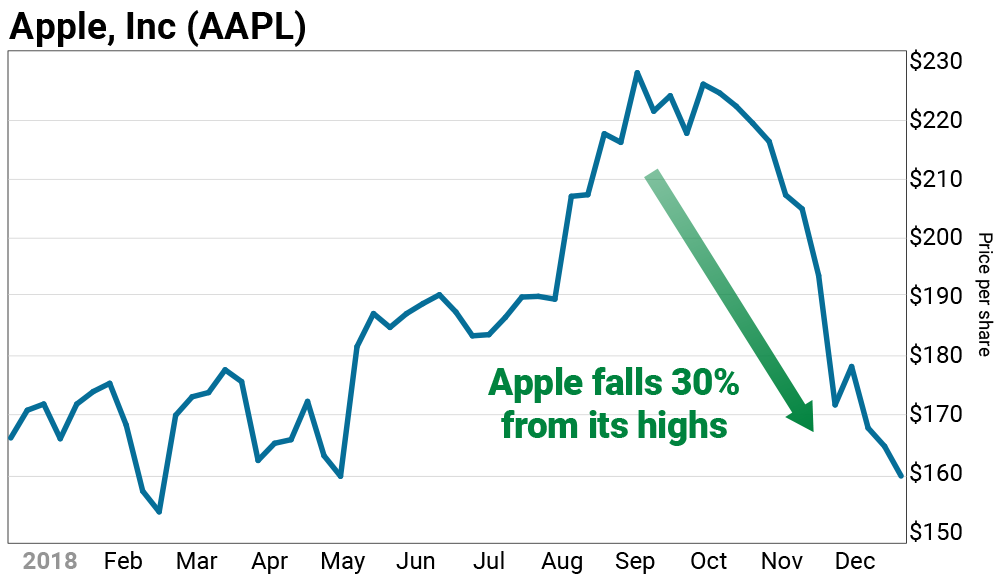

This is just one reason the tech giant has gotten crushed. But there are other headwinds that helped push Apple down more than 30% from its highs since September.

If you’re thinking of buying Apple on this selloff… you may want to wait until these key factors change. Otherwise the stock will likely fall even further in the first half of 2019.

Apple was trading at an all-time high in September.

But several of its parts makers warned that smartphone sales were slowing. This sentiment was confirmed in November… after CEO Tim Cook announced it would no longer provide the number of iPhones (units) it sells every quarter.

To put this in perspective, that’s like a pizza company telling its investors it’ll no longer report how many pizzas it sells.

As expected, the stock started to fall. This is normal for any company that lowers its growth expectations. But this was just one of several problems impacting the tech giant.

Apple also generates 20% of sales from China. A recent ruling by a Chinese intellectual property (IP) court found Apple violated two of Qualcomm’s patents. The court banned the sale of several iPhone models in the country.

Throw in the overall downturn we’re seeing in the markets… and Apple’s stock has been freefalling. It’s now down more than 30% off its highs, losing more than $300 billion of its market cap.

Following the recent selloff, Apple is starting to look like a buy.

It has over $100 billion in net cash on its balance sheet, it’s trading at a discount to the markets, and it plans on buying $100 billion of its stock back over the next 12 months.

Plus, the more than 40 sell-side analysts covering the stock lowered their estimates on revenue, earnings, and iPhone unit sales. With estimates being lowered… this means the company should have an easier time (since expectations are lower) beating estimates in future quarters.

I disagree with this sentiment.

| Recommended Link | ||

| ||

| – |

I mentioned earlier how estimates have come down. This includes sales estimates, earnings estimates, and even iPhone unit estimates. Yet, despite the collapse in the stock… not one of the more than 40 analysts covering the stock has a sell rating.

Plus, the average target price from these analysts is $220. That’s more than 30% higher than the current price. That doesn’t sound like a stock with “low expectations.”

More importantly…

Apple is only projected to grow sales by 5% annually over the next two years. EBITDA (earnings before interest, taxes, depreciation, amortization) is expected to grow by just 3% annually over the same timeframe.

If these projections hold true… Apple will be growing at a much slower pace than the overall market. And based on the recent drop-off in iPhone unit sales… these numbers may prove to be optimistic.

Apple is expected to grow earnings per share at about the same pace as the markets. But most of this growth will come directly from buybacks. The company already spent around $31 billion and $34 billion on share buybacks in 2016 and 2017, respectively. It’s ballooned up to over $70 billion so far in 2018.

As an investor, I’d rather see earnings growth come from stronger demand for its products… and less from manipulation—even if it’s legal.

But expectations are still high when it comes to overall optimism from analysts. There are no sell ratings on the stock… and they have an average target that’s more than 30% higher than the current price.

If you’re thinking of buying Apple here… I suggest waiting at least until the next earnings report.

If the company reports strong sales and earnings guidance… you may miss the first 5 – 7% move higher. But at least you’ll have a solid base to build your position on.

Plus, you’ll have more evidence that Apple has finally bottomed.

| |

| Frank Curzio with Daniel Creech | |

Note: It’s critical for companies to have a growth component… Growth drives prices higher. And I’ve been pounding the table on one hated sector that will see explosive growth over the next few years. With prices falling, there’s never been a better time to gain exposure to this sector. And to scoop up one dirt-cheap name that will grow faster than its peers… Read my full report right here.