Three years ago, a weird thing happened in the energy market…

The price of oil fell below zero.

No, you couldn’t pull up at your local gas station and be paid for filling up your car.

But on April 20, 2020, the price of oil closed at negative levels for the first time ever.

The simple explanation goes like this: Traders who owned oil futures expiring in May were willing to pay someone—anyone—to take the oil off their hands. At its worst point, oil hit -$37.63 per barrel… which shows how dire the situation had become.

In short, oil prices plunged due to a handful of unusual events. The biggest was obviously COVID, which resulted in a global economic shock that crushed oil demand. As oil supply piled up, the market quickly ran out of places to put it… sending storage costs soaring.

But that’s not the full story.

Today, I’ll reveal another reason for the insane situation the oil sector went through three years ago. It’s something every investor who owns energy stocks must understand… Plus, I’ll show you why energy, a sector that’s been left for dead this year, is a fantastic bet right now (and two stocks to take advantage).

Why oil prices go to extremes

The price of oil—just like in any other commodity—is determined by a constant battle between supply and demand.

When supply exceeds demand, prices drop… and vice versa (excessive demand leads to higher prices).

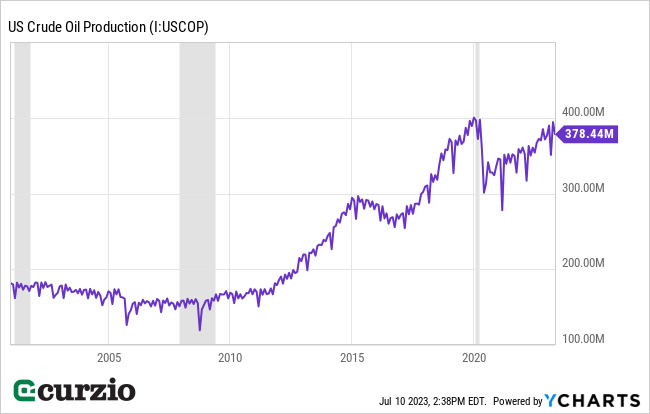

Heading into 2020, the oil market was oversupplied. As you can see below, U.S. oil production was at record levels (running at a rate just under 400 million barrels per month).

For most commodities, a drop in demand triggers a corresponding drop in production/supply—and prices quickly find their equilibrium.

But in the energy markets, the balancing process is more complicated.

For one, it’s often not feasible for oil companies to shut down production (it can damage the wells permanently—and take them out of consideration in the future). So they tend to keep pumping long after it’s economical (based on the selling price).

Plus, the cartel-like structure of major producers (OPEC+) means price wars can have devastating long-term effects. That’s what happened in 2020—when Saudi Arabia and Russia, two of the world’s biggest oil producers, failed to honor the terms of their production cut deals and started a price war.

By April 2020, these factors led to record volumes of crude oil flowing into the market… even as oil demand collapsed.

And while oil’s plunge into negative territory was an “extreme” result, it’s not entirely abnormal…

The simple fact is that oil prices often go to extremes—both up and down.

But these extreme prices rarely last for long. That’s because the laws of supply and demand—even with the oil market complications mentioned above—still work.

Below, you can see how the boom-and-bust cycle has played out since 2000… with plenty of wild swings and corrections in the price of oil.

And there’s another critical factor you can see above: Oil prices inevitably decline in recessions (the gray areas on the chart).

Put simply, the oil market has already gone through the “bust” portion of the cycle… which creates a big opportunity for investors.

Oil prices have likely bottomed… and that’s great for oil stocks

If you take another look at the chart above, you’ll see that oil prices are down more than 40% from their 2022 highs.

