The market is celebrating Christmas early this year.

Stocks have rallied in November as investors cheer a slew of positive developments: The Israel-Hamas war remains contained… oil prices are down 20% from their September peak… and the Fed has paused its interest rate hikes.

But it’s too early to celebrate…

Today, I’ll explain why investors’ optimism is misplaced… why we need to be prepared for a market reversal… and how to capitalize when it happens.

Let’s start with why, contrary to popular belief, the Fed’s tightening policies are far from over…

The Fed isn’t done fighting inflation

As you surely know, the Fed has been battling inflation since March 2022. In total, the central bank has raised rates 11 times (from near-zero to the current 5.25–5.5%) to slow the economy.

These rate hikes have brought inflation down from 9.1% (at its peak in June 2022) to 3.2% today.

The drop is certainly good news… but there’s still a long way to go before inflation gets back to the Fed’s 2% target.

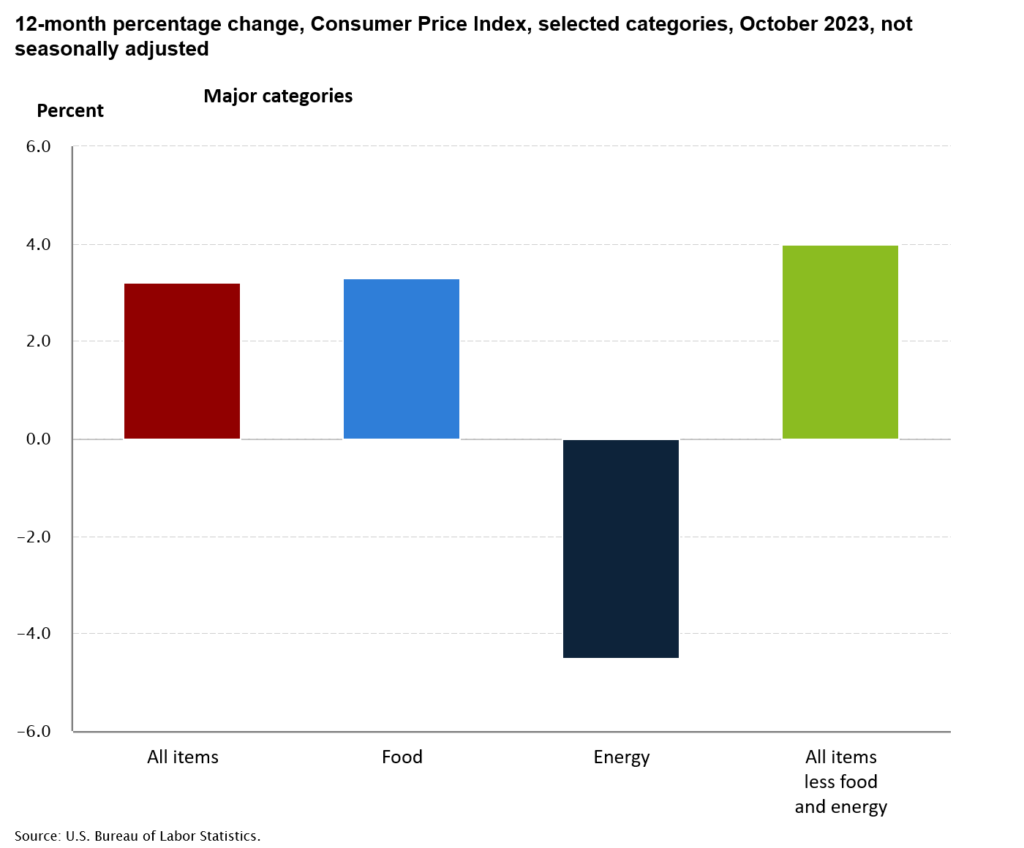

As you can see below, the latest Consumer Price Index (CPI) data shows prices rose 3.2% year over year in October. In other words, inflation is 1.2% above the Fed’s target.

And the situation is even worse if you look at core CPI, which excludes food and energy prices. By this metric, inflation is running at 4% right now.

Put simply, inflation isn’t dead yet… not even close.

