You might know me as the guy who follows the Big Money—the stocks institutional investors are buying. But that’s not the only way to find great investment ideas.

In fact, one of my best investments started in a restaurant…

A few years ago, I was at dinner and had an unforgettable exchange. The drinks were flowing, and the three of us were catching up on old times.

As we were finishing up, the waiter handed me the bill. I did what I always do: I put my credit card in the sleeve and gave it to my buddy… He didn’t take it.

Then came a conversation I’ll never forget…

Me: “Let’s split the bill.”

Friend: “You pay it. I’ll just Venmo you.”

Me: “What? You don’t want to put your card down?”

Friend: “No. You’ve never used Venmo? It’s how you send money to people. Just download the app and Venmo me what I owe you.”

My other friend was clearly familiar with Venmo, too. I ended up paying the bill and got their cash later. I was blown away by this. It was fast and easy.

Later that night I looked online and started researching the situation. I kept asking myself, “Is there an investment opportunity here?”

Today, I’ll show you how I dug deeper into this growth story… and why I decided to bet big on the company behind it.

How to follow up on a great growth story

Exchanging money with friends via an app was a whole new concept to me… but it also made perfect sense. Personally, I think using cash is a thing of the past. I rarely walk around with anything other than credit cards and my phone.

And I’m not the only one giving up on cash.

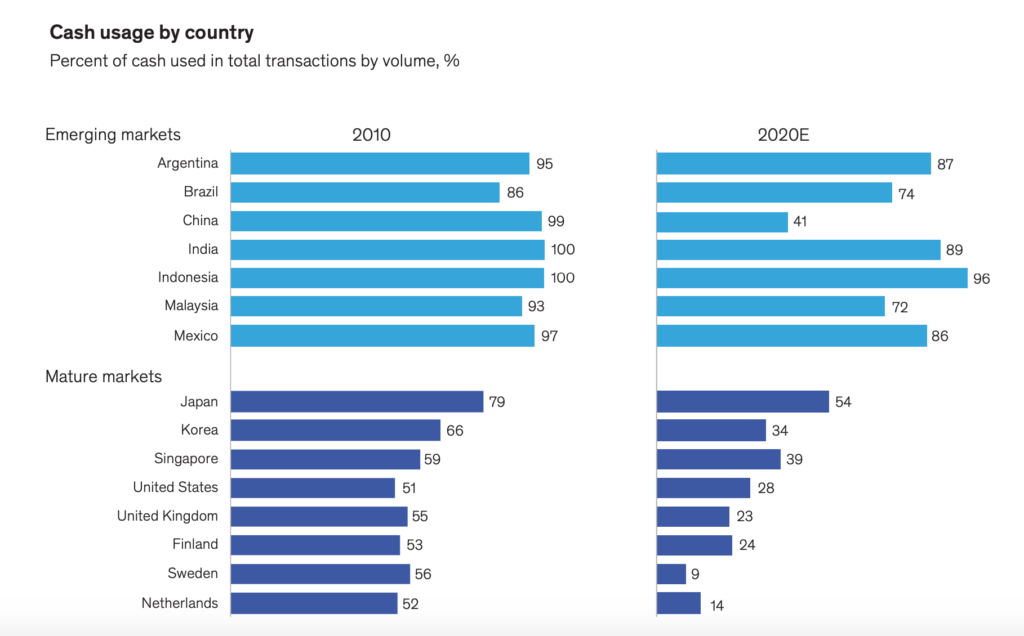

Below, you can see the decline in cash usage in different countries over the past decade (2010–2020)…

Click to enlarge

Cash usage declined by 25%-plus in the U.S., Japan, and throughout Europe. And in China, it plunged more than 40% over the past 10 years. Those are some huge declines in cash usage, especially in developed (or “mature”) economies.

These numbers prove there’s a massive tailwind for companies in the digital payments space.

But what about Venmo?

I quickly realized it was owned by PayPal (PYPL)—a dominant force in the digital payments space for a long time.

And my experience with Venmo convinced me there was a whole new growth leg ahead.

I loved the app’s social component—you can see how much you’ve sent or received from your friends. And the app shows the people your friends have exchanged money with. It made me feel more connected to everyone.

