As you know, prices for everything are rising. Inflation is up more than 7% over the past year, and its effects are already hitting consumers and businesses.

Over the weekend, crude oil surged above $130 per barrel, its highest level since 2008.

Russia’s invasion of Ukraine isn’t helping matters, especially as it relates to commodities. Oil prices are the most obvious example, but there’s another commodity that’s surging… and today, I’ll show you how to play it.

Fertilizer is the next victim of inflation… and Russia

Russian sanctions are disrupting the supply of a key global product: fertilizer.

You see, Russia is the largest fertilizer producer in the world. According to The Wall Street Journal, as of 2019, Russia was the top exporter of nitrogen and the third-largest exporter of phosphate—essential fertilizer ingredients.

But the military operations, along with possibly suspended exports, are resulting in higher prices globally. U.S. farmers in Missouri, for example, are facing exorbitant fertilizer costs. This has the potential to raise food prices across the board.

Plus, the petrochemicals used in fertilizer production mean they tend to be levered to energy markets.

It’s a perfect storm for a big, long-term surge in fertilizer prices.

To get a better understanding of the situation, our next step is to look at the Big Money data.

Two big players in the fertilizer game are CF Industries Holdings (CF) and Mosaic Company (MOS). Their recent charts are just bananas, with both stocks up massively.

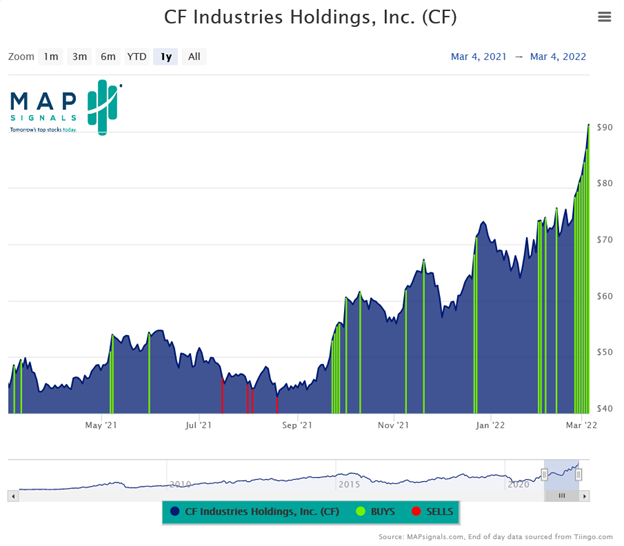

Below, you can see the chart for CF, which is up almost 30% so far this year. But what’s really amazing is that it has 11 Big Money buy signals already in 2022 (the green bars). Take a look:

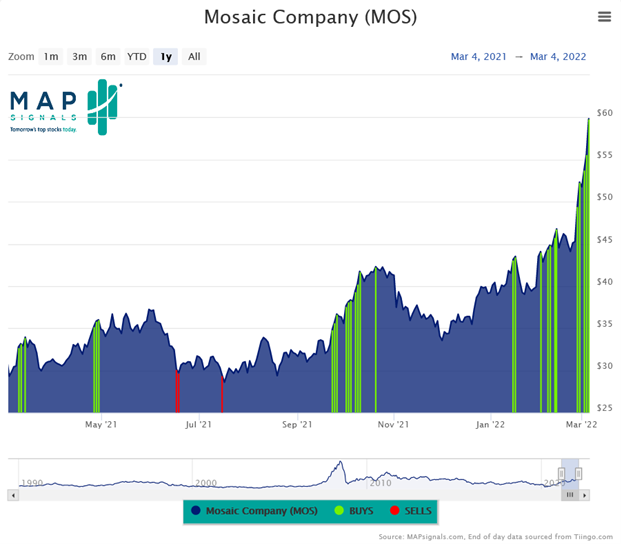

Now let’s check the chart for MOS. It’s up an incredible 52% this year! And it has 28 Big Money buy signals over the last year, including 12 so far in 2022. Check it out:

It’s clear Big Money is moving into fertilizer stocks in a major way.

These names are certainly extended at these levels. Given the Russia-Ukraine conflict, their recent uptrends could be subject to near-term violent swings. That’s why my preferred way to play this uptrend is the Invesco S&P 500 Equal Weight Materials ETF (RTM).

While its top two holdings are MOS and CF (5.4% and 5.1%, respectively), this ETF gives you broad exposure to 28 different materials companies… from chemicals to packaging to mining to construction.

Inflationary pressures should keep pushing commodity prices higher, including fertilizer. Materials companies—like the 28 names RTM owns—will be the biggest winners from this uptrend. Plus, RTM provides exposure across the materials spectrum… which lets us play this theme while avoiding the risk of owning a single stock.

The bottom line

Russia’s invasion of Ukraine… and the subsequent sanctions from the world against Russia… have upended some commodity markets, including fertilizer. Russia is a top fertilizer exporter, which means the overall supply is destined to be suppressed, especially in the short term.

It’s a great opportunity for investors looking to take advantage of rising commodity prices. And RTM is my preferred option to gain exposure across multiple key materials areas. Since its two top holdings are fertilizer companies, this ETF is primed to capture gains from the space, but it’s also set up to reap the rewards from rising prices in other materials sectors, like metals and chemicals.

I recommended MOS to my Big Money Report members last month… and we’re already up more than 35%.

If you’d like to get in early on other stocks Big Money is buying up today, join us here.