We’re more than halfway through 2023… And investors seem to have left the bear market of 2022 far behind—with stocks up 19% year to date.

Given the strength of the market, you’d be forgiven for thinking stocks have been outperforming all other assets… or that “safe haven” assets like precious metals have been stagnating during the rally.

But that’s not the case…

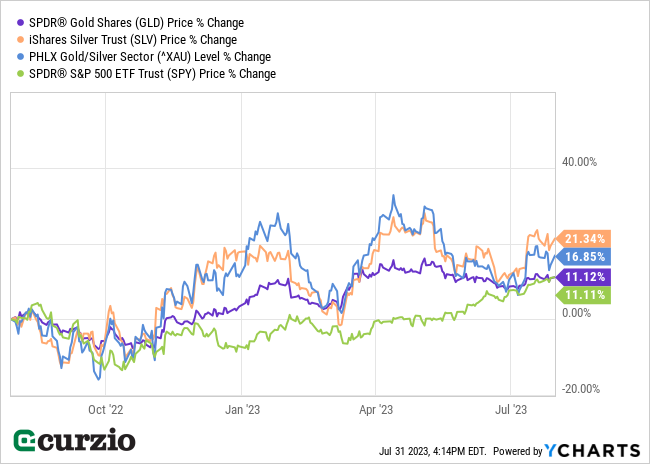

As you can see from the chart below, gold—represented by SPDR Gold Shares ETF (GLD)—has bested the performance of the S&P 500 over the past 12 months.

Meanwhile, silver—represented by the iShares Silver Trust (SLV)—has nearly doubled the market’s performance (SLV is up 21.3% vs. an 11.1% gain for the S&P 500). And the leading index of the precious metals, the Philadelphia Gold and Silver Index (XAU), is up 16.8% over the same time frame.

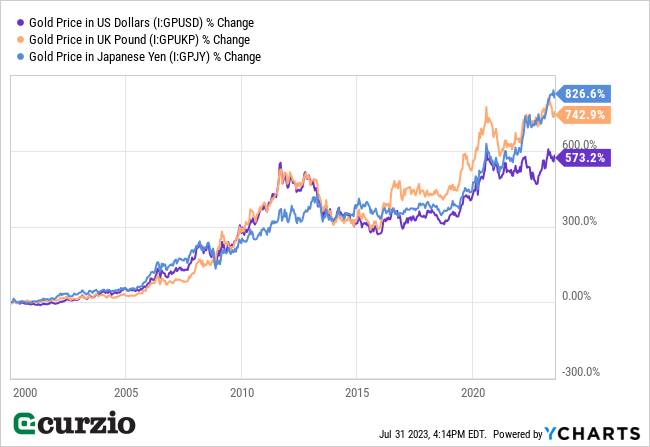

In fact, gold is currently in a multi-year bull market, as you can see below.

In short, this bull market in gold is a result of the easy money policies of central banks around the world. Their actions have effectively debased the U.S. dollar and other currencies.

Keep in mind, the Federal Reserve’s loose monetary policy—often called “money printing”—pumps extra liquidity into the economy. As a result, there’s too much money in the system… relative to the value of goods, services, and financial assets.

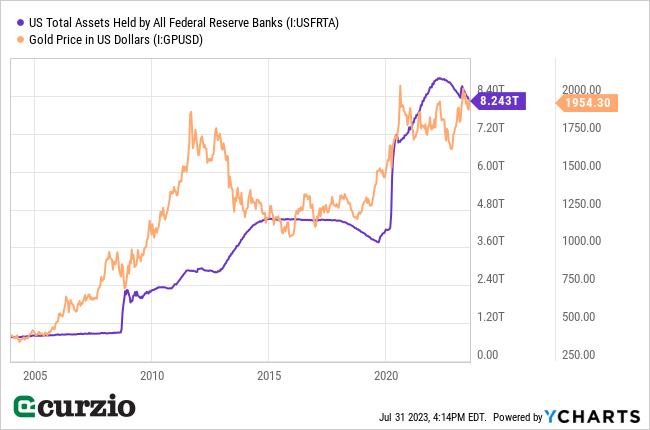

So it’s no coincidence that the current leg of gold’s bull market started with the Federal Reserve’s COVID-related balance sheet expansion (the blue line on the chart below).

On the chart, you’ll also see that the Fed never shrinks its balance sheet (at least, not to any significant degree) after it pushes more money into the economy.

Put simply, the Fed has a long history of devaluing the U.S. dollar.

It’s the same process that’s driving the next stage in the gold bull market.

You see, as the dollar’s value declines, gold becomes more attractive to investors who want to preserve the purchasing power of their savings.

In short, the bull market in precious metals has a lot more room to run… and every investor should allocate a portion of their portfolio to this asset class.

And there are several ways to get exposure…

How to ride the upside in precious metals

As I pointed out last week, the easiest way to invest in gold is via the metal itself.

