Almost three weeks into 2022, the market is looking for new leaders.

Tech stocks—and especially the pandemic leaders that were steering the post-COVID recovery—are down for the year.

The tech-heavy Nasdaq Composite has already dipped in a correction… its first since March 2021.

One of the most famous post-pandemic darlings, Ark Innovation ETF (ARKK), is down 19% in the first three weeks of 2022 alone… and has lost half of its value compared to last year’s high.

Market rotation is underway… and new leaders are emerging.

Find them early—and you’ll be in great shape for this changing market.

But these new leaders must be able to pass the inflation test. Until inflation is defeated, only companies with pricing power will do well in the economy… and only stocks that can grow their profits, despite rising prices, will do well in the market.

Last week, I told you about the resurgence of ’80s-style inflation… and outlined how to invest for maximum benefit.

Today, I’ll give you three specific investments poised to protect your purchasing power… and even soar if inflation refuses to back down.

First, let’s take a quick look at the leaders that have already emerged…

Among the S&P 500 sector, energy stands out.

While the market is down more than 5% so far in January, the energy sector—represented on the chart below by the Energy Select SPDR ETF (XLE)—rallied 18% over the same time frame.

Energy stocks are beating the market (and the tech sector) hands down over the past year, too: Even without dividends, XLE is up nearly 50%… some 30% better than the S&P and about 40% better than the Nasdaq.

The price of oil is one of the main drivers of this outperformance.

Having surged to a fresh eight-year high, higher oil has already translated into higher profits for the leading players in the energy sector.

And, unless we slide into a deep recession, more gains are on the horizon.

That’s because, as I explained back in October, the price of crude tends to overshoot on the downside AND and on the upside. Overproduction results in lower prices that disincentivize exploration and production… which, after a while, will lead to a shortage and a spike in oil prices.

These swings were exacerbated by COVID: The negative demand sent prices sharply lower… before the quick economic rebound sent them soaring.

This is largely why XLE has been leading the market for the past year.

And because oil is everywhere—from transportation to plastics—energy-related stocks remain the best way to protect your portfolio from inflation-related price increases.

Energy equities and ETFs—from Exxon Mobil (XOM) and Schlumberger (SLB) to the Energy Select SPDR ETF (XLE) and the VanEck Oil Services ETF (OIH)—are my top inflation-beating picks.

My other picks to fight inflation won’t surprise you: I expect precious metals and related equities to perform well as consumer prices rise.

I’ve been beating this particular drum for a while now… With a long history as monetary metals, gold and silver tend to increase in value as the purchasing power of the dollar declines. Most investment portfolios could benefit from adding some exposure to these metals and related stocks (gold and silver miners).

Precious metals are already starting to prove their inflation-beating mettle…

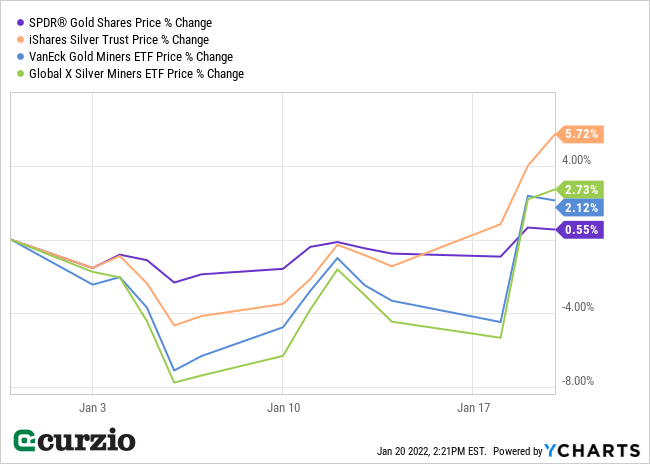

Gold, the traditional inflation hedge, made a massive move this week… as did its younger brother, silver.

Better yet, gold and silver miners—represented on the chart below by two ETFs, the VanEck Gold Miners (GDX) and Global X Silver Miners (SIL)—have also rallied.

Year to date, gold, silver, and related miners have all outperformed the market.

I expect this outperformance to continue well into 2022… and possibly well beyond.

But if gold investing isn’t your thing, U.S. Treasury inflation-protected securities (TIPS) are another way to build some inflation protection for your portfolio.

Issued by the U.S. Treasury, TIPS are among the safest assets around… And because they’re tied to the Consumer Price Index (CPI), the principal value of these bonds increases with inflation.

My favorite ETF in this category is Schwab U.S. TIPS ETF (SCHP).

This ETF’s expense ratio is only 0.05%. In other words, you’ll pay 0.05% of the dollar value invested in the fund annually to service it (holding and, as needed, buying and selling of the individual bonds).

SCHP is a much better bargain than the large competing fund, iShares TIPS ETF (TIP), which has a nearly identical portfolio but a much higher expense ratio of 0.19%.

The three types of investments above—energy, precious metals, and TIPS—aren’t the only ways to get inflation protection…

As my Unlimited Income subscribers know, income stocks that can grow dividends over time are another great tool to accumulate wealth—and therefore protect you from the wealth-destroying effects of inflation.

Commodities of all kinds, and even real estate properties, also tend to hold their value over time…

But whatever investments you select from today’s list, don’t pick just one. Staying diversified should always be your first line of defense.

P.S. For easy access to an outstanding portfolio of income stocks that can withstand inflation and build long-term wealth… join us at Unlimited Income.

These carefully selected assets have consistently returned double-digit gains… And right now, many are trading for bargain prices.