Inflation is raging.

Any doubts about it were crushed last week, as Friday’s Consumer Price Index (CPI) report showed inflation saw a one-year rise of 8.6%, the highest rate since 1981.

The data sent stocks plunging… and many investors are throwing in the towel.

But the smarter strategy is to invest in the companies that are benefitting…

You see, the rapid rise in prices is hurting consumers, but some industries are thriving in this environment. They’re the ones passing the higher prices along to their customers… pocketing the gains as profit… and generating growing cash flows.

Today, I’ll explain how to find the best stocks to own when inflation is raging… and share a simple way to invest in them.

Inflation is hitting these 2 areas especially hard

Let’s start with a quick recap of last week’s inflation report.

In short, there are two main areas hitting consumers really hard: energy and food. By now, I’m sure you’ve noticed how expensive it is to fill up your gas tank. Similarly, our grocery bills seem to rise every week.

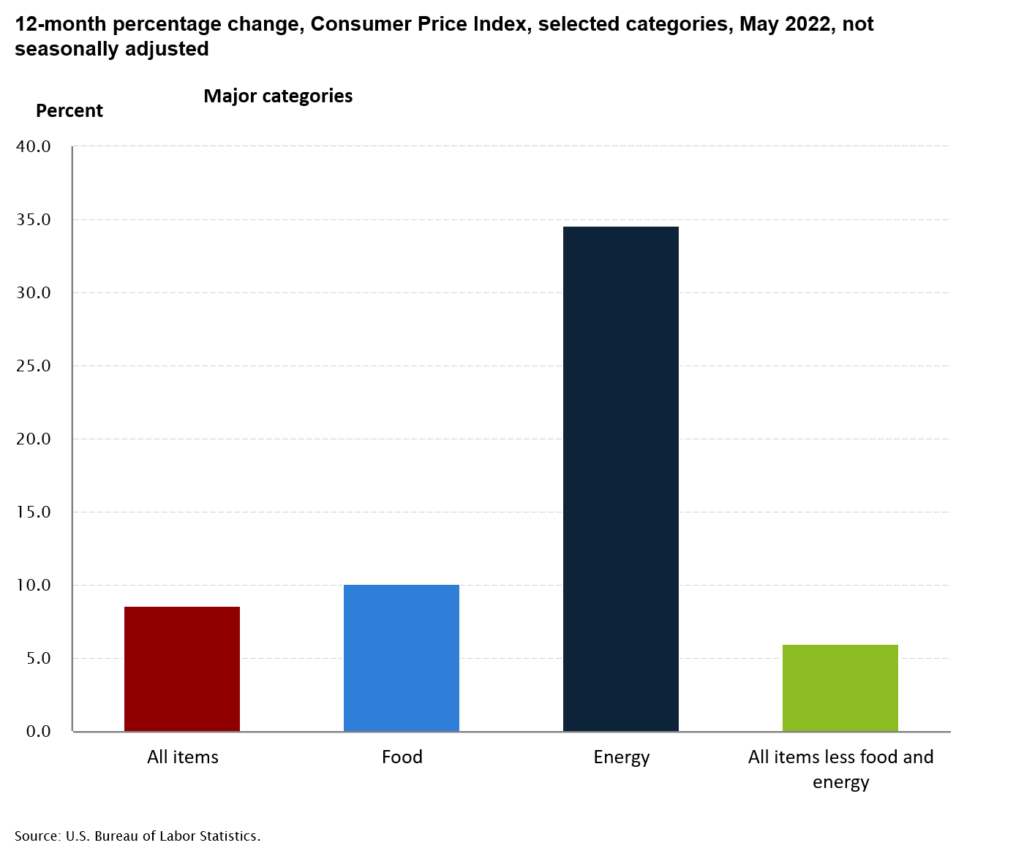

Below, you see a basic chart of the latest inflation data. It breaks out the energy and food costs from the overall numbers. The year-over-year increases have been incredible: Energy prices have soared by 34.6% and food prices have jumped 10.1%…

There’s nothing surprising in this table. But it’s a good reminder that energy and food prices are rising even faster than other stuff. (Keep in mind, one of the most common inflation gauges is “core” inflation, which excludes energy and food prices.)

