If you haven’t noticed from the half-stocked shelves in the grocery store… the global supply chain problems aren’t getting better.

We’ve never fully recovered from the production and shipping snags of 2020–2021 due to COVID… And now, we’re facing several new issues—from China locking down entire cities to the destructive, dangerous Russia-Ukraine war. The effects of these disruptions are being felt across the world… and that’ll continue for months, at least.

Global port congestion isn’t getting better either—rather the opposite: According to the CEO of Maersk, one of the largest shipping companies in the world, the congestion in the ports is worsening… spreading to the U.S. East Coast, China, and even Europe.

Two weeks ago, a huge container ship—the Ever Forward—was finally freed after being stuck in a Maryland shipping channel for more than a month… If this story sounds familiar, it’s probably because you remember the infamous Ever Given containership that blocked the Suez Canal a year ago. (And yes, the ships are owned by the same company.)

Supply chain problems are here to stay… But you can profit from this state of events.

In February, I told you about Triton International (TRTN)—how it was poised to profit from the supply chain crisis in 2022… while delivering a market-beating dividend.

Since then, Triton’s stock has outperformed the market by a couple of percentage points (not counting dividends). And it remains one of my favorite ways to play the ongoing supply chain woes.

Here’s why…

The product of a 2016 merger of two big names in the container leasing business, TAL International and Triton International, Triton is now the industry leader. Its market share in the leasing space is about as big as its next two largest competitors combined.

The container leasing business requires a lot of capital and a ton of experience. The business revolves around owning a lot of shipping containers, platforms, and chassis (the wheeled metal frames semi-trucks use to transport containers)… and leasing all that equipment to shipping lines and related companies.

This type of business is essential for large shippers (like Maersk)… Leasing makes it easy to mix and match containers and chassis. It gives shipping lines the ability to easily switch among a variety of loads… And it frees up capital for other business needs.

Plus, having a variety of containers and other equipment in multiple places around the globe makes it easier for shippers to pick up and drop off equipment as needed.

To succeed in this business, a company must have a significant geographic spread.

Add that to the high capital requirements needed to own all the equipment, and you’ll see why the container leasing industry has huge barriers to entry. This translates into less competition—exactly what you want if you plan to own a stock for a long time.

The company is already a huge winner in today’s supply chain crisis, as you can see from the chart below… And it’s in a great position to keep profiting from high container prices and lease rates.

A few days ago, Triton reported an incredible first quarter (Q1). Adjusted net income was $2.76 per share, an almost 45% increase from the same quarter a year ago. Revenue surged 20% vs. last year. And judging by many important operating metrics, profits are only going to improve.

For example, one key metric—container utilization—is exceptionally high at 99.6%. In other words, nearly all of the containers Triton owns are in constant use.

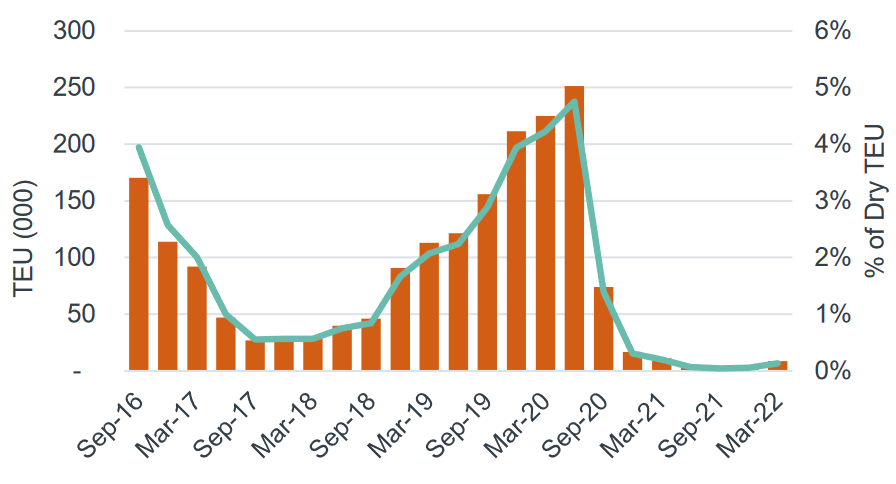

Triton’s depot stocks are very low

With demand off the charts, it makes sense that container leasing rates are historically high. No wonder TRTN is seeing record profits.

And don’t forget TRTN is an income stock: It pays a quarterly dividend of $0.65 per share, which means the shares offer a market-beating yield of 3.8%.

Besides paying a dividend, Triton is also returning money to shareholders via share buybacks. Since resuming its buyback program in 2021, Triton has repurchased 3.3 million shares—a massive 4.9% of shares outstanding—with $200 million more authorized for future buybacks.

It’s not too late to take advantage of this company’s dominance and its growing dividend. As long as there’s a shipping crisis, this container king will continue to reward investors.

Editor’s note:

For more of Genia’s favorite income stocks to win in the current environment, join Unlimited Income.

Just this week, she released her latest recommendation: An industry leader with a market-beating dividend trading at rare bargain levels.