In 1943, U.S. Secretary of the Interior Harold Ickes penned an article with a dire warning:

“We’re running out of oil!”

While the U.S. didn’t enter World War II until the end of 1941, it had been the sole supplier of the Allies’ oil throughout the war… nearly exhausting its reserves in the process.

Running out of oil would present a major threat to the country. Not only is the commodity a determining factor of global dominance, WWII proved beyond a doubt its importance during wartime. How would tanks run or jets fly without it?

In his letter, Ickes warned, “If there should be a World War III, it would have to be fought with someone else’s petroleum, because the United States wouldn’t have it.”

In 1944, Ickes was the first to propose stockpiling oil in case of emergency.

Maybe it was because the war was drawing to a close… but the U.S. didn’t move on the idea with any urgency.

It wasn’t until three decades later—during the oil embargo of 1973–1974—that the government recognized the need for a large oil emergency stockpile to reduce supply disruptions.

In 1975, the idea finally became a reality, with President Ford signing the Energy Policy and Conservation Act… thereby creating the Strategic Petroleum Reserve (SPR).

Today, the SPR is the world’s largest supply of emergency crude oil.

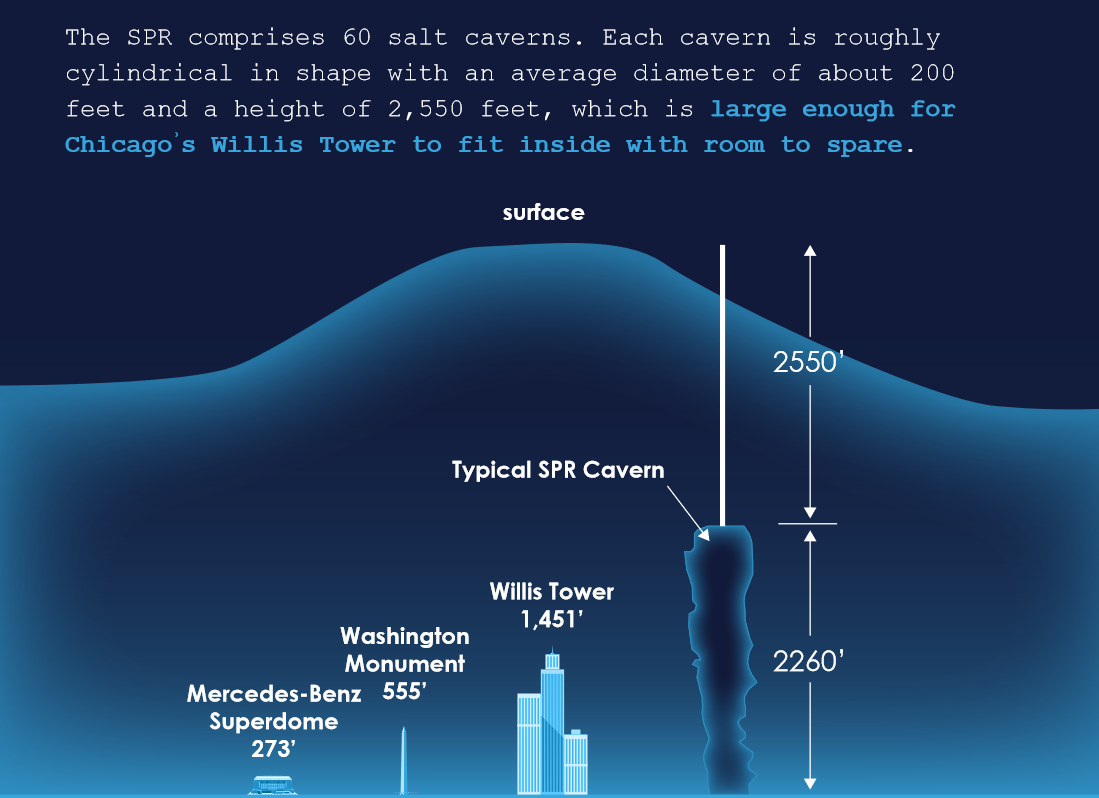

These federally owned oil stocks are stored in underground salt caverns at four sites along the coastline of the Gulf of Mexico—chosen thanks to its inexpensive, secure location close to many U.S. refineries and distribution points linking to pipelines, tankers, and barges.

The salt caverns of the SPR

The SPR can hold up to 727 million barrels… and oil can be withdrawn three ways: a full drawdown, a limited drawdown of up to 30 million barrels, or a small drawdown for a test sale or exchange.

A full or limited drawdown can only be authorized by a sitting president—and 13 days after the decision, the Energy Department can withdraw up to 4.4 million barrels of crude oil per day and release it to the market.

In October 2021, in an effort to fight high prices at the pump (and, in effect, inflation), President Biden authorized the largest drawdown in history—with plans to release up to 260 million barrels through October 2022.

And in April 2022, the government announced the release of another 180 million barrels to stabilize the markets after the Russian invasion of Ukraine.

Prior to these withdrawals, the last two emergency releases happened in 2011 and 2005—each for 30 million barrels.

