If you’ve been following me for any length of time… then you probably know I’ve been bullish on semiconductors for several months now…

I said it in December when I shared one of my favorite plays heading into 2021…

And I said it again in April after first quarter (Q1) earnings rolled in.

So far… since I started pounding the table on semiconductors… the VanEck Vectors Semiconductor ETF (SMH)—the sector-tracking exchange-traded fund—is up about 20%.

That’s a solid gain in just seven months.

You may be asking: Is it time to take profits… or is it still a good time to buy these companies?

Earnings season gives us the perfect opportunity to revisit these stocks: We can check whether they’re beating expectations… if their uptrends are likely to continue… And, most importantly, that Big Money investors are still buying these stocks…

Semiconductors can keep climbing into year-end

I love earnings season. It’s when we get an update on the health of a business. The results help us separate the pretenders from the contenders.

As I’ve mentioned before, guidance is a critical piece of info for investors—it gives us a snapshot of where the business is heading. And some companies can give us an idea of how an entire industry is doing.

Take ASML Holding N.V. (ASML), for example. It’s a $300 billion juggernaut that many investors have never heard of…

It has a frontrow view on the entire semiconductor space. It sells lithography systems and provides a range of services to chipmakers. Its biggest customers include giants like Taiwan Semiconductor (TSM), Samsung, and Intel (INTC).

These customers only order more equipment from ASML when they’re confident that semiconductor demand is set to increase.

And ASML’s latest results tell me there’s plenty more upside left for semiconductors.

On July 21, the company reported revenues grew 21% year-over-year (YOY) to €4.0 billion (ASML is based in the Netherlands, so its results are in euros).

But its future looks even brighter… According to guidance, the company expects sales to grow 35% in 2021. That’s a clear sign the business is gaining steam.

ASML also said it expects next quarter’s revenue to come in around €5.2–5.4 billion… well above previous expectations for €4.7 billion.

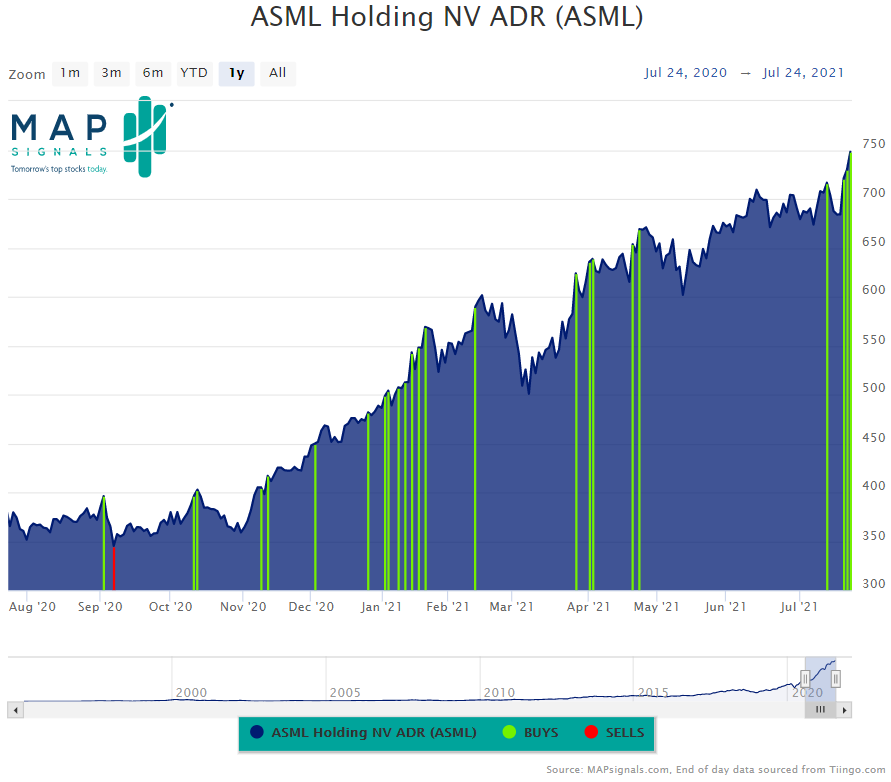

This positive guidance convinced Big Money players to buy the stock heavily. As you can see below, my data shows dozens of buy signals over the past year. Each of these green bars mean ASML saw outsized buying in a particular trading day.