After a little more research, I discovered that Venmo’s usage was exploding… but it wasn’t yet a profitable business for PayPal. Keep in mind, my dinner happened sometime in 2017.

But the growth trend has continued…

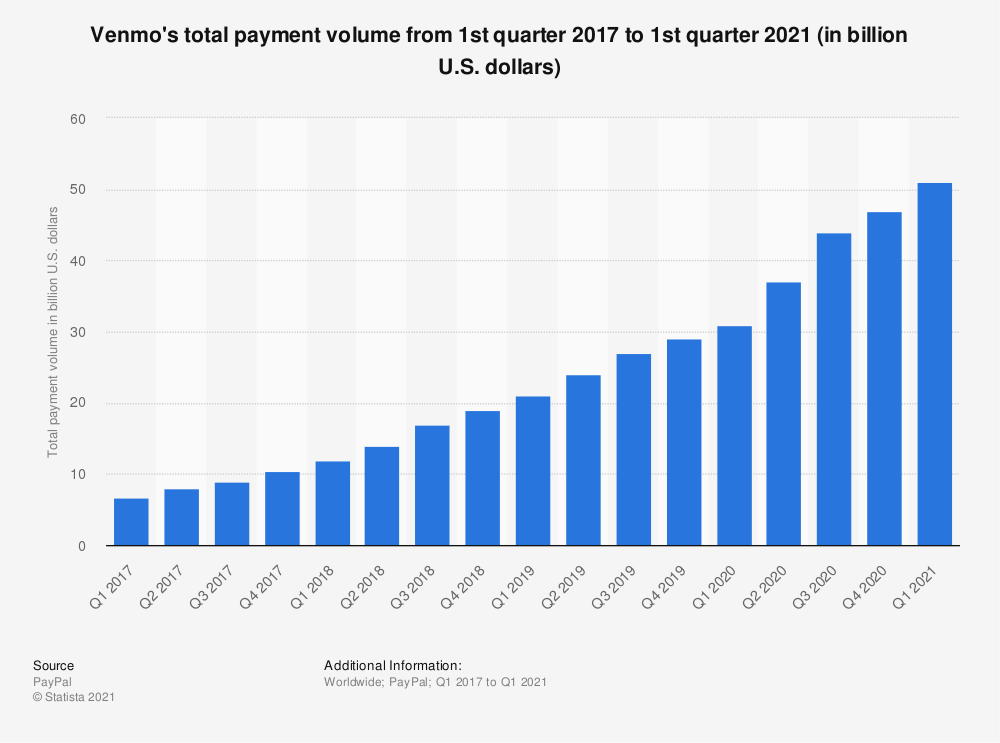

Here’s a chart showing how much money went through Venmo each quarter since 2017:

As you can see above, Venmo’s total payment volume (TPV) has grown from around $10 billion at the end of 2017 to over $50 billion today. That’s a 5x increase in a little over three years!

Back then, I was already thinking about additional growth drivers for Venmo. I wondered, “What if Venmo gets linked with merchants? And what if the social aspect can drive more consumers to business owners? Businesses might pay PayPal for that kind of exposure.”

Today, Venmo is making it easier for consumers to send money faster… and making it more fun! And as cash usage keeps declining, it’s a monster opportunity for PayPal.

There’s no substitute for personal experience

The lesson here is simple. Some of the best investment ideas come from our everyday experiences. I was able to hop on a big growth wave early on.

If you stumble upon a great product, don’t hesitate to research the company behind it. There’s a good chance you’ve discovered a successful growth trend. After all, if you love a new product or service, chances are others will, too.

My experience at dinner made me notice Venmo. And my research convinced me PayPal was a fantastic growth play. I ended up building this position soon after. It’s up more than 600% since I started buying…

I share this story in more detail in this YouTube video.

Here’s the bottom line: When everything lines up for a great growth story, lean into it.

Do your homework by familiarizing yourself with the story. Size up the sales and earnings, and make sure it matches your personal evidence.

One dinner years ago changed the way I thought about PayPal.

More importantly, it changed my portfolio… for the better.

P.S. Hey guys, I’m super excited to announce that my growth stock advisory, The Big Money Report, will soon be available to all Curzio readers. Keep an eye on your inbox for more details…