Over the last couple of weeks, I’ve discussed this crazy market… why it’s less risky than you might think… and how to invest for maximum profit.

But don’t get complacent: This market is still dangerous…

With inflation clocking in at 9.1% for June… the Fed can’t afford not to act.

A rate hike as high as 1% after the next FOMC meeting (in just two weeks) is now possible, recessionary fears be damned.

And if this next hike fails to put a dent in inflation, more increases will follow… and stocks could remain under selling pressure.

Fortunately for investors, there are ways to fight back… and profit from the market’s declines.

I’ve told you before about put options as a way to make money on the downside. But if you’re not comfortable using options, there’s another way…

I’m talking about inverse exchange-traded funds (ETFs).

These funds are specifically designed to profit from the downside of the market or a particular sector. They’re a great way to make money when the market is falling—if you use them strategically.

You see, inverse ETFs are not designed for passive investors.

They’re highly specialized and designed mostly for shorter-term trading.

But investors who understand how these funds work—and follow the guidelines below—can easily use them to hedge their portfolios… and profit when the market declines.

Most importantly, inverse ETFs can be your lifeline in a bear market…

How do inverse ETFs work?

Whether you’re a bull or a bear, there’s an ETF for whichever direction you think the market (or a specific sector) is going.

An inverse ETF is simply an ETF that promises to deliver the exact opposite of the sector it follows (or the entire market).

Let’s say that at the end of 2021, you were confident the market was due for a selloff.

To benefit, you could have bought the ProShares Short S&P 500 ETF (SH), which promises to deliver the opposite of the market return. In other words, if the S&P 500 goes down 2%… SH will go up 2% over the same timeframe.

If you wanted to make an even bigger bet, you could have aimed for double the inverse return by buying the ProShares UltraShort S&P 500 ETF (SDS)… or triple the return with the ProShares UltraPro Short S&P 500 ETF (SPXU).

The latter two are examples of “leveraged ETFs”—inverse ETFs that promise multiples of the market (or index) return.

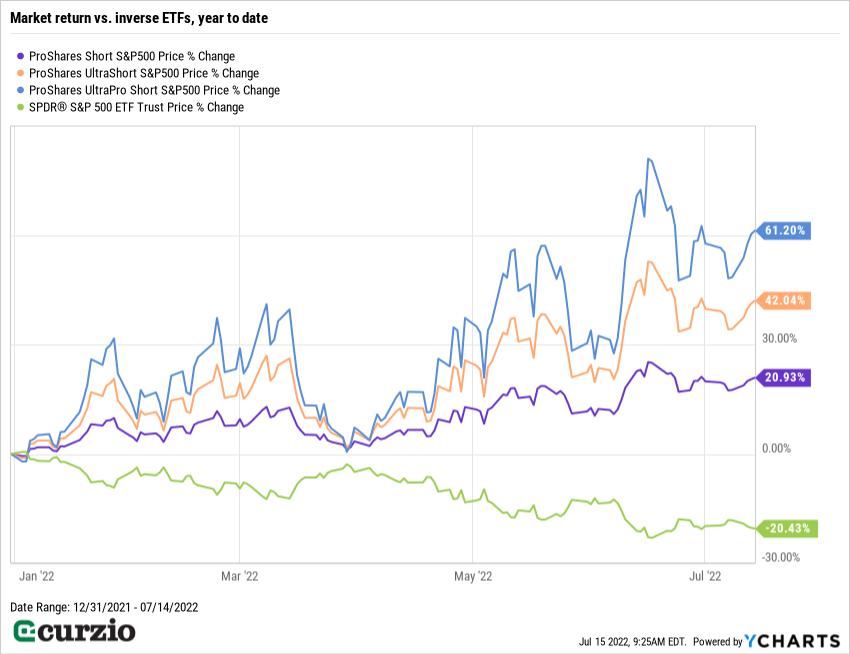

As you can see from the chart below, each choice would’ve made you money this year… and the more leverage, the higher the return.

