Inflation is eating into everyone’s spending power.

But don’t make the mistake of thinking it’s only an issue in the U.S.

Many developed economies are also facing rampant inflation, thanks in part to a restricted energy supply and unsustainably high energy prices across the globe.

Consider the following:

- Yesterday, Brent Crude oil traded at $94 per barrel (vs. less than $80 to start the year)

- A barrel of West Texas Intermediate Crude (WTI) fetched about $88 (vs. $76 to start the year)

- And Henry Hub, the U.S. natural gas benchmark, finished the day around $5.40 per million BTU (up from $4 at the beginning of the year)

Meanwhile, Europe’s full-blown energy crisis reached a new level this month… following the suspicious Nord Stream pipeline explosions.

To further complicate matters, OPEC+ just announced plans to cut oil output.

And while the U.S. will release up to 15 million barrels from strategic reserves (the final part of a program that began in the spring), the plan to start replenishing the emergency stockpile of WTI between $67 – $72 a barrel (or less) creates a floor in oil prices.

The long-term dynamics of the energy market are pretty simple:

- When oil prices fall, producers cut down on exploration and production (E&P)… reducing oil supply and setting the stage for a future price rebound.

- When oil prices rise, producers have an incentive to increase drilling activity… which eventually results in oversupply—pushing down prices and bringing us back to the start of the cycle.

Put simply, the oil market is typically self-correcting: The best cure for low prices is low prices… and vice versa.

But it takes a while for high prices to destroy demand and start the downward price spiral—especially when capital spending is limited and new production is slow to come online… like our current scenario.

So, why aren’t oil companies spending more, especially when energy has been performing so well?

Because they’re doing what their investors want them to do.

Oil investors look at multiple factors, including capital discipline… financial strength… longevity… and dividends. And in today’s scary economy, they’re particularly focused on dividend preservation.

That means companies are reluctant to spend much more than the bare minimum on E&P right now—especially since high oil prices are already benefiting their bottom lines.

The long-term transition to renewables gives oil companies another reason not to overspend on new drilling.

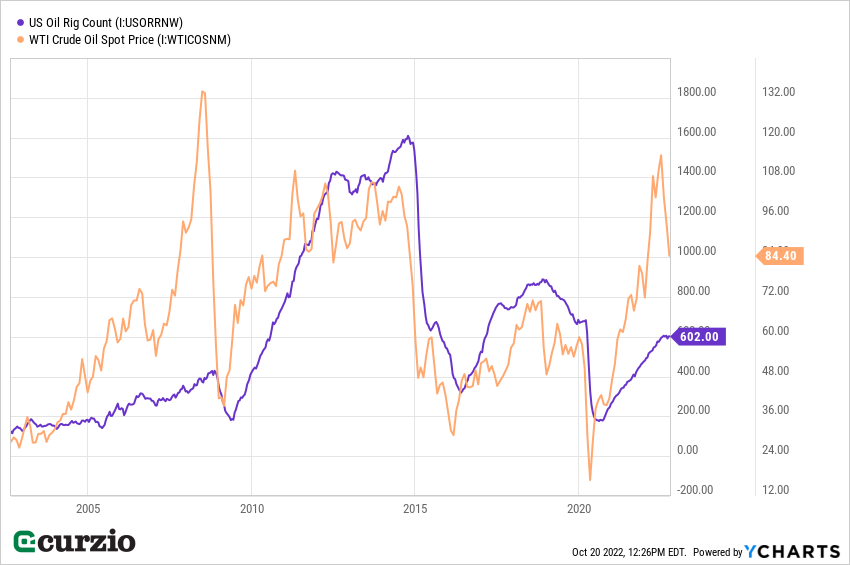

The most telling sign comes from drilling activity in the U.S.

As you can see below, the number of oil rigs in operation hasn’t kept up with the jump in oil prices over the past two years… and has yet to recover to pre-pandemic levels.

The orange line on the chart above shows the long-term price dynamic for WTI. With prices at historically high levels… and with a favorable supply/demand situation, it’s no wonder energy has been beating every other market sector this year.

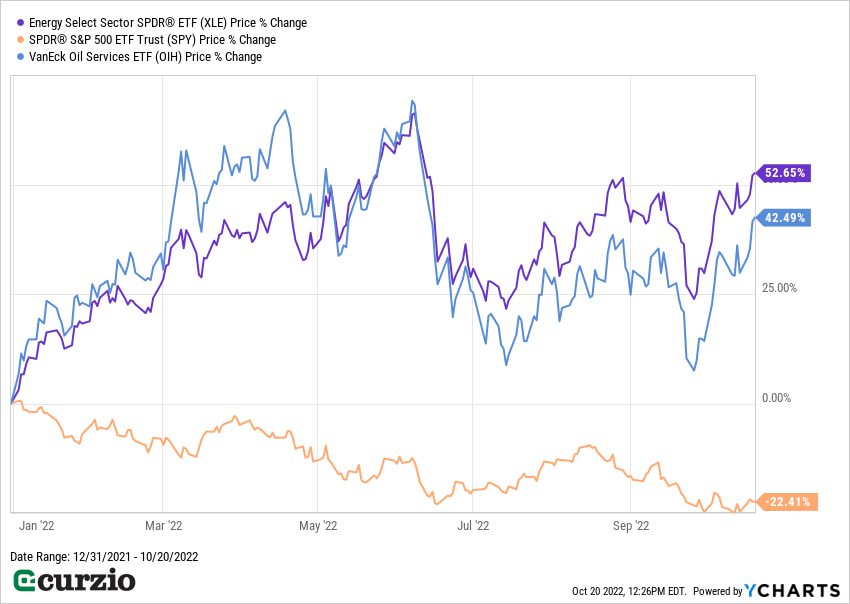

Two leading energy ETFs—the Big Oil-dominated Energy Select SPDR ETF (XLE) and the popular VanEck Oil Services ETF (OIH)—have outperformed the market by 76% and by 63%, respectively.

And that’s even without dividends, which are a big part of the investment thesis for large integrated oil companies like ExxonMobil (XOM) or Chevron (CVX), with their market-beating 3.5% yields. (Both are major positions in XLE.)

XOM and CVX are excellent choices to play the current situation. As are XLE and OIH. These funds offer an easy way for investors to get exposure to dozens of the best companies in the energy sector.

Just keep in mind… the less money oil companies spend on exploration, the fewer reserves they have. That’s good for the price of oil… but bad for inflation and the rest of the market.

In 2020 (the latest U.S.-wide data we have), proved reserves of crude oil plunged by 19%… and reserves of natural gas fell 4%.

Despite these lower numbers, the U.S. remains the world leader in untapped reserves—largely thanks to the Permian Basin, a massive oil field that stretches across west Texas and southeastern New Mexico.

The bottom line: In the current situation, the companies that own the most reserves (and need to spend the least to develop them) will win…

They can continue producing without spending too much… which will result in massive free cash flows thanks to high oil prices. And these cash flows will lead to fat dividends for investors.

P.S. Want to know what to do with your retirement account in today’s rocky market? Or how to play sectors like energy, commodities, and crypto?

Frank went LIVE to answer these questions and many more…

He even shared an under-the-radar stock he’s personally invested in—one positioned to soar from the global energy crisis. Go here to watch the replay.