Earlier this week, the U.S. Senate passed a $1 trillion infrastructure plan.

Although the future of the bill is far from certain, there are a few sectors that will inevitably benefit from the uptick in infrastructure spending.

Today, I’ll talk about the most promising areas of infrastructure development…

And I’ll share two investment ideas outside of the usual suspects (e.g., industrial commodity or construction companies)… and how they’ll profit from increased federal spending.

About half of the prospective infrastructure bill is the renewal of already-existing transportation spending.

New spending amounts to about $550 billion.

It’s a huge number.

Compare the inflation-adjusted cost of President Eisenhower’s Federal Aid Highway Act of 1956, signed into law 65 years ago.

The plan, which included 41,000 miles of new roads, called for $26 billion in federal spending. Adjusted for inflation, that’s around $260 billion today (or about half of the new spending planned in the latest infrastructure bill).

So even if some spending areas have been left out, and some prospective funding reduced, there’s enough money left to benefit many of the companies with a strong foothold in the most important sectors. One is water… and the other is alternative energy.

Water

An essential resource, water is allocated some $55 billion in the new infrastructure bill.

And this spending includes the ambitious plan to replace all of the country’s lead pipes.

That’s a lot of digging, a lot of pipes—and a steady wave of money for the main water infrastructure companies.

In this sector, I especially like a small, little-known company, Mueller Water (MWA). The company, which has a $2.5 billion market cap, manufactures water products and provides repair service for municipalities and water utilities.

Two months ago, I highlighted this company as a smart way to profit from Biden’s infrastructure plans.

I liked it for its pipe, valve, and fire hydrant businesses (where MWA is an undisputed leader)… not to mention the role in the booming housing market (MWA generates 25–30% of its business from new construction).

And the investment case for Mueller Water has only gotten stronger in the past few weeks.

Not only does it look like a huge beneficiary of the increased spending on water infrastructure upgrades… but it’s also shown that it can grow faster than the market expects.

In its third quarter (Q3) report on August 4, the company blew away sales and earnings expectations. And it upped its full-year guidance for the third consecutive time. Mueller now expects revenue to grow 14-16% for the year (a big increase over earlier guidance of 8-10% growth).

The stock is up about 4% since the news (compared to the market’s 1.4%).

If you bought it on my recommendation two months ago, well done—it’s jumped 12% since (more than twice the market’s 5.5%).

But there’s much more potential for this company… which is still trading below its all-time highs.

And the stock is still relatively cheap, trading at less than 22 times (22x) forward earnings (next year’s expected profits). That’s much lower than its larger, more diversified peers: Xylem (XYL) trades at nearly 40x… and Lindsay (LNN) at 35.5x.

All of this makes MWA a great small-cap play on water infrastructure.

Alternative energy

Clean energy tax credits were cut to zero in the current bill, but don’t ignore the $47 billion in projected spending for climate resiliency.

Some of this spending aims to upgrade utility operations to help withstand the effects of climate change (wildfires, hurricanes, flooding).

The plan (as it is today) also calls for $65 billion in power infrastructure spending. And more robust utility operations are essential for solar and wind power.

That’s because areas with abundant sun or wind are typically located far from large populations. “Energy farms” located in remote places must be connected to the main grid in order to function.

This is why spending on power infrastructure is a boost to alternative energies.

And I have one clean energy powerhouse for you today…

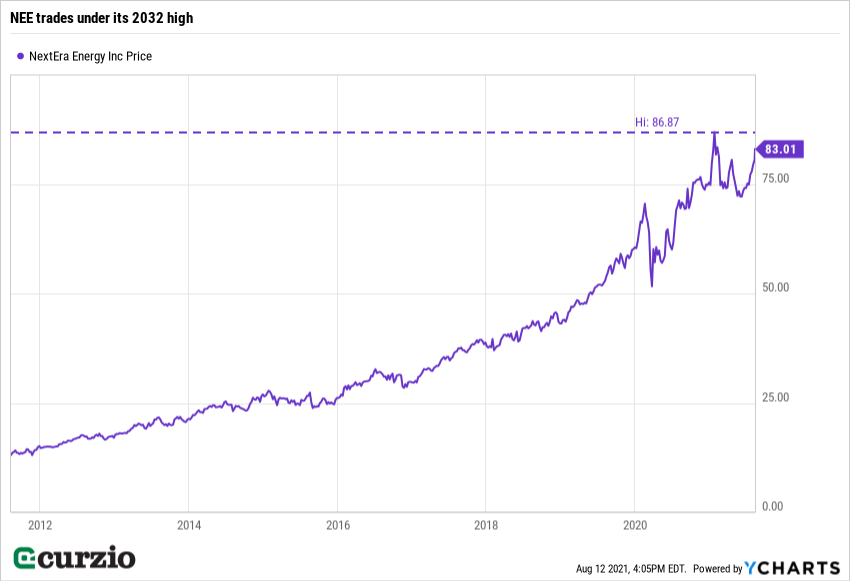

NextEra Energy (NEE)—the leading power provider in the state of Florida—is by far the largest utility company in the U.S. by market cap.

This company recognized the clean energy trend early on.

It placed a bet that solar and wind generation would get cheaper with time… and this foresight has been a boon to the overall business.

Before 2010, NextEra was known as the Florida Power and Light (FPL) Group. The company renamed itself to better reflect its long-term green power ambitions, while keeping the FPL name for its regulated utility business.

The company’s unregulated alternative energy segment—called NextEra Energy Resources—is its fastest-growing business.

Today, NextEra Energy is the world’s largest generator of renewable energy from wind and sun… and a world leader in battery storage capacity.

And did I mention the dividend?

NEE and MWA both offer a healthy (by today’s standards) and growing income stream: MWA yields 1.4% and NEE pays 1.9% in quarterly dividends.

I expect these companies to see plenty more upside from infrastructure spending…

But no matter how the finalized legislation shakes out, they’re fantastic long-term holdings that will continue to thrive.

Editor’s note:

Genia consistently gives fantastic actionable advice in these pages. But her Unlimited Income subscribers get her most profitable ideas first…

Both NEE and MWA are up double digits for Unlimited Income members… and climbing.

If you’re looking for that rare balance of dividends and big capital gains… this is the advisory for you.