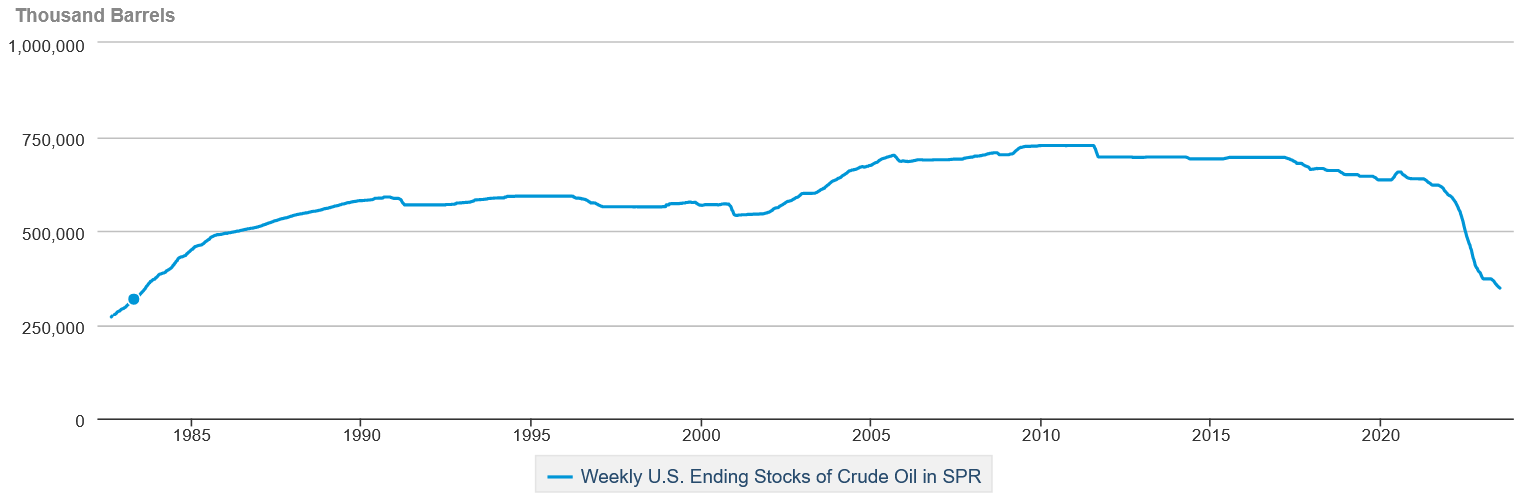

There are two reasons for the sharp price declines: Near-record U.S. production (up about 4% since the start of the year)… coupled with massive oil releases from the strategic petroleum reserve (SPR)—which is now sitting at its lowest levels in 40 years.

Crude oil in SPR

Together, these two factors have boosted the available supply of oil… and crushed prices.

But at least one of these factors is now reversing… as the Biden Administration starts refilling the country’s emergency oil reserve instead of drawing from it.

Put simply, the price of oil has likely bottomed.

And if the U.S. economy manages to avoid a recession—a surprisingly possible outcome, considering the latest jobs data—oil prices could soar from current levels.

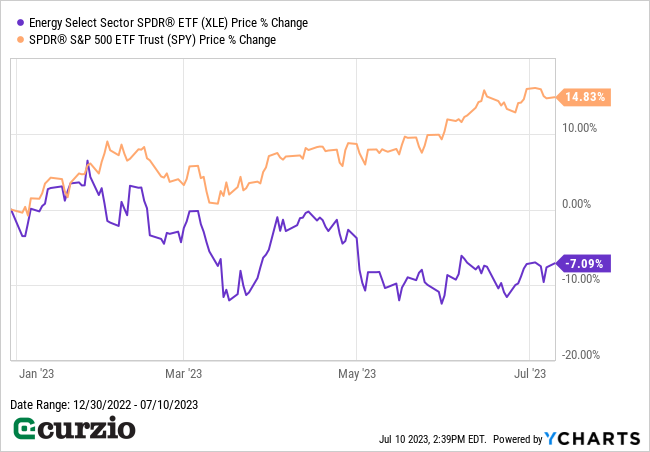

Meanwhile, energy stocks have underperformed the market significantly so far in 2023. Below, you can see the Energy Select Sector SPDR ETF (XLE) is down more than 7% since the start of the year… while the S&P 500 has surged nearly 15%.

The recent underperformance has pushed energy stocks to bargain levels.

For example, Exxon Mobil (XOM) trades at less than 11 times (11x) its forward earnings estimates… while Chevron (CVX) currently sits at just 11.4x earnings.

To put these valuations in perspective, the S&P 500 currently trades a forward price-to-earnings (P/E) ratio of 20.1x.

In short, oil giants like XOM and CVX (the two biggest positions in XLE) are trading at nearly half the market’s valuation.

And their cheap valuations make energy stocks a solid bet, even if the U.S. goes into a recession.

Conclusion

Like it or not, oil is irreplaceable in today’s economy. And energy stocks, including giants like Exxon Mobil and Chevron, are an absolute steal at current prices. Even if the U.S. enters a recession over the next year, these stocks offer a favorable risk/return scenario—with huge upside if the economy holds up.