Late last year, the mood of the market changed… leading to the recent selloff.

What happened?

On November 3, the Federal Open Market Committee (FOMC)—the decision-making arm of the Fed—concluded the time had come to start withdrawing market stimulus.

Even though the Fed was careful not to scare the market with the specter of higher rates… the possibility entered traders’ minds.

Expensive stocks met the possibility of slightly more expensive money, or higher borrowing rates. And since many businesses need cheap capital to grow, the market hasn’t been the same since.

Smaller-cap stocks didn’t rally into the year-end as they often do… and the entire market sold off big in January.

But there was one sector that would’ve made you money this year…

In a moment, I’ll tell you what it is… along with why you should expect more volatility ahead… and where to hide for a safer ride.

But first, let’s talk about the Fed.

This Wednesday, at the conclusion of the first FOMC meeting of the year, we learned a bit more about the U.S. central bank’s direction for 2022.

Fed Chair Powell referenced Omicron as a possible reason for slower growth… admitted inflation has exceeded the Fed’s target… and signaled interest rates will be hiked “soon.”

Once the rate hikes have started, the Fed will also begin selling off some bonds from its balance sheet… a process that’s been dubbed “quantitative tightening” (QT).

The good news for the market addicted to easy money: QT and rate hikes aren’t happening yet…

The bad news: With inflation well above the Fed target, the rate hike is almost sure to begin in March… which makes QT a near-term possibility, as well.

The market is changing. So we have to adjust our investments with it.

It’s easy to invest when everything is going up… but it can be hard to find assets to hold through downturns.

One that’s managed to rally in 2022: Energy.

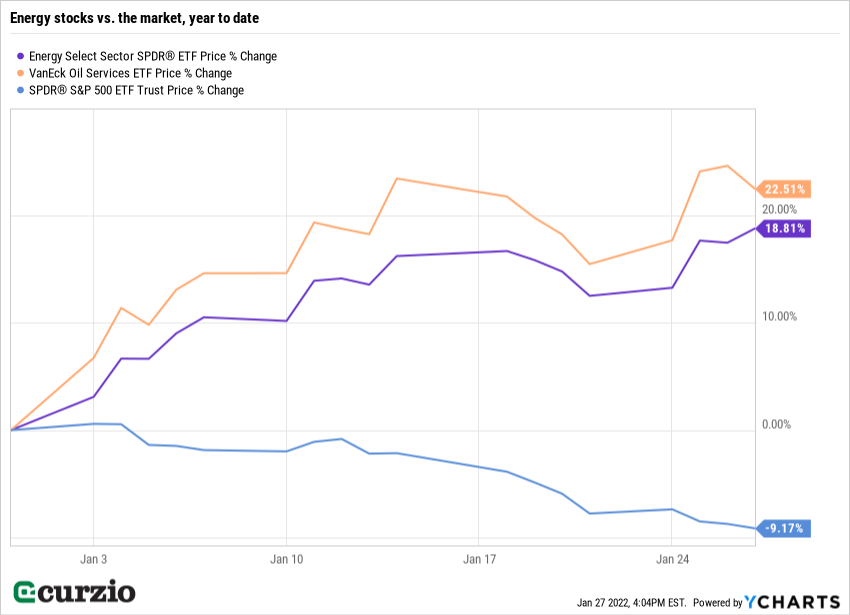

Represented on the chart below by two related exchange-traded funds (ETFs)—the Energy Select Sector SPDR (XLE) and the VanEck Oil Services (OIH)—energy stocks rallied double digits in the first few weeks of the year… vs. the market’s nearly 10% loss.

Past performance is not a guarantee of future returns… but here’s the main reason why energy has been so resilient: After lagging the market for a good portion of the past decade, these stocks are still cheap.

While the role of oil in the economy diminished this century as we’ve transitioned from manufacturing to services… energy quite literally powers the economy and our GDP.

The 75% jump in the price of oil over the past year also means higher profits in the energy patch.

And here’s another reason for this outstanding performance: Inflation is generally good for hard assets… and these higher oil prices aren’t yet reflected in related stock prices.

But energy isn’t the only area of the market poised to do well in the months ahead…

It’s just a subsector of a larger part of the market called “value.”

“Value” is simply the cheaper half of the market… In the last bull market, these stocks haven’t rallied as much as “growth,” and therefore remained cheaper and more attractive to a price-conscious investor.

The recent rally in energy stocks has been a great example of the market’s way of correcting valuation discrepancies: When a sector gets cheap enough, buyers inevitably show up.

Other value stocks include banks… Big Pharma… consumer staples… telecoms… and even tech, like Intel (INTC) and Cisco (CSCO).

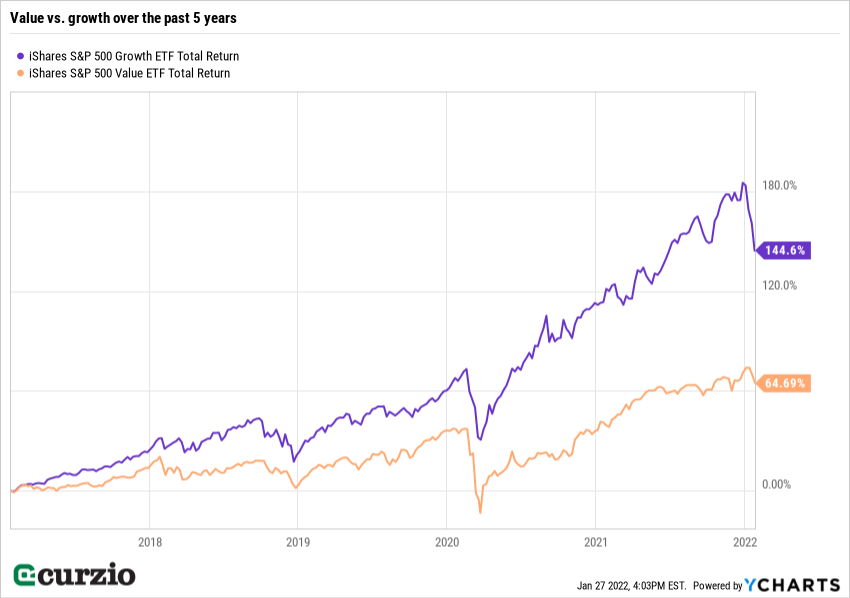

As you can see from the chart below, value has a long way to go until it catches up with growth: Over the past five years, growth outperformed by some 80%.

But after a long period of underperformance, value stocks—just like energy—have already begun to catch up with the market… and its growth counterparts.

Value is beating growth by some 9% in 2022—declining by much less… and adding to its year-over-year lead.

To gain exposure to the entire value section of the market, take a look at funds like the iShares S&P 500 Value ETF (IVE) or the Vanguard Value ETF (VTV).

Exxon Mobil (XOM), Chevron (CVX), and Schlumberger (SLB)—which is already up double digits in our Unlimited Income portfolio—are three individual stocks worth considering… and they all pay dividends. Barring a major recession, energy stocks like these will deliver both price appreciation and income in the weeks and months ahead.

Not every value stock will do well from now on…

But many will.

Valuations are beginning to matter… and the cheaper-priced value sectors are poised to outperform growth.

P.S. For new value recommendations every month—stocks that will not only survive, but thrive in this environment—join us at Unlimited Income.

Our strategy is one of the simplest, most powerful ways to build long-term wealth.