Rising energy and food costs are especially hard on consumers. You can’t just decide to stop driving or eating. So you’re left with less money to spend on other “discretionary” goods and services. This is why Wall Street’s been in a tizzy lately… Consumers are in a pinch.

But as investors, we need to look for opportunities in all market environments… including high inflationary times like now.

How to benefit from this ugly scenario

When the economic outlook turns murky, the best strategy is to focus on high-quality companies making steady profits.

While revenue and earnings are always important… cash flow is an underappreciated metric for finding the best companies.

A few months ago, I explained why investing in firms with strong free cash flow (FCF) is one of the best strategies for a tough environment.

It was a good lesson then… and even more important today.

As a reminder, FCF is a measure of how much cash a company makes after covering the expenses needed to run the business. And it’s a different way to look at accounting than earnings alone. Earnings are similar to FCF, since they also represent the money left over after subtracting expenses. However, earnings include a lot of extra “non-cash” expenses (depreciation, amortization, etc.).

In short, FCF gives us a clear answer to one of the most basic investment questions: How much cash is the company making? It’s the amount a firm could theoretically give back to shareholders.

And guess which industries are gushing cash right now? If you guessed energy and food… you’d be right.

Many of these companies are able to pass on higher costs to consumers, which means even after paying their own rising costs, they’re left with growing cash flow.

And when you generate lots of cash, you can return it to shareholders in the form of dividends.

Now let’s look at a couple of examples…

ConocoPhillips (COP) is a massive oil and gas producer based in Houston, Texas. Not surprisingly, it’s thriving in the current environment, with a three-year sales growth rate of 30.8% and profit margins above 17%, according to FactSet.

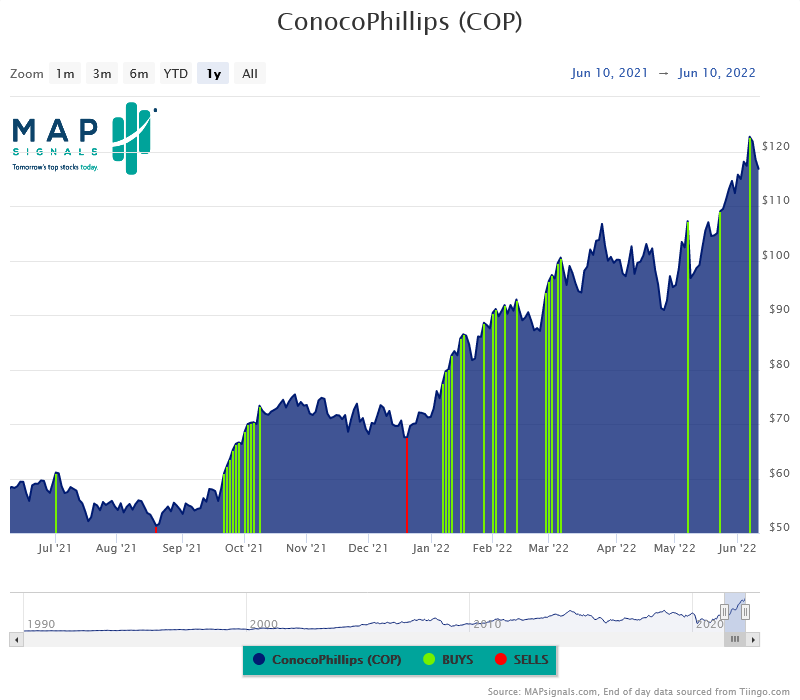

This is the type of stock that’s benefitting from soaring energy prices. Below, you can see the one-year chart for COP. The dark blue line shows its performance… and the vertical green lines show the days when institutional investors—also known as the “Big Money”—were heavily buying stock.

COP is up about 60% since the start of this year. More importantly, the company is gushing cash… it generated more than $11.6 billion in FCF last year. That’s a lot of money to pass along to shareholders: The stock currently sports a dividend yield around 1.6%.

