“They should just close the stock market in August and reopen in September.” That’s what Louis Navellier, a good friend and legend in the newsletter business, once said.

And he’s right…

August tends to be one of the most volatile months of the year. That’s due to lower trading volumes. Wall Street traders are usually focused on vacations in the thick of summer, rather than stocks.

When liquidity dries up, it makes it easier for stocks to make sharp moves. That means even minor news can send the market lower.

My Big Money data shows poor market breadth the last few weeks. In other words, while markets are near all-time highs, only a few stocks are doing well… while many are struggling.

So, what’s an investor to do? Run and hide?

Of course not… This isn’t the time to put the bear suit on.

I’ll tell you the perfect fund to help protect your portfolio from the volatility.

Let’s now take a look at some data.

August is often a red month

Seasoned traders know that August is full of volatility. And history shows it tends to be a red month… meaning a negative return for stocks.

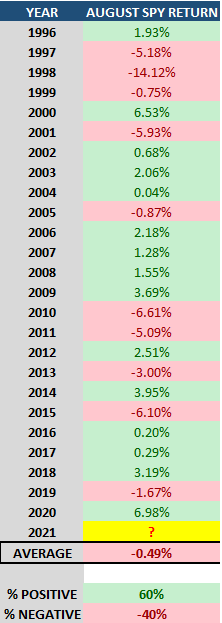

Below, I’ve listed the August performance for the S&P 500 each year going back to 1996.

As you can see, the 25-year average for the S&P 500 is ugly—a loss of nearly 0.5%. That may not seem like much, but in six of the past 25 years, the market fell more than 5% during August. In other words, stocks plunged 5%-plus for the month of August nearly a quarter of the time!

Don’t get me wrong, I don’t expect a huge pullback in 2021. I’m just pointing out that volatility is pretty common during August… and you should be prepared for it.

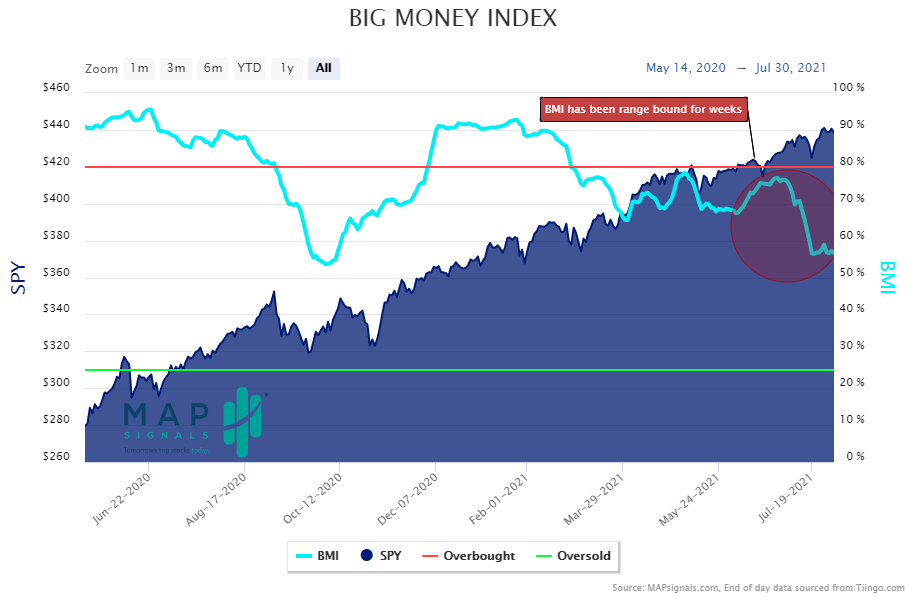

And that brings me to the Big Money data. It’s been showing some weakness as we head into August. Below is the Big Money Index (BMI). It measures the trend of buying and selling in stocks. If the line is increasing, stocks are getting bought (that’s bullish). If it’s falling (like now), that’s potentially bearish.

As you can see, the BMI is at its lowest level since October. That gives you an idea of how strong the rally has been since then. Buyers have been non-stop until now.

But the index has been in a downtrend due to low market breadth. That just means that the number of stocks keeping the market elevated is low.

