For investors, 2022 has been the worst year in decades.

Not only is the S&P 500 down more than 16% since the start of the year, bonds—traditionally a refuge from falling equities—have also suffered double-digit declines.

High inflation, rising interest rates, and a slowing economy all played a role in this dismal performance.

However, one corner of the market has done remarkably well…

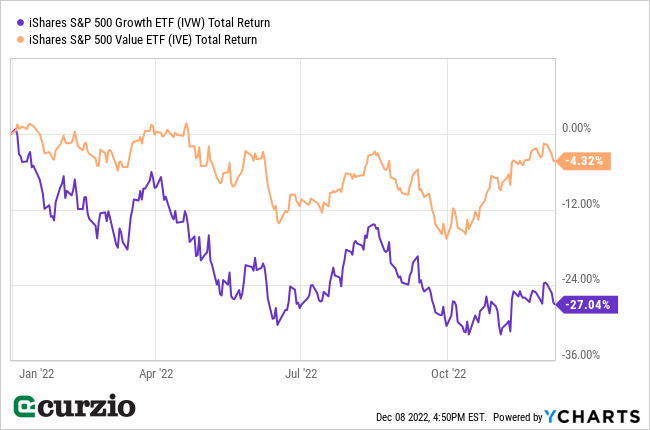

As you might already know, value—the cheaper part of the market that includes most income stocks—has beaten growth by more than 20% so far in 2022.

And dividend stocks are a major reason why…

This isn’t surprising: Dividend stocks—which account for a large portion of the value sector—have historically contributed the most to total market returns during times of high inflation. Plus, even if a specific dividend stock doesn’t go up, its steady payouts can help offset some price volatility.

But even if you don’t need income from your investments, you shouldn’t ignore this corner of the market…

There’s a simple, underappreciated strategy that can maximize your portfolio returns… In fact, it’s one of the best-kept secrets of the most successful investors.

I’m talking about reinvesting your dividends.

The surest way to make money in any market

When you reinvest dividends back into the same stock, you’re utilizing the power of compounding.

For one, it allows you to continuously grow the number of shares you own, which increases your capital gains. Plus, when you’re ready to start pocketing some of the dividend income, you’ll be collecting a bigger payout (since you own more shares than when you started).

Secondly, reinvesting dividends during a bear market means you’re buying more shares at cheaper prices and, ultimately, setting yourself up for even bigger gains when the next uptrend starts. And in a bull market, you’ll buy fewer shares as prices go up and become more expensive.

Put simply, compounding works in your favor whether the market is heading up or down.

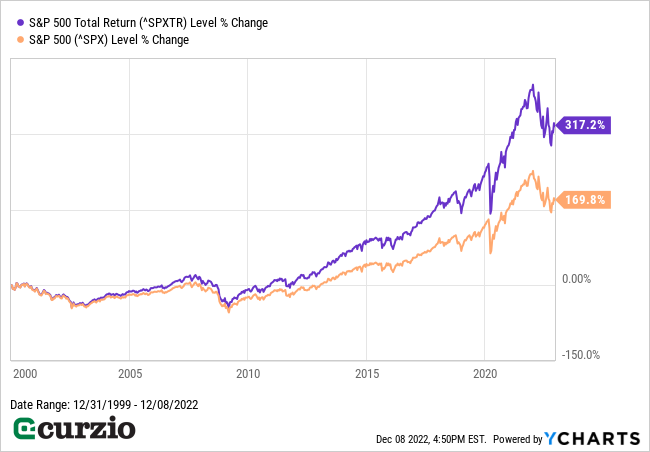

Here’s a chart to prove my point. It compares the returns on the S&P 500 since 2000 with and without dividend reinvestment (the purple and orange lines, respectively).

As you can see, had you owned the S&P 500 all these years without reinvesting your dividends, you’d been sitting on a gain of 170%—or 2.7 times—your original investment.

But if you kept reinvesting your dividends back into the index, you’d have more than quadrupled your money since 2000.

Dividend reinvestment also helps reinforce your commitment to an investment (by growing your position in it). This puts even more emphasis on picking just the right stock: You don’t want to keep throwing more money into a bad investment.

The simplest way to find the best dividend payers is with my Unlimited Income service. In 2022, our picks outperformed the market by nearly 23%. Here’s how you can join us—risk-free.

When you invest in the best income stocks, you benefit from dividends AND capital gains… And if you don’t immediately need the income, you can use this dividend reinvestment strategy to easily multiply your returns.

That’s the power of compounding.