With the market down 20.4% year-to-date, these inverse ETFs have delivered solid gains: a 20.8% return for SH, 42% for SDS, and 61.3% for SPXU.

You can view a list of inverse ETFs here.

Bear in mind: These ETFs have one thing in common…

How inverse ETFs are designed

Because inverse ETFs use sophisticated financial tools like options, swaps, and other derivatives… these funds typically reset their portfolios daily.

Therefore, they’re designed to track a one-day performance of a chosen sector (or the market)—not its long-term returns.

This can have practical implications… especially for double- and triple-inverse ETFs: They will lag the expected return in an oscillating market…

And the higher the volatility—with big swings in the underlying index—the more the actual return on leveraged ETF will differ from the expected return.

This year, the market’s declines have been relentless—and consistent.

As a result, the inverse ETFs mentioned above have delivered results that are pretty close to their stated goals: The opposite of the market (SH), the double-inverse return (SDS), and the triple-inverse return (SPXU). You’ll notice that SDS underperformed its promised return by about 1%, while SPXU underperformed by about 2%. Still, that’s not far off.

But this underperformance can be bigger if the market—or a sector—is especially volatile.

Let’s take the financial sector as an example.

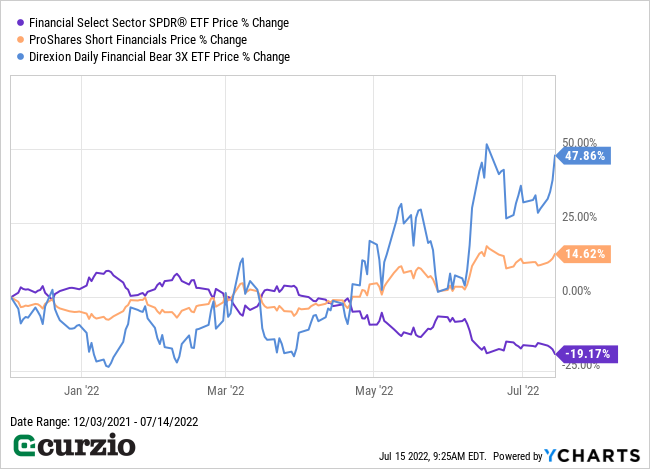

Had you bought the ProShares Short Financials ETF (SEF) on December 3, 2021, when I suggested the trade, you’d be looking at a 14.8% gain as of yesterday.

But as you can see from the chart below… that’s well below the inverse of XLF, the financial sector fund it’s designed to mirror.

While XLF lost 19.2% since early December, SEF only gained 14.8%—4.4% less than the goal.

And this difference is even more striking for the Direxion Daily Financial Bear 3X ETF (FAZ)… which gained 47.9% over this time–even though it was supposed to earn 57.6%. It’s another example of the kind of “slippage” that can happen when you hold a leveraged ETF for more than a few days.

The most important thing to keep in mind is that these vehicles are designed to track daily changes only. They’re a great tool for investors over the short term… but the longer you hold them, the more they’ll underperform their target return.

And the more volatile the market is, the more their returns will lag. But if you know what to expect, you won’t be disappointed if that happens.

The bottom line: Inverse ETFs are one of the easiest and most efficient ways to profit from a falling stock market.

But to maximize your profits while controlling the risk, remember these three simple guidelines:

- Leveraged ETFs are an ideal tool to play a market or sector that has a consistent direction… or to profit when you expect a sharp, short-term move.

- Double- and triple-leveraged ETFs are designed for active trading and are better for shorter-term trades.

- For a longer-term portfolio hedge, stick to inverse ETFs that promise the direct (1x) opposite of the market/sector returns (like SH or SEF in the examples above).

As long as you remember (and follow) these guidelines, you’ll be able to make money easily and confidently during a bear market.

P.S. If you’re ready to take your investing game to the next level…

Check out our Moneyflow Trader strategy… You’ll be astounded at the consistent double- and even triple-digit gains we’re generating with contrarian strategies—often in just a few weeks.

And I’ll walk you through every step of the way.