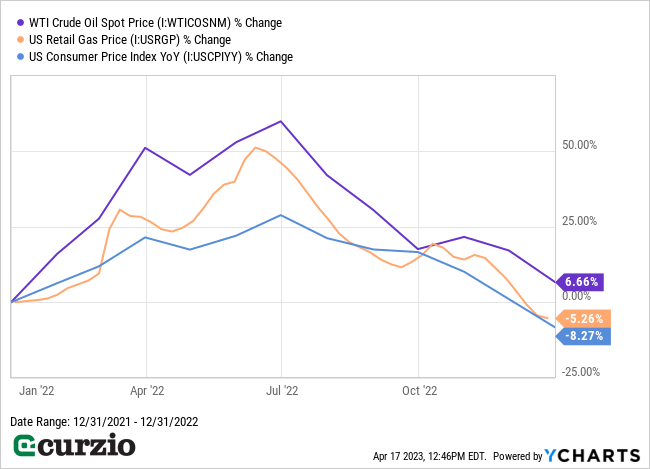

As you can see from the chart below, the latest massive drawdowns helped lower the price of oil and gasoline in the second half of 2022 (and slowed inflation along the way).

But these drawdowns also dropped the SPR to its lowest level since 1985. The reservoirs are about half empty.

Today, the time is fast approaching that the SPR will need to be refilled.

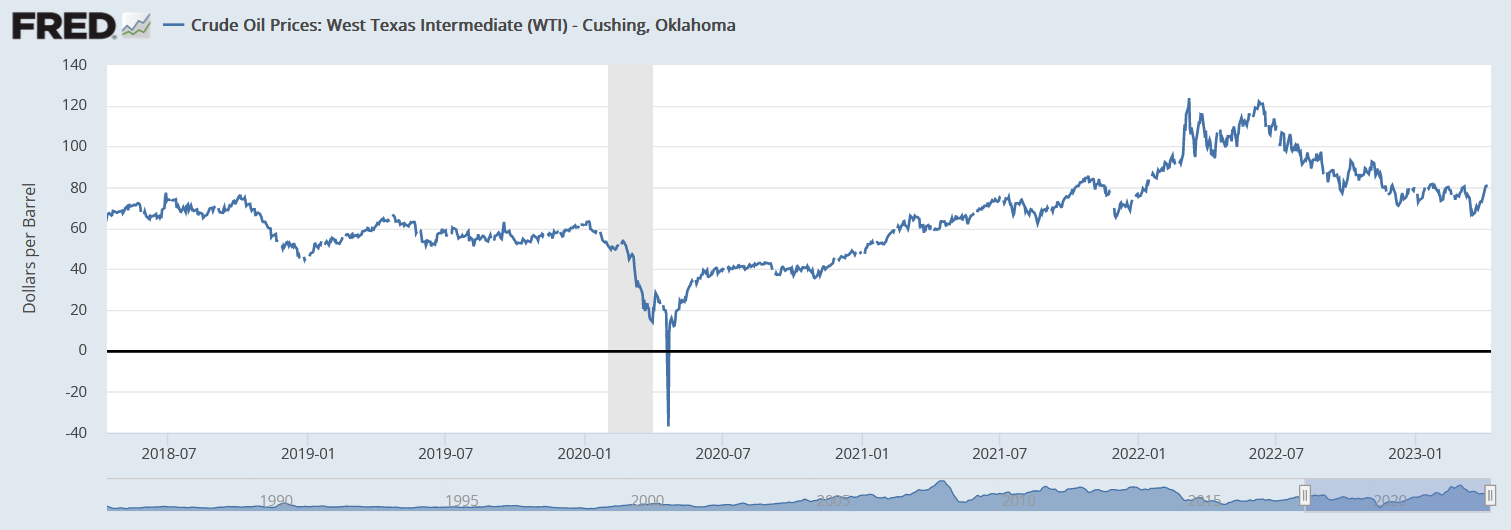

What’s more, we’re almost at an ideal price point for refilling the SPR. While the price of crude is up year to date (currently just under $85 per barrel), it’s significantly lower than last summer’s $120-plus highs… and is well below the average 2022 price of $94 per barrel (as you can see below).

Last October, the Biden Administration announced it was ready to buy crude for the SPR at prices around $67–72 per barrel.

And while the government hasn’t followed through on this plan yet, its repurchase goal puts a floor under the price of oil around $70 per barrel—not too far from where it traded just last month.

America’s urgent need to refill the SPR is great news for U.S. producers. Even if the economy goes into recession later this year, oil companies will be able to sell their output at steady prices… as government purchases should offset a pullback in demand from the private sector.

In short, now is the time to start scooping up oil stocks—particularly independent producers. This positive backdrop is one reason why Warren Buffett is buying as much Occidental Petroleum as he can… and also why the biggest U.S. energy company, ExxonMobil, is shopping around for a new acquisition target.

Last week, I highlighted one strategically positioned, asset-rich company that Exxon is reportedly looking at as an acquisition target…

Next week, I’ll share a few more names that will benefit as Big Oil hunts for already-discovered, easy-to-access oil reserves.

P.S. My Unlimited Income portfolio contains several energy stocks that will profit as oil prices rise. And the best part: They pay us while we wait.

Join us at Unlimited Income—risk-free—to access all my favorite dividend stocks for this market.