This is exactly the kind of setup that means we should expect outsized volatility in the near term. In other words, August could get whippy.

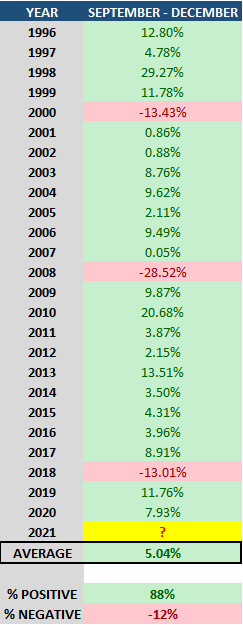

But it’s important to think longer term… And after August, the market’s hits a major “green zone.” Below, you can see how September through December is usually a great time to own stocks:

That’s right. The final third of the year tends to be monstrously green, averaging a 5% gain over the past 25 years… That’s the green zone for stocks!

So, while August is usually a downer, keep your head high. Once it’s over, the final four months of the year tend to be a great time for investors.

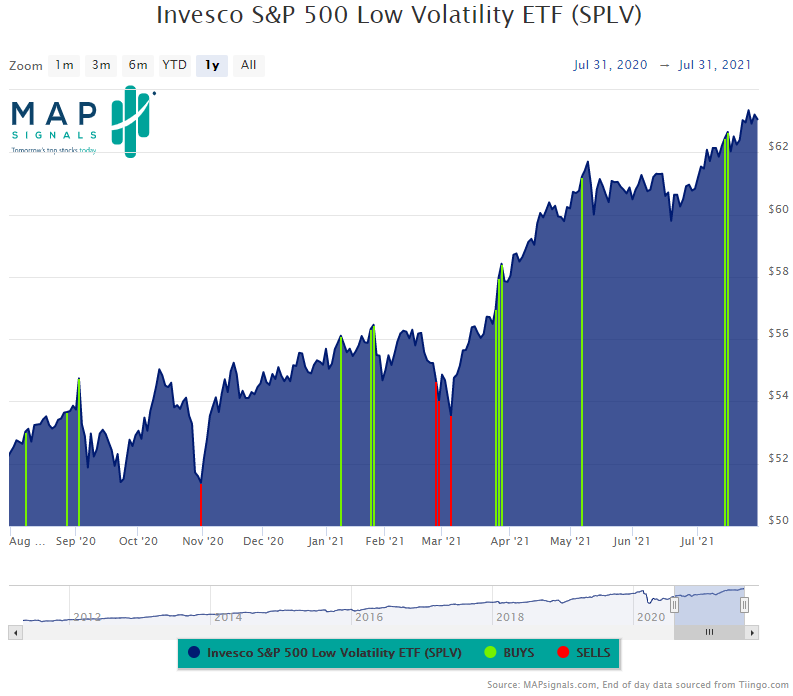

In the meantime, you can lower the volatility of your portfolio by owning the Invesco S&P 500 Low Volatility ETF (SPLV). It’s a fund that holds dozens of steady, dividend-paying names like Procter & Gamble (PG), Johnson & Johnson (JNJ), and Verizon Communications (VZ).

And it’s also seeing Big Money buying recently, which points to the fund being one of the few areas getting bought. That’s incredibly positive given we are in a low market breadth environment.

Have a look:

Those green bars signal that the ETF was rising on chunky trading volumes… which indicates institutional investors were building positions. And green usually begets more green.

That’s a very stable-looking chart if you ask me. I first mentioned this fund two weeks ago, when I discussed the looming summer volatility.

And I still see it as a good play for the coming weeks.

Here’s the bottom line: August is generally no cakewalk for investors. August isn’t always a bad month for the market, but history shows that it’s a red month on average. That means it’s a good idea to stay defensive. SPLV allows you to stay invested while lowering the volatility of your portfolio.

But remember, don’t be a big bad bear. The market’s “green zone” starts in September. That’s usually when the liftoff comes.

P.S. If you’re curious about the growth stocks I think are among the best today, check out my newly released advisory, The Big Money Report.

I sift through the stocks seeing Big Money buying… in order to find the few “outliers” poised to generate massive returns over the next few years.