The SPDR Gold Shares ETF (GLD) is a good proxy for owning physical gold. This fund is designed to move up and down with the price of gold. And you don’t have to worry about things like storage or insurance that come along with owning physical gold.

However, while GLD gives you exposure to gold, its returns are designed to track the returns of the metal. In other words, it won’t give you any “extra” upside.

Fortunately, there are a few ways to increase your leverage to the precious metals uptrend… without taking on much extra risk.

One way to do that is with silver, gold’s “little brother.”

Like gold, silver is a safe haven asset. But it has a few qualities that set it apart from the yellow metal. For one, its price tends to be lower… and for another, silver benefits from industrial demand (not just investment demand).

It’s used in photography, electronics, and solar panels. The industrial uses change as technology develops (we use much less silver in photography today than we did 50 years ago… while the use in solar panels has grown exponentially)… and can ebb and flow with the economy, too.

This feature makes silver approximately 1.5 times more volatile than gold, according to the London Gold Exchange. That means when gold rises, silver should rise by about 1.5x as much.

In fact, you can see this leverage in the performance charts I shared above. Silver’s 21% gain over the past year is nearly double gold’s performance.

Put simply, silver should outperform gold when precious metals are in a bull market.

And the iShares Silver Trust ETF (SLV) is an easy way to get direct exposure to silver. This fund owns silver bullion as its main asset (it also owns some cash)… Its price closely tracks the price of silver… And, like GLD, it’s a convenient way to buy precious metals while avoiding the headaches of owning the physical asset.

And there’s one more investment option I need to mention…

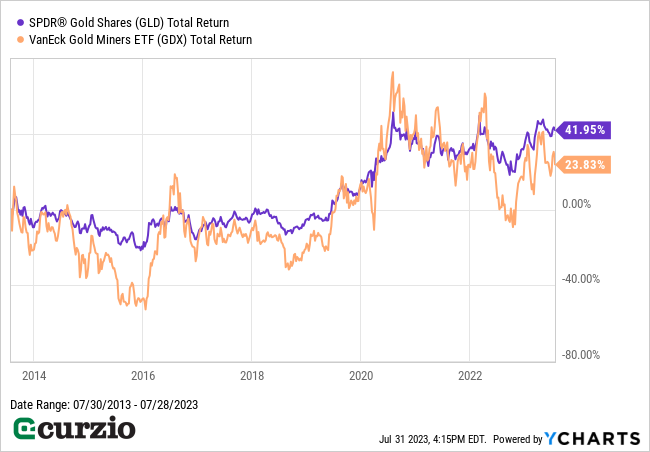

While gold prices are up more than 40% over the past decade, gold miners—represented by the VanEck Gold Miners ETF (GDX)—are up just 24% (as you can see below).

There’s a good reason for this underperformance…

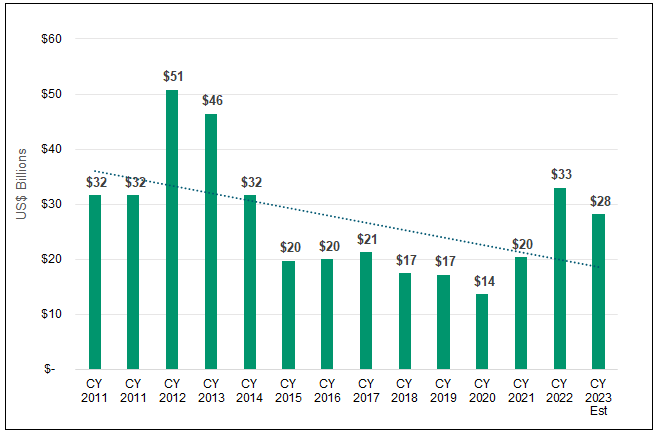

Back in 2012–2013, miners overspent on building new mines (following a big runup in the price of gold). After this overexpansion, they had to slash expenses over the next few years, leading to lower output and stagnating profits.

But today, thanks to the rising price of gold, we’re finally seeing miners increasing capital spending (new gold mines) once again. This will lead to higher production growth, greater profits, and rising share prices.

Gold miners’ capital spending in $Billions, 2011-2023

Meanwhile, gold miners—after a decade of underperforming the metal—are selling at bargain prices. Collectively, these stocks are trading around 17.7 times (17.7x) next year’s profits… vs. 21x for the S&P 500.

Put simply, GDX gives investors the opportunity to scoop up leveraged gold investments on the cheap as the precious metal bull market unfolds… and miners’ profits soar.

Conclusion

Precious metals are set to keep thriving. And there are several ways to profit…

For one-to-one price tracking with minimal risk and low volatility, consider investing directly in gold via the SPDR Gold Shares Trust (GLD). For slightly higher gains, I recommend buying silver via the iShares Silver Trust (SLV). And for maximum leverage to the bull market in precious metals, you can buy a basket of mining stocks instantly by purchasing the VanEck Gold Miners ETF (GDX).