Most importantly, ASML saw three fresh Big Money buy signals last week—immediately after its latest earnings announcement. This buying activity confirms the uptrend we’re seeing in the short term. It means big institutional investors expect strong growth over the next year or more.

Positive guidance can also spell more upside for the sector. Basically, if one company is seeing increasing demand, it makes sense that competing companies would, too. And remember, ASML supplies chipmakers, which gives it better insights to the health of the industry.

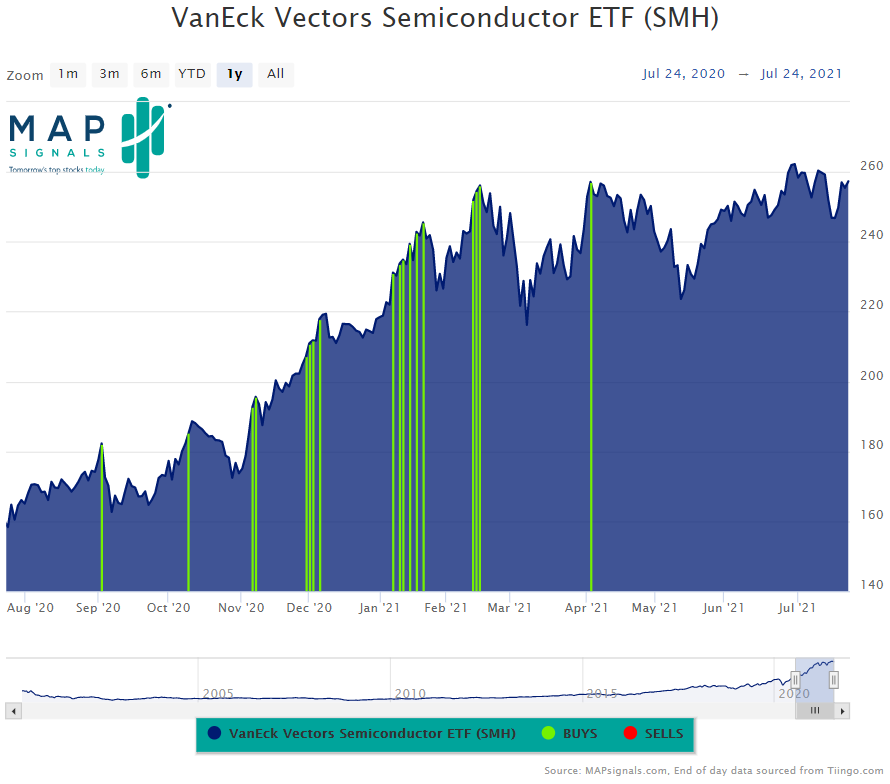

The SMH is a great proxy for the space. And as you can see, it’s had plenty of green this year as well:

You can see 18 buy signals over the past year. That’s a trend you don’t want to fight. And if stocks in the ETF are making green signals (like ASML, which is over 6% of this fund), that can put additional upward pressure on the fund’s price.

If you’re looking for a way to play more upside in semiconductors, consider owning SMH.

After ASML’s blazing report, I expect more upside for the semiconductor space.

When it comes to stocks, it’s not where they’ve been that matters—it’s where they’re going. Signs point to semiconductors heading my favorite direction: UP.

If you want to see more of what I’m watching this earnings season, be sure to check out the latest Lessons With Luke video, where I discuss four earnings reports on my radar thus far.

P.S. I’m not the only one who called early for an uptrend in semiconductors… In January, Genia recommended two top semi stocks in her Unlimited Income advisory… which are already up double digits…

To stay ahead of the trends—while earning market-beating dividends—join Unlimited Income today.