Every year, Wall Street pros and Main Street investors alike eagerly await Byron Wien’s annual list of “10 surprises.”

An influential chief investment strategist at Morgan Stanley (MS) for 21 years… and now vice chairman of wealth business at private equity giant Blackstone (BX)… Wien’s been publishing this list every January since 1986…

And he’s been right more than he’s been wrong.

In January 2000, almost at the top of the dot-com bubble, he predicted a decline in the S&P 500… and an even sharper drop in the internet sector. As we now know, the market was down 10% for the year, while the internet-stock heavy Nasdaq 100 lost more than 36%.

In 2008, he predicted the first economic recession in the U.S. since 2001, along with high inflation, and a spike in oil prices to $115 a barrel.

And for 2020, the surprises called for market volatility and significant interest rate cuts. These turned out to be pretty good guesses—although, arguably, 2020 was a hard year to anticipate… Wien and his co-author Joe Zilde didn’t anticipate when they wrote the list two years ago that a global pandemic would be the main cause of a brutal selloff and recession (nor did most market observers and analysts).

For 2021, Wien and Zilde predicted the Fed’s easing would continue, oil prices would rise, the U.S. dollar would strengthen, and the S&P would hit 4,500 in the second half of the year. Again, the predictions weren’t far from reality.

Keep in mind, predicting the future is hardly a perfect science… and not every one of Wien’s “surprises” over the past decades has come to fruition.

But, while it’s easy to be wrong… it’s hard to be right. And his track record has earned him a reputation as a winner on Wall Street. That’s why so many folks review his annual list as soon as it’s published.

While no one can predict the future with total accuracy—and we should take any predictions with a grain of salt—we can rely on the experience and market acumen of people like Byron Wien to help form our own market expectations… and prepare for what’s ahead.

Below are three of Wien’s 10 surprises for 2022 I expect to matter most.

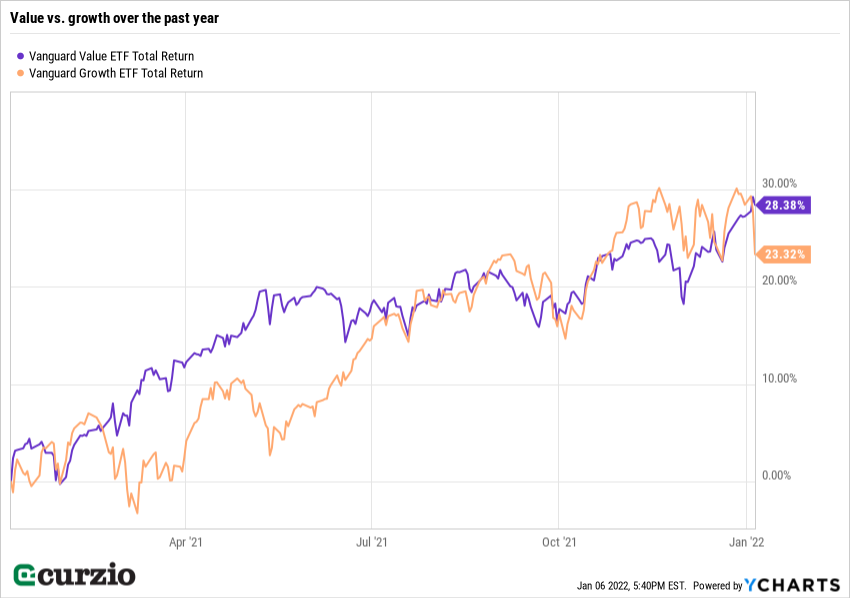

No. 1: In 2022, thanks to the combination of strong earnings and higher rates, markets stay relatively flat… but value outperforms growth. A mid-year correction will not exceed 20%.

No. 2: Inflation remains elevated at 4.5%.

No. 3: Gold rallies 20% and reclaim its safe haven role…

I’d also assign a high probability to a couple of his other predictions, such as the return of nuclear power as a safe power generation alternative… and the price of oil rising to $100/barrel.

Most importantly, investors must be ready for volatility this year.

The markets are facing multiple obstacles that could limit near-term gains and possibly trigger a sharp correction. For example, the Federal Reserve is turning more hawkish and plans to raise interest rates—probably multiple times—in 2022. Meanwhile, stock valuations are sitting at historically high levels (especially for growth stocks).

These issues are partially behind the market’s weak start in 2022. We’ve only had four days of trading in 2022, and the S&P 500 has already lost its year-end (Santa Claus rally) gains—and is down 1% for the year.

The recent action is even worse for non-profitable and/or expensive tech stocks. The ARK Innovation ETF (ARKK)—which is full of these kinds of names—has already corrected by some 9% this year… after losing 24% in 2021.

In short, it’s time to be careful with the market. Make sure to hedge your bets… invest in quality stocks that you want to hold for years… and don’t overlook valuations.

Not only are value stocks cheaper than the other half of the market (growth stocks)… most of them pay dividends, which could be a lifesaver when the market goes through a correction.

In fact, value stocks are already starting to outperform their growth counterparts. As you can see in the chart above, value recently caught up with growth… and is beginning to power ahead. I fully expect this type of action to continue in 2022.

Plus, you shouldn’t overlook precious metals, commodities and other hard assets. These types of investments are uniquely suited for inflationary markets: As long as there’s demand for a specific commodity, its value tends to hold steady or even rise during inflationary scenarios.

Again, none of us can see into the future. But it makes sense to be ready for a weaker market in 2022… especially after the non-stop rally of the last year and a half… and given the Fed’s plans to raise interest rates in the coming months.

It pays to be prepared.

P.S. This year’s market will look very different from last year’s… and it’s likely to be much tougher on the average investor.

In Moneyflow Trader, I recently recommended two of my favorite ways to strengthen your defenses against a weakening market in 2022.

If I’m right, members could be sitting on double and triple-digit gains in a matter of months… while others are taking losses. Learn why Moneyflow Trader is the best way to capitalize on a volatile market.