Just over a week ago, the world watched in horror as Hamas—a Palestinian militant group—launched a series of surprise attacks on Israel… killing hundreds in a single day and kidnapping countless hostages.

Israel responded by launching missiles at the Hamas-controlled Gaza Strip.

Since then, the conflict has escalated into a full-blown war… with casualties in the thousands.

U.S. diplomats have been traveling all over the Middle East in a push to contain the war. But so far, the geopolitical situation keeps deteriorating.

As I explained last week, the war creates a new tailwind for oil. Any geopolitical conflict—especially in the oil-rich Middle East—raises concerns about global oil supplies. Not surprisingly, oil prices are up more than 6% since October 7 (the day of Hamas’ surprise attack).

But oil isn’t the only asset poised to rise as the conflict unfolds…

Precious metals are also surging.

Over the past week, gold prices are up 4.9%… while silver has jumped 5%.

Today, I’ll explain why gold has much further to rise… especially if the war in the Middle East isn’t contained. I’ll also share the easiest way to play gold’s upside.

Why the war has investors running to precious metals

The Israel-Hamas war creates massive uncertainty for the global economy.

Put simply, we don’t know how long the conflict will last… which countries will get involved… how the conflict will affect global trade… or what the end result will ultimately be.

So it makes sense that investors would flock to gold, which has served as a safe haven asset throughout history.

Gold hasn’t just held its value during times of turmoil. History shows it’s one of the few assets that actually benefits from uncertainty.

For example, during the 1970s, gold outperformed every other major asset class by a huge margin. As you probably know, the world was struggling with high inflation, economic stagnation, and the effects of another conflict in the Middle East.

From the start of 1970 through the end of 1979, gold prices skyrocketed by more than 1,200%. By comparison, the S&P 500 gained less than 80% during the decade.

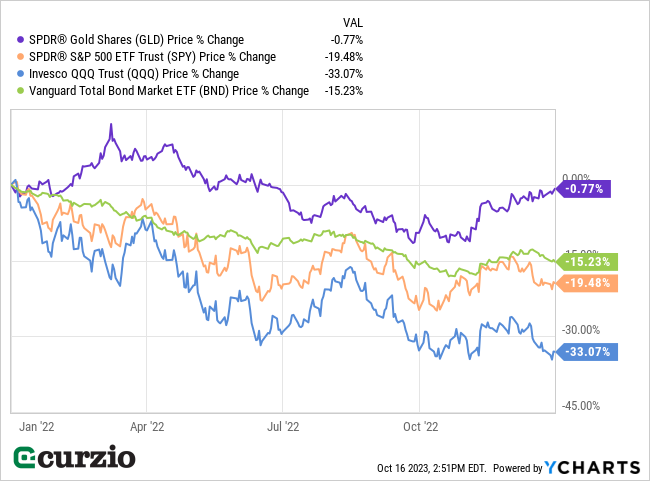

More recently, gold was the only major asset class to avoid a double-digit drop during the 2022 bear market (as you can see below).

Put simply, any market uncertainty is typically bullish for gold.

And the worsening geopolitical situation is adding to another critical factor—inflation…

Inflation is worsening… and that’s good for gold

Oil prices are a key contributor to inflation. When oil prices rise, it puts upward pressure on the price of every product that needs to be transported to consumers (basically everything).

During the first half of this year, oil prices were sitting nearly 50% below their $130-per-barrel highs set back in March 2022 (following Russia’s invasion of Ukraine). This helped bring inflation down from its mid-2022 highs.

But today, oil is up about 30% from its summer lows. And, as I mentioned above, the conflict in the Middle East means oil prices are likely to rise from here.

Put simply, the ongoing rally in oil threatens to trigger a new surge in inflation.

That will give an extra boost to inflation-resistant assets like gold.

As you probably know already, gold has a long track record of holding its value as currencies—including the U.S. dollar—lose their purchasing power over time due to inflation. That’s why gold prices tend to get a big boost during inflationary times.

In fact, the last time we saw inflation this high was during the 1970s. As I mentioned above, gold soared more than 12-fold for the decade.

Today’s conditions are remarkably similar… and set the stage for another big rally in gold.

How to profit from the gold’s upside

To profit from the coming uptrend, I like the SPDR Gold Shares ETF (GLD). This fund holds gold bullion as its sole asset.

In short, GLD gives us an easy way to get exposure to gold… without the hassle (and costs) of buying, insuring, and storing the physical metal.

Best of all, GLD closely tracks the price of gold… which makes it a great tool for profiting as growing uncertainty sends gold soaring over the coming months.