Bonds are often viewed as the picture of stability—thanks to their coupon payments and the implicit promise to repay their principal at maturity.

But in the rising-rate environment of 2022… they’re not the stable diversifiers they used to be.

In fact, while the S&P 500 is down some 6% for the year… the bond sector is doing even worse. The Bloomberg Global Aggregate Index has lost 11% from its January 2021 high… exceeding the previous record drawdown of 10.8% set back in 2008.

This is bad news for many investors: The classic 60/40 portfolio (a balanced investment mix of 60% stocks and 40% bonds) has been losing money.

I warned of this possibility last January.

Today, I’ll show you why you must be careful with bonds… and which type of bond I like best for this particular market.

But first, let’s review the historical success of the 60/40 concept:

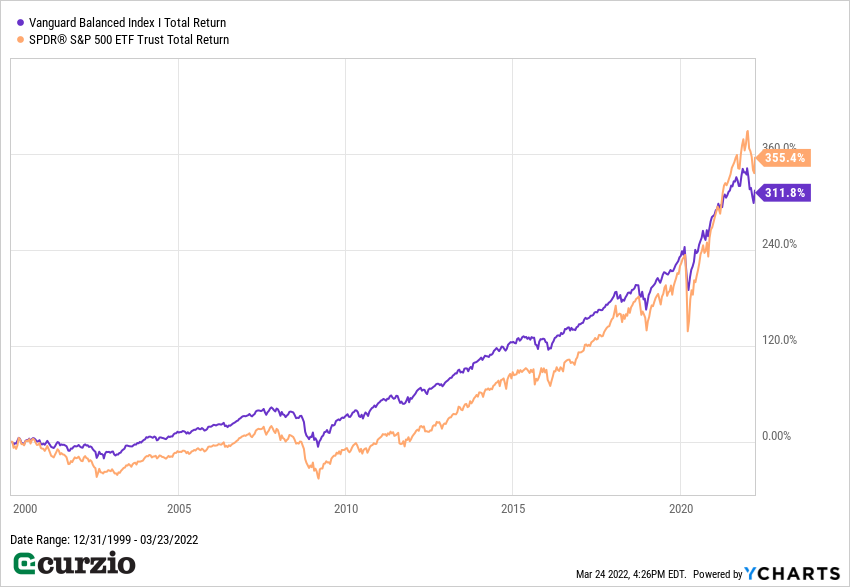

The chart below shows the Vanguard Balanced Index Fund (VBAIX)—known for its adherence to the 60/40 strategy—and compares its total return to the S&P 500 since 2000.

Throughout the bull and bear markets of the past 20-plus years), the 60/40 portfolio not only held its own… it outperformed a 100% stock portfolio since 2000. Take a look:

The 2020 recession changed things…

Typically, bond prices move in the opposite direction of yield: The higher the yield, the lower the bond price, and vice versa. But even in a zero-rate environment, no bond could keep up with the post-COVID stock rally.

And now, in the wake of the Fed’s first rate hike since 2018—and with six more hikes expected in 2022 alone—bond prices are declining sharply.

On the flip side, bond yields are on the rise. Eventually, these yields will rise enough to entice investors… compensate for the price decline… and help 60/40 portfolios regain their ground.

But now is not that time.

For one thing, shorter-dated bonds are seeing the sharpest increase in yields, as you can see from the chart below. At the same time, 30-year Treasurys still yield much less than they did a decade ago… and show the slowest rate of yield growth.

This phenomenon, also known as the yield curve inversion, can signify a recession is coming. It also means the worst of the bond rout might still be ahead of us…

