“Should I stop putting money into my 401(k)?”

My doctor looked more worried than I’d ever seen him.

As I sat in his exam room last week, I could tell he’d been watching his portfolio closely. The plunging markets were making him question his long-term investing plan.

It was a shock to me… because my doctor is always long-term minded when he talks about health.

But right now, his mind is 100% focused on the short term.

And that’s a dangerous mindset during a bear market…

A common investing mistake

Everyone’s talking about the stock market these days. Fear is rampant. Turn on any news outlet and you’ll see a bunch of talking heads discussing out-of-control inflation, rising interest rates, and soaring oil and gas prices.

Scary headlines are nothing new in financial news. What’s really rattling investors is the brutal selloff happening across the markets. Stocks, cryptocurrencies, and even bonds are all down double digits since the start of 2022.

So it’s no surprise my doctor wanted to talk about the markets when I went for my annual physical last week…

Normally, our conversations focus on stuff like my eating and drinking habits, physical exercise, and how much sleep I’m getting.

But for this visit, the focus was on him instead of me. He said he’d been contributing to his index funds each month… but was thinking about stopping these regular contributions. The ugly headlines had him worried. And the steep declines in his portfolio had him on the verge of panic.

He said he wanted to hold off putting any more money into the account until the dust settles.

My first question: “What’s this account for and when do you need the money?”

“Oh, this is long-term money. I’m not touching this for many years,” he said.

That was all I needed to hear.

I reminded him of his long-term plan for my health. It’s always the same: eat healthy, drink less, and stick to a steady exercise schedule.

“Keep up with the smart daily routines,” he always says… “Because over the long run, they’ll keep you healthier, happier, and wealthier. Trust me.”

The same strategy applies to your financial health…

Why it’s critical to keep investing during a bear market

One of the few inarguable facts about investing is this: Lower prices are great for buyers.

Unless you’re already retired and looking to cash out of the market… you should WANT prices to be lower.

Lower prices mean you can buy more of a stock or fund… Accumulating shares as prices fall will likely be a big benefit down the road.

Let’s go over some hypothetical numbers to show you what I mean…

Over time, the stock market goes up about 10% a year on average. That’s the gain you can expect based on decades of history.

Let’s assume you put $500 into a basic exchange-traded fund (ETF) like the SPDR S&P 500 ETF Trust (SPY) every month. Based on Friday’s closing price of $411.34, that would buy you 1.21 shares.

By comparison, if you’d bought SPY at its January 12, 2022 high of $469.56, your $500 would have only bought you 1.06 shares.

This might not seem like a major difference, but it can have a big effect on your long-term gains…

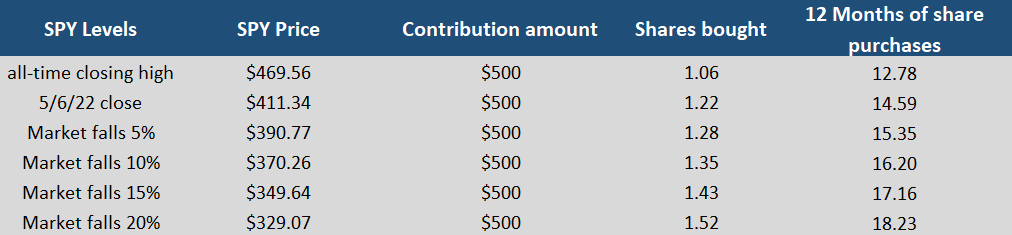

Below, I’ve put together a table showing how far your $500 would go based on different SPY prices.

The “SPY Price” column shows (in descending order): The ETF’s all-time high closing price (which happened in January)… Friday’s closing price… and the closing prices in four hypothetical scenarios wherein the market drops by a certain percent from Friday’s close (to keep things simple, I used 5%, 10%, 15%, and 20%).

The “Shares bought” column shows the number of SPY shares you could buy based on each price…

And the far-right column shows how many shares you’d end up with if you bought $500 worth (at that price) for 12 months.

The most important thing to notice is that you’re able to buy more shares as the SPY price falls. Notice how you could buy 18 shares at 20% below the current price… vs. fewer than 13 shares at the January 2022 highs.

Put simply, lower prices are good. As the market falls, your money goes a lot further. You’re accumulating more shares for the same contribution.

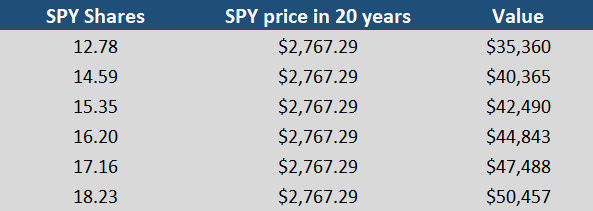

Now let’s take this example and fast-forward 20 years. We’ll use the same share counts from the far-right column in the table above… And calculate their value assuming steady growth over the next 20 years.

Keep in mind, the stock market goes through major ups and downs over time… but history shows the long-term average growth rate ends up around 10%.

To keep things simple, we’ll just use last Friday’s SPY price of $411.34 and apply a 10% annual compound growth rate. So in 20 years, the SPY price will be $2,767.29.

Take a look at the value of our holdings 20 years from now:

Keep in mind, the only difference is the number of shares we own after buying $500 worth of SPY each month (for 12 months) at different prices.

As you can see, the difference between owning different numbers of shares can have a huge effect over two decades. At the January highs, we could have only bought 12.78 shares… which (in this example) would end up being worth $35,360 over time. But if the S&P 500 were to decline 20%… we could buy 18.23 shares over the course of 12 months. And over the course of 20 years, we could make an extra $15,000.

When you look at the long-term results… you should be rooting for lower prices today!

It’s especially true if you’ve got a long runway ahead before retirement. If you want to make big long-term gains, you should think of these market pullbacks as a massive opportunity.

As I explained to my doctor last week… It’s easy to get rattled when you see the financial markets plunging. Many folks will end up making the wrong move by holding off on buying. Instead, they end up waiting until the market moves a lot higher… which means they miss buying at lower prices. (Or, as our example shows, they end up owning fewer shares because they only bought at high prices.)

Don’t let the current downtrend derail your long-term plans. The big money is made by sticking to your investing plan… and taking advantage of the lower prices available during the rough patches.