Conventional wisdom tells us rising interest rates are bad for real estate investment trusts (REITs).

The higher the rate… the more expensive it is to borrow money… And real estate companies of all kinds require significant capital to operate.

So rising rates typically mean a higher cost of conducting business… and lower profits.

On the other hand, real estate properties tend to hold value much better than cash, bonds, and many equities during inflationary times.

Let’s take a look at why some REITs have been performing better than others… and which ones to avoid with interest rates on the rise.

Not all REITs are created equal

REITs are companies that own or finance income-producing real estate in a range of property sectors.

With a REIT, investors can own many pieces of property, from office buildings to storage units, without spending the significant amount of money required to buy actual land and buildings… or the hassle (and expense) of running the businesses.

Better yet, because REITs must distribute at least 90% of earned net income to shareholders, these companies are subject to little or no corporate tax.

As I mentioned above, higher interest rates typically hurt these investments. But they tend to do better than other assets during inflationary periods.

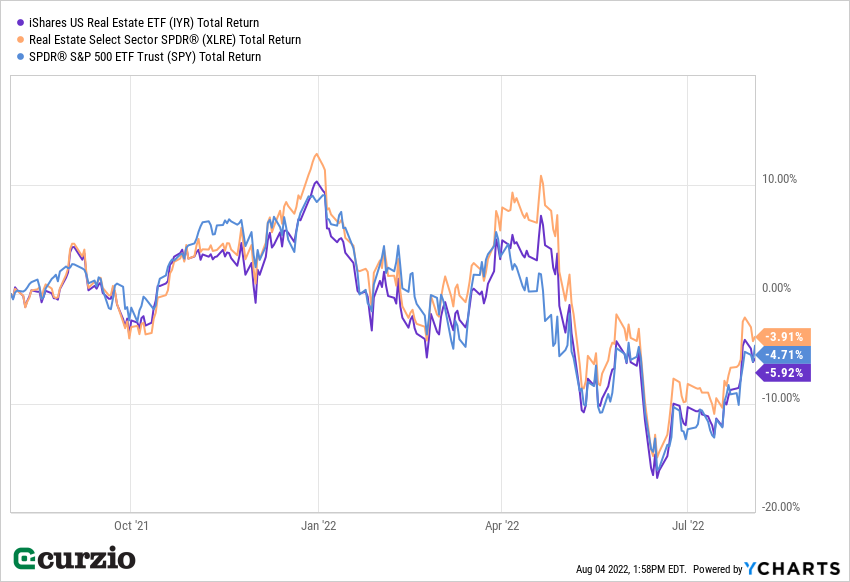

That’s why REITs as a group—represented below by two leading REIT ETFs, the iShares US Real Estate ETF (IYR) and the Real Estate Select Sector SPDR Fund (XLRE)—have performed in line with the S&P 500 over the past year.

But, as you can see from the difference in price action in these two ETFs, some REITs haven’t performed as well as others.

That’s because IYR and XLRE have different compositions. While XLRE includes only one type of REIT, called equity REITs, IYR aims to cover the entire sector… including a class called mortgage REITs (mREITs).

Mortgage REITs aren’t in the business of managing properties. Instead, they focus on financing them by originating or purchasing mortgages and mortgage-backed securities (MBS)… and collecting the income from the interest on these loans.

In other words, they borrow at shorter-term rates… use that money to purchase mortgages… and collect interest at longer-term rates. This business model is closely linked to the difference (or “spread”) between long- and short-term interest rates. The wider the spread between long- and short-term rates, the more income mREITs can generate.

But when this spread narrows (which happens when the yield curve flattens), it means lower profits for mREITs. If the spread gets narrow enough, these REITs may have no choice but to reduce their payouts to shareholders… which often leads to a sharp share price decline.

That explains why the group has been underperforming the market by a significant margin over the past year. In the chart below, I compared the returns—including dividends—of the S&P 500 to two popular mREITs: AGNC Investment Corp (AGNC) and Annaly Capital Management, Inc. (NLY).

Equity REITs are a much better choice in today’s market. The best of the group should continue to outperform amid inflationary pressures… and despite rising rates.

Next week, I’ll tell you about one of my favorites—a REIT with significant inflation-fighting power… in an industry set to do well, even in a recession.

P.S. I just recommended another ideal REIT for the recession in Unlimited Income…

It’s a dominant company profiting from a critical role in the global supply chain… And it pays a 2.5% dividend.

Join us today—risk-free—to access this REIT… plus a portfolio full of my favorite dividend stocks, many of which are now trading at incredible bargains.