Despite the bizarre (now debunked) rumor that Corona beer caused COVID, beer sales for its maker, Constellation Brands (STZ), held up well during the pandemic.

It was the power of the Corona brand that helped the business… and it’s the same power that makes Constellation Brands such an exciting company.

But there’s more to like here…

Constellation Brands isn’t your run-of-the-mill, dividend-paying reopen stock.

It’s a low-risk play on cannabis market growth… thanks to its timely investment in one of the earliest movers in the business.

Before we get into that, let’s take a quick look at Constellation’s core business and its major moneymaker: beer.

The pandemic made us drink more… but beer didn’t fare as well as hard liquor or wine.

Despite this, the company reported strong double-digit beer revenue growth last Wednesday… thanks to premium brands like Corona… Modelo… and Pacifico. The stock is up more than 4% since… handily outperforming the market.

The only category more profitable than Corona and its peers is craft beer… but as it’s made in small, local breweries, craft beer sales will never really be able to compete with the mass-producing, mass-selling power of national brands like Corona.

And the power of the Corona brand also means pricing power, the ability to raise prices without alienating the customer… which is what Constellation now plans to do. And companies with pricing power are what you want to own during inflationary times.

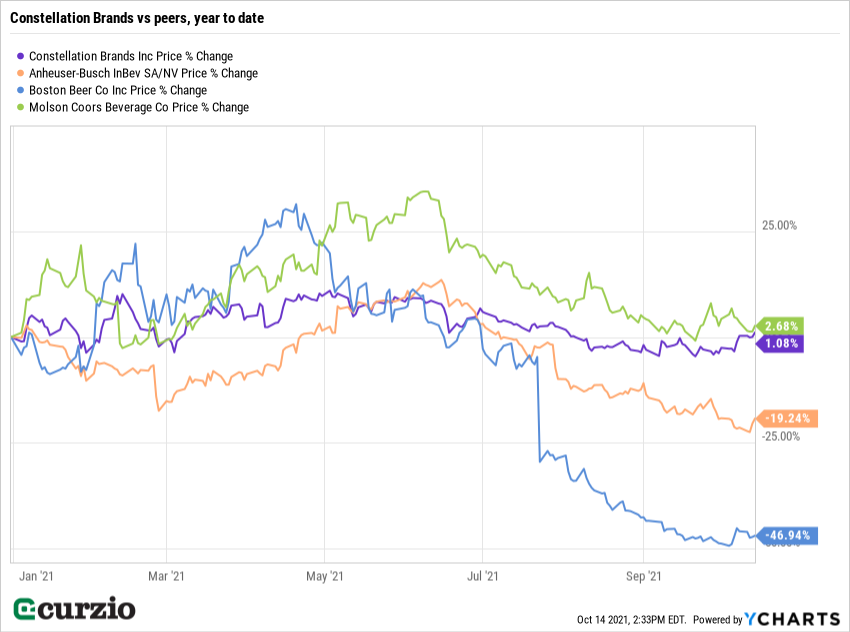

As you can see on the chart below, Constellation has outperformed one of its biggest rivals, Anheuser-Busch (BUD), by a 20% margin this year.

It outperformed Boston Beer (SAM) by an even larger margin… (both were brought down by the overly optimistic view on hard seltzer… a market that’s peaked).

In fact, the only peer that kept up with Constellation Brands in 2021 is Molson Coors (TAP).

But this price action speaks volumes: Molson Coors is retiring a big chunk of its lower-end beers in order to focus on what Constellation already has—premium brands. It’s where the money is.

And Constellation has another leg up on its competitors…

It recognized early on there’s a great deal of money to be made in cannabis.

STZ was one of the first major companies to invest in pot’s growth potential… In October 2017, it bought a major (9.9%) stake in Canada’s Canopy Growth (CGC)… at a better price than CGC trades for today.

That was a full year before Canada legalized marijuana… and well before the entire sector went on a “buy the rumors, sell the news” rollercoaster.

