Editor’s note: As the 2022 selloff continues with no end in sight, we’re revisiting one of Genia’s timeless lessons: How to use put options to build portfolio insurance… and profit in a declining market.

You’ve probably heard the market maxim, “Don’t fight the Fed.”

You might have also heard the expression, “Clichés are clichés for a reason: Because they’re true.”

There’s simply no getting around the fact that stocks are directly impacted by the Fed’s policies.

The evidence is everywhere.

Back in 2020, the Fed’s “easy money” policy sent stocks soaring after the COVID crash.

And today, the Fed’s aggressive interest rate hikes are causing the market to plunge.

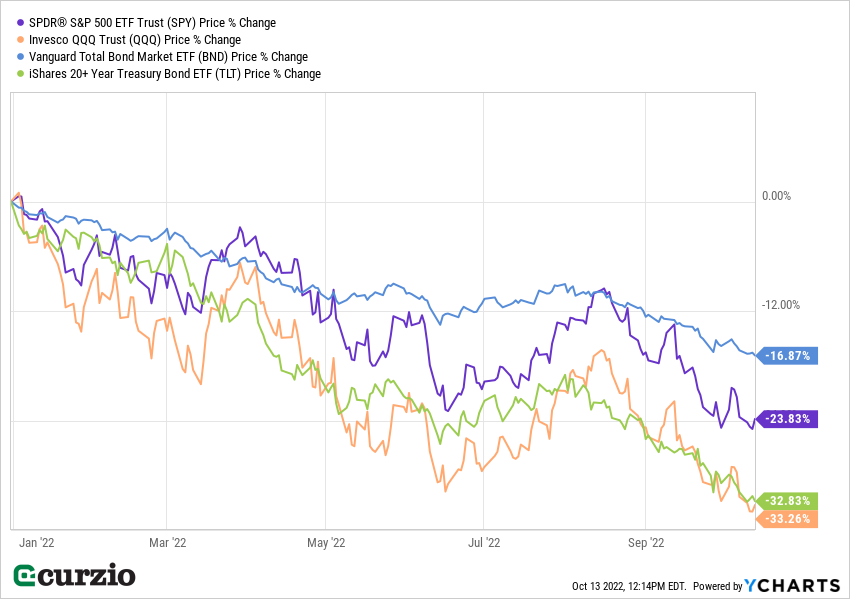

So far this year, the Fed has raised rates from zero to 3%—with the promise of more hikes in the coming months. As a result, we’ve seen the S&P 500 lose 23%… and mortgage rates have more than doubled.

But it’s not necessarily a bad thing that you can’t fight the Fed… Knowledge is power: Once you understand how the market reacts to Fed policies (and vice versa), you can prepare yourself for what comes next.

Since we know to expect more rate hikes before the end of the year (and since we know the market is likely to react negatively), we can plan accordingly.

My favorite way to play falling stock prices is by building “portfolio insurance” with put options.

Similar to life insurance, portfolio insurance protects an investor against an adverse event. More specifically, put options—when properly used—allow you to profit from a stock, sector, or market-wide decline.

Here’s how they work…

When you buy a put option, you get the right (but not the obligation), to sell the underlying security (stock or ETF) at a specific price (strike) before a certain date (expiration).

If the underlying security declines in price, the put option increases in value—and the faster and sharper the asset’s decline, the more you can potentially make on your put trade.

To buy a put, you’ll need to pay some money upfront. Think of it as an insurance premium…

But, like an insurance premium, that’s the maximum you’ll lose if the asset doesn’t end up declining. And if you’re right, you’ll collect much more than you paid for the put option.

In other words, when you own a put on a specific security, you’re positioned to benefit from that security’s decline.

You might think it’s too late to start buying insurance in the middle of the market selloff…

But nothing could be further from the truth.

For one, no one ever really knows where the market is heading. It makes sense to maintain hedges at all times—for safety when the market is rallying… and for profits when it’s not.

Secondly, a market decline often feeds off of itself: As investors start to flee, others get spooked and do the same—generating more pain for your “long” portfolio (assets you believe have upside)… but more profits for your short, put-based positions. (The tech-heavy Nasdaq is already down about 33% this year—and put positions on some of these stocks have already generated gains as high as 270% in a month for my Moneyflow Trader advisory.)

Finally, put options offer investors a way to go against the grain… and profit when the market is falling—which is the case today. As you can see from the chart below, there’s almost no place to hide in this selloff—every asset class is hurting.

Of course, options are a tool to be used carefully… If you’re wrong about the direction of the asset, its volatility, or the timing of your trade, your put could expire worthless. So only invest what you can afford to lose on the “insurance premium.”

But if you plan carefully and understand the risks… a series of well-placed put trades will not only provide valuable protection against a falling market… but also incredible profits.