Let’s move over to the food industry…

Archer-Daniels-Midland (ADM) is a food commodity powerhouse… It processes tons of grains, seeds, and other crops to make the ingredients for much of the stuff we eat. As food and related commodity prices keep rising, this company is a direct beneficiary. Its annual sales have surged 32.4% over the past year… driving a 52% increase in its earnings per share (EPS).

As I mentioned earlier, we need to check FCF… ADM generated over $5.4 billion last year.

Below, you can see ADM’s stock performance over the past 12 months. Like the COP chart above, the vertical green bars are Big Money buy signals. Each green bar represents a day when the stock surged on high volume buying…

As you can see, ADM is in a clear uptrend. And it has a ton of Big Money support, especially since the start of 2022.

The bottom line: While inflation remains a headwind for the overall economy, select companies in the energy and food industries are thriving. They’re growing revenues at a double-digit rate… leaving billions in cash flow to pass along to investors.

And there’s an easy way to buy dozens of cash-rich companies with one click…

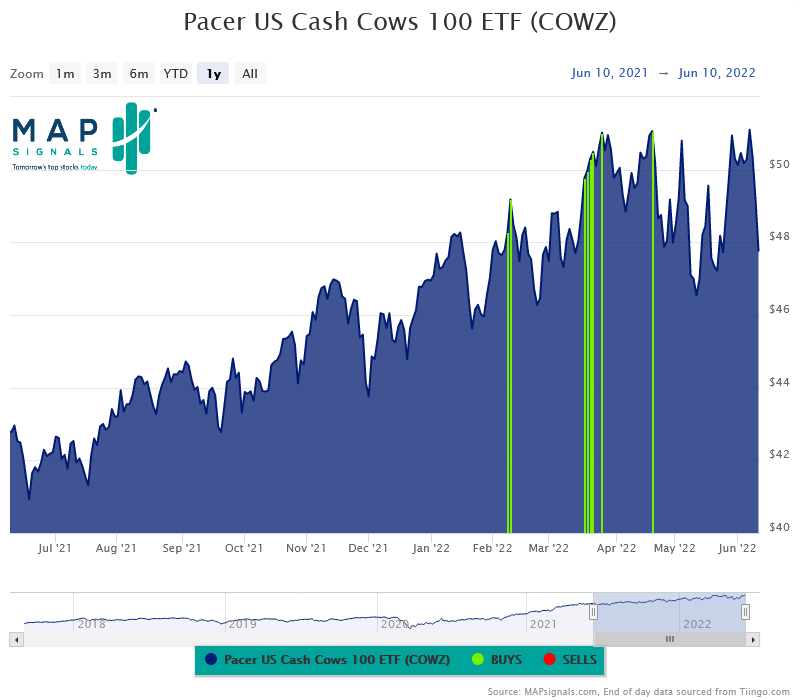

The Pacer U.S. Cash Cows 100 ETF (COWZ) is an exchange-traded fund (ETF) that holds 100 of the best companies in the stock market. The fund screens the top 100 companies in the Russell 1000 (the biggest 1000 publicly-traded U.S. companies) based on FCF yield. In other words, it holds 100 of the strongest cash-generating businesses in the market.

As a result, COWZ has big positions in industries like energy, materials (which includes food commodity players like ADM), and healthcare… and it pays a solid dividend yield around 1.7%.

In fact, the fund provides exposure to ConocoPhillips (a 2.37% weighting in the fund) and Archer-Daniels-Midland (with a 2.08% weighting).

Not surprisingly, the fund has attracted a handful of Big Money signals in recent months:

Wrapping it up

Inflation is high. The latest CPI reading was a shock, highlighting the biggest price hikes on record since 1981. While this is hurting consumers, some companies are producing elevated cash flows.

And COWZ is a great way to own the best of these companies—the ones thriving in this inflationary environment.

P.S. If you wish you’d bought stocks at pandemic lows… you have another chance now.

As money rushes out of the market, it’s creating incredible opportunities to buy the best stocks… at historic discounts.

Sign up for The Big Money Report today to find out what I’m buying now.