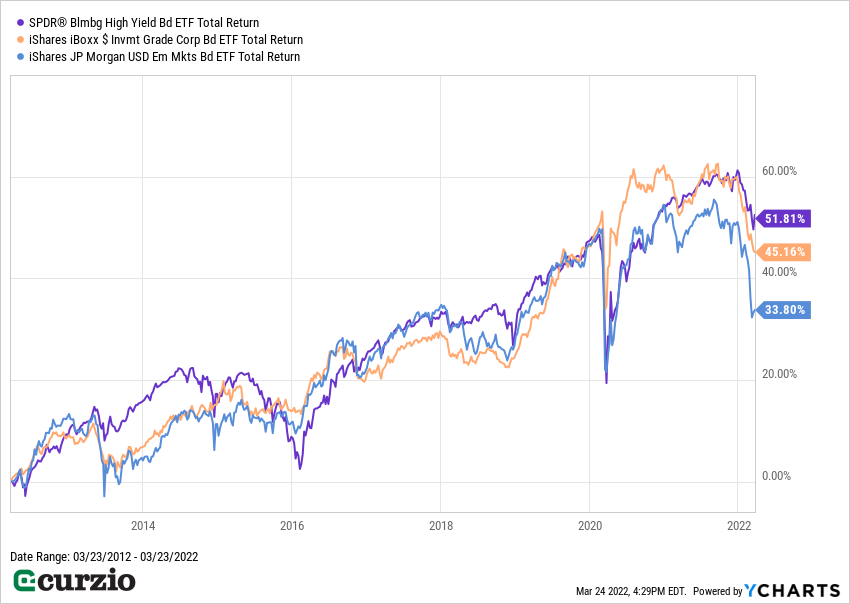

Moreover, the 2022 bear market has impacted all kinds of bonds, from Treasurys (see the chart above)… to high-quality corporate bonds—represented on the chart below by the iShares Investment Grade ETF (LQD)… to junk bonds—represented by the SPDR High Yield ETF (JNK)… to emerging markets—the iShares Emerging Markets ETF (EMB).

And these conditions aren’t likely to change anytime soon.

Higher rates will crush returns for quality corporate bonds as companies will be forced to pay more for new debt.

Emerging markets have their own problems, including the real possibility of a Russian default… and spreading disruptions from the Russian aggression in Ukraine.

Meanwhile, high-yield junk bonds typically do better than the rest of the bond market when interest rates are rising… simply because higher rates normally mean a stronger economy—which, in turn, benefits the weakest parts of the market disproportionally.

But I don’t expect that to happen today.

Unlike years past, the Fed waited too long to start the tightening cycle this time around… And with inflation running at the highest levels in 40 years, it has no choice but to keep hiking rates into a slowing economy. In other words, junk bonds are likely to remain weak.

In sum, the standard, well-diversified 60/40 portfolio will not help much against the current market volatility.

But that doesn’t mean you need to avoid all bonds.

For one, bonds can still work as a buffer if stocks experience another selloff.

Also, if the economy worsens and the Fed is forced to pause its rate hikes, bonds could rebound quickly.

But if you’re looking for the traditional safety of a bond investment, there’s one bond category that’s still attractive in the current environment.

I’m talking about Treasury Inflation-Protected Securities (TIPS)—which we currently hold in the Unlimited Income portfolio.

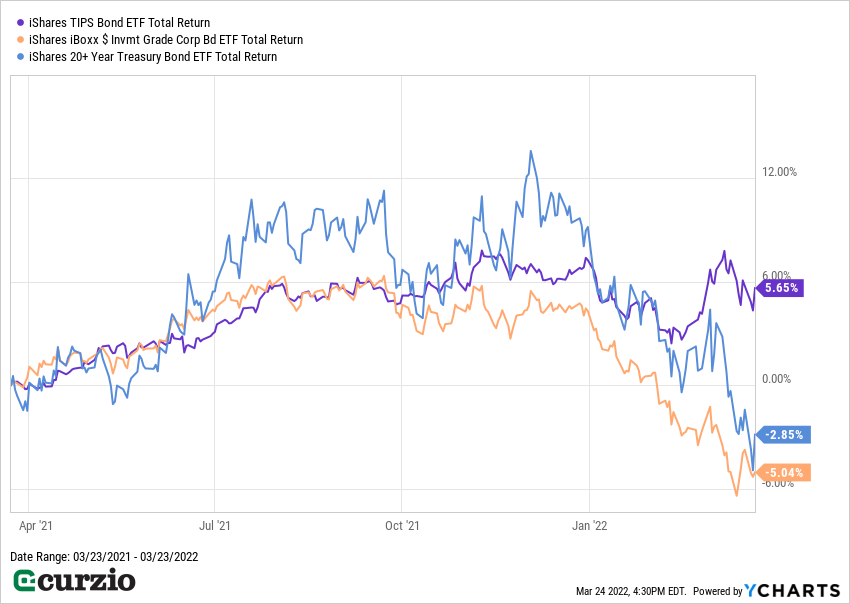

As you can see from the chart below, TIPS have easily outperformed other bonds over the past year.

TIPS do well in an inflationary environment because their principal increases with the Consumer Price Index (CPI). And when a TIPS bond matures, investors are paid the adjusted principal or the original principal—whichever is greater. Plus, because TIPS’ yields are applied to the adjusted principal, interest income from TIPS also grows when inflation is on the rise.

These features make TIPS a much better bet than cash (and other types of bonds) during inflation. As you can see from the chart above, in just one year, the TIPS fund appreciated 5.7% (with dividends)… while long-term Treasurys and corporate bonds lost 2.9% and 5% respectively.

While most bonds present a losing proposition in the rising-rate, inflationary environment… TIPS can still help generate income, diversification, and safety for your portfolio.

P.S. For more of my favorite high-yield, high-growth assets for this inflationary environment…