Back in 1976, a man named Sol Price came up with a new idea for the retail industry…

The “membership warehouse club.”

He opened the first Price Club warehouse in a converted airplane hangar in San Diego that was once owned by Howard Hughes.

For a $25 annual membership fee, customers could buy products in bulk at the lowest available cost.

At first, Price Club solely targeted small business owners… which made sense, since these folks were typically looking to buy supplies in larger quantities.

But Jim Sinegal, Price Club’s executive vice president of merchandising, distribution and marketing, realized something early on: “Regular” customers also wanted to buy top-quality products in bulk… as long as prices were low. Sinegal helped pivot the business to target everyday buyers.

Within a few years, the company had transformed the global retail landscape.

By 1983, Sinegal left Price Club to co-found another warehouse retailer—Costco. Within six years, the business grew to $3 billion in sales—the first company in history to do so in such a short time frame.

A decade later, Costco and Price Club agreed to merge… And as the combined company grew, so did its bargaining power… and its ability to offer a variety of quality items at rock-bottom prices.

It took less than 50 years for Costco to build a dominant position as one of the largest retailers in the world…

Thanks to its tremendous pricing power, Costco can keep its own costs down, while selling a wide range of products at unbeatable prices… which is becoming ever more important for consumers as the economy worsens.

Put simply, COST is exactly the kind of stock you want to own in a recession. Here’s why…

1. A loyal—and growing—customer base

Put simply, consumers love Costco… which explains its fantastic 92.5% membership renewal rate.

And despite its large size, Costco is still growing rapidly. Total memberships increased from 90 million customers in 2017… to 99 million in 2019… to 121 million today. That’s a 34% increase in just five years.

The company collects an impressive $4.3 billion in annual membership fees. And that number is just a drop in the bucket (less than 2%) compared to its $231 billion in annual revenue.

2. Proven growth in a recession—and post-pandemic world

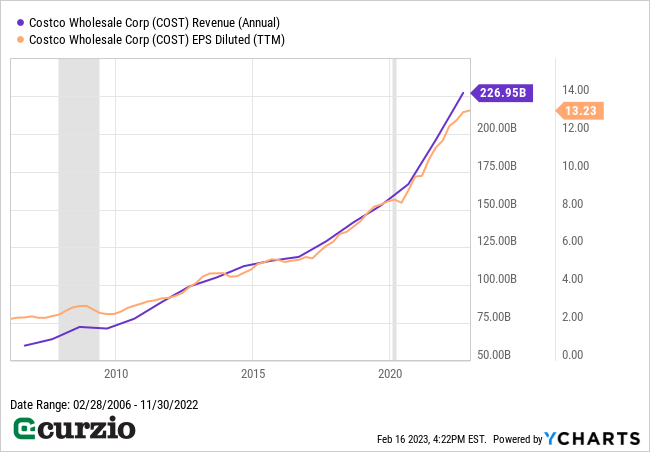

The company’s growth didn’t suffer during the 2020 COVID recession—as you can see in the chart below.

And its revenues and profits have continued to grow in the post-pandemic environment, where shoppers are increasingly looking for bargains.

Most recently, Costco’s January revenue of $16.84 billion marked a 6.9% increase vs. January 2022.

For comparison, retail sales for the entire U.S. are up 3.9% over the past year… while sales in general merchandise stores grew 4.5% year over year.

Any way you look at it, Costco’s revenue growth is beating the retail industry as a whole.

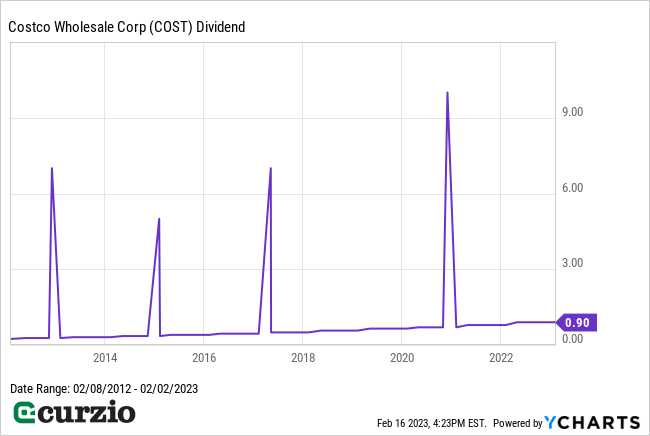

3. A very “special” dividend

Costco’s dividend growth has also been fantastic—up 38% in three years. And that number doesn’t include a $10 special dividend the company paid a year ago.

This special dividend wasn’t out of the ordinary for longtime Costco shareholders…

As you can see below, the company has paid out four massive special dividends over the past decade… while increasing its regular (quarterly) dividend by a whopping 275%.

4. Outperforming the market

Of course, any stock that keeps adding 15% to its share price annually for two decades (as Costco has) is bound to get overbought.

That’s a big reason why the stock lost 20% amid the market-wide selloff in 2022. But that decline was in line with the market. In other words, the pullback in COST wasn’t caused by any internal or operational problems.

And since the start of 2023, COST has already rallied 10.5%… much better than the market’s 6.8% gain.

Given Costco’s massive customer base, its focus on low-cost pricing, and its commitment to paying a growing dividend to investors… COST is a perfect example of the kind of high-quality stock you want to own during a recession.

Plus, the stock is still sitting about 16% below its all-time highs… which represents a buying opportunity for anyone who wants to own a stake in one of the best-managed and most beloved companies in retail.

P.S. Unlimited Income crushed the market last year… thanks to our time-tested strategy of buying dividend-growth stocks.

While most stocks crashed, the picks in my Unlimited Income portfolio outperformed the market by more than 20% (on average) in 2022.

And I expect this to remain a winning strategy to 2023.