Near the peak of the market’s crash in 2008, I was sitting at a bar with one of the most seasoned traders I knew.

The TV didn’t even have sports on—by that point, the media was 100% focused on the collapsing economy and plunging stock prices.

Then, my friend turned to me and said something that sounded absolutely crazy at the time…

He said I should buy stocks.

Between sips of beer, he gave me instructions: “Take some money right now and buy the S&P 500. You have decades ahead of you.”

He told me the crisis was creating the greatest buying opportunity I’d ever see.

I thought he’d gone insane. If anything, I thought it was time to sell stocks.

The global financial system was imploding. The economy was heading into a steep recession. And anyone who had bought stocks over the past year had taken double-digit losses… usually within a few weeks or less.

For months, I’d watch stocks fall day after day. Many of my clients had been forced to close up shop. The phone lines on the trading floor had gone silent.

As things got worse, I became scared for my job. I watched plenty of coworkers get laid off… and constantly worried I’d be next.

All this uncertainty made sitting in cash seem like the best move. The way I saw it, being fearful was logical… especially considering the constant whirlwind of negative news.

During the summer of 2007, I had moved my 401(k) to cash after a lot of the “higher-ups” turned cautious about our company’s trading opportunities. There was a lot of talk about the “easy times being over.” Despite the veteran trader’s good advice, I went to bed every night thinking, “Moving to cash was the right move… I’m safe as long as I have this cash position.” I’d become addicted to the safety of cash.

It turned out to be my biggest financial blunder ever…

As you probably know, 2008 was one of the worst years in the stock market since the 1930s.

Most stocks fell more than 50% within a year of the market’s October 2007 peak. Below, you can see the carnage in the S&P 500 (via the SPY ETF).

But as we know now, the world didn’t end. Over the next decade, stocks had an epic run.

Below, I’ve included a long-term chart of the S&P 500… so you can see how the market did after my coworker begged me to start buying stocks:

When my veteran trader friend shared his advice with me, stocks were at levels not seen since late 1996. In other words, the S&P 500 was trading at a 12-year low.

Few people realized it at the time, but it turned out to be a wonderful buying opportunity.

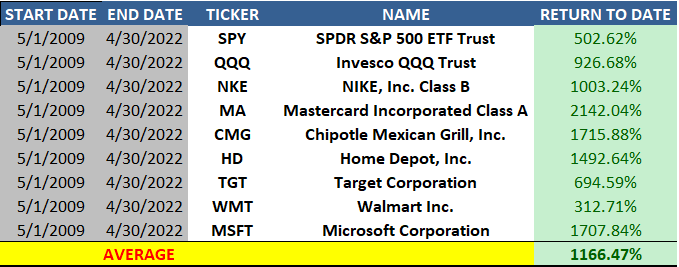

Using May 1, 2009 as our starting point, here are some of the potential gains I left on the table by moving to cash.

It’s a mix of market ETFs and stocks on my radar back then… In other words, these are all names I wanted to buy—but was too scared to pull the trigger on:

Those returns are mind-boggling.

Countless other stocks were on sale, too.

You’re probably thinking, “Luke, you’re picking stocks at the absolute low. Of course the returns are incredible!”

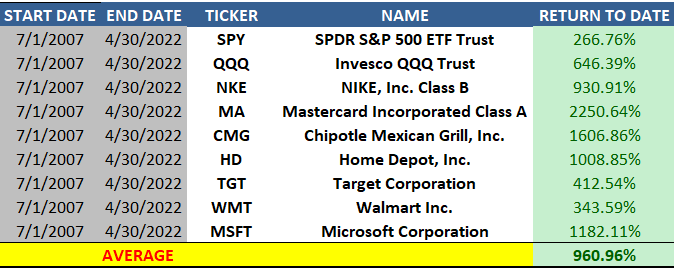

And you’d be right. So instead, let’s assume I bought near the 2007 highs.

Below, I’ve included the same stocks and ETFs from the table above… but used their July 2007 prices. In other words, here’s how I would have done if I’d bought near the 2007 highs… and held through the 2008 crash and the multiple ups and downs of the past decade:

Keep in mind, these numbers include the 2008 crash. As you can see, the returns are still hundreds and thousands of percent gains.

Put simply, moving to cash in 2007 felt great in the short term… but in the end, I still kick myself for staying in cash for so long.

Having lived through the financial crisis and other nasty pullbacks since, I’ve learned great companies—and the stock market as a whole—will ultimately prevail over time.

The key is to push fear and emotions aside. Let time and compounding work their magic.

The current pullback won’t last forever. And what you do during a market panic can have a big effect on where you’ll be years from now.

If you’ve got at least 10 years until retirement, the smart move is to hold stocks of great companies. Stay invested… and buy more if possible.

It’s also a good time to start building a list of companies you’d love to own (but at much lower prices). Write the tickers down. List the reasons why you want to own them. Then list some silly prices you’d happily buy them at.

If the current bear market gets worse… and you get to buy great companies at super-low prices… you’ll likely be sitting on multiple 10-baggers a few years from now.

Editor’s note:

For a portfolio full of great companies designed to build long-term wealth, join Genia Turanova’s Unlimited Income.

These carefully selected dividend stocks have consistently returned double- and even triple-digit gains.