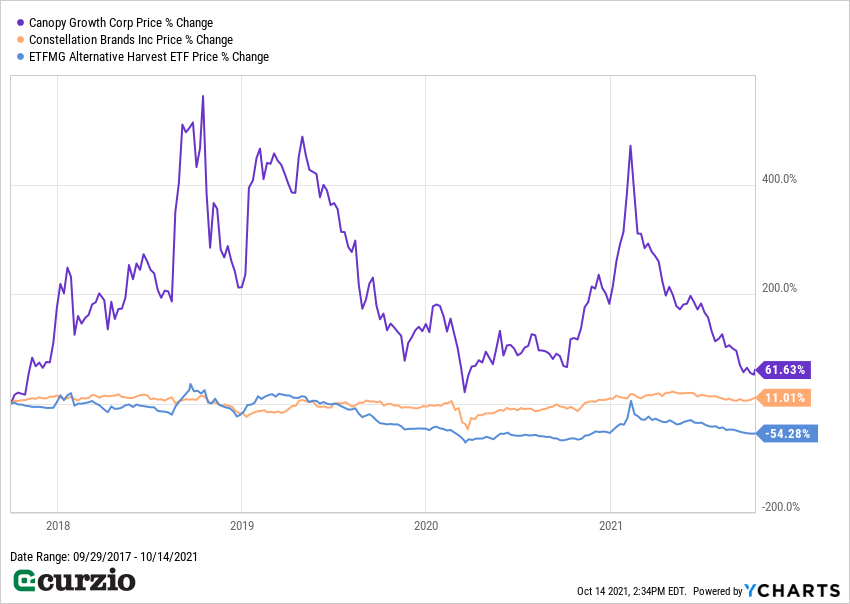

Canopy Growth has done much better than its peers… up some 66% over the past four years vs. a 54% sector decline—represented on the chart below by the ETFMG Alternative Harvest ETF (MJ).

Since its first CGC purchase, Constellation’s stake has grown substantially… Today, it owns 37% of all shares outstanding in CGC, plus warrants. If exercised, these warrants would give STZ 50%-plus ownership.

The fortunes of these two companies are now linked… and Canopy CEO David Klein, at the helm since 2020, joined the company after a long career (including CFO) at Constellation Brands.

Unlike Canada, recreational cannabis isn’t fully legal in the U.S… yet.

But the bill to decriminalize marijuana is making its way through the Senate… and the majority of Americans support this legalization, according to Constellation.

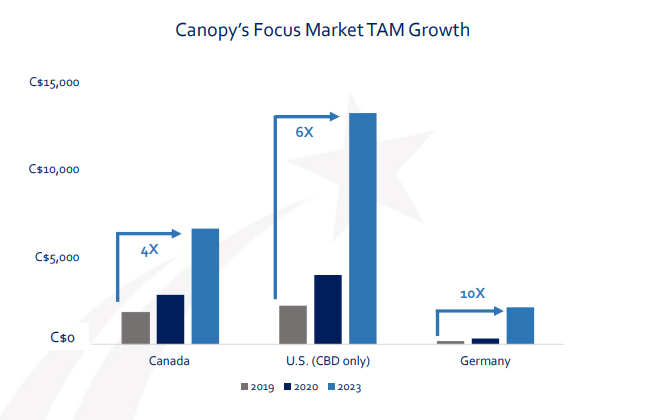

Plus, Canopy targets other countries, too… with significant—and growing—total addressable market (TAM) opportunities.

Although the U.S. market isn’t entirely open for cannabis business, Constellation reports its cannabis product sales nearly doubled in the U.S. (up 91% year over year) in the most recent quarter (Q2 FY 2022, reported October 6).

Meanwhile, beer has plenty more room to grow… It’s still the drink of choice in many bars… casual dining restaurants… and, most importantly, in large venues like rock concerts or sporting events.

And STZ is attractively priced, too.

Its Canopy Brands bet was largely panned by the market… and the stock is about flat (vs. the market’s 65%) over the past 3 years—since Canada’s legalization of pot sent the sector sharply down.

But as more cannabis markets open, I expect Constellation’s long-term investment in Canopy to pay off handsomely… and without the volatility of pure-play cannabis stocks.

Constellation is projected to earn more than $11.90 per share in profits next year… and its stock is relatively cheap at a forward price-to-earnings ratio (P/E) of 18.50 (vs. the market’s 21.50).

Constellation Brands is a low-risk, value-priced, dividend-paying stock that will benefit from a return to normalcy… plus, it gives you a foothold in the burgeoning cannabis market.

P.S. For a portfolio full of low-risk, high-yielding plays on growth trends… try out my Unlimited Income advisory.

Members have been able to lock in quick capital gains as high as the triple digits… while earning market-beating dividends.

Our strategy is one of the surest paths to real wealth—with very little effort…