At its November meeting, the Fed said it has only made “limited progress in bringing down inflation in core services excluding housing.”

And it’s not just the Fed that thinks inflation has room to run. A recent survey by the University of Michigan shows consumers expect annual inflation to reach 4.5%. That’s a 0.3% jump vs. a month ago… and the highest reading since April 2023. In fact, expectations for longer-term (5–10 year) inflation rose from 3.0% last month to 3.2% this month—the highest reading since 2011!

(It’s worth noting that consumers’ inflation expectations directly impact actual inflation. A 1% rise in expectations typically translates to a 1% rise in actual inflation, all else equal.)

As long as inflation remains well above 2%, it’s unlikely we’ll see the Fed start cutting rates.

And that’s a big problem… because the market expects rate cuts as early as the first half of 2024. Meanwhile, consumers are expecting inflation to come back—which means the Fed’s job isn’t finished.

And that brings me to my next point: Investors are way too optimistic. In fact, one important market index is at extreme levels right now…

What the ‘fear gauge’ is telling us

The simplest way to measure investors’ expectations for market-wide volatility is the CBOE Volatility Index (VIX).

When the VIX is high (above historical averages), it means investors are fearful and approaching the market with caution. When it’s low, investors are bullish and looking to take on more risk.

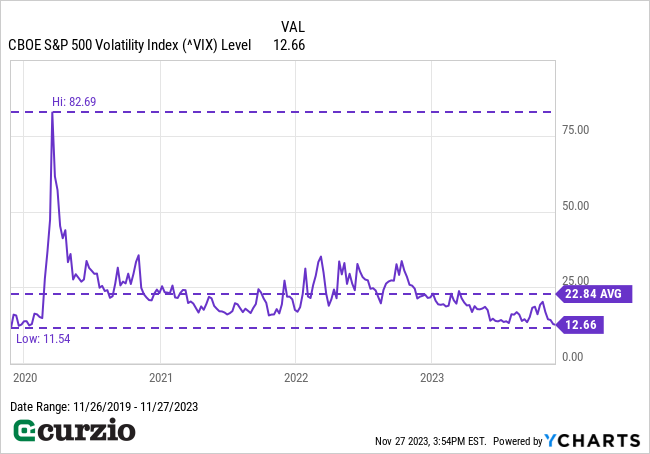

Today, investors are definitely bullish… and feeling pretty complacent about risk. In fact, the VIX is sitting at levels not seen since before COVID. As you can see below, the VIX is just 13%—well below its four-year average of 22.8%.

It’s important to note that the VIX is often a contrarian indicator for stocks. When it’s low, it means the market is priced to perfection… and bad news could send stocks plummeting. And when it’s high, it’s usually a sign the market is bottoming and set to rally.

You can see the contrarian action in the chart above: As the VIX spiked in early 2020, it kicked off a multi-year bull market. And the VIX fell to multi-month lows just as the market was peaking in late 2021.

Put simply, “implied volatility” for the S&P 500 (how volatile traders/investors are expecting the market to be going forward) is historically low.

In addition to being a contrarian indicator, this super-low implied volatility comes with a fortunate side effect…

How to profit as investors’ optimism fades

The big decline in the VIX means that market insurance (in the form of put options) is as cheap as it’s been in many years.

You see, implied volatility is a key factor in determining options prices. So if the VIX is low, it means options are cheap.

As I mentioned above, the VIX is currently sitting near a four-year low. That means you can buy insurance (in the form of put options) for prices we haven’t seen since early 2020.

Thanks to these low prices, put buyers stand to score big profits if the market declines even slightly from current levels…

For example, Moneyflow Trader subscribers recently locked in a gain of nearly 80% in just over a week… by simply buying put options to bet against the S&P 500. And following the recent rally, there’s more downside potential ahead, which is why we rolled our original trade into a new option position. (Join us today to get the trade.)

The bottom line: The current rally is NOT the start of a new bull market. With the Fed’s tightening policies poised to continue, the upside will be short-lived. The smart move is to take advantage of historically low prices for put options, which will allow you to score big gains when stocks fall.